Suspension Spring Market Trend, Share, Growth, Size Analysis and Forecast 2030

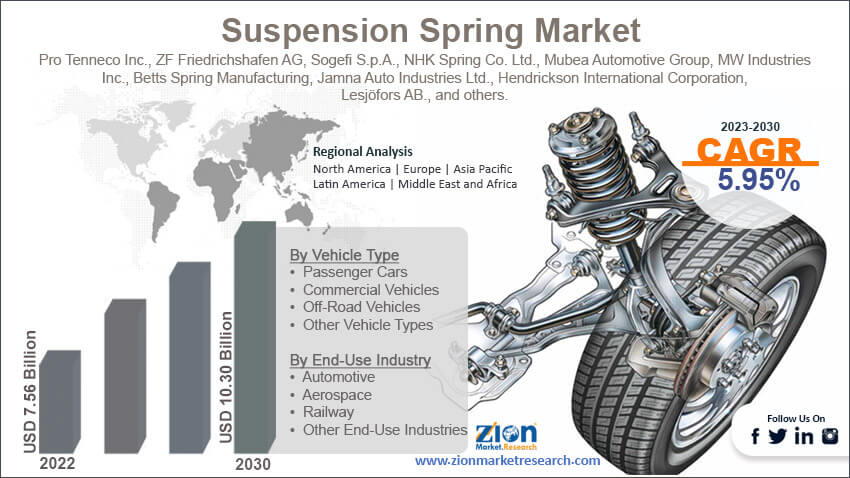

Suspension Spring Market By Type (Coil Springs, Leaf Springs, Air Springs, Torsion Bars, Progressive Springs, and Other Suspension Springs), By Vehicle Type (Passenger Cars, Commercial Vehicles, Off-Road Vehicles, and Other Vehicle Types), and By End-Use Industry (Automotive, Aerospace, Railway, and Other End-Use Industries), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2023 - 2030

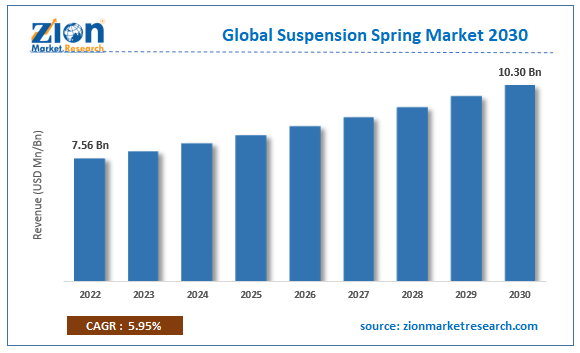

| Market Size in 2022 | Market Forecast in 2030 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 7.56 Billion | USD 10.30 Billion | 5.95% | 2022 |

Suspension Spring Industry Prospective:

The global suspension spring market size was worth around USD 7.56 billion in 2022 and is predicted to grow to around USD 10.30 billion by 2030 with a compound annual growth rate (CAGR) of roughly 5.95% between 2023 and 2030.

Suspension Spring Market: Overview

The suspension spring plays a critical role in a vehicle's suspension system, absorbing the impact of uneven terrain to provide a smoother ride for passengers. It comes in various types, including coil, leaf, and air springs, each tailored for specific loads and road conditions. Maintaining well-functioning suspension springs is essential for control, stability, and driving comfort. These springs collaborate with components like shock absorbers and control arms to ensure a balanced and responsive ride. If any signs of suspension issues surface, it's recommended to consult a qualified mechanic. Professional inspection and timely maintenance are key to preserving the safety and performance of the suspension system.

Key Insights

- As per the analysis shared by our research analyst, the global suspension spring industry is estimated to grow annually at a CAGR of around 5.95% over the forecast period (2023-2030).

- In terms of revenue, the global suspension spring market size was valued at around USD 7.56 billion in 2022 and is projected to reach USD 10.30 billion, by 2030.

- The global suspension spring market is projected to grow at a significant rate due to the escalating demand for comfort and ride quality in the automotive industry.

- Based on type segmentation, coil springs was predicted to hold the maximum market share in the year 2022.

- Based on vehicle type segmentation, passenger cars were the leading revenue generator in 2022.

- Based on end-use industry segmentation, automotive was the leading revenue generator in 2022.

- On the basis of region, Asia Pacific was the leading revenue generator in 2022.

Request Free Sample

Request Free Sample

Suspension Spring Market: Growth Drivers

Escalating demand for comfort and ride quality in the automotive industry propels market growth.

The escalating demand for comfort and ride quality in the automotive industry is a pivotal driver influencing the suspension spring market. Consumers today place a significant emphasis on the overall experience of driving or being a passenger in a vehicle. A smoother, more comfortable ride is not only considered a luxury but also a safety feature, as it reduces fatigue and enhances driver alertness. Consequently, automakers are investing heavily in advanced suspension technologies, including high-quality springs, to meet these evolving customer preferences. This trend is particularly evident in premium and high-end vehicle segments, where manufacturers are continuously innovating to deliver an unparalleled level of ride comfort. Moreover, the demand for comfort and ride quality is not limited to luxury vehicles; it is permeating across all automotive segments.

As consumers become more discerning, even in budget-friendly or mid-range vehicles, manufacturers are incorporating improved suspension systems, which rely heavily on well-designed and efficient suspension springs. This market shift towards prioritizing comfort is reshaping the suspension industry, with an increasing focus on materials and designs that optimize shock absorption and ensure a smoother, more enjoyable ride for all passengers. Companies are developing new materials and manufacturing processes to create lighter, stronger, and more durable suspension springs for aerospace vehicle types. For instance, Hendrickson is developing a new composite leaf spring for commercial aircraft that is 30% lighter than traditional steel leaf springs.

Suspension Spring Market: Restraints

Increasing adoption of alternative suspension technologies may slow down the market growth.

The increasing adoption of alternative suspension technologies, particularly electronic or active suspension systems, poses a notable challenge to the traditional suspension spring market. Unlike conventional springs, electronic suspension systems utilize advanced sensors and actuators to continuously monitor and adjust the vehicle's suspension settings in real time. This allows for dynamic control over each wheel's movement, resulting in a highly adaptive and comfortable ride. Additionally, active suspension systems can enhance vehicle stability during cornering, braking, and acceleration, further improving overall handling and performance. As a result, automakers and consumers alike are increasingly drawn towards these innovative technologies for their ability to offer a more tailored and sophisticated driving experience. While electronic suspension systems bring numerous benefits, their widespread adoption may hinder the growth of the traditional suspension spring industry. These advanced systems, although highly effective, tend to be more complex and expensive to manufacture and install compared to traditional springs. This cost differential may deter price-sensitive consumers and manufacturers, particularly in budget-friendly vehicle segments. Additionally, the electronic components of these systems may require specialized maintenance and repair, potentially leading to higher long-term ownership costs. Therefore, while electronic suspension systems represent a remarkable advancement in automotive technology, they also present a restraint for the traditional suspension spring market in certain market segments.

Suspension Spring Market: Opportunities

Snowballing demand for lightweight and high-performance materials to provide growth opportunities

The escalating demand for lightweight and high-performance materials within the suspension spring market signifies a significant growth opportunity. As automotive manufacturers intensify their efforts to improve fuel efficiency and reduce environmental impact, the need for lighter components becomes paramount. This trend is further accentuated by the burgeoning popularity of electric and hybrid vehicles, where every ounce of weight reduction directly translates into extended battery range and improved overall performance. Therefore, companies specializing in suspension springs can seize this opportunity by investing in research and development efforts focused on innovative materials that strike a balance between weight reduction and durability. Moreover, the adoption of high-performance materials in suspension springs aligns with the broader industry shift towards enhancing vehicle safety and comfort. Advanced materials can be engineered to withstand a wider range of loads and road conditions, resulting in a smoother, more controlled ride for passengers. This not only meets consumer expectations for a comfortable driving experience but also contributes to improved vehicle handling and stability. By capitalizing on the snowballing demand for such materials, companies in the suspension spring market can position themselves at the forefront of innovation and cater to the evolving needs of the automotive sector.

Suspension Spring Market: Challenges

Growing pressure to meet stringent regulatory standards and compliance requirements to challenge market cap growth

The suspension spring industry is grappling with a formidable challenge stemming from the mounting pressure to meet increasingly stringent regulatory standards and compliance requirements. Governments worldwide are steadfastly raising the bar for vehicle safety, emissions, and performance. This necessitates manufacturers to engineer suspension springs that not only withstand rigorous testing but also contribute to overall vehicle compliance. Achieving this delicate balance demands substantial investments in research, development, and testing processes. Manufacturers must devote considerable resources to ensure that their suspension springs not only meet these exacting standards but also maintain or enhance the vehicle's overall performance. Furthermore, this challenge is compounded by the dynamic nature of regulatory environments across different regions. Manufacturers must navigate a complex web of standards and requirements that can vary significantly from one jurisdiction to another. This necessitates a comprehensive understanding of regional compliance nuances and a flexible approach to engineering suspension springs that meet diverse sets of criteria. The pressure to comply with these stringent regulations underscores the importance of ongoing innovation and adaptability within the suspension spring market, as manufacturers strive to keep pace with evolving industry standards while delivering top-tier products.

Suspension Spring Market: Segmentation

The global suspension spring market is segmented based on type, vehicle type, end-use industry, and region.

Based on type, the global market segments are coil springs, leaf springs, air springs, torsion bars, progressive springs, and other suspension springs. At present, the global market is dominated by the coil springs segment. The coil springs segment currently dominates the global market due to their versatile applicability across a wide range of vehicles, cost-effectiveness in production, proven reliability, ease of installation and maintenance, balanced performance in terms of comfort and handling, and the availability of advanced materials. These factors collectively position coil springs as a preferred choice for both manufacturers and consumers, particularly in budget-friendly vehicle segments, underscoring their widespread adoption in the automotive industry.

Based on vehicle type the global suspension spring market is categorized as passenger cars, commercial vehicles, off-road vehicles, and other vehicle types. among these, the passenger cars segment was the largest shareholding segment in the global market. The dominance of passenger cars in the global market can be attributed to their sheer volume of production and widespread consumer demand. Passenger cars represent a significant portion of the automotive market, with millions being manufactured and sold annually worldwide. As a result, the demand for suspension springs in this segment far surpasses that of commercial or off-road vehicles. Moreover, consumers often prioritize ride comfort and handling in passenger cars, placing a premium on high-quality suspension systems, further driving the demand for suspension springs in this category. This combination of high production volume and consumer preferences positions passenger cars as the largest shareholding segment in the global market.

Based on end-use industry the global suspension spring industry is categorized as automotive, aerospace, railway, and other end-use industries. Out of these, automotive was the largest shareholding segment in the global market. The automotive sector's prominent position in the global market can be attributed to its sheer size and the widespread reliance on suspension systems. The automotive industry constitutes a substantial portion of the global manufacturing landscape, with millions of vehicles produced and sold annually. As suspension springs are integral components for ensuring ride comfort, stability, and safety in vehicles, the demand from the automotive sector far outweighs that of aerospace, railway, and other industries. Additionally, continuous advancements and innovations in automotive suspension technologies further drive the need for high-quality suspension springs in this segment. This, combined with the sheer scale of the automotive industry, solidifies its status as the largest shareholding segment in the global market.

Suspension Spring Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Suspension Spring Market |

| Market Size in 2022 | USD 7.56 Billion |

| Market Forecast in 2030 | USD 10.30 Billion |

| Growth Rate | CAGR of 5.95% |

| Number of Pages | 211 |

| Key Companies Covered | Pro Tenneco Inc., ZF Friedrichshafen AG, Sogefi S.p.A., NHK Spring Co. Ltd., Mubea Automotive Group, MW Industries Inc., Betts Spring Manufacturing, Jamna Auto Industries Ltd., Hendrickson International Corporation, Lesjöfors AB., and others. |

| Segments Covered | By Type, By Vehicle Type, By End-Use Industry, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2022 |

| Historical Year | 2017 to 2021 |

| Forecast Year | 2023 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Suspension Spring Market: Regional Analysis

Asia Pacific to lead the market during the forecast period

Asia Pacific is poised to lead the global suspension spring market in the forecast period, driven by several compelling factors. Firstly, the rapid expansion of the automotive industry in this region, which stands as the world's largest automotive market, is expected to continue its robust growth trajectory. This surge in automotive demand naturally translates to an increased need for suspension springs, critical components in all types of vehicles. Additionally, there is a growing preference for lightweight and fuel-efficient vehicles in Asia Pacific. This shift in consumer demand is compelling manufacturers to innovate in vehicle design, with suspension springs playing a pivotal role in reducing overall vehicle weight, thereby enhancing fuel efficiency. Moreover, the rising popularity of SUVs and crossovers in the region is bolstering the demand for robust suspension systems, particularly heavy-duty suspension springs tailored to meet the distinctive requirements of these vehicle types.

Recent Developments

In August 2023, ZF Friedrichshafen AG announced that it would acquire TRW Automotive, another leading player in the global automotive parts market. This acquisition will help ZF Friedrichshafen AG to expand its product range and strengthen its position in the global automotive parts market, including the suspension spring market.

In June 2023, KYB Corporation announced that it would invest USD 100 million in expanding its production capacity of suspension springs. KYB Corporation is a Japanese company that is a leading player in the global suspension spring market. his investment will help the company to meet the growing demand for its suspension springs, particularly from the electric vehicle market.

In September 2023, Tenneco Inc. announced that it is developing new lightweight suspension springs. These new suspension springs will be made from lightweight materials, such as aluminum and carbon fiber. This will help to reduce the weight of vehicles, which will improve fuel efficiency and reduce emissions.

Suspension Spring Market: Competitive Analysis

The global suspension spring market is dominated by players like:

- Tenneco Inc. (Monroe)

- ZF Friedrichshafen AG

- Sogefi S.p.A.

- NHK Spring Co., Ltd.

- Mubea Automotive Group

- MW Industries, Inc.

- Betts Spring Manufacturing

- Jamna Auto Industries Ltd.

- Hendrickson International Corporation

- Lesjöfors AB

The global suspension spring market is segmented as follows:

By Type

- Coil Springs

- Leaf Springs

- Air Springs

- Torsion Bars

- Progressive Springs

- Others Suspension Springs

By Vehicle Type

- Passenger Cars

- Commercial Vehicles

- Off-Road Vehicles

- Other Vehicle Types

By End-Use Industry

- Automotive

- Aerospace

- Railway

- Other End-Use Industries

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The suspension spring plays a critical role in a vehicle's suspension system, absorbing the impact of uneven terrain to provide a smoother ride for passengers. It comes in various types, including coil, leaf, and air springs, each tailored for specific loads and road conditions

The global suspension spring market cap may grow owing to rising demand for comfort and ride quality in the automotive sector.

According to study, the global suspension spring market size was worth around USD 7.56 billion in 2022 and is predicted to grow to around USD 10.30 billion by 2030.

The CAGR value of the suspension spring market is expected to be around 5.95% during 2023-2030.

The global suspension spring market growth is expected to be driven by Asia Pacific. It is currently the world’s highest revenue-generating market owing to the rapid industrialization and booming automotive sector.

The global suspension spring market is led by players like Pro Tenneco Inc., ZF Friedrichshafen AG, Sogefi S.p.A., NHK Spring Co., Ltd., Mubea Automotive Group, MW Industries, Inc., Betts Spring Manufacturing, Jamna Auto Industries Ltd., Hendrickson International Corporation, and Lesjöfors AB.

The report analyzes the global suspension spring market’s drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the suspension spring industry.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed