US Biofilm Treatment Market Size, Share, Industry Analysis, Trends, Growth, 2032

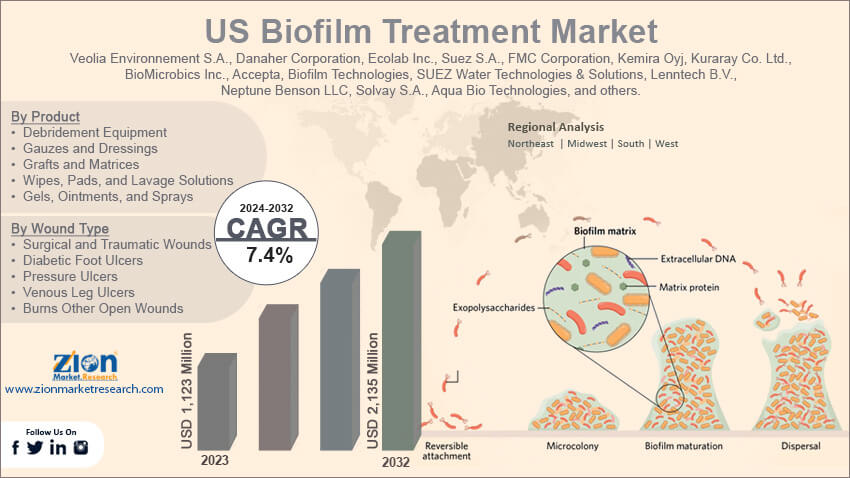

US Biofilm Treatment Market By Product (Debridement Equipment, Gauzes and Dressings, Grafts & Matrices, Wipes, Pads, & Lavage Solutions, and Gels, Ointments, & Sprays), By Wound Type (Surgical & Traumatic Wounds, Diabetic Foot Ulcers, Pressure Ulcers, Venous Leg Ulcers, and Burns Other Open Wounds), By End User (Hospitals, ASCS, Wound Care Centers, Home Care Settings, and Others), and By Country-State Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

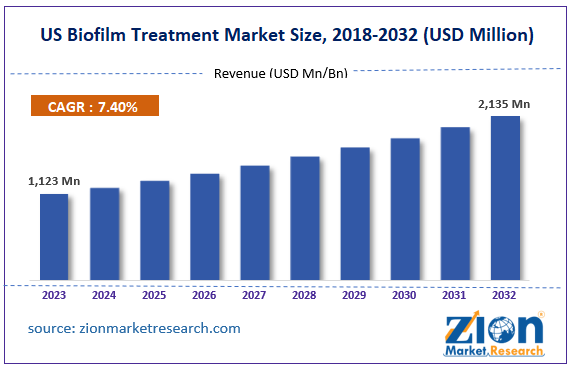

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1,123 Million | USD 2,135 Million | 7.4% | 2023 |

US Biofilm Treatment Industry Perspective:

The US biofilm treatment market size was worth around USD 1,123 million in 2023 and is predicted to grow to around USD 2,135 million by 2032 with a compound annual growth rate (CAGR) of roughly 7.4% between 2024 and 2032.

US Biofilm Treatment Market: Overview

A biofilm is a colony of bacteria that functions as a multicellular organism by colonizing a surface. When a bacterial cell can adhere to a suitable surface and start to multiply, biofilms are created. The more complex organism is aided in its creation by the replicated bacterial cells. The human body contains both beneficial and toxic biofilms. Biofilms are often seen in mucus, the skin's surface, and teeth (plaque buildup). Sterilization of operating rooms and equipment is necessary because biofilms may be introduced during the surgical implantation of objects. Bacterial cells produce biofilms, which provide defense against immunological and antimicrobial reactions. Bacterial colonies can remain in one place for longer because of these intricate matrixes.

Key Insights

- As per the analysis shared by our research analyst, the US biofilm treatment market is estimated to grow annually at a CAGR of around 7.4% over the forecast period (2024-2032).

- In terms of revenue, the US biofilm treatment market size was valued at around USD 1,123 million in 2023 and is projected to reach USD 2,135 million, by 2032.

- The increasing focus on environmental sustainability and biodegradability is expected to propel the US Biofilm Treatment market growth over the projected period.

- Based on the product, the debridement equipment segment is expected to dominate the market over the forecast period.

- Based on the wound type, the surgical and traumatic wounds segment is expected to capture a significant market share during the analysis period.

- Based on the end user, the hospital segment is expected to capture the largest market share during the forecast period.

- Based on the state, California is expected to dominate the market over the projected period.

Request Free Sample

Request Free Sample

US Biofilm Treatment Market: Growth Drivers

Rising focus on environmental sustainability drives market growth

The US biofilm treatment industry is being driven primarily by the growing emphasis in the US on environmental sustainability. The use of biofilm treatment has increased dramatically as a result of the need for packaging solutions that are waste- and environmentally friendly. Due to its complete biodegradability, demand for biodegradable carton-board packaging is particularly rising. This is in line with customer desires for environmentally friendly goods and legislative actions that support sustainable business operations. Thus, biofilm treatment is at the forefront of this expanding market due to its capacity to provide economical and environmentally friendly packaging solutions.

US Biofilm Treatment Market: Restraints

Regulatory compliance and certification barriers impede market growth

In the US biofilm treatment business, strict certification and regulatory compliance requirements are major barriers. Strict testing and verification procedures are necessary to meet requirements for packaging that is biobased and biodegradable. Handling these regulatory environments can be expensive and time-consuming, which could impede the US biofilm treatment market expansion. Simplifying certification procedures and defining precise industry norms are necessary to lessen these difficulties and promote an atmosphere that is more favorable for biofilm treatment.

US Biofilm Treatment Market: Opportunities

Growing number of wounds and HAIs provides a lucrative opportunity for market growth

The need for biofilm in the healthcare sector has surged due to an increase in wounds and hospital-acquired infections. The principal sites for biofilm growth are implanted devices, like pacemakers and catheters, hence treating biofilms is necessary to prevent contamination. The survey indicates that between 60% and 70% of chronic wounds have biofilms. This element is anticipated to accelerate overall US biofilm treatment market expansion.

US Biofilm Treatment Market: Challenges

Growing resistance to antibiotics and illnesses associated with biofilms pose a major challenge to market expansion

Bacterial biofilms pose a major threat to US health since they contribute to chronic infections that are persistent and resistant to antibiotics, host defense mechanisms, and other external pressures. Biofilms, which are stationary microbial communities that form on the surfaces of medical implants including sutures, catheters, and dental implants, are generated by the microorganisms themselves using extracellular polymeric molecules. Patients who have infections caused by these biofilms run the danger of developing costly medical conditions as well as mental disorders because these biofilms can only be eliminated. Apart from protecting microorganisms against changes in pH potential, osmolarity, nutritional deficiency, mechanical stress, and shear forces, biofilms also stop antibiotics and the host's immune system from reaching bacterial colonies. Because of the extra resistance that the biofilm matrix gives the bacteria, these nasty guys may now not only survive in hostile environments but also develop antibiotic resistance, leading to the creation of germs that are, widely, and multi-drug resistant. These are a few of the variables that could limit the increase in US biofilm treatment industry revenue.

US Biofilm Treatment Market: Segmentation

The US biofilm treatment industry is segmented based on product, wound type, end user, and state.

Based on the product, the US biofilm treatment market is bifurcated into debridement equipment, gauzes & dressings, grafts & matrices, wipes, pads, & lavage solutions, and gels, ointments, & sprays. The debridement equipment segment is expected to dominate the market over the forecast period. The increasing requirement for appropriate wound care due to the rising prevalence of diseases like diabetes and obesity is what propels the need for debridement equipment. For instance, the American Diabetes Association projects that in 2021, 38.4 million Americans, or 11.6% of the total population, will have diabetes. Approximately 304,000 children and adolescents out of the 2 million Americans have type 1 diabetes.

Based on the wound type, the US biofilm treatment industry is segmented into surgical & traumatic wounds, diabetic foot ulcers, pressure ulcers, venous leg ulcers and burns other open wounds. The surgical and traumatic wounds segment is expected to capture a significant market share during the analysis period. The need for efficient biofilm treatment solutions is being driven by the rising number of operations, especially among the elderly population. Furthermore, healthcare practitioners are becoming more conscious of the problems that biofilms present, which is causing them to place more emphasis on treatment and prevention.

Based on the end user, the US biofilm treatment market is segmented into hospitals, ASCs, wound care centers, home care settings, and others. The hospital segment is expected to capture the largest market share during the forecast period. Advanced biofilm treatment technologies, like antimicrobial coatings, innovative debridement instruments, and specialty wound dressings, are becoming more and more expensive for hospitals to purchase. The need for hospitals to lower HAIs and enhance patient outcomes additionally encourages the use of biofilm treatment methods and products.

US Biofilm Treatment Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | US Biofilm Treatment Market |

| Market Size in 2023 | USD 1,123 Million |

| Market Forecast in 2032 | USD 2,135 Million |

| Growth Rate | CAGR of 7.4% |

| Number of Pages | 222 |

| Key Companies Covered | Veolia Environnement S.A., Danaher Corporation, Ecolab Inc., Suez S.A., FMC Corporation, Kemira Oyj, Kuraray Co. Ltd., BioMicrobics Inc., Accepta, Biofilm Technologies, SUEZ Water Technologies & Solutions, Lenntech B.V., Neptune Benson LLC, Solvay S.A., Aqua Bio Technologies, and others. |

| Segments Covered | By Product, By Wound Type, By End User, and By State |

| States Covered in US | California, Florida, New York, Washington, Texas, New Jersey, Georgia, Oregon, Arizona, and Colorado |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

US Biofilm Treatment Market: State Analysis

California is expected to dominate the market over the forecast period

California is expected to dominate the US biofilm treatment market over the forecast period. The market growth in the area is attributed to the high prevalence of diabetes. For instance, as per the report released by the American Diabetes Association (ADA), 3,026,764 people (about 10% of the adult population) in California have been diagnosed with diabetes. There are an additional 884,000 people in California who do not know they have diabetes, which greatly increases the chance of complications. In California, 10,320,000 persons, or 33.4% of the adult population, have prediabetes, which is raised blood glucose levels that are higher than normal but not high enough to be considered diabetes. An estimated 230,273 people in California are diagnosed with diabetes each year. Thus, the aforementioned stats are expected to drive the market growth in the California state.

US Biofilm Treatment Market: Biofilm Treatment Competitive Analysis

The US biofilm treatment market is dominated by players like:

- Veolia Environnement S.A.

- Danaher Corporation

- Ecolab Inc.

- Suez S.A.

- FMC Corporation

- Kemira Oyj

- Kuraray Co. Ltd.

- BioMicrobics Inc.

- Accepta

- Biofilm Technologies

- SUEZ Water Technologies & Solutions

- Lenntech B.V.

- Neptune Benson LLC

- Solvay S.A.

- Aqua Bio Technologies

The US biofilm treatment market is segmented as follows:

By Product

- Debridement Equipment

- Gauzes and Dressings

- Grafts and Matrices

- Wipes, Pads, and Lavage Solutions

- Gels, Ointments, and Sprays

By Wound Type

- Surgical and Traumatic Wounds

- Diabetic Foot Ulcers

- Pressure Ulcers

- Venous Leg Ulcers

- Burns Other Open Wounds

By End User

- Hospitals

- ASCS

- Wound Care Centers

- Home Care Settings

- Others

By State

- California

- Florida

- New York

- Washington

- Texas

- New Jersey

- Georgia

- Oregon

- Arizona

- Colorado

- Others

Table Of Content

Methodology

FrequentlyAsked Questions

A biofilm is a colony of bacteria that functions as a multicellular organism by colonizing a surface. When a bacterial cell can adhere to a suitable surface and start to multiply, biofilms are created. The more complex organism is aided in its creation by the replicated bacterial cells. The human body contains both beneficial and toxic biofilms. Biofilms are often seen in mucus, the skin's surface, and teeth (plaque buildup). Sterilization of operating rooms and equipment is necessary because biofilms may be introduced during the surgical implantation of objects. Bacterial cells produce biofilms, which provide defense against immunological and antimicrobial reactions. Bacterial colonies can remain in one place for longer because of these intricate matrixes.

The US biofilm treatment market is being driven by several factors such as the growing prevalence of diabetes, increasing hospital-acquired infections, increasing elderly population, rising government initiatives, increasing focus on environment sustainability, and others.

According to the report, the US biofilm treatment market size was worth around USD 1,123 million in 2023 and is predicted to grow to around USD 2,135 million by 2032.

The US biofilm treatment market is expected to grow at a CAGR of 7.4% during the forecast period.

US biofilm treatment market growth is driven by California. It is currently the nation's highest revenue-generating market due to the prevalence of diabetes.

The US biofilm treatment market is dominated by players like Veolia Environnement S.A., Danaher Corporation, Ecolab Inc., Suez S.A., FMC Corporation, Kemira Oyj, Kuraray Co. Ltd., BioMicrobics Inc., Accepta, Biofilm Technologies, SUEZ Water Technologies & Solutions, Lenntech B.V., Neptune Benson LLC, Solvay S.A. and Aqua Bio Technologies among others.

The US biofilm treatment market report covers the geographical market along with a comprehensive Biofilm Treatment competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed