Thiophene Market Size, Share, Trends, Growth and Forecast 2030

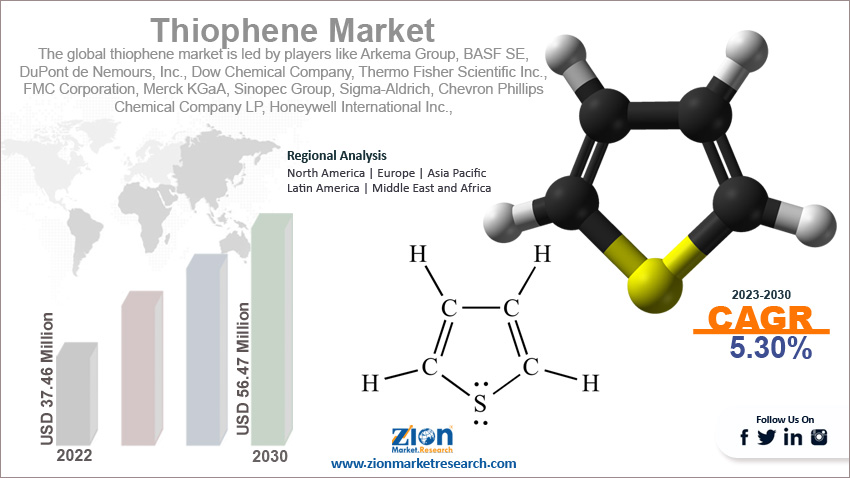

Thiophene Market By Application (Chemical Intermediate, Biocide, and Active Pharmaceuticals Ingredients), By Source (Plant Pigments, Petroleum, Synthetic Production, Natural Gas, and Coal), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2023 - 2030

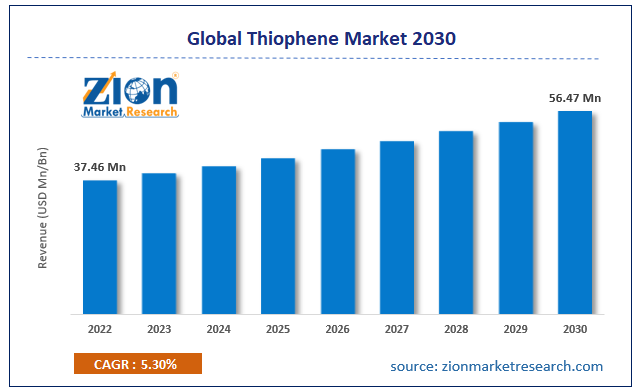

| Market Size in 2022 | Market Forecast in 2030 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 37.46 Million | USD 56.47 Million | 5.30% | 2022 |

Thiophene Industry Prospective:

The global thiophene market size was worth around USD 37.46 million in 2022 and is predicted to grow to around USD 56.47 million by 2030 with a compound annual growth rate (CAGR) of roughly 5.30% between 2023 and 2030.

Thiophene Market: Overview

Thiophene is an aromatic compound containing sulfur. The chemical formula for thiophene is C4H4S and it is the simplest form of its kind consisting of a chemical ring with 5 members. In terms of properties, it is similar to benzene (C6H6) and was first discovered as a contaminant to benzene. It is a colorless liquid and during reactions, it mimics the actions of benzene. Thiophene is most available in coal tar along with C6H6 however it is currently produced commercially on a large scale. Commercial production deals with the use of butene or butane and sulfur dioxide or sulfur. Research indicated that thiophene is also available in plant sources including natural products and plant pigments.

With all the similarities that the compound shares with benzene, studies show that thiophene’s degree of aromaticity is less than C6H6. In recent times, thiophenes have become crucial heterocyclic compounds and play the role of building blocks in modern organic chemistry with extensive applications in the growing pharmaceutical industry. Drug developers often use thiophene as a replacement for benzene rings in biologically active compounds without loss of any activity. This is a widely accepted method as seen in the production of certain Non-steroidal anti-inflammatory drugs (NSAIDs) including Piroxicam and Lornoxicam.

Key Insights:

- As per the analysis shared by our research analyst, the global thiophene market is estimated to grow annually at a CAGR of around 5.30% over the forecast period (2023-2030)

- In terms of revenue, the global thiophene market size was valued at around USD 37.46 million in 2022 and is projected to reach USD 56.47 million, by 2030.

- The thiophene market is projected to grow at a significant rate due to the rising investments in the pharmaceutical industry

- Based on application segmentation, active pharmaceutical ingredients was predicted to show maximum market share in the year 2022

- Based on source segmentation, petroleum was the leading source in 2022

- On the basis of region, Asia-Pacific was the leading revenue generator in 2022

Request Free Sample

Request Free Sample

Thiophene Market: Growth Drivers

Rising investments in the pharmaceutical industry to drive market growth

The global thiophene market is expected to grow owing to the rising investments in the pharmaceutical industry. Thiophene is widely used in the production of several pharmaceutical drugs to treat a large range of medical conditions. These applications are attributed to the anti-inflammatory, antibacterial, antipsychotic, anticancer, anti-anxiety, and antiarrhythmic properties of thiophene. These properties are highly valuable in the pharmaceutical world especially when the global medical care sector is witnessing mounting pressure with the growing number of patients and increased demand for improved patient care.

One of the most crucial applications of thiophene is in the production of several NSAIDs. For instance, Piroxicam is used to relieve arthritis symptoms and treat associated pain. It helps patients manage issues such as swelling, inflammation, joint pain, and stiffness. On the other hand, Lornoxicam is mostly used as a painkiller. Studies indicate that nearly 45% of cases of moderate and high-intensity postoperative dental pain register pain relief with just a single dose of lornoxicam 8 mg as compared to some of the other alternatives. The global pharmaceutical industry is expanding at a quick rate. For instance, in May 2022, Pfizer, a leading pharma country, announced an investment of INR 150 crore in the Indian market to set up a new drug development plant. Similar investments are being carried out on a global scale to meet changing healthcare demand.

Thiophene Market: Restraints

Harmful environmental impact of thiophene production to restrict market growth

The thiophene industry growth is likely to be restricted owing to the harmful impact on the environment associated with the thiophene production process. For instance, several published studies indicate that thiophene and its derivatives production process require the use of several solvents and harsh chemicals that impact environmental quality. In addition to this, thiophene itself is a Volatile Organic Compound (VOC) and can lead to the formation of smog or ground-level ozone. Furthermore, the production process is known to create large amounts of water streams that directly or indirectly lead to harmful environmental effects. There is a general lack of proper waste disposal processes in several countries. Thiophene waste consists of harsh solvents, chemicals, and metals that have the ability to contaminate soil and water. More efforts are needed to ensure that the industry operations do not impact the environment for continuous growth in the future.

Thiophene Market: Opportunities

Rising applications in the agrochemical sector to push the thiophene consumption rate during the projection period

The applications of thiophene also extend to the expanding agrochemical sector as it is used in the production of crucial pesticides and fertilizers. They are also used to produce fungicides and insecticides such as pyrethroids that are widely used in several agricultural and household settings to kill pests and insects. Pyrethroids are effective in repelling a large range of insects such as ticks, flies, mosquitoes, ants, and fleas. On the other hand, it can also get rid of agricultural pests such as beetles, caterpillars, and aphids. With the surging rate of agricultural infestation and the damage caused to the food supply chain, the demand for effective and high-performance insecticides, pesticides, and fertilizers has reached new heights.

Use of thiophene derivatives in personal care products is an excellent expansion opportunity

Several researches have been conducted to understand the role and application of thiophene derivatives in personal care products. The studies have yielded positive results since certain derivatives are known to be safe additives for personal care products such as soaps, body deodorants, shampoos, and antiperspirants. Factors likely to open more doors for further growth in the personal care segment include the rapidly expanding consumer base with the increasing population and rising per capita income along with a higher number of new products launched across price categories and exhaustive marketing or advertising initiatives undertaken by personal care product manufacturers to reach remote markets.

Thiophene Market: Challenges

Market growth expected to be subject to several challenges

The global thiophene market players are expected to come across several challenges during the forecast period. The primary being the changing, dynamic, and complex network of regulatory measures that determine the quantity and quality of thiophene used in end-products including pharmaceutical products and agrochemicals. Each country has specific rules that determine the extent to which thiophene contents can be used in the products and product manufacturers must comply with these rules to ensure commercial sale. In addition to this, managing supply chains of raw materials and final goods could also create more growth barriers since raw material prices are highly sensitive to external political, social, and environmental factors.

Thiophene Market: Segmentation

The global thiophene market is segmented based on application, source, and region.

Based on application, the global market segments are chemical intermediate, biocide, and active pharmaceutical ingredients. In 2022, the highest growth was witnessed in the active pharmaceutical ingredients segment led by increasing application in the development of novel medicines and therapeutics. The versatile medicinal attributes of the compound make it one of the most popular and widely used active ingredients in the drug development industry. Growing research on thiophene-based medication and anti-cancer may act as a crucial growth propeller during the forecast period. As of 2022, the global oncology market was valued at USD 204 billion.

Based on source, the thiophene industry divisions are plant pigments, petroleum, synthetic production, natural gas, and coal. In 2022, the highest growth was registered in the petroleum segment. Thiophene and derivatives are present in the concentration of 1% to 3% in petroleum and they are extracted from the source using specific refining processes. On the other hand, certain plant pigments are also rich sources of thiophene such as onions and garlic, however, the quantity of thiophene available may not be as high as petroleum.

Thiophene Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Thiophene Market |

| Market Size in 2022 | USD 37.46 Million |

| Market Forecast in 2030 | USD 56.47 Million |

| Growth Rate | CAGR of 5.30 |

| Number of Pages | 220 |

| Key Companies Covered | Arkema Group, BASF SE, DuPont de Nemours Inc., Dow Chemical Company, Thermo Fisher Scientific Inc., FMC Corporation, Merck KGaA, Sinopec Group, Sigma-Aldrich, Chevron Phillips Chemical Company LP, Honeywell International Inc., Royal Dutch Shell plc, Lanxess AG, Sumitomo Chemical Company, Limited, Albemarle Corporation, and others. |

| Segments Covered | By Application, By Source, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2022 |

| Historical Year | 2017 to 2021 |

| Forecast Year | 2023 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Thiophene Market: Regional Analysis

Asia-Pacific to register the highest growth rate during the projected period

The global thiophene market is expected to witness the highest growth rate in Asia-Pacific during the forecast period with China acting as the most dominant region. The country is home to an extensive chemical & material industry and it currently ranks at the top position in terms of chemical production and export rate. In addition to this, China is investing heavily in developing its domestic pharmaceutical industry due to the growing number of people and the higher need for improved medical care. Research indicates that China is well equipped to handle novel raw pharmaceutical materials and intermediates making it a strong player in the global market. Other countries such as South Korea and India are investing heavily in end-user verticals. For instance, the rising agrochemical industry in India is expected to create higher domestic demand for thiophene. As per the Fertilizer Association of India, total regional fertilizer consumption in 2021-2022 was around 63.94 million MT.

Thiophene Market: Competitive Analysis

The global thiophene market is led by players like:

- Arkema Group

- BASF SE

- DuPont de Nemours Inc.

- Dow Chemical Company

- Thermo Fisher Scientific Inc.

- FMC Corporation

- Merck KGaA

- Sinopec Group

- Sigma-Aldrich

- Chevron Phillips Chemical Company LP

- Honeywell International Inc.

- Royal Dutch Shell plc

- Lanxess AG

- Sumitomo Chemical Company

- Limited

- Albemarle Corporation

The global thiophene market is segmented as follows:

By Application

- Chemical Intermediate

- Biocide

- Active Pharmaceuticals Ingredients

By Source

- Plant Pigments

- Petroleum, Synthetic Production

- Natural Gas

- Coal

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Thiophene is an aromatic compound containing sulfur. The chemical formula for thiophene is C4H4S and it is the simplest form of its kind consisting of a chemical ring with 5 members.

The global thiophene market is expected to grow owing to the rising investments in the pharmaceutical industry.

According to study, the global thiophene market size was worth around USD 37.46 million in 2022 and is predicted to grow to around USD 56.47 million by 2030.

The CAGR value of the thiophene market is expected to be around 5.30% during 2023-2030.

The global thiophene market is expected to witness the highest growth rate in Asia-Pacific during the forecast period with China acting as the most dominant region.

The global thiophene market is led by players like Arkema Group, BASF SE, DuPont de Nemours, Inc., Dow Chemical Company, Thermo Fisher Scientific Inc., FMC Corporation, Merck KGaA, Sinopec Group, Sigma-Aldrich, Chevron Phillips Chemical Company LP, Honeywell International Inc., Royal Dutch Shell plc, Lanxess AG, Sumitomo Chemical Company, Limited, Albemarle Corporation, and others.

The report explores crucial aspects of the thiophene market including a detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed