US Chicken Market Size, Share, Trends, Growth and Forecast 2032

US Chicken Market By Type (Conventional Chicken, Organic Chicken, Antibiotic - Free, and Cage - Free/Free - Range), By Pricing (Commodity Chicken and Premium/Organic Chicken), By Distribution Channel (Supermarkets and Hypermarkets, Specialty Organic Retailers, Online Retail, Farmers’ Markets, and Butcher Shops), and By Country - State Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032-

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 43.5 Billion | USD 77.9 Billion | 6.7% | 2023 |

US Chicken Industry Prospective:

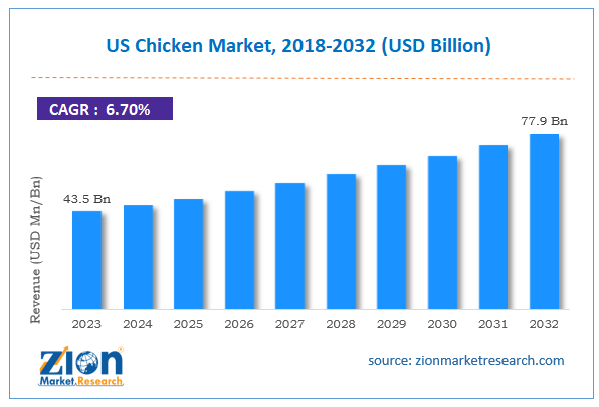

The US chicken market size was worth around USD 43.5 billion in 2023 and is predicted to grow to around USD 77.9 billion by 2032, with a compound annual growth rate (CAGR) of roughly 6.7% between 2024 and 2032.

US Chicken Market: Overview

Domesticated birds, Gallus gallus domesticus, chickens, are kept often for their meat and eggs as well as occasionally as pets. A subspecies of the red junglefowl, this one of the most often kept household animals is rather common. Living in flocks and being omnivorous, gregarious creatures, chickens use a variety of vocalizations to communicate.

Among other applications, they have used selective breeding to generate meat (broilers) and eggs (layers). The US chicken market is influenced by several factors, such as high consumer demand for poultry meat, fast-food & processed chicken growth, technical advancements in poultry farming, and others.

However, the rising feed cost might hamper the expansion of the industry.

Key Insights

- As per the analysis shared by our research analyst, the US chicken market is estimated to grow annually at a CAGR of around 6.7% over the forecast period (2024-2032).

- In terms of revenue, the US Chicken market size was valued at around USD 43.5 billion in 2023 and is projected to reach USD 77.9 billion by 2032.

- The increasing consumption of chicken is expected to propel the US chicken market growth over the projected period.

- Based on the type, the conventional chicken segment is expected to dominate the market over the forecast period.

- Based on the pricing, the commodity chicken segment is expected to grow at a significant rate over the projected period.

- Based on the distribution channel, the supermarkets and hypermarkets segment are expected to hold a prominent market share over the forecast period.

- Based on the state, California is expected to dominate the market over the projected period.

US Chicken Market: Growth Drivers

Growing poultry production drives market growth

The US poultry business is the world's largest producer and second-largest exporter of poultry meat, as well as a major egg producer. The country's consumption of poultry meat (broilers, other fowl, and turkey) is around 45% greater than other meat varieties like beef or hog. Its total poultry output value includes 68% from broilers, 13% from turkey, and less than 1% from hens.

For instance, in 2021, the United States produced 9.13 billion broilers, a 1% reduction from 2020. The number of turkeys raised in 2021 was 217 million, down by 3% from 2020. Turkey's 3.91-billion-pound meat output in the United States between January and September 2022 was 7% less than in the same period in 2021.

Still, rises in broiler output exceeded the fall in turkey production. The United States sold around 200 million chickens (excluding broilers) in 2022, 4% less than in 2021. Produced were almost 111 billion eggs, 1% less than 112 billion in 2021. Leading US states producing broilers were Georgia, Alabama, and Arkansas; their respective head of broiler counts were 1,298,900, 1,171,600, and 1,051,300, respectively. Usually laying 10–12 eggs a year, wild chickens are limited by the difficulties that their bodies go through during reproduction.

US Chicken Market: Restraints

High feed price impedes market growth

The highly pathogenic avian influenza (HPAI) outbreak of 2022 had a major impact on the poultry industry. Tight supplies before the epidemic and disease-related supply limitations drove wholesale hen prices to a record monthly average of USD 1.81 per pound in November and kept prices high all through the fourth quarter of 2022.

Though prices were predicted to drop in the second half of 2023, the average national turkey hen price is expected to be USD 1.62 per pound, compared to an average of USD 1.55 in 2022. Higher feed costs are driving rising chicken prices in the United States.

Out of all the maize exports worldwide, Russia generates 17%. Essential for the manufacturing of corn used as feed for poultry, Russia is also among the top exporters of the three main forms of fertilizers—nitrogen, phosphorous, and potassium. Consequently, the Russia-Ukraine War raised the feed expenses for poultry, driving up chicken meat prices in Russia.

US Chicken Market: Opportunities

Growth in fast food & processed chicken provides a lucrative opportunity for market growth

The fast-food and processed chicken sectors are driving the expansion of the US chicken market. Consumer tastes for affordability, convenience, and diets heavy in protein have pushed demand for value-added chicken products as well as ready-to-eat ones. Wings, nuggets, tenders, and fried sandwiches are just a few of the chicken meals fast-food restaurants include on their menus.

Well-known businesses actively pushing fresh chicken products are Wendy's, McDonald's, Popeyes, KFC, and Chick-fil-A. Fast-food restaurants are also providing baked, grilled, and air-fried chicken replacements to attract health-conscious consumers. Companies like Chick-fil-A and Subway stress lean protein options to appeal to consumers who are more concerned about fitness.

US Chicken Market: Challenges

Consumer shift toward alternative proteins poses a major challenge to market expansion

The US chicken industry is increasingly threatened by alternative proteins, including plant-based meat substitutes and lab-grown meats. Though chicken is still the most often used protein choice, changing consumer tastes, health trends, and sustainability issues are driving a push toward non-animal protein sources.

Consumers are eating less meat by moving to vegetarian, vegan, and flexitarian diets. From firms like Beyond Meat, Impossible Foods, Gardein, and Daring Foods, plant-based substitutes for chicken are becoming more and more popular. Because they have less saturated fat and cholesterol, many also think that plant-based proteins are healthier than conventional chicken. Clean-label trends are driving demand for natural, non-GMO, antibiotic-free replacements.

US Chicken Market : Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | US Chicken Market |

| Market Size in 2023 | USD 43.5 Billion |

| Market Forecast in 2032 | USD 77.9 Billion |

| Growth Rate | CAGR of 6.7% |

| Number of Pages | 221 |

| Key Companies Covered | Tyson Foods Inc., Pilgrim’s Pride Corporation, Perdue Farms, Wayne Sanderson Farms, Bell & Evans, Murray’s Organic Chicken, Just Bare, Bachoco USA, Cargill, Tecumseh Poultry LLC, and others. |

| Segments Covered | By Type, By Pricing, By Distribution Channel, and By State |

|

States Covered In US |

California, Florida, New York, Washington, Texas, New Jersey, Georgia, Oregon, Arizona, Colorado, Others, |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

US Chicken Market: Segmentation

The US chicken industry is segmented based on type, pricing, distribution channel, and state.

Based on the type, the US chicken market is bifurcated into conventional chicken, organic chicken, antibiotic-free, and cage-free/free-range. The conventional chicken segment is expected to dominate the market over the forecast period. The U.S. broiler production has shown a consistent upward trend over the decades. Data from the National Chicken Council indicates a continual increase in production volume, highlighting the industry's expansion.

Based on the pricing, the US chicken industry is bifurcated into commodity chicken and premium/organic chicken. The commodity chicken segment is expected to grow at a significant rate over the projected period. Commodity chicken refers to mass-produced, conventionally farmed chicken that is widely available in grocery stores, restaurants, and food service industries. The high production drives the industry growth.

Based on the distribution channel, the US chicken market is bifurcated into supermarkets and hypermarkets, specialty organic retailers, online retail, farmers’ markets, and butcher shops. The supermarkets and hypermarkets segment is expected to hold a prominent market share over the forecast period. The availability of a variety of chicken drives the industry's growth.

US Chicken Market: State Analysis

California is expected to dominate the market over the forecast period

California is expected to dominate the US chicken market over the forecast period. The regional expansion of the market is attributed to the high consumption of chicken. For instance, as per the data shared by USDA, California's poultry business employs over 25,000 people and generates over $250 million in revenue yearly. In 2024, the state's broiler industry contributed $1.59 billion to the agricultural market.

Furthermore, a growing trend toward ecological and compassionate agricultural methods is reflected in initiatives like Sonoma County's Measure J, which prompts for the phase-out of huge factory farms. Such actions might serve as models for agricultural reforms across the country.

US Chicken Market: Competitive Analysis

The US chicken market is dominated by players like

- Tyson Foods Inc.

- Pilgrim’s Pride Corporation

- Perdue Farms

- Wayne Sanderson Farms

- Bell & Evans

- Murray’s Organic Chicken

- Just Bare

- Bachoco USA

- Cargill

- Tecumseh Poultry LLC,

The US chicken market is segmented as follows:

By Type

- Conventional Chicken

- Organic Chicken

- Antibiotic-Free

- Cage- Free/Free-Range

By Pricing

- Commodity Chicken

- Premium/Organic Chicken

By Distribution Channel

- Supermarkets and Hypermarkets

- Specialty Organic Retailers

- Online Retail

- Farmers’ Markets

- Butcher Shops

By State

- California

- Florida

- New York

- Washington

- Texas

- New Jersey

- Georgia

- Oregon

- Arizona

- Colorado

Table Of Content

Methodology

FrequentlyAsked Questions

Domesticated birds, Gallus gallus domesticus, chickens, are kept often for their meat and eggs as well as occasionally as pets. A subspecies of the red junglefowl, this one of the most often kept household animals is rather common.

The US chicken market is influenced by several factors, such as high consumer demand for poultry meat, fast-food & processed chicken growth, technical advancements in poultry farming, and others.

According to the report, the US chicken market size was worth around USD 43.5 billion in 2023 and is predicted to grow to around USD 77.9 billion by 2032.

The US chicken market is expected to grow at a CAGR of 6.7% during the forecast period.

US Chicken market growth is driven by California. It is currently the nation's highest revenue-generating market due to the high chicken consumption.

The US Chicken market is dominated by players like Tyson Foods Inc., Pilgrim’s Pride Corporation, Perdue Farms, Wayne Sanderson Farms, Bell & Evans, Murray’s Organic Chicken, Just Bare, Bachoco USA, Cargill, Tecumseh Poultry LLC, and others.

The US Chicken market report covers the geographical market along with a comprehensive Chicken competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed