U.S. Driver Monitoring System Market Size, Share, Analysis, Trends, Growth, Forecasts, 2032

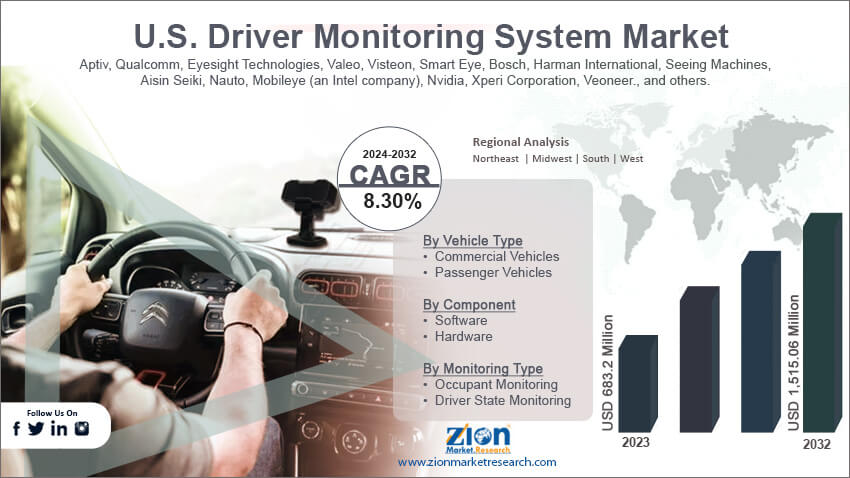

U.S. Driver Monitoring System Market By Vehicle Type (Commercial Vehicles and Passenger Vehicles), By Component (Software and Hardware), By Monitoring Type (Occupant Monitoring and Driver State Monitoring), By Sales Channel (Aftermarket and Original Equipment Manufacturer (OEM)), and By Region - Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

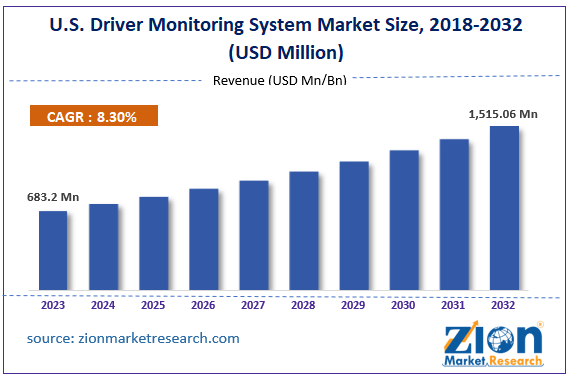

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 683.2 Million | USD 1,515.06 Million | 8.30% | 2023 |

U.S. Driver Monitoring System Industry Prospective:

The U.S. driver monitoring system market size was worth around USD 683.2 million in 2023 and is predicted to grow to around USD 1,515.06 million by 2032 with a compound annual growth rate (CAGR) of roughly 8.30% between 2024 and 2032.

U.S. Driver Monitoring System Market: Overview

The U.S. driver monitoring system industry deals with the development, application, strategic partnerships, and international collaborations related to driver monitoring systems in the country. It is showing promising signs of growth during the projection period. A driver monitoring system helps in keeping vehicle drivers more alert by tracking distraction patterns in drivers and avoiding possible accidents. The growing number of road accidents in the US is a major promoter of driver monitoring systems (DMS) in vehicles. The technology leverages driver-facing cameras mostly placed into the vehicle instrument cluster or dashboard. It consists of infrared light-emitting diodes (LEDs) that allow the system to monitor the driver's face at night. The LEDs are powerful enough to track the driver's eye movement even when wearing sunglasses. Using advanced application programs, the tool collects facial data points in a relaxed state which is later used as a benchmark to highlight deflection from the standard points. The system tries to capture the driver's attention when it concludes that the driver is drowsy or distracted. The goal is to alert the driver and prevent any accident or collision.

Key Insights:

- As per the analysis shared by our research analyst, the U.S. driver monitoring system market is estimated to grow annually at a CAGR of around 8.30% over the forecast period (2024-2032)

- In terms of revenue, the U.S. driver monitoring system market size was valued at around USD 683.2 million in 2023 and is projected to reach USD 1,515.06 million, by 2032.

- The U.S. driver monitoring system market is projected to grow at a significant rate due to the growing rate of road accidents across the country

- Based on the vehicle type, the commercial vehicles segment is growing at a high rate and will continue to dominate the regional market as per industry projection

- Based on the monitoring type, the driver-state monitoring segment is anticipated to command the largest market share

- Based on region, eastern states are projected to dominate the regional market during the forecast period

Request Free Sample

Request Free Sample

U.S. Driver Monitoring System Market: Growth Drivers

Growing rate of road accidents across the country to drive the market demand rate

The U.S. driver monitoring system market is expected to grow due to the rising number of road accidents across the country. According to the National Safety Council, around 36.164 motor vehicle accidents were reported every day in the US in 2021. According to market research, distracted driving is one of the major reasons for road accidents, followed by speeding and drunk driving. Studies indicate several reasons for driver’s distraction. It may be caused due to fatigue or exhaustion. For instance, rideshare drivers tend to drive at a stretch for multiple hours. Driving without frequent breaks in between can lead to exhaustion. Other reasons for distracted driving include adjusting car settings, texting & driving, grooming, handling other passengers in the vehicle, watching videos, and eating or drinking. The growing fatality rate among US citizens caused by distracted driving will fuel the demand for DMS in the coming years.

Growing development of new DMS in the region will promote the market adoption rate

DMS developers and automotive companies are actively seeking new solutions that enhance overall deliverables. The surging investments in developing new driver monitoring systems may be helpful in driving the market demand further. In January 2024, Magna, a leading provider of mobility technology, announced the launch of a new technology based on camera and breath. The innovation was launched at the Consumer Electronics Show 2024. It was developed to manage and prevent risks associated with distracted driving. The sensors are embedded in the cockpit and provide highly reliable and affordable ways to determine whether a driver can drive. In September 2021, Tesla, a prominent domestic and international EV industry player, rolled out driver monitoring systems for cars with radar. The surge in development rate for advanced DMS is expected to fuel revenue in the U.S. driver monitoring system market.

U.S. Driver Monitoring System Market: Restraints

Inaccurate interpretation of DMS functions among drivers to limit market adoption rate

The U.S. industry for driver monitoring systems is projected to be limited in terms of growth due to inaccurate interpretation of DMS technology among drivers. For instance, there are concerns about DMS invading driver’s privacy by using cameras controlled by a third party. Moreover, drivers may become uncomfortable with sensors and cameras constantly facing them. Industry leaders claim that DMS only tracks facial movement to analyze if the driver is alert, and users may misinterpret it as a privacy violation. Market companies and regional officials must focus on generating more awareness about drivers to register higher DMS adoption.

U.S. Driver Monitoring System Market: Opportunities

Surge in efforts undertaken by the regional government to promote DMS use will generate expansion possibilities

The U.S. driver monitoring system market is expected to generate more growth opportunities as regional officials draft new regulations promoting DMS use in vehicles. For instance, the implementation of the Stay Aware for Everyone (SAFE) Act by the US government has helped the Secretary of Transportation explore several end-user applications of DMS. In a recent announcement, the US Congress announced a new requirement for automotive companies operating in the country. As per the mandate, automotive companies must develop and use a high-tech system to prevent drunken drivers from operating a vehicle. All new vehicles that will roll out starting in 2026 must be equipped with technologies that prevent drunk driving in the country

U.S. Driver Monitoring System Market: Challenges

Lack of clear regulations around DMS will challenge the market expansion rate

The U.S. driver monitoring system market is projected to be challenged by the lack of clear regulations governing DMS installation and applications. The laws promoting DMS use in vehicles change from one state to another. Moreover, the regional government is exploring other ways of preventing road accidents, which could lead to financial fragmentation, thus leaving fewer opportunities for DMS developers to expand.

U.S. Driver Monitoring System Market: Segmentation

The U.S. driver monitoring system market is segmented based on vehicle type, component, monitoring type, sales channel, and region.

Based on the vehicle type, the regional market segments are commercial vehicles and passenger vehicles. In 2023, the highest demand was observed in the commercial vehicles segment. These automotives are used for commercial reasons, including the transportation of people and goods. The surge in the number of rideshare service providers in the US along with growing mandates to improve passenger safety, is fueling the segmental demand. In the first quarter of 2024, Uber completed more than 2.5 billion rides, per official statistics.

Based on components, the U.S. driver monitoring system market is divided into software and hardware.

Based on the monitoring type, the regional market segments are occupant monitoring and driver state monitoring. In 2023, the demand was the highest for driver state monitoring variants. Drivers are responsible for the safety of the passengers when driving. One of the prominent reasons for accident-related deaths in the US is caused due to inattentive driving. The total number of crashes was around 13,200,000 in 2021, as per the National Safety Council.

Based on the sales channel, the regional market divisions are aftermarket and original equipment manufacturer (OEM).

U.S. Driver Monitoring System Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | U.S. Driver Monitoring System Market |

| Market Size in 2023 | USD 683.2 Million |

| Market Forecast in 2032 | USD 1,515.06 Million |

| Growth Rate | CAGR of 8.30% |

| Number of Pages | 213 |

| Key Companies Covered | Aptiv, Qualcomm, Eyesight Technologies, Valeo, Visteon, Smart Eye, Bosch, Harman International, Seeing Machines, Aisin Seiki, Nauto, Mobileye (an Intel company), Nvidia, Xperi Corporation, Veoneer., and others. |

| Segments Covered | By Vehicle Type, By Component, By Monitoring Type, By Sales Channel, and By Region |

| Regions Covered in U.S. | Northeast, Midwest, South, and West |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

U.S. Driver Monitoring System Market: Regional Analysis

Growth across states will be steady and increasing during the projection period

The U.S. driver monitoring system market will witness steady growth across regions with eastern states leading with higher growth during the projection period. Cities such as Boston, New York, and Chicago are some of the most densely populated eastern regions. These cities are home to a large number of students and a working population with vehicles. The growing vehicle density on the road, fueling the risk of accidents, is expected to drive the demand for DMS in eastern states. According to official statistics, more than 600 road accidents are reported in New York every day. The rising investments in the automotive industry will help generate more revenue for the DMS sector. In February 2024, Schaeffler, a global motion technology company, announced its plan to invest in expanding its US manufacturing capacity for producing electric mobility solutions. The company is expected to invest USD 230 million for the new production site. Western regions such as Seattle and Los Angeles may also register greater DMS adoption. These regions are popular tourist sites. They also enjoy considerable demand for ridesharing services, which could promote DMS applications. The growing focus on improving passenger safety and overall maintenance of traffic rules will also be critical to regional revenue.

U.S. Driver Monitoring System Market: Competitive Analysis

The U.S. driver monitoring system market is led by players like:

- Aptiv

- Qualcomm

- Eyesight Technologies

- Valeo

- Visteon

- Smart Eye

- Bosch

- Harman International

- Seeing Machines

- Aisin Seiki

- Nauto

- Mobileye (an Intel company)

- Nvidia

- Xperi Corporation

- Veoneer.

The U.S. driver monitoring system market is segmented as follows:

By Vehicle Type

- Commercial Vehicles

- Passenger Vehicles

By Component

- Software

- Hardware

By Monitoring Type

- Occupant Monitoring

- Driver State Monitoring

By Sales Channel

- Aftermarket

- Original Equipment Manufacturer (OEM

By Region

- The U.S.

Table Of Content

Methodology

FrequentlyAsked Questions

The U.S. driver monitoring system industry deals with the development, application, strategic partnerships, and international collaborations related to driver monitoring systems in the country.

The U.S. driver monitoring system market is expected to grow due to the rising number of road accidents across the country.

According to study, the U.S. driver monitoring system market size was worth around USD 683.2 million in 2023 and is predicted to grow to around USD 1,515.06 million by 2032.

The CAGR value of the U.S. driver monitoring system market is expected to be around 8.30% during 2024-2032.

The U.S. driver monitoring system market will witness steady growth across regions, with eastern states leading with higher growth during the projection period.

The U.S. driver monitoring system market is led by players like Aptiv, Qualcomm, Eyesight Technologies, Valeo, Visteon, Smart Eye, Bosch, Harman International, Seeing Machines, Aisin Seiki, Nauto, Mobileye (an Intel company), Nvidia, Xperi Corporation and Veoneer.

The report explores crucial aspects of the U.S. driver monitoring system market including a detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed