Solar PV Panels Market Size, Share, Trends, Report 2032

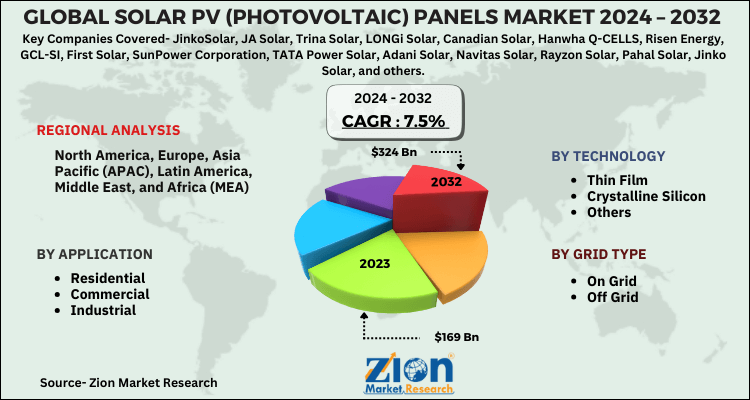

Solar PV (Photovoltaic) Panels Market By Technology (Thin Film, Crystalline Silicon, and Others), By Grid Type (On Grid and Off Grid), By Application (Residential, Commercial, and Industrial), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 169 Billion | USD 324 Billion | 7.5% | 2023 |

Solar PV (Photovoltaic) Panels Industry Prospective:

The global Solar PV (Photovoltaic) Panels market size was worth around USD 169 billion in 2023 and is predicted to grow to around USD 324 billion by 2032 with a compound annual growth rate (CAGR) of roughly 7.5% between 2024 and 2032.

Solar PV (Photovoltaic) Panels Market: Overview

Using a mechanism called the photovoltaic effect, solar PV (photovoltaic) panels directly translate sunlight into electricity. Comprising many solar cells, usually silicon-based, photovoltaic panels capture photons from sunlight to excite electrons within the cells, generating an electric current.

Solar PV panels are a clean and renewable energy source since residences, businesses, and other electrical equipment may be powered by this current.

Usually found on rooftops, open fields, or integrated into construction components, solar PV panels are quite important in helping to minimize greenhouse gas emissions, therefore reducing dependency on fossil fuels and encouraging sustainable energy generation.

Key Insights

- As per the analysis shared by our research analyst, the global Solar PV (Photovoltaic) Panels market is estimated to grow annually at a CAGR of around 7.5% over the forecast period (2024-2032).

- In terms of revenue, the global Solar PV (Photovoltaic) Panels market size was valued at around USD 169 billion in 2023 and is projected to reach USD 324 billion by 2032.

- The rising government initiatives are expected to drive the solar PV (photovoltaic) panels market over the forecast period.

- Based on technology, the thin film segment is expected to capture the largest market share over the forecast period.

- Based on application, the industrial segment is expected to dominate the Solar PV (Photovoltaic) Panels market over the forecast period.

- Based on region, the Asia Pacific is expected to dominate the market during the forecast period.

Solar PV Panels Market: Growth Drivers

Favorable government policies drive market growth

In response to rising carbon emissions, governments throughout the world have implemented an array of policies to promote renewable energy development. The policies have considerably increased the expansion of solar energy business worldwide. The solar PV industry in China makes a substantial contribution to the global market. Changes to its policies have a significant impact on the global solar PV business. China observed an enormous decrease in investment as a result of its confusing FiT policy and reduced subsidies for solar projects.

However, with the implementation of the modified FiT law, the market is expected to pick up speed for the development of solar projects over the projected time.

As with any other important solar energy market, India benefits from several government programs that promote utility and residential solar PV installations. The Grid Connected Solar Rooftop Program, launched by the Ministry of New and Renewable Energy, aims to install 40 GW of rooftop solar installations in 2022.

Solar PV (Photovoltaic) Panels Market: Restraints

Rising adoption of alternate clean power sources hindering the market growth

The rising global use of electrical equipment makes a prime power source more and more needed. The elevated frequency of electrical gadget use indicates that electricity demand may rise clearly during some periods of the day.

Utilities have to update their power source to meet the growing demand for it. In such a situation, the infrastructure for power generation has to be ready to rapidly increase electricity output. Gas-fired power plants are peak-load power plants, unlike renewable energy sources, as they can be matched with the grid in a few minutes.

Above all other sources of energy generation, including solar electricity, gas power plants have evolved as the preferred choice for utilities. These elements are expected to impede the expansion of the solar photovoltaic (PV) industry during the next years. Furthermore, significantly speeding up the global growth of the wind power sector is increasing investments in wind power projects.

Solar PV (Photovoltaic) Panels Market: Opportunities

Growing number of agreements in the sector offer a lucrative opportunity for market growth

The increasing number of agreements in the sector is expected to offer a lucrative opportunity for the solar PV panels market over the forecast period.

For instance, in July 2023, global leader in smart and sustainable mobility Alstom and global leader in the digital transformation of energy management and automation Schneider Electric announced a notable new Power Purchase Agreement (PPA) targeted at solar development in Spain. Covering about 80% of Alstom's European electrical consumption, the 160 GWh/year solar farm project would Have a 10-year contract; the solar farm is planned to start running in 2025.

The statement follows Alstom's near-term emissions reduction targets confirmed by the Science Based Targets program (SBTi), which match levels needed to satisfy Paris Agreement targets. The SBTi has verified that Alstom's scope 1 and 2 target ambition align with a 1.5°C trajectory and validated the corporate greenhouse gas emissions reduction targets Alstom stated.

Solar PV (Photovoltaic) Panels Market: Challenges

High initial installation cost poses a major challenge to market expansion

High initial installation costs are a key barrier to the Solar PV (Photovoltaic) Panels Market and can hinder adoption, particularly in the residential and small-business segments.

Solar installation necessitates expert labor to ensure correct installation, which frequently includes electrical work, roof mounting, and system configuration. Labor prices vary significantly depending on location, and they are frequently high in areas with a shortage of experienced installers.

Furthermore, to improve reliability, several systems use battery storage to provide electricity when sunlight is not available. However, battery systems remain rather expensive, substantially raising initial expenditures. Connecting solar PV systems to the grid, especially in rural places, can be costly in terms of infrastructure and licenses.

Solar PV Panels Market: Segmentation

The global Solar PV (Photovoltaic) Panels industry is segmented based on technology, grid type, application, and region.

Based on the technology, the global Solar PV (Photovoltaic) Panels market is segmented into thin film, crystalline silicon, and others. The thin film segment is expected to capture the largest market share over the forecast period.

Thin-film solar PV panels' enhanced durability and compact form are driving the segment's growth. Furthermore, these panels are flexible and light.

Thin-film solar PV panels are most commonly employed in utility-scale and commercial applications due to their low installation costs. These panels are known as cost-effective replacements for silicon-based solar PV panels since they can be made in large proportions.

Based on the grid type, the global Solar PV (Photovoltaic) Panels industry is bifurcated into on grid and off grid.

Based on application, the global Solar PV (Photovoltaic) Panels market is bifurcated into residential, commercial and industrial. The industrial segment is expected to dominate the Solar PV (Photovoltaic) Panels market over the forecast period.

Industrial buildings like data centers and manufacturing operations consume huge amounts of energy. These buildings may substantially reduce their electricity costs by using solar PV systems.

Driven by cost stability, solar PV becomes an appealing option as energy prices change, thereby increasing industrial solar PV market revenue. Furthermore, industrial solar projects sometimes qualify for rebates, tax credits, and significant incentives that help to reduce the effective cost of investment.

For instance, in some areas, accelerated depreciation benefits and investment tax credits (ITCs) inspire industrial players to install solar PV systems, therefore indirectly increasing the revenue growth of the solar PV market.

Solar PV (Photovoltaic) Panels Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Solar PV (Photovoltaic) Panels Market |

| Market Size in 2023 | USD 169 Billion |

| Market Forecast in 2032 | USD 324 Billion |

| Growth Rate | CAGR of 7.5% |

| Number of Pages | 222 |

| Key Companies Covered | JinkoSolar, JA Solar, Trina Solar, LONGi Solar, Canadian Solar, Hanwha Q-CELLS, Risen Energy, GCL-SI, First Solar, SunPower Corporation, TATA Power Solar, Adani Solar, Navitas Solar, Rayzon Solar, Pahal Solar, Jinko Solar, and others. |

| Segments Covered | By Technology, By Grid Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Solar PV (Photovoltaic) Panels Market: Regional Analysis

Asia Pacific dominates the market over the projected period

The Asia Pacific is expected to dominate the global Solar PV (Photovoltaic) Panels market during the forecast period. Key elements driving the regional industry are abundant sunlight, favorable government incentives, and growing consumer preference towards renewable energy to meet the rising power demand of its big and growing population.

Along with India's ambitious solar ambitions, China, a global leader in solar photovoltaic (PV) manufacturing, is essential for the region's dominance.

For instance, the New Delhi government adopted the draft of its Solar Policy 2022, which changed the installed capacity of 6,000 MW from 2,000 MW in two years in December 2022. The initiative sought to establish a single-window state portal run by the Delhi Solar Cell with uniform information on the advantages of solar PV installations.

Solar PV Panels Market: Competitive Analysis

The global Solar PV (Photovoltaic) Panels market is dominated by players like:

- JinkoSolar

- JA Solar

- Trina Solar

- LONGi Solar

- Canadian Solar

- Hanwha Q-CELLS

- Risen Energy

- GCL-SI

- First Solar

- SunPower Corporation

- TATA Power Solar

- Adani Solar

- Navitas Solar

- Rayzon Solar

- Pahal Solar

- Jinko Solar

The global Solar PV Panels market is segmented as follows:

By Technology

- Thin Film

- Crystalline Silicon

- Others

By Grid Type

- On Grid

- Off Grid

By Application

- Residential

- Commercial

- Industrial

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Using a mechanism called the photovoltaic effect, solar PV (photovoltaic) panels directly translate sunlight into electricity. Comprising many solar cells, usually silicon-based, photovoltaic panels capture photons from sunlight to excite electrons within the cells, generating an electric current. Solar PV panels are a clean and renewable energy source since residences, businesses, and other electrical equipment may be powered by this current. Usually found on rooftops, open fields, or integrated into construction components, solar PV panels are quite important in helping to minimize greenhouse gas emissions, therefore reducing dependency on fossil fuels and encouraging sustainable energy generation.

The solar PV panels market is driven by several factors, such as increasing investment in solar energy, increasing government initiatives, rising demand for clean energy, technological advancements, and the declining cost of solar panels.

According to the report, the global solar PV panels market size was worth around USD 169 billion in 2023 and is predicted to grow to around USD 324 billion by 2032.

The global Solar PV (Photovoltaic) Panels market is expected to grow at a CAGR of 7.5% during the forecast period.

The global solar PV (photovoltaic) panels market growth is expected to be driven by the Asia Pacific. It is currently the world’s highest revenue-generating market due to supportive government initiatives.

The global Solar PV Panels market is dominated by players like JinkoSolar, JA Solar, Trina Solar, LONGi Solar, Canadian Solar, Hanwha Q-CELLS, Risen Energy, GCL-SI, First Solar, SunPower Corporation, TATA Power Solar, Adani Solar, Navitas Solar, Rayzon Solar, Pahal Solar and Jinko Solar among others.

The solar PV (photovoltaic) panels market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed

-panels-market-size.png)