Storage Tank Market Size, Share, Analysis, Trends, Growth, Forecasts, 2032

Storage Tank Market By End-User Industry (Oil & Gas, Food & Beverages, Paper & Pulp, Power Generation, Water & Wastewater Management, and Others), By Material Type (FRP, Metal, Plastic, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

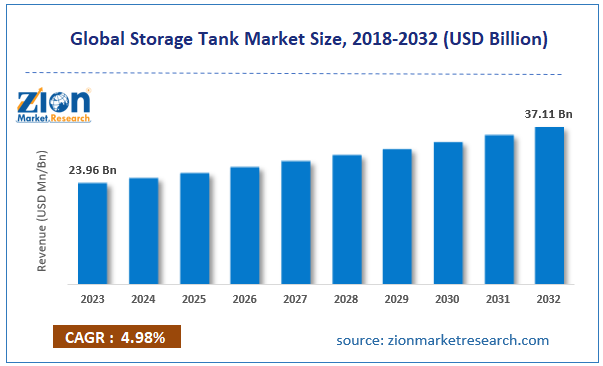

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 23.96 Billion | USD 37.11 Billion | 4.98% | 2023 |

Storage Tank Industry Prospective:

The global storage tank market size was worth around USD 23.96 billion in 2023 and is predicted to grow to around USD 37.11 billion by 2032 with a compound annual growth rate (CAGR) of roughly 4.98% between 2024 and 2032.

Storage Tank Market: Overview

Storage tanks are containers across size groups used for safely holding liquid or compressed gasses. The demand for superior-grade and high-functioning storage tanks has increased over the years due to rising end-user applications.

Some of the major industries spending heavily on the development of customized and secure storage tanks include oil & gas, food & beverages, water & wastewater treatment industry, and others.

In certain cases, storage tanks are located above the ground, while in specific industries, they are placed beneath the ground as a safety precaution.

Most storage tanks are made of high-quality raw materials since the containers are responsible for carefully holding the stored products over an extended period. Carbon steel is a common raw material used to manufacture highly durable and versatile storage tanks.

Additionally, concrete-based containers are also widely popular, especially water storage tanks. The ongoing investments in the development of composite materials offering higher performance will further help the storage tank industry expand during the projection period. However, disruptions in the supply chain of raw materials and finished goods may impact the market growth trajectory.

Key Insights:

- As per the analysis shared by our research analyst, the global storage tank market is estimated to grow annually at a CAGR of around 4.98% over the forecast period (2024-2032)

- In terms of revenue, the global storage tank market size was valued at around USD 23.96 billion in 2023 and is projected to reach USD 37.11 billion by 2032.

- The storage tank market is projected to grow at a significant rate due to the growing applications in the oil & gas industry.

- Based on end-user industry, the oil & gas segment is growing at a high rate and will continue to dominate the global market as per industry projections.

- Based on material type, the plastic segment is anticipated to command the largest market share.

- Based on region, Asia-Pacific is projected to dominate the global market during the forecast period.

Storage Tank Market: Growth Drivers

Growing applications in the oil & gas industry will drive industry demand rate

The global storage tank market is expected to grow due to the rising applications of the containers in the oil & gas industry. Storage tanks are widely used in the industry across oil extraction and distribution processes.

For instance, they are used to store raw materials required for extraction activities. They are also used to transport finished goods from oil refining factories to end-users across the globe.

In addition, the oil & gas industry has a high demand for specialized storage tanks due to the sensitive and hazardous nature of the materials stored.

The market demand will be led by the rising investments in the oil & gas sector across the board. For instance, in April 2024, South Korea announced the launch of a new oil & gas import and storage facility.

The port also received its first shipment in the same month. Similarly, in October 2024, Hindustan Petroleum Corporation, the Indian state-owned petroleum company, announced that it expects to commission the newly developed Liquified Natural Gas (LNG) import terminal by December 2024 or January 2025. The company has already started negotiating with LNG suppliers. Moreover, the rising investments in the offshore oil drilling segment will further help the market generate significant revenue.

Stringent regulations surrounding the use of storage tanks for workers and environmental safety will further promote market revenue

Containers are essential for storing liquid and compressed gasses that could be otherwise harmful to the environment or employed personnel. The growing stringency toward maintaining and complying with workplace safety protocols is likely to drive the demand for superior and highly durable storage tanks.

For instance, the US has carefully drafted laws for underground storage tanks (USTs). The framework is available in the U.S. Code, Title 42, Chapter 82, Subchapter IX. The laws include information on applications of the Leaking Underground Storage Tank (LUST) Trust Fund, along with provisions for operator training, inspections, and other aspects related to containers.

According to the Occupational Safety and Health (OSH) Act, employers in the US willfully violating the law are subject to a penalty of not more than $156,259 for each violation. Such strict measures will impact the demand rate in the global storage tank market.

Storage Tank Market: Restraints

Supply chain disruptions of raw materials and finished goods will impact market revenue

The global industry for storage tanks is projected to be restricted due to the ongoing disruption in the supply chain concerning raw materials and finished goods.

For instance, the steel production rate has been highly volatile in the last few years. In 2022, global steel production plummeted by over 4%, becoming the first such incident since 2015.

Additionally, the changing geopolitical scenario on the global stage directly impacts the smooth supply of final goods, leaving market players with limited profit margins.

Storage Tank Market: Opportunities

Rising investments in novel materials and integration of technology to generate growth opportunities

The global storage tank market is projected to generate growth opportunities due to rising investments in the innovation of new materials. Market players are focusing on developing robust materials that can withstand harsh environments, chemical resistance, and high strength while being lightweight.

In February 2024, Beltecno India, a leading player in the manufacturing sector, announced the launch of Thermal Water Storage Tanks to meet the changing commercial and industrial demand. The key features of the new tank include the use of high-quality materials, exceptional storage capacity, and cutting-edge thermal technology.

The rising focus on sophisticated storage tank manufacturing technologies will be crucial in shaping the industry revenue during the projection period.

One such solution is in the form of extrusion blow molded High-Density Polyethylene (HDPE) tanks. They are produced without any joints by molding a single parison. The integration of engineering solutions such as sensors, Artificial Intelligence (AI), and the Internet of Things (IoT) in storage tanks is expected to improve the market growth rate in the long run. Additionally, double-walled tanks have become widely successful in the oil storage industry.

Storage Tank Market: Challenges

Constantly changing consumer demands may challenge innovation speed in the industry

The global storage tank industry is expected to be challenged by the changing demands of end-user industries. For instance, developments in the renewable energy sector have emphasized the development of containers that can meet industry-specific demands.

Additionally, it has impacted the traditional container-based requirements in the oil & gas sector. Evolving consumer demands can lead to difficulties innovating new solutions within a time frame.

Storage Tank Market: Segmentation

The global storage tank market is segmented based on end-user industry, material type, and region.

Based on the end-user industry, the global market segments are oil & gas, food & beverages, paper & pulp, power generation, water & wastewater management, and others.

In 2023, the highest growth was witnessed in the oil & gas sector. The exceptionally high use of superior-strength storage tanks across processes in the oil industry will fuel segmental demand in the oil industry. According to market research, the oil & gas industry contributes to over 2.51% of global gross domestic product (GDP).

Based on the material type, the storage tank industry divisions are FRP, metal, plastic, and others. In 2023, the highest demand was listed in the plastic segment due to wider applications across small and medium-scale applications.

The demand for HDPE-based storage tanks is the highest in the segment. The general lifespan of a high-density polyethylene container is more than 5 decades if maintained under ideal conditions. The demand for superior metal-based storage tanks is expected to grow steadily over the forecast period.

Storage Tank Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Storage Tank Market |

| Market Size in 2023 | USD 23.96 Billion |

| Market Forecast in 2032 | USD 37.11 Billion |

| Growth Rate | CAGR of 4.98% |

| Number of Pages | 216 |

| Key Companies Covered | Vitol Tank Terminals International (VTTI), Shubham Tanks & Liners, Shawcor Ltd., Sunrise Process Equipment, China National Petroleum Corporation, Koninklijke Vopak NV, Fluor Corporation, McDermott International Inc., Simplex Plast, Oiltanking GmbH, T.F. Warren Group, Buckeye Partners L.P., Joemillars Aquatek, Aquatech Tanks., and others. |

| Segments Covered | By End-User Industry, By Material Type, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Storage Tank Market: Regional Analysis

Asia-Pacific to generate the highest revenue during the projection period

The global storage tank market will be led by Asia-Pacific during the forecast period. Countries such as China, India, and South Korea will lead the regional revenue, according to market research. China, for instance, is home to one of the world’s leading manufacturing industries involved in the production of all types of storage tanks.

In addition to this, it is also the largest contributor in terms of plastic-based solutions, including storage tanks. Rapid industrialization and urbanization across Asian countries are crucial drivers for storage tank-related demand.

In September 2024, reports emerged suggesting that the Yulong project in China had begun commercial operations. It is a USD 20 billion project consisting of a 400,000-bpd crude refinery along with a 3 million tons per year (tpy) paraxylene facility and a 3 million tpy ethylene complex.

Similarly, India has been investing heavily in the chemicals & materials segment, contributing to regional demand. The growing demand for upscale storage tanks in the renewable energy market in Asia-Pacific holds several novel growth opportunities for the global players.

Storage Tank Market: Competitive Analysis

The global storage tank market is led by players like:

- Vitol Tank Terminals International (VTTI)

- Shubham Tanks & Liners

- Shawcor Ltd.

- Sunrise Process Equipment

- China National Petroleum Corporation

- Koninklijke Vopak NV

- Fluor Corporation

- McDermott International Inc.

- Simplex Plast

- Oiltanking GmbH

- T.F. Warren Group

- Buckeye Partners L.P.

- Joemillars Aquatek

- Aquatech Tanks.

The global storage tank market is segmented as follows:

By End-User Industry

- Oil & Gas

- Food & Beverages

- Paper & Pulp

- Power Generation

- Water & Wastewater Management

- Other

By Material Type

- FRP

- Metal

- Plastic

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Storage tanks are containers across size groups used for safely holding liquid or compressed gasses.

The global storage tank market is expected to grow due to the rising applications of the containers in the oil & gas industry.

According to study, the global storage tank market size was worth around USD 23.96 billion in 2023 and is predicted to grow to around USD 37.11 billion by 2032.

The CAGR value of the storage tank market is expected to be around 4.98% during 2024-2032.

The global storage tank market will be led by Asia-Pacific during the forecast period.

The global storage tank market is led by players like Vitol Tank Terminals International (VTTI), Shubham Tanks & Liners, Shawcor Ltd., Sunrise Process Equipment, China National Petroleum Corporation, Koninklijke Vopak NV, Fluor Corporation, McDermott International, Inc., Simplex Plast, Oiltanking GmbH, T.F. Warren Group, Buckeye Partners L.P., Joemillars Aquatek and Aquatech Tanks.

The report explores crucial aspects of the storage tank market, including a detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

Choose License Type

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed