Tilapia Market Growth, Size, Share, Trends, and Forecast 2034

Tilapia Market By Species (Nile Tilapia, Blue Tilapia, and Mozambique Tilapia), By Product Type (Fresh, Frozen and Processed), By End-Use (Retail and Food Service), By Distribution Channel (Supermarkets/Hypermarkets, Seafood Stores, and Online Retail), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 9.17 Billion | USD 12.65 Billion | 3.1% | 2024 |

Tilapia Market: Industry Perspective

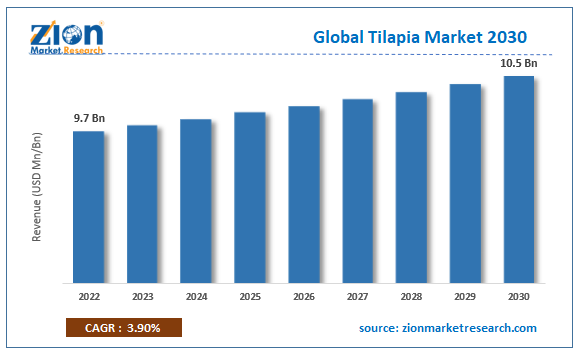

The global tilapia market size was worth around USD 9.17 Billion in 2024 and is predicted to grow to around USD 12.65 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 3.1% between 2025 and 2034. The report analyzes the global tilapia market's drivers, restraints/challenges, and the effect they have on the demand during the projection period. In addition, the report explores emerging opportunities in the tilapia industry.

Tilapia Market: Overview

Tilapia is a popular freshwater fish that has gained widespread recognition for its mild, white flesh, and versatile culinary applications. Native to Africa, tilapia is now farmed globally and is considered one of the most cultivated fish species in the world. Its neutral flavor profile makes it an adaptable ingredient in a variety of dishes, allowing it to take on the flavors of different seasonings, herbs, and sauces. This characteristic, along with its firm texture, makes tilapia a favorite among chefs and home cooks seeking a flexible and nutritious protein source. One of the key attractions of tilapia is its nutritional profile. It is a low-calorie fish with high protein content, making it an excellent choice for individuals looking to maintain a balanced diet. Additionally, tilapia is a good source of essential nutrients such as omega-3 fatty acids, which contribute to heart health, and various vitamins and minerals like selenium and vitamin B12. While it's important to be mindful of sourcing practices to ensure responsible aquaculture, tilapia's availability and nutritional benefits have made it a staple in the diets of many around the world.

Key Insights

- As per the analysis shared by our research analyst, the global tilapia market is estimated to grow annually at a CAGR of around 3.1% over the forecast period (2025-2034).

- Regarding revenue, the global tilapia market size was valued at around USD 9.17 Billion in 2024 and is projected to reach USD 12.65 Billion by 2034.

- The global tilapia market is projected to grow at a significant rate due to the affordability and cost-effectiveness of tilapia compared to other popular seafood options.

- Based on species segmentation, Nile tilapia was predicted to hold the maximum market share.

- Based on product type segmentation, frozen was the leading revenue generator in 2024.

- Based on end-use segmentation, retail was the leading revenue generator in 2024.

- On the basis of region, Asia Pacific is expected to dominate the global market during the forecast period.

Tilapia Market: Growth Drivers

Affordability and cost-effectiveness of tilapia compared to other popular seafood options are driving the market growth.

The global tilapia market is poised for substantial growth, primarily driven by the affordability and cost-effectiveness of tilapia when compared to other sought-after seafood choices. Tilapia's economic advantage stems from its efficient feed conversion rates and relatively low production costs, which make it an attractive option for both aquaculture producers and price-conscious consumers. This affordability factor has significantly expanded the availability of tilapia in various markets, making it an accessible choice for a wide spectrum of consumers across different income levels. Furthermore, the cost-effectiveness of tilapia doesn't compromise its nutritional value. It remains a rich source of high-quality protein, essential omega-3 fatty acids, and a range of vital vitamins and minerals. This makes it an appealing dietary choice for health-conscious consumers who are mindful of both their nutritional intake and budget. As a result, the affordability and cost-effectiveness of tilapia have propelled it to the forefront of the global seafood market, driving its projected growth in the foreseeable future.

Tilapia Market: Restraints

The potential environmental impact associated with intensive aquaculture practices may restrain the market growth

The tilapia industry is facing a significant constraint in the form of potential environmental impacts linked with intensive aquaculture practices. As the demand for tilapia continues to rise, particularly in response to its affordability and popularity as a seafood choice, there has been an uptick in the intensity and scale of tilapia farming operations. This intensification, if not managed carefully, can lead to a range of environmental issues. These may include water pollution from excess nutrients and waste, habitat degradation due to alterations in water flow and quality, and the potential for the spread of diseases among farmed fish. Furthermore, the use of antibiotics and chemicals in some intensive tilapia farming operations raises concerns about their release into the surrounding environment. This not only poses risks to non-target species but also contributes to the growing problem of antibiotic resistance. To mitigate these challenges, there is an increasing need for more sustainable and responsible aquaculture practices. This could involve the implementation of advanced water treatment technologies, the development of closed-loop systems, and the promotion of best management practices to minimize the negative environmental footprint associated with tilapia farming. Stricter regulatory frameworks and certifications that prioritize environmental stewardship are also critical in ensuring the long-term viability and sustainability of the tilapia market.

Tilapia Market: Opportunities

The growing trend toward sustainable and responsible seafood consumption provides growth opportunities

One significant opportunity in the tilapia market lies in the growing trend toward sustainable and responsible seafood consumption. As consumers become more environmentally conscious and seek out products with transparent and ethical sourcing practices, there is an increasing demand for sustainably produced tilapia. This presents an opportunity for producers and suppliers to adopt and promote eco-friendly aquaculture methods, such as integrated multi-trophic systems or recirculating aquaculture systems, which can help minimize the environmental impact of tilapia farming. By obtaining certifications like Aquaculture Stewardship Council (ASC) or Best Aquaculture Practices (BAP), producers can tap into this burgeoning market segment and cater to environmentally-conscious consumers. Furthermore, the versatility of tilapia as a fish species offers opportunities for innovative product development and culinary creations. With its mild flavor profile and firm texture, tilapia can be used in a wide range of culinary applications, from traditional dishes to modern, health-conscious meals. Entrepreneurs and chefs have the chance to experiment with new preparation methods, flavor combinations, and value-added products, catering to diverse consumer tastes and preferences. This adaptability positions tilapia as a versatile and valuable ingredient in the culinary world, allowing for continued innovation and market expansion.

Tilapia Market: Challenges

The competition from other seafood options, particularly those that are highly promoted for their premium quality or unique flavors poses challenge to the market growth

The tilapia industry confronts a substantial challenge in the form of stiff competition from other seafood options, particularly those that are heavily marketed for their premium quality or distinctive flavors. Species like salmon, trout, and seabass have established themselves as premium choices in the seafood industry, often commanding higher prices due to their unique taste profiles and perceived health benefits. These alternatives can overshadow tilapia's presence in the market, as consumers may be enticed by the allure of trying something new or indulging in a perceived higher-end option. This dynamic poses a significant hurdle for the tilapia market, as it must find ways to differentiate itself and highlight its own strengths amidst a sea of competing choices. To address this challenge, stakeholders in the tilapia market must strategically position tilapia as a valuable and viable seafood option. This may involve emphasizing its affordability and cost-effectiveness, particularly appealing to consumers looking for a budget-friendly yet nutritious protein source. Additionally, efforts to promote the versatility of tilapia in various culinary applications can help showcase its adaptability and appeal to a wide range of tastes and preferences. By effectively communicating these strengths and finding innovative ways to stand out in a crowded market, the tilapia industry can work towards overcoming the competition posed by premium seafood options and continue to grow its market share.

Tilapia Market: Segmentation

The global Tilapia market is segmented based on species, product type, end-use, distribution channel, and region.

Based on species, the global market segments are Nile tilapia, blue tilapia, and Mozambique tilapia. At present, the global market is dominated by the Nile tilapia segment. This is primarily due to Nile Tilapia's popularity and widespread cultivation for aquaculture. It is known for its fast growth rate, adaptability to various environmental conditions, and relatively high reproductive capacity, which makes it a preferred choice for many tilapia farmers. Additionally, Nile tilapia has a mild flavor and firm texture, making it well-received by consumers worldwide. However, it's important to note that market dynamics can change over time, and the dominance of a particular species may shift due to factors like evolving consumer preferences, advancements in breeding techniques, and environmental considerations.

Based on product type, the global tilapia industry is categorized as fresh, frozen, and processed. Among these frozen segments holds the largest segment in the global market in 2024. This dominance is attributed to the convenience and extended shelf life that frozen tilapia offers, making it a preferred choice for both domestic and international markets. The ability to store and transport frozen tilapia over extended periods without compromising its quality is a key factor driving its popularity. Additionally, frozen tilapia is a favored option for foodservice providers, catering companies, and retailers, further solidifying its position as the leading product type in the market.

Based on end-use, the global tilapia industry is categorized as retail and food service. Among retail was the largest shareholding segment in the global market. This is due to the widespread availability and consumer demand for tilapia in grocery stores, supermarkets, and other retail outlets. Tilapia is a popular choice for consumers seeking an affordable and versatile seafood option for home cooking. Additionally, the retail sector often offers a range of value-added tilapia products, such as fillets and pre-marinated options, catering to consumer preferences for convenient meal solutions. However, it's worth noting that the food service segment, which includes restaurants, hotels, and catering services, also plays a significant role in the tilapia market, particularly in regions with a strong culinary tradition centered on seafood.

By distribution channel, the global tilapia market is split into supermarkets/hypermarkets, seafood stores, and online retail.

Tilapia Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Tilapia Market |

| Market Size in 2024 | USD 9.17 Billion |

| Market Forecast in 2034 | USD 12.65 Billion |

| Growth Rate | CAGR of 3.1% |

| Number of Pages | 212 |

| Key Companies Covered | Regal Springs Group, AquaBounty Technologies, Blue Ridge Aquaculture, Til-Aqua International, China Fishery Group, Dainichi Corporation, Mazzetta Company, Nile Tilapia, Fish Farm LLC, Ecuakirsa, and others. |

| Segments Covered | By Species, By Product Type, By End-Use, By Distribution Channel, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, the Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Tilapia Market: Regional Analysis

Asia Pacific to lead the market during the forecast period

Asia Pacific is poised to dominate the global tilapia market during the forecast period. This region has long been a powerhouse in the global aquaculture industry, with China leading the way as the largest producer of tilapia. The favorable climate conditions, extensive experience in aquaculture practices, and a well-established supply chain infrastructure contribute to the Asia Pacific's leadership in tilapia production. Additionally, countries like Indonesia, Thailand, and Vietnam have emerged as key players, further bolstering the region's position in the market. The increasing demand for affordable and versatile seafood options in the Asia Pacific, coupled with the expertise of local farmers and producers, is expected to drive sustained growth in the tilapia market within the region.

Moreover, Asia Pacific's dominance in tilapia production is complemented by its expanding export market. The region benefits from strong trade relationships with various international markets, particularly in North America and Europe, where tilapia is in high demand. This export-oriented approach, combined with the region's capacity for large-scale production, solidifies Asia Pacific's leading role in the global tilapia market. However, it's worth noting that with evolving consumer preferences and sustainable aquaculture practices gaining traction, other regions may seek to enhance their own tilapia production capabilities, potentially influencing the market dynamics in the future.

Key Development

- In 2023, Superior Fresh Seafoods acquired Tilapia Mexico, a leading producer of tilapia in Mexico. This acquisition strengthened Superior Fresh Seafoods' position as a leading provider of tilapia in North America.

- In 2023, AquaChile partnered with Cargill to develop new sustainable tilapia aquaculture practices. This partnership leverages AquaChile's expertise in tilapia aquaculture and Cargill's expertise in feed and nutrition.

- In 2023, Regal Springs launched a new line of tilapia products that are certified by the Aquaculture Stewardship Council (ASC). These new products offer consumers a sustainable and high-quality tilapia option.

- In 2022, AquaChile launched a new line of tilapia products that are free of antibiotics and hormones. These new products offer consumers a healthy and natural tilapia option.

Tilapia Market: Competitive Analysis

The global tilapia market is dominated by players like:

- Regal Springs Group

- AquaBounty Technologies

- Blue Ridge Aquaculture

- Til-Aqua International

- China Fishery Group

- Dainichi Corporation

- Mazzetta Company

- Nile Tilapia

- Fish Farm LLC

- Ecuakirsa

The global tilapia market is segmented as follows:

By Species

- Nile Tilapia

- Blue Tilapia

- Mozambique Tilapia

By Product Type

- Fresh

- Frozen

- Processed

By End-Use

- Retail

- Food Service

By Distribution Channel

- Supermarkets/Hypermarkets

- Seafood Stores

- Online Retail

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Tilapia is a popular freshwater fish that has gained widespread recognition for its mild, white flesh and versatile culinary applications. Native to Africa, tilapia is now farmed globally and is considered one of the most cultivated fish species in the world.

The global tilapia market cap may grow owing to the affordability and cost-effectiveness of tilapia compared to other popular seafood options.

According to a study, the global tilapia market size was worth around USD 9.17 Billion in 2024 and is expected to reach USD 12.65 Billion by 2034.

The global tilapia market is expected to grow at a CAGR of 3.1% during the forecast period.

The global tilapia market growth is expected to be driven by Asia Pacific. It is currently the world’s highest revenue-generating market owing to the aquaculture and booming seafood sector.

The global tilapia market is led by players like Regal Springs Group, AquaBounty Technologies, Blue Ridge Aquaculture, Til-Aqua International, China Fishery Group, Dainichi Corporation, Mazzetta Company, Nile Tilapia, Fish Farm LLC, Ecuakirsa.

The report analyzes the global tilapia market’s drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the Tilapia industry.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed