United States E-Commerce Payment Market Size, Share, Growth & Forecast 2032

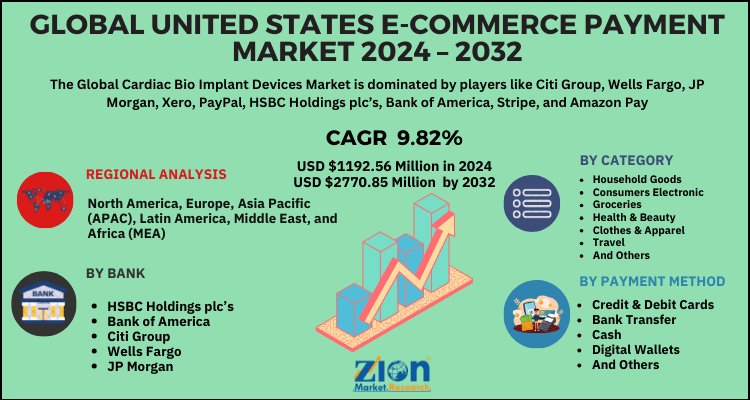

United States E-Commerce Payment Market By bank (HSBC Holdings plc’s, Bank of America, Citi Group, Wells Fargo, and JP Morgan), By category (household goods, consumers electronic, groceries, health & beauty, clothes & apparel, travel, and others), By payment method (credit & debit cards, bank transfer, cash, digital wallets, and others) And By Region: - Global And Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, And Forecasts, 2024-2032-

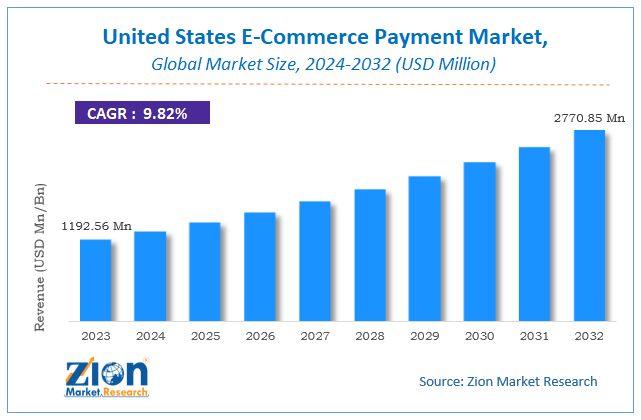

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1192.56 Million | USD 2770.85 Million | 9.82% | 2023 |

Description

United States E-Commerce Payment Market Insights

According to the report published by Zion Market Research, the global United States E-Commerce Payment Market size was valued at USD 1192.56 Million in 2023 and is predicted to reach USD 2770.85 Million by the end of 2032. The market is expected to grow with a CAGR of 9.82% during the forecast period. The report analyzes the global United States E-Commerce Payment Market's growth drivers, restraints, and impact on demand during the forecast period. It will also help navigate and explore the arising opportunities in the United States E-Commerce Payment industry.

United States E-Commerce Payment Market: Overview

Online purchase of goods and services with the use of electronic medium for the payment is known as e-commerce payment. Such payment mode without using cheque or cash is referred as e-commerce payment system or online payment system. Several types of e-commerce payments are used in day-to-day life. This includes debit cards, credit cards, smart cards, mobile payment, net banking, Amazon pay, and e-wallet. E-commerce payments can be made for household goods, electronics, traveling, and many more, making the process of payments easier to the consumers.

United States E-Commerce Payment Market: Growth Factors

The United States e-commerce payment market is growing at a significant rate. The rise in penetration of internet in banking sector, availability of several options for e-commerce payments, and growing use of e-commerce payment systems form the millennials are the major factors that are boosting the growth of the United States e-commerce payment market. In terms of sales, the United States holds the second position in the global e-commerce market. There is substantial rise in online shopping and e-commerce payment is considered to be the best mode of payments in the US. In addition to this, the consumer can avail numerous benefits with the use of e-commerce payments such as more efficient & effective transactions, expenses control for customers, convenient use, and much more.

Additionally, the payment providers and payment gateways offer anti-fraud and security tools which makes the transactions highly reliable. All such factors are equally contributing to the growth of the market in the US region. Moreover, the rise in use of smartphones & tablets, renowned banks such as JP Morgan & Bank of America offering special offers, and digital wallets are also the factors that are spurring the growth of the market. Furthermore, the rapid expansion of domestic online giants including eBay & Amazon and rise in use of digital shopping & grocery apps may lead to ample opportunities for the growth of the United States e-commerce payment market during the forecast period. However, factors such as lack of anonymity and increase in the rate of e-commerce frauds are likely to hinder the growth of the United States e-commerce payment market.

The Covid-19 pandemic has severely hit the United States. Almost one quarter of the confirmed cases of Covid-19 across the world were reported from the US. National emergency was been declared by the government and enforced stay-at-home orders, quarantine, and closure of schools & universities. In such case, e-commerce payment became a convenient and essential tool for the Americans. The Covid-19 outbreak accelerated the rate of online transactions as the consumers highly depended on e-commerce payments for ordering medical, groceries, and other household essential goods. Owing to all such factors, a substantial growth in the United States e-commerce payment market is been witnessed during the pandemic.

United States E-Commerce Payment Market: Segmentation

The United States e-commerce payment market is divided into bank, category, payment method.

Based on the bank, the United States e-commerce payment market is bifurcated into HSBC Holdings plc’s, Bank of America, Citi Group, Wells Fargo, and JP Morgan.

Based on the category, the market is split into household goods, consumers electronic, groceries, health & beauty, clothes & apparel, travel, and others.

The payment method is classified into credit & debit cards, bank transfer, cash, digital wallets, and others.

United States E-Commerce Payment Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | United States E-Commerce Payment Market |

| Market Size in 2023 | USD 1192.56 Million |

| Market Forecast in 2032 | USD 2770.85 Million |

| Growth Rate | CAGR of 9.82% |

| Number of Pages | 204 |

| Key Companies Covered | Citi Group, Wells Fargo, JP Morgan, Xero, PayPal, HSBC Holdings plc’s, Bank of America, Stripe, and Amazon Pay |

| Segments Covered | By bank, By category, By payment method and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

United States E-Commerce Payment Market: Country Analysis

The E-commerce payment market in the United States is growing at a significant rate. The rapid growth of digitalization in the US has connected the majority of the business under digital payment gateway. The US e-commerce payment sector possesses significant growth opportunities, particularly through app-based sales. E-commerce payment gateway continues to transform the retail industry in the United States, which led to growth in consumer confidence for online shopping and mobile e-commerce. E-commerce payment is continuing to offer new ways to shop for and buy goods and services in the US. With all these and many more factors E-commerce payment market is expected to experience healthy growth over the forecast period.

United States E-Commerce Payment Market: Competitive Players

- Citi Group

- Wells Fargo

- JP Morgan

- Xero

- PayPal

- HSBC Holdings plc’s

- Bank of America

- Stripe

- Amazon Pay

are some of the giant players that are operating in the United States e-commerce payment market.

The Global United States E-Commerce Payment Market is segmented as follows:

By bank

- HSBC Holdings plc’s

- Bank of America

- Citi Group

- Wells Fargo

- JP Morgan

By category

- household goods

- consumers electronic

- groceries

- health & beauty

- clothes & apparel

- travel

- and others

By payment method

- credit & debit cards

- bank transfer

- cash

- digital wallets

- and others

United States E-Commerce Payment Market: Regional Segment Analysis

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

What Reports Provides

- Full in-depth analysis of the parent market

- Important changes in market dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional markets

- Testimonials to companies in order to fortify their foothold in the market.

Table Of Content

FrequentlyAsked Questions

The United States e-commerce payment market is growing at a significant rate. The rise in penetration of internet in banking sector, availability of several options for e-commerce payments, and growing use of e-commerce payment systems form the millennials are the major factors that are boosting the growth of the United States e-commerce payment market. Furthermore, the rapid expansion of domestic online giants including eBay &Amazon and rise in use of digital shopping & grocery apps may lead to ample opportunities for the growth of the United States e-commerce payment market during the forecast period.

Citi Group, Wells Fargo, JP Morgan, Xero, PayPal, HSBC Holdings plc’s, Bank of America, Stripe, and Amazon Pay are some of the giant players that are operating in the United States e-commerce payment market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed