Specialty Insurance Market Size, Share, Analysis, Trends, Growth Report, 2032

Specialty Insurance Market By Type (Marine Insurance, Livestock & Aquaculture Insurance, Art Insurance, Aviation & Transport Insurance, Entertainment Insurance, and Political Risk & Credit Insurance), By End-User (Individual and Business), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

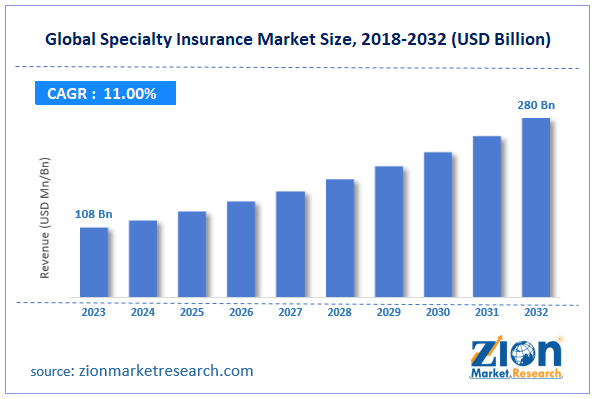

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 108 Billion | USD 280 Billion | 11% | 2023 |

Specialty Insurance Industry Prospective:

The global specialty insurance market size was evaluated at $108 billion in 2023 and is slated to hit $280 billion by the end of 2032 with a CAGR of nearly 11% between 2024 and 2032.

Specialty Insurance Market: Overview

Specialty insurance is insurance coverage for various businesses as well as individual persons having particular requirements. Few of the best examples of specialty insurance include vendor insurance, marine insurance, home insurance, performer insurance, professional liability insurance, and vehicle insurance.

Key Insights

- As per the analysis shared by our research analyst, the global specialty insurance market is projected to expand annually at the annual growth rate of around 11% over the forecast timespan (2024-2032)

- In terms of revenue, the global specialty insurance market size was evaluated at nearly $108 billion in 2023 and is expected to reach $280 billion by 2032.

- The global specialty insurance market is anticipated to grow rapidly over the forecast timeline owing to demand for customization, legal compliance, and comprehensive coverage & protection.

- In terms of type, the marine insurance segment is slated to register the highest CAGR over the forecast period.

- Based on end-user, the individual segment is predicted to contribute majorly towards the global industry profits in the upcoming years.

- Region-wise, the Asia-Pacific specialty insurance industry is projected to register the fastest CAGR during the projected timespan.

Request Free Sample

Request Free Sample

Specialty Insurance Market: Growth Factors

Huge demand for product in developing countries will expedite the growth of the market globally

Demand for customization, legal compliance, and comprehensive coverage & protection will prop up the growth of the global specialty insurance market. Apart from this, the need for reducing risks of product damage along with digital transformation has paved the way for the humungous growth of the global market. Reportedly, insurance firms are improving their underwriting capabilities and this has contributed humungously towards global market expansion. Large-scale fund allocation from venture capital firms in specialty insurance firms is expected to spearhead the growth of the global market. Product innovations will further enable the growth of the market globally. High awareness about the benefits offered by specialty insurance will pave the way for the immense progression of the market globally. Need for the product for the aging populace along with the easy availability of personalized insurance coverage facilities in emerging economies is likely to scale up the global market surge. Moreover, developing specialized insurance products based on consumer preference will steer the global market trends.

Specialty Insurance Market: Restraints

Rise in risk assessment costs due to manual time-consuming procedures can restrict the global industry expansion

Restricted underwriting capabilities and manual subscription processes can halt the rapid expansion of the global specialty insurance industry. In addition to this, surging prices of risk assessment and rise in the costs of managing special insurance claims can lead to depreciation in the growth of the global industry.

Specialty Insurance Market: Opportunities

Growing focus of insurance firms on new products targeting low-income group population to open new growth avenues for the global market

Escalating need for specialty insurance in the life sciences and healthcare sectors is anticipated to open new growth avenues for the global specialty insurance market. With insurance products aiding genetic testing procedures and precision medicine, the global market is likely to expand by leaps & bounds in the coming years. Moreover, some of the specialty insurance products can be availed by low-income groups in emerging economies and this can open new avenues of growth for the global market.

Specialty Insurance Market: Challenges

Changes in the insurance charges based on age and the insurance liability coverage can challenge the global industry surge by 2032

Risks of litigation and growing issues related to new product development are likely to challenge the expansion of the global specialty insurance industry. Apart from this, the unpredictability of claims and pricing issues due to dynamic pricing can put brakes on the global industry expansion.

Specialty Insurance Market: Segmentation

The global specialty insurance market is divided into type, end-user, and region.

In terms of type, the specialty insurance market across the globe is bifurcated into marine insurance, livestock & aquaculture insurance, art insurance, aviation & transport insurance, entertainment insurance, and political risk & credit insurance segments. Additionally, the marine insurance segment, which gained approximately 45.3% of the global market share in 2023, is projected to record the highest growth rate annually in the forecast timespan. The expansion of the segment in the coming couple of years can be due to a large number of risks such as vessel damage, cargo damage, and goods damage in ships covered under marine insurance coverage.

Based on the end-user, the global specialty insurance industry is divided into individual and business segments. Furthermore, the individual segment, which gathered approximately two-thirds of the global industry earnings in 2023, is set to make major contributions towards the global industry profits in the forecasting timespan. The expansion of the segment in the analysis timeline can be attributed to growing individual awareness about special insurance coverage for their assets.

Specialty Insurance Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Specialty Insurance Market |

| Market Size in 2023 | USD 108 Billion |

| Market Forecast in 2032 | USD 280 Billion |

| Growth Rate | CAGR of 11% |

| Number of Pages | 216 |

| Key Companies Covered | Berkshire Hathaway Inc., Chubb, Munich Re, AXA AG, ASSICURAZIONI GENERALI S.P.A., American International Group Inc. (AIG), Tokio Marine HCC, PICC (People's Insurance Company of China), Allianz., and others. |

| Segments Covered | By Type, By End-User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Specialty Insurance Market: Regional Insights

Europe is expected to maintain a numero uno position in the global market during the analysis timeframe

Europe, which accounted for 60% of the global specialty insurance market revenue in 2023, is projected to establish a leading position in the global market in the years to come. In addition to this, the regional market surge in the forecast timeframe can be attributed to the presence of key private and public players in European countries along with favorable compensation policies in these countries. Availability of seamless online insurance services due to strong web connectivity and awareness about the people about benefits of specialty insurance is likely to boost the growth of the market in Europe.

Asia-Pacific specialty insurance industry is predicted to register the highest growth rate years over 2024-2032. The growth of the industry in the APAC can be subject to swift economic development and effective risk management activities witnessed in the countries of Asia. Apart from this, a rise in awareness about the benefits accrued due to the purchase of specialty insurance among middle-income groups will drive regional industry trends.

Key Developments

- In the first half of 2023, The Hanover Insurance Group Inc. declared the introduction of SimpliSafe for its partners. Reportedly, SimpliSafe offers them coverage against various kinds of damages or losses incurred to the real-estate property.

- In the second quarter of 2022, RenaissanceRe Holdings Limited introduced Fontana Holdings which covered specialty and casualty risks for institutional investors.

Specialty Insurance Market: Competitive Space

The global specialty insurance market profiles key players such as:

- Berkshire Hathaway Inc.

- Chubb

- Munich Re

- AXA AG

- ASSICURAZIONI GENERALI S.P.A.

- American International Group Inc. (AIG)

- Tokio Marine HCC

- PICC (People's Insurance Company of China)

- Allianz

The global specialty insurance market is segmented as follows:

By Type

- Marine Insurance

- Livestock & Aquaculture Insurance

- Art Insurance

- Aviation & Transport Insurance

- Entertainment Insurance

- Political Risk & Credit Insurance

By End-User

- Individual

- Business

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Specialty insurance is insurance coverage for various businesses as well as individual persons having particular requirements.

The global specialty insurance market growth over the forecast period can be owing to large-scale fund allocation from venture capital firms in specialty insurance firms.

According to a study, the global specialty insurance industry size was $108 billion in 2023 and is projected to reach $280 billion by the end of 2032.

The global specialty insurance market is anticipated to record a CAGR of nearly 11% from 2024 to 2032.

Asia-Pacific specialty insurance industry is set to register the fastest CAGR over the forecasting timeline owing to swift economic development and effective risk management activities witnessed in the countries of Asia. Apart from this, a rise in awareness about the benefits accrued due to the purchase of specialty insurance among middle-income groups will drive regional industry trends.

The global specialty insurance market is led by players such as Berkshire Hathaway Inc., Chubb, Munich Re, AXA AG, ASSICURAZIONI GENERALI S.P.A., American International Group Inc. (AIG), Tokio Marine HCC, PICC (People's Insurance Company of China), and Allianz.

The global specialty insurance market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTEL analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five force analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed