Stock Music Software Market Size, Share, Industry Analysis, Trends, Growth, 2032

Stock Music Software Market By Type (Web-Based and Cloud-Based), By Application (Enterprise, Individual, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

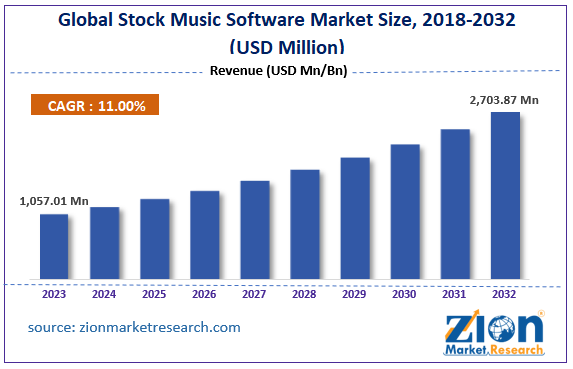

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1,057.01 Million | USD 2,703.87 Million | 11.00% | 2023 |

Stock Music Software Industry Prospective:

The global stock music software market size was worth around USD 1,057.01 million in 2023 and is predicted to grow to around USD 2,703.87 million by 2032 with a compound annual growth rate (CAGR) of roughly 11.00% between 2024 and 2032.

Stock Music Software Market: Overview

Stock music software is a program housing different types of music including songs and jingles. The key difference between stock music software and other music-enlisting applications is that the former allows royalty-free use of the store music in different ways. Stock music software allows companies and individuals to use stocked music in podcasts, internet courses, advertisements, movies, games, and other programs that require music to enrich the overall viewer experience. Stock music software is also equipped with licensing features so that the users do not have to pay royalty fees for every use. Currently, the commercial industry is dominated by several players offering highly lucrative features. The leading brands offering stock music include Audio Jungle, Soundstripe, Shockwave-Sound.com, Pond5, and others. Stock music software offers an extensive music library and hence has something to offer to all potential users. The age of social media is driving the demand for stock music software. During the forecast period, companies operating in the market can invest in artificial intelligence (AI)-enabled solutions to garner more revenue.

Key Insights:

- As per the analysis shared by our research analyst, the global stock music software market is estimated to grow annually at a CAGR of around 11.00% over the forecast period (2024-2032)

- In terms of revenue, the global stock music software market size was valued at around USD 1,057.01 million in 2023 and is projected to reach USD 2,703.87 million, by 2032.

- The stock music software market is projected to grow at a significant rate due to the increasing advertising and marketing expenditure by brands

- Based on the type, the web-based segment is growing at a high rate and will continue to dominate the global market as per industry projection

- Based on the application, the individual segment is anticipated to command the largest market share

- Based on region, North America is projected to dominate the global market during the forecast period

Request Free Sample

Request Free Sample

Stock Music Software Market: Growth Drivers

Increasing advertising and marketing expenditures by brands will drive the market demand rate

The global stock music software market is expected to benefit from the growing advertisement and marketing expenditure by product and service providers. The modern commercial world is highly competitive. For every product type, multiple companies are offering a wide range of solutions. This has led to increased efforts toward developing solutions that promote brand differentiations. Studies indicate that efficient and effective marketing or advertising techniques are crucial to a brand’s overall growth rate. The importance and subsequent focus on curating innovative marketing techniques, especially through digital media has surged in the present times. In 2024, leading food & beverages (F&B) player PepsiCo was reported to have invested more than USD 3.2 billion on promotions and advertisement. Similarly, retail giant Walmart spent nearly USD 4.42 billion on advertising in 2023.

Marketing and promotion techniques have also evolved over the years. With the advent of digital mediums and increased access to consumer electronics such as smartphones, tablets, and laptops, digital advertising has become the front-runner in terms of promotional techniques. Advertisements conducted through digital solutions reach a broader group of audience in a limited time. Moreover, they tend to have a longer-lasting impact. Digital advertisements also offer extensive opportunities to experiment with creative ideas through which brands can market their product. The pressing need to develop and launch more creative digital advertisements to stay relevant among a dynamic consumer group is expected to fuel demand for stock music software industry.

Emerging video games market to impact the demand for stock music

All forms of video games including online programs, mobile games, digital downloads, and retail games have found massive popularity among modern consumers. The higher access to portable smart devices such as mobile phones equipped to handle longer hours of gaming has led to the surging use of stock music in the gaming industry. Furthermore, the more advanced versions of video games including the ones played using gaming consoles and virtual or augmented reality headsets and technologies have generated massive revenue in the video gaming sector. More than 3 billion people worldwide play some form of video game. The global average weekly hours of gaming mounted to more than 8 hours in 2021 thus signifying the strength of the global stock music software market.

Stock Music Software Market: Restraints

Costs associated with the software solutions may limit the market’s adoption rate

The global stock music software industry is expected to come across specific growth restrictions during the projection period. Most stock music applications offer paid services. They run on a subscription-based model thus limiting the number of users on the tool. In addition to this, the internet is filled with several other free offerings that do not have any associated cost thus attracting a large number of customers. For instance, Musicbed charges are around USD 29. Furthermore, certain platforms may offer a limited music range failing to justify the associated costs.

Stock Music Software Market: Opportunities

Integrating artificial intelligence and machine learning (ML) technologies to deliver improved tool features will generate growth opportunities

The global stock music software market players must experiment with integrating advanced technologies such as AI and ML to improve the overall delivery of the tool. In the last 5 years, AI and ML technologies have reached new heights with increasing interest and investments from technology companies. These tools are used to optimize the overall performance of a machine or a program. For instance, AI in stock music software can play the role of analyzing patterns and consumer preferences for certain songs or music. Furthermore, they can be applied to make the complex licensing process easier for consumers.

Growing popularity of social media content will generate massive revenue in the market

The social media culture has held a consistently increasing growth pace in the last decade. Platforms such as YouTube, Instagram, Snapchat, TikTok, and others host billions of people from across the globe. For instance, YouTube has more than 3 billion active years every month. Similar numbers are presented by other platforms. These applications garner viewership because of the type of content posted on the platforms. Each content piece requires some form of music to make it more engaging. Stock music software is likely to find more customers in the social media market group as companies continue to invest in improving the platforms and launching new apps; and locations. In March 2024, Steven Mnuchin, a former Treasury Secretary of the US, announced that he was putting together a new investor group to buy TikTok with each investor owning not more than 10% of the total shares thus creating more growth opportunities for the global stock music software industry.

Stock Music Software Market: Challenges

High competition in the industry may challenge the market expansion rate

The global stock music software market is projected to be challenged due to the presence of several competitors in the otherwise small industry. The companies may be unable to generate a dedicated consumer group since almost all software offers the same features. The difference is mainly in the music library. Furthermore, the complications arising from constantly upgrading the tool could further impact the market growth rate.

Stock Music Software Market: Segmentation

The global stock music software market is segmented based on type, application, and region.

Based on the type, the global market segments are web-based and cloud-based. In 2023, the highest growth was witnessed in the web-based segment. Information is shared and accessed through the internet. Web-based solutions are easier to use and hence have greater consumer groups. Moreover, the websites or applications can be accessed from anywhere thus adding to the overall advantage. The cloud-based segment utilizes cloud technology and is slowly gaining traction. Musicbed hosts more than 1000 artists on its platform.

Based on the application, the global market divisions are enterprise, individual, and others. In 2023, the individual segment of the stock music software industry was the leading revenue generator driven by the growing use of the tools for obtaining music in content posted on social media channels. The number of users across social media platforms has risen above expectations since these platforms offer lucrative monetary and non-monetary opportunities. In early 2024, more than 2 billion monthly users were reported by Instagram.

Stock Music Software Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Stock Music Software Market |

| Market Size in 2023 | USD 1,057.01 Million |

| Market Forecast in 2032 | USD 2,703.87 Million |

| Growth Rate | CAGR of 11.00% |

| Number of Pages | 212 |

| Key Companies Covered | Audio Network, Bensound, Artlist, PremiumBeat (a Shutterstock company), Jamendo, Adobe (Adobe Stock), 123RF, Epidemic Sound, Envato (AudioJungle), Musicbed, Pond5, Marmoset, Shutterstock Music, AudioBlocks (Storyblocks), Soundstripe., and others. |

| Segments Covered | By Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Stock Music Software Market: Regional Analysis

North America to be led by the US during the projection period

The global stock music software market will be led by North America during the projection period. The US is expected to lead the regional market growth rate driven by the growing number of stock music software companies in the region. For instance, leading regional players include Motion Array and Melody Loops. StockMusic.net, and TunePocket among others. Moreover, the US music industry is extremely complicated in terms of using artist-owned music across other mediums. Registered stock music software applications help ordinary users navigate the complex web and hence the demand for such software is higher in the North American market.

Asia-Pacific is projected to deliver exceptional results in the coming years. The regional countries are witnessing massive economic growth rates resulting in the emergence of several new companies and the addition of international players in the domestic market. To gain customer attention and loyalty, these companies spend hefty on digital marketing and advertising resulting in higher regional revenue. Moreover, the growing social media culture is further impacting revenue in the Asia-Pacific market. Furthermore, the domestic video gaming industry is also a significant consumer of stock music software.

Stock Music Software Market: Competitive Analysis

The global stock music software market is led by players like:

- Audio Network

- Bensound

- Artlist

- PremiumBeat (a Shutterstock company)

- Jamendo

- Adobe (Adobe Stock)

- 123RF

- Epidemic Sound

- Envato (AudioJungle)

- Musicbed

- Pond5

- Marmoset

- Shutterstock Music

- AudioBlocks (Storyblocks)

- Soundstripe.

The global stock music software market is segmented as follows:

By Type

- Web-Based

- Cloud-Based

By Application

- Enterprise

- Individual

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Stock music software is a program housing different types of music including songs and jingles.

The global stock music software market is expected to benefit from the growing advertisement and marketing expenditure by product and service providers.

According to study, the global stock music software market size was worth around USD 1,057.01 million in 2023 and is predicted to grow to around USD 2,703.87 million by 2032.

The CAGR value of the stock music software market is expected to be around 11.00% during 2024-2032.

The global stock music software market will be led by North America during the projection period.

The global stock music software market is led by players like Audio Network, Bensound, Artlist, PremiumBeat (a Shutterstock company), Jamendo, Adobe (Adobe Stock), 123RF, Epidemic Sound, Envato (AudioJungle), Musicbed, Pond5, Marmoset, Shutterstock Music, AudioBlocks (Storyblocks) and Soundstripe.

The report explores crucial aspects of the stock music software market including a detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed