Thermoplastic Pipe Market Size, Share, Growth Report 2032

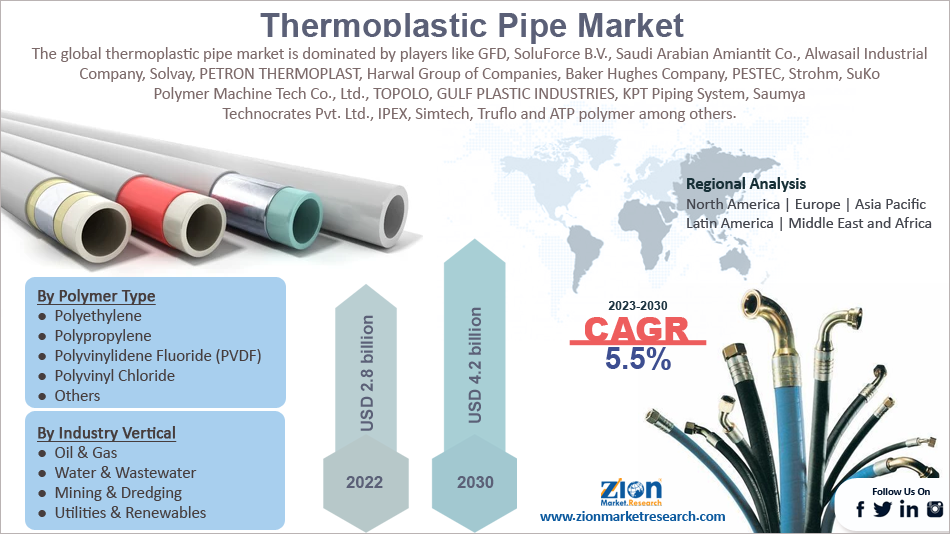

Thermoplastic Pipe Market By Product (Reinforced Thermoplastic Pipes and Thermoplastic Composite Pipes), By Polymer Type (Polyethylene, Polypropylene, Polyvinylidene Fluoride (PVDF), Polyvinyl Chloride and Others), By Application (Onshore and Offshore), By Industry Vertical (Oil & Gas, Water & Wastewater, Mining & Dredging, and Utilities & Renewables) and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2023 - 2030

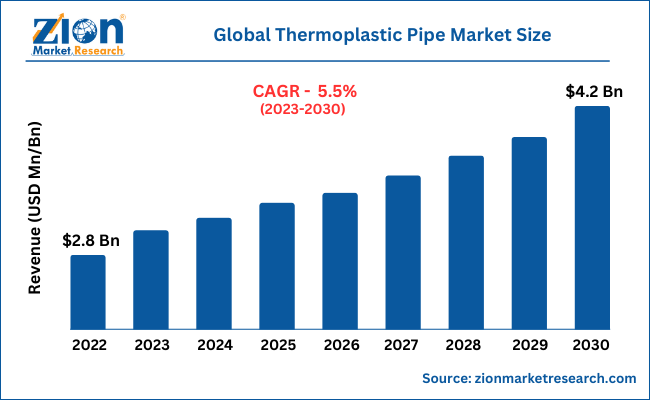

| Market Size in 2022 | Market Forecast in 2030 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 2.8 Billion | USD 4.2 Billion | 5.5% | 2022 |

Industry Prospective:

The global thermoplastic pipe market size was worth around USD 2.8 Billion in 2022 and is predicted to grow to around USD 4.2 Billion by 2030 with a compound annual growth rate (CAGR) of roughly 5.5% between 2023 and 2030.

The report analyzes the global thermoplastic pipe market’s drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the thermoplastic pipe industry.

Thermoplastic Pipe Market: Overview

Thermoplastic pipes have properties that are unique such as flexibility, low installation cost, greater flow, excellent chemical resistance, high mechanical strength, and rust-resistant features. Owing to these beneficial properties provided by the thermoplastic pipes they are preferred over the metal pipes and hence they are used widely in gas and oil offshore drilling. The other application areas where the thermoplastics are used include the chemical sector, municipal, and mining & dredging sectors.

Key Insights

- As per the analysis shared by our research analyst, the global thermoplastic pipe market is estimated to grow annually at a CAGR of around 5.5% over the forecast period (2023-2030).

- In terms of revenue, the global thermoplastic pipe market size was valued at around USD 2.8 billion in 2022 and is projected to reach USD 4.2 billion, by 2030.

- The growing demand for thermoplastic pipes from various end-use industries is expected to drive thermoplastic pipe market growth over the forecast period.

- Based on the product, reinforced thermoplastic pipes are expected to dominate the market over the forecast period.

- Based on the polymer type, the polyethylene segment is expected to capture the largest market share during the forecast period.

- Based on region, the Asia Pacific is expected to capture the largest market share over the forecast period.

Thermoplastic Pipe Market: Growth Drivers

Increasing demand from oil & gas industries drives the market growth

Future market expansion for thermoplastic pipes is anticipated to be driven by rising demand from the oil and gas sector for corrosion-resistant materials. The structure of a pipe oxidizes and electrochemically degrades due to pipeline corrosion. An efficient and effective method of reducing corrosion is the use of thermoplastics in the production and transportation of oil and gas.

Oil and gas companies can explore and produce from deeper offshore oilfields owing to these pipelines' lower weight and higher corrosion resistance compared to metals. For instance, in May 2020, Oil Review Middle East, a Middle Eastern oil and gas magazine, reported that the cost of corrosion to the global oil and gas industry was anticipated to be greater than USD 60 billion, with the US contributing for an estimated $27 billion of that total. In the region, it is estimated that refinery corrosion damages the world economy by USD 15 billion annually.

The market for thermoplastic pipes is therefore driven by rising demand from the oil and gas industry for corrosion-resistant materials.

Thermoplastic Pipe Market: Restraints

Low melting point and poor resistance is expected to hamper the market

Factors such as low melting point and poor resistance are expected to hamper the thermoplastic pipe market growth over the forecast period. Thermoplastics can melt when they are exposed to the sun for a long period and they have poor resistance to organic solvents, hydrocarbons, and highly polar solvents.

Thermoplastic Pipe Market: Opportunities

The growing innovative product launch by the key players provides a lucrative opportunity

The growing innovative product launch by the key players is expected to provide a lucrative opportunity for thermoplastic pipe market expansion. The prominent players adopt various strategies such as collaboration, expansion, increasing R&D expenditure, product launch and others to remain competitive in the industry. In March 2022, GF Piping Systems launched HEAT-FIT. HEAT-FIT is intended to be compatible with GF Piping Systems' ecoFIT product line, which includes a variety of polyethylene pipes and fittings for use in industrial applications as well as water and wastewater treatment. Two layers of TPU make up the innovative lightweight pipe jacket technology.

HEAT-FIT has a high-temperature fiberglass fabric between the TPU layers to protect the pipe beneath, as well as an intumescent coating that is non-toxic and water-based, making it an environmentally acceptable material. Therefore, this type of product launch in the thermoplastic pipe industry is expected to offer an enormous opportunity to drive thermoplastic pipe industry growth.

Thermoplastic Pipe Market: Challenges

Volatility in the raw material price poses a major challenge for the market growth

Thermoplastics pipes are produced with various raw materials which include PVC, PE, PP, and others. These materials are a by-product of crude oil, and the crude oil price is volatile. Thus, the rise in the crude oil price has directly impacted the price of these raw materials, which in turn, poses a major challenge to the thermoplastic pipe market to a certain extent.

Thermoplastic Pipe Market: Segmentation

The global thermoplastic pipe industry is segmented based on product, polymer type, application, industry vertical, and region.

Based on the product, the global market is bifurcated into reinforced thermoplastic pipes and thermoplastic composite pipes. Reinforced thermoplastic pipes are expected to dominate the market over the forecast period. The growth the in the segment is attributed to its properties including high strength, ultra-low permeability, high-pressure resistance, high-temperature resistance, and corrosion resistant. Moreover, it is the best alternative for steel pipes due to its cost-effectiveness, thereby finding application in many industries such as oil & gas, chemical, and others. Thus, this factor exponentially rises in the demand for RTP during the projected timeframe.

Based on the polymer type, the global thermoplastic pipe industry is bifurcated into polyethylene, polypropylene, polyvinylidene fluoride (PVDF), polyvinyl chloride, and others. The polyethylene segment is expected to capture the largest market share during the forecast period. Polyethylene is a tough thermoplastic material and is utilized for a broad range of pressure applications including the transportation of drinking water and natural gas, irrigation, sewers, and drainage lines. Moreover, PE pipe is extruded in a variety of sizes. It is lightweight, flexible, and simple to weld. Its smooth inside finish offers good flow characteristics. Continuous research of the material has so improved its performance, resulting in fast-rising usage by major water and gas utility companies throughout the world.

The weldability enables the pipes to be butt-welded or electrofused weld to extended lengths and hence provide durable joints. Thus, owing to these benefits PE holds the largest market share in 2022.

Based on the application, the market is divided into onshore and offshore.

Based on the industry vertical, the market is divided into oil & gas, water & wastewater, mining & dredging, and utilities & renewables.

Recent Developments:

- In October 2021, TechnipFMC acquired Magma Global, the leading provider of composite pipe technology to support the Energy Transition. Magma technology enables the manufacturing of Thermoplastic Composite Pipe (TCP) from Polyether Ether Ketone (PEEK) polymer, which is exceptionally resistant to corrosive substances such as CO2. With this collaboration, both companies develop a Hybrid Flexible Pipe (HFP) that will be used in the Brazilian pre-salt areas.

- In June 2022, the Wienerberger Group, the world's leading supplier of building materials and infrastructure solutions, acquired Vargon d.o.o. Through the acquisition, the company strengthens the market position of its Piping Solutions Business Unit in South-Eastern Europe.

- In February 2022, SIMONA AG acquired PEAK Pipe Systems Limited. The acquisition will help SIMONA Group's strategy realignment, to achieve a strong emphasis on applications while assisting the Group in its efforts to reach its growth ambitions in the EMEA infrastructure and aquaculture industries. Furthermore, as a result of the acquisition, the Group's product portfolio in the UK will be significantly expanded, while its overall position in this attractive, niche market will be strengthened.

Thermoplastic Pipe Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Thermoplastic Pipe Market Research Report |

| Market Size in 2022 | USD 2.8 Billion |

| Market Forecast in 2030 | USD 4.2 Billion |

| Growth Rate | CAGR of 5.5% |

| Number of Pages | 199 |

| Key Companies Covered | GFD, SoluForce B.V., Saudi Arabian Amiantit Co., Alwasail Industrial Company, Solvay, PETRON THERMOPLAST, Harwal Group of Companies, Baker Hughes Company, PESTEC, Strohm, SuKo Polymer Machine Tech Co., Ltd., TOPOLO, GULF PLASTIC INDUSTRIES, KPT Piping System, Saumya Technocrates Pvt. Ltd., IPEX, Simtech, Truflo and ATP polymer among others. |

| Segments Covered | By Product, By Polymer Type, By Application, By Industry Vertical, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2022 |

| Historical Year | 2017 to 2021 |

| Forecast Year | 2023 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Thermoplastic Pipe Market: Regional Analysis

The Asia Pacific is expected to capture the largest revenue share during the forecast period

The Asia Pacific is expected to capture the largest thermoplastic pipe market share during the forecast period. The regional growth is attributed to the increasing energy demand with a growing population base in the region and the growing emphasis by the governments on renewable sources of energy. For instance, according to secondary sources, in 2021, the Asia Pacific region's primary energy consumption was 272.45 exajoules, an increase of more than 6% over the previous year.

Figures climbed by about 168 exajoules during the study period, reaching a consumption peak in 2021. In the same year, China's energy consumption accounted for over 58 percent of the total in Asia Pacific. Moreover, in April 2021, the government launched the "National Programme on High-Efficiency Solar PV Modules" Production Linked Incentive Scheme with an outlay of USD 550 million to encourage and promote the development of high-efficiency solar PV modules.

Furthermore, the growing water and wastewater treatment industry along with growing government initiatives is expected to provide enormous opportunities for market growth over the projected period. For instance, the Indian government established the Jal Shakti Ministry in May 2019, connecting all water-related agencies under one ministry to ensure clean drinking water for the people of India. The Jal Shakti Ministry quickly established the Jal Jeevan Mission, which aims to supply piped drinking water to 146 million homes in 700,000 villages by 2024. The mission has allocated $51 billion to states to raise home water connection coverage from 18.33 percent in 2019 to 100 percent by 2024. Thus, the aforementioned facts support the market growth.

North America is expected to grow at a rapid pace over the projected period. The growth in the North American region is attributed to the growing demand for thermoplastic pipes from the water and wastewater industry and the growing exploration and production activity in the oil & gas industry. For instance, as per the US Energy Information Administration, US dry natural gas production from shale accounted 28.5 trillion cubic feet in 2022 which is around 80% of total US dry natural gas production.

Thermoplastic Pipe Market: Competitive Analysis

The global thermoplastic pipe market is dominated by players like:

- GFD

- SoluForce B.V.

- Saudi Arabian Amiantit Co.

- Alwasail Industrial Company

- Solvay

- PETRON THERMOPLAST

- Harwal Group of Companies

- Baker Hughes Company

- PESTEC

- Strohm

- SuKo Polymer Machine Tech Co. Ltd.

- TOPOLO

- GULF PLASTIC INDUSTRIES

- KPT Piping System

- Saumya Technocrates Pvt. Ltd.

- IPEX

- Simtech

- Truflo and ATP polymer

- Among Others.

The global thermoplastic pipe market is segmented as follows:

By Product

- Reinforced Thermoplastic Pipes

- Thermoplastic Composite Pipes

By Polymer Type

- Polyethylene

- Polypropylene

- Polyvinylidene Fluoride (PVDF)

- Polyvinyl Chloride

- Others

By Application

- Onshore

- Offshore

By Industry Vertical

- Oil & Gas

- Water & Wastewater

- Mining & Dredging

- Utilities & Renewables

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Thermoplastic pipes have properties that are unique such as flexibility, low installation cost, greater flow, excellent chemical resistance, high mechanical strength, and rust-resistant features. Owing to these beneficial properties provided by the thermoplastic pipes they are preferred over the metal pipes and hence they are used widely in gas and oil offshore drilling. The other application areas where the thermoplastics are used include the chemical sector, municipal and mining & dredging sectors.

The rise of the utilization of thermoplastic pipes across the sectors such as chemical, municipal, oil & gas, mining & dredging along with its applications in ultra-deep water and deep water is the major factor that is driving the growth of the market. The engineering processes and the large-diameter pipe applications widely use thermoplastic pipes hence boosting the market growth.

According to the report, the global thermoplastic pipe market size was worth around USD 2.8 billion in 2022 and is predicted to grow to around USD 4.2 billion by 2030.

The global thermoplastic pipe market is expected to grow at a CAGR of 5.5% during the forecast period.

The global thermoplastic pipe market growth is expected to be driven by the Asia Pacific. It is currently the world’s highest revenue-generating market owing to the growing industrialization and the increasing energy demand owing to the growing population base in the region.

The global thermoplastic pipe market is dominated by players like GFD, SoluForce B.V., Saudi Arabian Amiantit Co., Alwasail Industrial Company, Solvay, PETRON THERMOPLAST, Harwal Group of Companies, Baker Hughes Company, PESTEC, Strohm, SuKo Polymer Machine Tech Co., Ltd., TOPOLO, GULF PLASTIC INDUSTRIES, KPT Piping System, Saumya Technocrates Pvt. Ltd., IPEX, Simtech, Truflo and ATP polymer among others.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed