Stretch and Shrink Films Market Trend, Share, Growth, Size and Forecast 2030

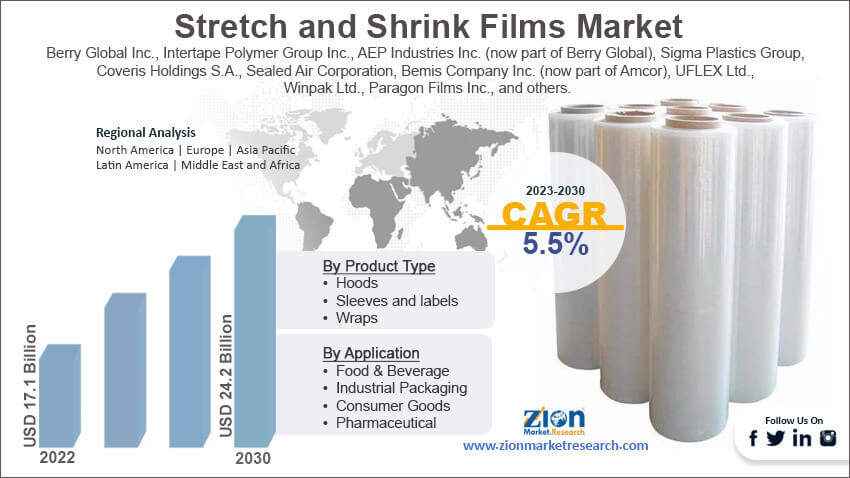

Stretch and Shrink Films Market By Resin (LLDPE, LDPE, PVC, and Other resins), By Product Type (Hoods, Sleeves & Labels, and Wraps), By Application (Food & Beverage, Industrial Packaging, Consumer Goods, and Pharmaceutical), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, And Forecasts 2023 - 2030

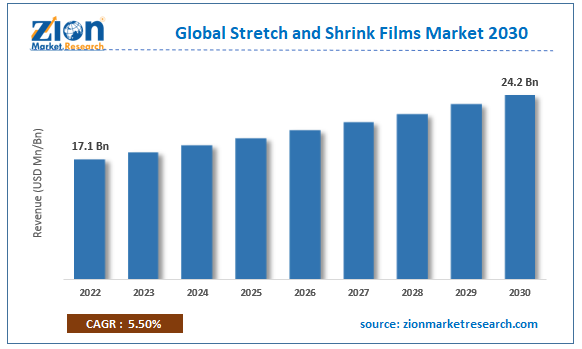

| Market Size in 2022 | Market Forecast in 2030 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 17.1 Billion | USD 24.2 Billion | 5.5% | 2022 |

Stretch and Shrink Films Industry Prospective:

The global stretch and shrink films market size was worth around USD 17.1 billion in 2022 and is predicted to grow to around USD 24.2 billion by 2030 with a compound annual growth rate (CAGR) of roughly 5.5% between 2023 and 2030.

Stretch and Shrink Films Market: Overview

Stretch and shrink films are types of plastic films widely used in packaging applications to secure and protect various products. These films are made from materials such as polyethylene, polypropylene, or PVC, and they possess unique properties that make them ideal for different packaging needs. Stretch and shrink films are integral components of the global packaging landscape, with materials like LLDPE taking center stage due to its flexibility and cost-effectiveness. Hoods, the dominant product type, offer versatility in packaging irregularly shaped items and pallets.

The food & beverage sector commands the largest share in applications, relying on these films for preserving and protecting perishable goods. Beyond this, stretch and shrink films play vital roles in industrial packaging, consumer goods, and pharmaceuticals. The market's dynamic landscape is evident in the prominence of the Asia Pacific region, driven by robust growth in e-commerce, retail, and industrial activities. As environmental considerations become increasingly significant, the industry is witnessing innovations to align with sustainable packaging practices. The stretch and shrink films market continues to adapt to evolving industry demands, showcasing its resilience and importance in the broader packaging ecosystem.

Key Insights

- As per the analysis shared by our research analyst, the global stretch and shrink films industry is estimated to grow annually at a CAGR of around 5.5% over the forecast period (2023-2030).

- In terms of revenue, the global stretch and shrink films market size was valued at around USD 17.1 billion in 2022 and is projected to reach USD 24.2 billion, by 2030.

- The global stretch and shrink films market is projected to grow at a significant rate due to the growing demand for efficient and cost-effective packaging solutions in various industries.

- Based on resin segmentation, LLDPE was predicted to hold maximum market share in the year 2022.

- Based on product type segmentation, hoods was the leading revenue generator in 2022.

- Based on application segmentation, food & beverage was the leading revenue generator in 2022.

- On the basis of region, Asia Pacific was the leading revenue generator in 2022.

Request Free Sample

Request Free Sample

Stretch and Shrink Films Market: Growth Drivers

The growing demand for efficient and cost-effective packaging solutions to drive the market.

The stretch and shrink films market is experiencing robust growth, fueled by the escalating demand for efficient and cost-effective packaging solutions across diverse industries. As businesses seek to optimize their packaging processes, these films have emerged as versatile and indispensable components. Industries such as logistics, manufacturing, and retail are increasingly relying on stretch films for palletizing goods, providing stability during transportation, and safeguarding products against external elements. The inherent flexibility, stretchability, and cost-effectiveness of these films make them attractive choices for companies aiming to enhance the integrity and presentation of their packaged goods. Moreover, the market's expansion is particularly evident in the context of the booming e-commerce sector. The surge in online retail activities has led to a higher volume of individual shipments, intensifying the need for reliable packaging materials. Stretch and shrink films play a pivotal role in securing and bundling products for efficient transportation, contributing to the overall growth of the market.

Additionally, the films' ability to conform to various shapes and sizes, coupled with their cost efficiency, positions them as preferred solutions for businesses looking to balance packaging effectiveness with economic considerations. As the demand for streamlined and economical packaging solutions continues to rise, the stretch and shrink films market is poised for sustained growth. Moreover, government initiatives are helping to create a positive environment for the growth of the stretch and shrink films market. In 2023, the European Commission adopted the Single-Use Plastics Directive (SUPD), which bans the use of certain single-use plastic products, including single-use stretch films. In 2022, the US Department of Agriculture (USDA) announced a USD 1 million grant to support the development of new and innovative sustainable packaging solutions, including stretch and shrink films made from bio-based materials. As a result, the market is expected to continue to grow in the coming years.

Stretch and Shrink Films Market: Restraints

Environmental concern associated with plastic packaging may hurdle the market growth.

The stretch and shrink films industry faces a significant restraint in the form of heightened environmental concerns associated with plastic packaging. The widespread use of these films, typically made from materials like polyethylene, raises issues related to plastic waste generation, recycling challenges, and environmental sustainability. As consumers and regulatory bodies increasingly emphasize eco-friendly practices, the negative environmental impact of plastic packaging has become a key factor limiting the growth of the market. Efforts to address these concerns have led to a growing demand for sustainable packaging alternatives. Companies are exploring and adopting environmentally friendly materials, and there is a shift towards circular economy models to minimize the ecological footprint of packaging solutions. The industry's response to these environmental challenges is crucial for the future trajectory of the stretch and shrink films market, prompting innovations in biodegradable materials, recycling technologies, and more sustainable packaging practices to align with evolving consumer expectations and global environmental goals.

Stretch and Shrink Films Market: Opportunities

Increasing demand for sustainable and eco-friendly packaging solutions to provide growth opportunities

The escalating demand for sustainable and eco-friendly packaging solutions presents a substantial growth opportunity for the global stretch and shrink films market. With environmental consciousness at the forefront of consumer and industry considerations, there is a rising preference for packaging materials that minimize ecological impact. This shift in consumer behavior, coupled with stringent regulations promoting sustainability, is driving a significant market trend towards biodegradable, recyclable, and renewable-source stretch and shrink films.

Manufacturers are strategically positioning themselves to capitalize on this opportunity by investing in research and development to create innovative, environmentally responsible packaging solutions. By offering products that align with sustainability goals without compromising on performance, companies can not only tap into a growing market segment but also enhance their brand image as environmentally conscious entities. Embracing this opportunity not only meets the evolving demands of a socially responsible consumer base but also positions the stretch and shrink films industry as a key player in advancing sustainable practices within the broader packaging landscape.

Stretch and Shrink Films Market: Challenges

Intensifying competition and price pressures within the industry to challenge market growth

The stretch and shrink films market faces a formidable challenge in the form of intensifying competition and escalating price pressures. As these films play a crucial role in diverse industries, including logistics, manufacturing, and retail, the market has become saturated with numerous suppliers vying for dominance. This competitive landscape often triggers price wars as companies strive to secure contracts and market share, leading to tighter profit margins across the industry.

This challenge is further exacerbated by the prevailing trend of businesses seeking cost optimization throughout their supply chains. In this pursuit, there is a growing inclination toward lower-cost alternatives, posing a direct threat to the profitability of stretch and shrink film producers. To surmount these challenges and foster sustainable growth, companies must strategically differentiate themselves. This could involve innovations in product features, the development of specialized applications to meet specific industry needs or a strong commitment to sustainability. Successfully navigating the delicate balance between cost considerations and added value will be crucial for industry players looking to thrive amid the competitive and price-driven challenges in the market.

Stretch and Shrink Films Market: Segmentation

The global stretch and shrink films market is segmented based on resin, product type, application, and region.

Based on resin, the global market segments are LLDPE, LDPE, PVC, and others. Presently, the LLDPE (Linear Low-Density Polyethylene) segment dominates the global market due to its versatile properties that align with the diverse requirements of packaging applications. LLDPE offers exceptional stretchability, puncture resistance, and clarity, making it an ideal choice for stretch and shrink films. Its superior performance in terms of film strength and flexibility caters to the increasing demand for efficient and durable packaging solutions across industries. Additionally, LLDPE's cost-effectiveness and compatibility with various processing methods contribute to its widespread adoption, consolidating its position as the leading resin in the global stretch and shrink films market.

Based on product type, the global stretch and shrink films industry is categorized as hoods, sleeves & labels, and wraps. Out of these, hoods were the largest shareholding segment in the global market. This dominance can be attributed to the wide range of applications for hoods, which are extensively used in packaging solutions for pallets, machinery, and large or irregularly shaped items. Hoods offer efficient protection and stability during transportation and storage, making them a preferred choice in various industries. The versatility and adaptability of hoods contribute to their leading position in the global stretch and shrink films market, meeting the diverse packaging needs of different sectors.

Based on application, the global stretch and shrink films industry is categorized as food & beverage, industrial packaging, consumer goods, and pharmaceutical. Out of these, food & beverage was the largest shareholding segment in the global market. This dominance can be attributed to the critical role of stretch and shrink films in preserving and protecting food products during packaging, transportation, and in-store displays. The food and beverage industry's stringent requirements for efficient, hygienic, and visually appealing packaging contribute to the widespread adoption of these films in this segment. The emphasis on extending the shelf life of perishable items and ensuring product integrity positions the food & beverage category as the leading application in the global stretch and shrink films market.

Stretch and Shrink Films Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Stretch and Shrink Films Market |

| Market Size in 2022 | USD 17.1 Billion |

| Market Forecast in 2030 | USD 24.2 Billion |

| Growth Rate | CAGR of 5.5% |

| Number of Pages | 222 |

| Key Companies Covered | Berry Global Inc., Intertape Polymer Group Inc., AEP Industries Inc. (now part of Berry Global), Sigma Plastics Group, Coveris Holdings S.A., Sealed Air Corporation, Bemis Company Inc. (now part of Amcor), UFLEX Ltd., Winpak Ltd., Paragon Films Inc., and others. |

| Segments Covered | By Resin, By Product Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2022 |

| Historical Year | 2017 to 2021 |

| Forecast Year | 2023 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Stretch and Shrink Films Market: Regional Analysis

Asia Pacific to lead the market during the forecast period

Asia Pacific is poised to take the lead in the global stretch and shrink film market throughout the forecast period, fueled by a convergence of factors shaping the region's packaging industry. The exponential growth of e-commerce and retail sectors in countries such as China and India is a significant driver, propelling the demand for efficient packaging solutions like stretch and shrink films.

The region's expanding manufacturing and industrial activities further contribute to the rising need for these films in securing and protecting goods during transit. Additionally, as environmental concerns drive a shift towards sustainable packaging practices, Asia Pacific is at the forefront of adopting innovative and eco-friendly materials, influencing the evolution of the global stretch and shrink films market.

The leadership of Asia Pacific in this market is underscored by strategic initiatives from key industry players, technological advancements in film manufacturing, and a proactive approach to meeting the diverse packaging requirements of various sectors. With a burgeoning population, rapid urbanization, and increasing consumer demand for packaged goods, Asia Pacific stands as a key influencer and driver in shaping the future of the global stretch and shrink films industry.

Key Developments

In 2023: Berry Global Group, Inc. acquired Reifenhäuser Group, a leading provider of stretch and shrink film solutions. This acquisition gave Berry Global Group a strong foothold in the market for stretch and shrink films for food and beverage packaging.

In 2023: ExxonMobil Corporation and BASF SE announced a partnership to develop new stretch and shrink film solutions made from recycled materials.

In 2022: Dow, Inc. and Henkel AG & Co. KGaA announced a partnership to develop new stretch and shrink film coatings with improved barrier properties.

In 2022: Dow, Inc. acquired DowDupont's Performance Materials business, which includes a leading provider of stretch and shrink films for industrial applications. This acquisition gave Dow, Inc. a strong foothold in the market for stretch and shrink films for palletizing and bundling.

In 2021: Sealed Air Corporation acquired Cryovac Sealed Solutions, a leading provider of shrink films for food and beverage packaging. This acquisition gave Sealed Air Corporation a strong foothold in the market for high-performance shrink films.

In 2021: Sealed Air Corporation and Sidel announced a partnership to develop new shrink film solutions for single-serve beverage packaging.

Stretch and Shrink Films Market: Competitive Analysis

The global stretch and shrink films market is dominated by players like:

- Berry Global Inc.

- Intertape Polymer Group Inc.

- AEP Industries Inc. (Now part of Berry Global)

- Sigma Plastics Group

- Coveris Holdings S.A.

- Sealed Air Corporation

- Bemis Company, Inc. (Now part of Amcor)

- UFLEX Ltd.

- Winpak Ltd.

- Paragon Films, Inc.

The global stretch and shrink films market is segmented as follows:

By Resin

- LLDPE

- LDPE

- PVC

- Others

By Product Type

- Hoods

- Sleeves and labels

- Wraps

By Application

- Food & Beverage

- Industrial Packaging

- Consumer Goods

- Pharmaceutical

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Stretch and shrink films are versatile packaging materials widely used in various industries. Stretch films, typically made of polyethylene, are elastic and stretchable, providing a tight and secure wrap around items. This property makes them ideal for bundling and securing palletized goods during transportation, offering stability and protection against dust and moisture.

The global stretch and shrink films market cap may grow due to growing demand for efficient and cost-effective packaging solutions in various industries.

According to study, the global stretch and shrink films market size was worth around USD 17.1 billion in 2022 and is predicted to grow to around USD 24.2 billion by 2030.

The CAGR value of the stretch and shrink films market is expected to be around 5.5% during 2023-2030.

The global stretch and shrink films market growth is expected to be driven by Asia Pacific. It is currently the world’s highest revenue-generating market owing to the e-commerce and retail sectors booming.

The global stretch and shrink films market is led by players like Berry Global Inc., Intertape Polymer Group Inc., AEP Industries Inc. (now part of Berry Global), Sigma Plastics Group, Coveris Holdings S.A., Sealed Air Corporation, Bemis Company, Inc. (now part of Amcor), UFLEX Ltd., Winpak Ltd., and Paragon Films, Inc.

The report analyzes the global stretch and shrink films market’s drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the stretch and shrink films industry.

Choose License Type

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed