U.S. Dog Food Market Size, Share, Analysis, Trends, Growth, Forecasts, 2032

U.S. Dog Food Market By Nature (Conventional, Organic, and Monoprotein), By Pet Type (Puppy, Senior, and Adult), By Product Type (Powder, Kibble/Dry, Freeze Dried Food, Treats & Chews, Freeze-Dried Raw, Wet Food, Frozen Food, and Raw Food), and By Region - Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032 -

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 44 Billion | USD 55 Billion | 4.7% | 2023 |

U.S. Dog Food Industry Prospective:

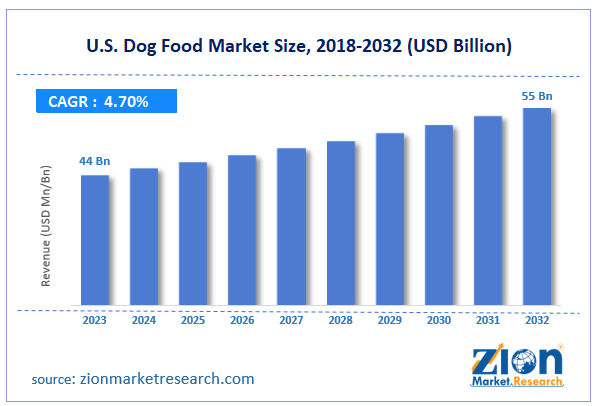

The U.S. dog food market size was evaluated at $44 billion in 2023 and is slated to hit $55 billion by the end of 2032 with a CAGR of nearly 4.7% between 2024 and 2032.

U.S. Dog Food Market: Overview

Dog food is produced so that the canine intake, thereby fulfilling their preference for omnivorous food. Reportedly, for decades, dogs have adapted to various foods that include meat and non-meat products. Moreover, studies have revealed that they can digest carbohydrates, unlike cats. For the record, dog foods are available in various forms, including commercial dog foods, special foods, freeze-dried food products, and dehydrated food products.

Key Insights

- As per the analysis shared by our research analyst, the U.S. dog food market is projected to expand annually at the annual growth rate of around 4.7% over the forecast timespan (2024-2032)

- In terms of revenue, the U.S. dog food market size was evaluated at nearly $44 billion in 2023 and is expected to reach $55 billion by 2032.

- The global U.S. dog food market is anticipated to grow rapidly over the forecast timeline owing to escalating disposable income and rising urbanization.

- In terms of nature, the organic segment is slated to register the highest CAGR over the forecast period.

- Based on pet type, the puppy segment is predicted to dominate the segmental growth in the upcoming years.

- On the basis of product type, the raw food segment is expected to lead the segmental space in the forecasting years.

- Region-wise, the Northeast dog food industry in the U.S. is projected to register the fastest CAGR during the projected timespan.

Request Free Sample

Request Free Sample

U.S. Dog Food Market: Growth Factors

Rising per capita income to boost the market trends in the country over the forecast period

Escalating disposable income and rising urbanization are anticipated to boost the growth of the U.S. dog food market. Furthermore, the surging preference of the millennial population for pets will promote the growth of the market in the country. Moreover, growing pet humanization in the U.S. will prompt the growth of the market in the country. With customers trying to pay more for premium dog food due to its high quality, the market for dog food in the U.S. is likely to gain traction in the years ahead. Apart from this, surging consciousness about the health of pets and the nutritive contents of pet foods will drive the market trends in the U.S. Flourishing online retail and e-commerce sectors is anticipated to prop up the expansion of the U.S. market.

U.S. Dog Food Market: Restraints

Surge in the inflation rate can restrict industry expansion in the U.S. over the assessment period

Rising inflation and economic fluctuations are likely to impede the growth of the U.S. dog food industry. Furthermore, an increase in price conflicts and saturation witnessed in product sales can hinder industry growth in the country.

U.S. Dog Food Market: Opportunities

High demand for specialized pet foods to open lucrative growth facets for the market in the U.S.

Large-scale demand for subscription-based models and the need for special diets are predicted to open new growth avenues for the U.S. dog food market. Moreover, new product launches and the use of functional ingredients such as omega-3 fatty acids, antioxidants, and probiotics will boost the market growth in the U.S. Moreover, strict labeling needs and enforcement of safety regulations will embellish the expansion of the market in the country.

U.S. Dog Food Market: Challenges

Growing food safety concerns to challenge the expansion of the industry in the U.S.

Changing rules and compliance issues have resulted in product recalls along with a surge in the costs of pet food, thereby leading to a decline and dilution of the product demand in the U.S., and this retarding the expansion of the U.S. dog food industry. Concerns over food safety as well as ingredient safety can prevent the pet owners from purchasing the pet food, thereby severely affecting the expansion of industry in the country.

U.S. Dog Food Market: Segmentation

The U.S. dog food market is divided into nature, pet type, product type, and region.

In terms of nature, the U.S. dog food market is bifurcated into conventional, organic, and monoprotein segments. Additionally, the organic segment, which gained approximately half of the market earnings in 2023, is set to register the fastest growth rate yearly during the time interval from 2024 to 2032. The main factor bolstering the segmental expansion can be credited to the huge purchase of organic dog foods by pet owners as they do not contain preservatives and artificial colors.

On the basis of pet type, the U.S. dog food industry is sectored into puppy, senior, and adult segments. In addition to this, the puppy segment, which accrued about 60% of the industry share in 2023, is likely to lead the segmental surge in the U.S. in the upcoming years. The segmental expansion can be due to the fact that puppies can be easily domesticated and play with children.

Based on the product type, the U.S. dog food market is divided into powder, kibble/dry, freeze-dried food, treats & chews, freeze-dried raw, wet food, frozen food, and raw food segments. Furthermore, the raw food segment, which led the segment space in 2023, will retain its dominant status in the forecasting timeline. The growth can be due to a growing preference for raw foods by canines, as the latter have their digestive systems tuned to raw meat.

U.S. Dog Food Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | U.S. Dog Food Market |

| Market Size in 2023 | USD 44 Billion |

| Market Forecast in 2032 | USD 55 Billion |

| Growth Rate | CAGR of 4.7% |

| Number of Pages | 223 |

| Key Companies Covered | Nestle Purina PetCare, Mars Inc., The J.M. Smucker Company, General Mills, Champion Petfoods, Hill’s Pet Nutrition., and others. |

| Segments Covered | By Nature, By Pet Type, By Product Type, and By Region |

| Regions Covered in U.S. | Northeast, Midwest, South, and West |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

U.S. Dog Food Market: Regional Insights

Southern part of the U.S. is expected to dominate the market surge over 2024-2032

The Southern part, which accrued 62% of the U.S. dog food market share in 2023, is set to uphold its position in the U.S. market in the years to come. In addition to this, the regional market surge in the forecast timeframe can be credited to a surge in pet ownership, leading to humungous dog food demand in the region. Apart from this, the growing focus on the health & fitness of pets along with a surge in product offerings will steer the regional market trends. Presence of key players in the country and the flourishing e-commerce sector will steer the expansion of the market in this part of the country.

The Northeast dog food industry in the U.S. is predicted to record the highest rate of expansion annually within the next few years. The growth of the dog food industry in the Northeastern part of the U.S. can be due to the humungous demand for high-quality dog foods in the region and the massive preference for pet humanization in this part of the U.S.

U.S. Dog Food Market: Competitive Space

The U.S. dog food market profiles key players such as:

- Nestle Purina PetCare

- Mars Inc.

- The J.M. Smucker Company

- General Mills

- Champion Petfoods

- Hill’s Pet Nutrition.,

The U.S. dog food market is segmented as follows:

By Nature

- Conventional

- Organic

- Monoprotein

By Pet Type

- Puppy

- Senior

- Adult

By Product Type

- Powder

- Kibble/Dry

- Freeze Dried Food

- Treats & Chews

- Freeze-Dried Raw

- Wet Food

- Frozen Food

- Raw Food

By Region

The U.S.

- Northeast

- Midwest

- South

- West

Table Of Content

Methodology

FrequentlyAsked Questions

Dog food is produced so that the canine intake, thereby fulfilling their preference for omnivorous food. Reportedly, since decades dogs have adapted to various foods that include meat as well as non-meat products.

The U.S. dog food market growth over the forecast period can be owing to surging consciousness about the health of pets and the nutritive contents of pet foods.

According to a study, the global U.S. dog food industry size was $44 billion in 2023 and is projected to reach $55 billion by the end of 2032.

The global U.S. dog food market is anticipated to record a CAGR of nearly 4.7% from 2024 to 2032.

The Northeast dog food industry in the U.S. is set to register the fastest CAGR over the forecasting timeline owing to the region's huge demand for high-quality dog foods and massive preference for pet humanization.

The U.S. dog food market is led by players such as Nestle Purina PetCare, Mars Inc., The J.M. Smucker Company, General Mills, Champion Petfoods, and Hill’s Pet Nutrition.

The U.S. dog food market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTEL analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five force analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed