Styrene Butadiene Rubber Market Size, Share, Trends, Growth and Forecast 2032

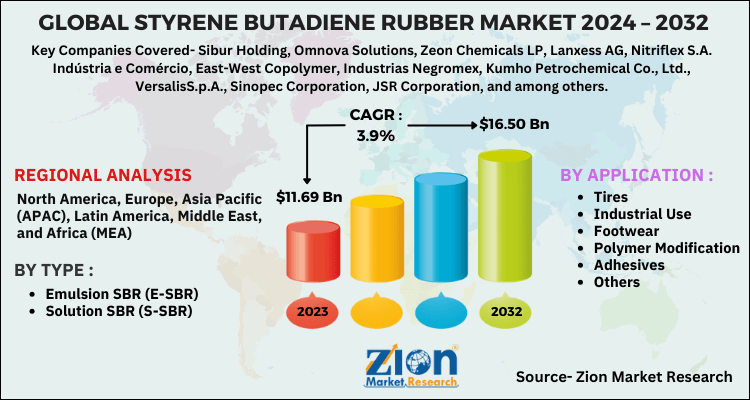

Styrene Butadiene Rubber Market - by Product Type (Emulsion SBR (E-SBR), and Solution SBR (S-SBR)), by Application (Tires, Industrial Use, Footwear, Polymer Modification, Adhesives, and others): Global Industry Perspective, Comprehensive Analysis and Forecast, 2024 - 2032-

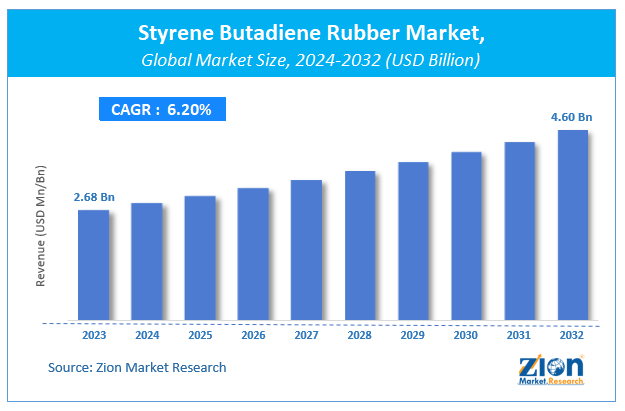

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 2.68 Billion | USD 4.60 Billion | 6.2% | 2023 |

Styrene Butadiene Rubber Market Insights

According to a report from Zion Market Research, the global Styrene Butadiene Rubber Market was valued at USD 2.68 Billion in 2023 and is projected to hit USD 4.60 Billion by 2032, with a compound annual growth rate (CAGR) of 6.2% during the forecast period 2024-2032.

This report explores market strengths, weakness, opportunities, and threats. It also provides valuable insights into the market's growth drivers, challenges, and the future prospects that may emerge in the Styrene Butadiene Rubber Market industry over the next decade.

Market Overview

Styrene Butadiene rubber is the cheap synthetic general purpose elastomer which is used as substitute for natural rubber. It is produced using polymerization techniques such as free radical polymerization or by solution polymerization. Emulsion SBR (ESBR) continues to lose ground to solution SBR (SSBR) which is better suited for high-performance tires. Nevertheless, emulsion SBR grades still account for more than 75% of the total world capacity as of 2018.

COVID-19 Impact Analysis

Since the outbreak of COVID-19 in December 2019, government bodies all over the world declared health emergency. This was affected the major manufacturing industries such as automotive, electrical appliances, consumer goods, and various others. Majority of the raw materials used in these industries require SBR for manufacturing. This was on a halt and hence directly affecting the Styrene Butadiene Rubber Marker. The outbreak of pandemic has affected the world economy and mostly majority of industries were forced to stop production by local authorities.

Growth Factors

The tire is the leading industry in the usage of styrene butadiene rubber. Recently, the countries have imposed the labeling regulations on the tire manufacturers, that is, the tires need to be labeled for effective fuel consumption, wet grip and resistance to rolling. The footwear industry is also growing rapidly which in turn is driving the styrene butadiene market. The styrene butadiene rubber provides better performance and abrasion resistance, thus contributing to the styrene butadiene rubber market to grow rapidly. The other segments that contribute to the market growth are adhesive, polymer modification, and insulation. The polymerization of butadiene with styrene in the ratio of 3:1 forms a synthetic rubber which is known as styrene butadiene rubber. The styrene-butadiene rubber is of two types, solution styrene butadiene rubber (S-SBR) and emulsion styrene butadiene rubber (E-SBR). In the former type, free radicals are used to initiate the process; the later uses the alkyl lithium compound. At the present situation, the emulsion styrene butadiene rubber is used more widely but in the coming years, the solution styrene butadiene rubber will capture the market owing to its better properties. In the past, the tire industry used emulsion styrene butadiene rubber for the production of tires and they were also able to switch between different grades of E-SBR without actually altering the process. But in the recent years, different countries started implementing the labeling regulation.

Styrene Butadiene Rubber Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Styrene Butadiene Rubber Market |

| Market Size in 2023 | USD 2.68 Billion |

| Market Forecast in 2032 | USD 4.60 Billion |

| Growth Rate | CAGR of 6.2% |

| Number of Pages | 165 |

| Key Companies Covered | Asahi Kasei Corporation, JSR Corporation, ARLANXEO, Lion Elastomers, Versalis SpA, Reliance Industries Limited, Zeon Corporation, LG Chem, Trinseo, KUMHO PETROCHEMICAL, Goodyear Rubber Company |

| Segments Covered | By Type, By Application and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

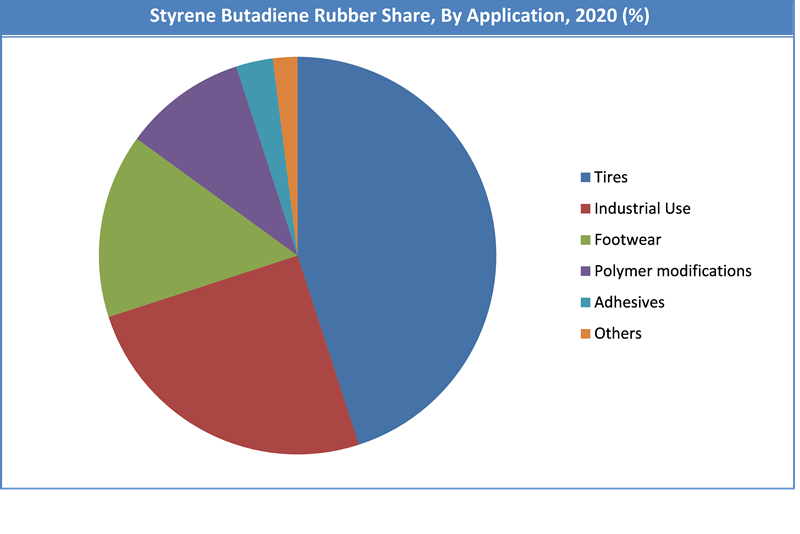

Application Segment Analysis Preview

The application segment is divided into six sub-segments such as tires, industrial use, footwear, polymer modification, adhesives, and others. Tires contribute of around 40% of global revenue for styrene butadiene rubber market. As majority of SBR is used in tires and other applications it has become a huge and important material for the automotive industry. However recent decline in the automotive industry due to higher fuel prices and COVID -19 impacts, the requirement for SBR has declined drastically on a global scale

Regional Analysis Preview

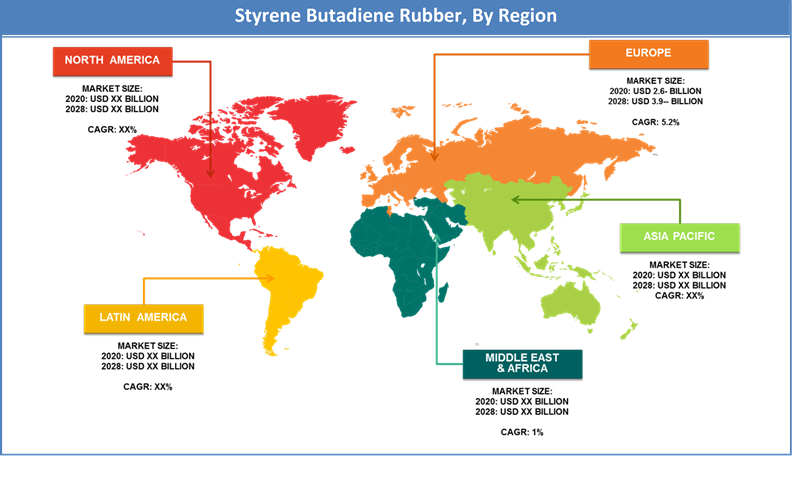

The styrene butadiene rubber market is led by the Asia Pacific region. The main factor that has made the styrene butadiene market grow is the tire industry. China is the leading country in the tire manufacturing industry. Owing to the reason that the region has low labor and operating cost, the tire manufacturers have shifted their facilities to the Asia Pacific region. The increased middle-class population and economic development in China and India have made a significant growth in the automobile industry which in turn increased the market growth of styrene butadiene rubber.

Countries such as Malaysia, Indonesia, and Thailand have also grown steadily in terms of disposable income, thus contributing to the market growth. Europe is the second largest consumer of the styrene-butadiene rubber. The countries such as Germany and Italy have the largest activities of automobile manufacturing, thus driving the demand of the market.

Key Market Players & Competitive Landscape

Major market players in -

- Styrene Butadiene Rubber are Asahi Kasei Corporation

- JSR Corporation

- ARLANXEO

- Lion Elastomers

- Versalis SpA

- Reliance Industries Limited

- Zeon Corporation

- LG Chem

- Trinseo

- KUMHO PETROCHEMICAL

- Goodyear Rubber Company

brief information about 10 companies will also be provided in the report.

Similarly, growth strategies such as acquisition, merger, and expansion of the distribution network were few techniques adopted by most of Tier 1 and Tier 2 manufacturers in recent years.

The styrene butadiene rubber market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies’ focus related to styrene butadiene rubber market.

The styrene butadiene rubber market is segmented as follows:

By Type

- Emulsion SBR (E-SBR)

- Solution SBR (S-SBR)

By Application

- Tires

- Industrial Use

- Footwear

- Polymer Modification

- Adhesives

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Styrene Butadiene Rubber Market size worth at USD 2.68 Billion in 2023

Styrene Butadiene Rubber Market size worth at USD 2.68 Billion in 2023 and projected to USD 4.60 Billion by 2032, with a CAGR of around 6.2% between 2024-2032.

The tire is the leading industry in the usage of styrene butadiene rubber. Recently, the countries have imposed the labeling regulations on the tire manufacturers, that is, the tires need to be labeled for effective fuel consumption, wet grip and resistance to rolling.

The styrene butadiene rubber market is led by the Asia Pacific region. The main factor that has made the styrene butadiene market grow is the tire industry. China is the leading country in the tire manufacturing industry.

Some of key players in the styrene butadiene rubber market includes. Asahi Kasei Corporation, JSR Corporation, ARLANXEO, Lion Elastomers, Versalis SpA, Reliance Industries Limited, Zeon Corporation, LG Chem, Trinseo, KUMHO PETROCHEMICAL, Goodyear Rubber Company, and various others.

Choose License Type

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed