Global Styrenic Polymers Market Size, Share, Growth Analysis Report - Forecast 2034

Styrenic Polymers Market By Products (Polystyrene (PS), Acrylonitrile Butadiene Styrene (ABS), Expanded Polystyrene (EPS), Unsaturated Polyester Resin (UPR), Styrene-Butadiene Rubber (SBR), and Other Polymers), By Application (Building & Construction, Automotive Industry, Packaging, Medical, Electrical & Electronics, Consumer Goods, and Others), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

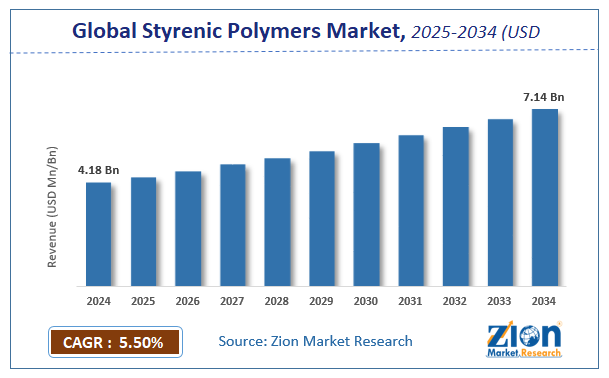

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 4.18 Billion | USD 7.14 Billion | 5.5% | 2024 |

Styrenic Polymers Market Size

The global styrenic polymers market size was worth around USD 4.18 Billion in 2024 and is predicted to grow to around USD 7.14 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 5.5% between 2025 and 2034.

The report analyzes the global styrenic polymers market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the styrenic polymers industry.

Styrenic Polymers Market: Overview

Styrenic polymers are cost-effective plastics that comprise a class of widely used plastic goods with styrene as their main component. With their amorphous form, these polymers can be treated easily over a wide temperature range and well above their softening point. In contrast to other partially crystalline polymers, styrenic polymers do not have a clearly defined melting point. As a result, these polymers may be processed more quickly and with higher dimensional stability and superior mechanical qualities.

The polystyrene, expandable polystyrene, styrene-acrylonitrile, styrene-methyl methacrylate, acrylonitrile-butadiene-styrene, and acrylonitrile-styrene-acrylate copolymers, as well as mixtures of these polymers with polyphenylene ether (PPE) and polycarbonate, are examples of styrene (PC). Styrenic polymers are used to make a wide range of home items, including cups, utensils, furniture, and kitchen appliances.

They are also used to make consumer electronics, auto parts, sports and recreational equipment, boats, and sturdy, lightweight packaging materials. The increased use of styrenic polymers in the automotive industry is one of the key drivers fueling market expansion.

With the increased worries about reducing the overall weight of cars to comply with strict pollution standards, there is a rising need for plastics in this industry. The high cost of styrenic polymers is anticipated to hamper the market expansion compared to other thermoplastic materials.

Key Insights

- As per the analysis shared by our research analyst, the global styrenic polymers market is estimated to grow annually at a CAGR of around 5.5% over the forecast period (2025-2034).

- Regarding revenue, the global styrenic polymers market size was valued at around USD 4.18 Billion in 2024 and is projected to reach USD 7.14 Billion by 2034.

- The styrenic polymers market is projected to grow at a significant rate due to rising demand in automotive, packaging, and construction industries due to lightweight, durable, and high-performance properties.

- Based on Products, the Polystyrene (PS) segment is expected to lead the global market.

- On the basis of Application, the Building & Construction segment is growing at a high rate and will continue to dominate the global market.

- Based on region, Asia-Pacific is predicted to dominate the global market during the forecast period.

Styrenic Polymers Market: Growth Drivers

The demand for styrenics is increasing, which will enhance the growth of the market

The market for styrenics is developing due to the rise in polystyrene consumption. Styrene is converted into polystyrene by the suspension polymerization process. Polystyrene, a flexible material, creates appliances such as air conditioners, microwaves, stoves, and refrigerators. In the packaging industry, polystyrene is frequently utilized because it keeps food fresher for longer. In the automotive industry, polystyrene is highly sought after because it can be used to create foam that absorbs sound and absorbs energy in door panels, trim, vehicle knobs, and instrument panels.

Thus, the market has expanded due to the high demand for polystyrene. The global styrenics polymers market will continue to rise at a quick clip due to the rapidly expanding urbanization. A rise in market value will also result from increased trade through air travel. The market is expected to expand due to the rise of the consumer products, packaging, and industrial sectors.

Styrenic Polymers Market: Restraints

Negative effects on the environment and health will restrict the growth of the market

Utilizing styrene increases health and environmental problems, which shrinks its market. Styrene is largely used in the production of plastics and other resins. Styrene is known to have long-term consequences on humans' central nervous system (CNS), including hearing loss, weakness, depression, headache, and peripheral neuropathy. Humans experience mucous membrane, ocular, and gastrointestinal symptoms from short-term styrene exposure. Animals who ingest styrene experience effects on their liver, blood, kidney, and stomach. Styrene's harmful impacts on the environment and human health restrict the global styrenic polymers market growth.

Styrenic Polymers Market: Segmentation Analysis

The global styrenic polymers market has been segmented into product, application, and region.

Based on product, the worldwide styrenic polymers market is segmented into polystyrene (PS), acrylonitrile butadiene styrene (ABS), expanded polystyrene (EPS), unsaturated polyester resin (UPR), styrene-butadiene rubber (SBR), and other polymers. In 2021, the polystyrene segment dominated the market.

The demand for environmentally friendly, lightweight products with long lifespans combined with improved thermal insulation has increased, which is anticipated to drive market growth for polystyrene trends. More packaged products are being purchased in these nations due to rising per capita incomes, particularly the growing middle class. Polystyrene's usage for packaging manufactured goods has expanded along with its demand and production.

Based on application, the global styrenic polymers market is segmented into building and construction, automotive industry, packaging, medical, electrical and electronics, consumer goods, and others. The medical application of styrene polymers dominated the market in 2021. Medical applications use a range of styrenic polymers, including SMMA, ABS, SAN, MABS, SBCs, MBS, and others.

The market for medical styrenic polymers is dominated by polystyrene, one of the most popular styrenic copolymer kinds. This is partly because it has many good characteristics, including aesthetics, color stability, and melt flow consistency. Styrenic polymers are frequently utilized in packaging, IV solution bags, textiles, containers, multi-flow devices, and other applications.

Styrenic Polymers Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Styrenic Polymers Market |

| Market Size in 2024 | USD 4.18 Billion |

| Market Forecast in 2034 | USD 7.14 Billion |

| Growth Rate | CAGR of 5.5% |

| Number of Pages | 255 |

| Key Companies Covered | BASF, Lanxess AG, SABIC, Styron LLC, The Dow Chemical Company, Chevron Philips Chemical Company, Chi Mei Corporation, Asahi Kasei Corporation, Nova Chemicals Corporation, Total S.A., and others. |

| Segments Covered | By Products, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Styrenic Polymers Market: Regional Landscape

The Asia Pacific dominated the styrenic polymers market in 2025

With a market share of more than 50% of the global styrenic polymers market in 2025, the Asia-Pacific region's market dominated the whole market. The region's consumer goods and automotive industries significantly contribute to the regional market expansion. In the upcoming years, it is anticipated that styrenic polymers will be mostly consumed by the automobile industries in India, China, Japan, South Korea, and Thailand. With significant contributions from China, India, and Southeast Asian nations, among other growing economies, the Asian-Pacific region's automobile sector is the largest internationally. While India is the most lucrative market for these polymers, China is predicted to be the region's largest market for styrenic polymers. Demand for these polymers is increasing in the local market because of the growing requirement to reduce component weight and fuel consumption and meet aesthetic appeals.

Styrenic Polymers Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the styrenic polymers market on a global and regional basis.

The global styrenic polymers market is dominated by players like:

- BASF

- Lanxess AG

- SABIC

- Styron LLC

- The Dow Chemical Company

- Chevron Philips Chemical Company

- Chi Mei Corporation

- Asahi Kasei Corporation

- Nova Chemicals Corporation

- Total S.A.

The global styrenic polymers market is segmented as follows;

By Products

- Polystyrene (PS)

- Acrylonitrile Butadiene Styrene (ABS)

- Expanded Polystyrene (EPS)

- Unsaturated Polyester Resin (UPR)

- Styrene-Butadiene Rubber (SBR)

- and Other Polymers

By Application

- Building & Construction

- Automotive Industry

- Packaging

- Medical

- Electrical & Electronics

- Consumer Goods

- and Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

Leading players in the global styrenic polymers market include BASF, Lanxess AG, SABIC, Styron LLC, The Dow Chemical Company, Chevron Philips Chemical Company, Chi Mei Corporation, Asahi Kasei Corporation, Nova Chemicals Corporation, Total S.A., among others.

Choose License Type

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed