US Fire Fighting Foam Market Size, Share, Trends, Growth 2032

US Fire Fighting Foam Market By Application (Aviation, Marine, Oil & Gas, Warehousing, Mining, and Others), By Fire Type (Type C, Type B, and Type A), and By Region - Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032-

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

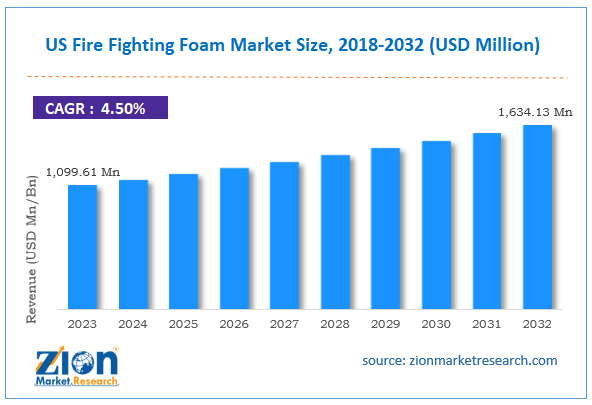

| USD 1,099.61 Million | USD 1,634.13 Million | 4.50% | 2023 |

US Fire Fighting Foam Industry Prospective:

The US fire fighting foam market size was worth around USD 1,099.61 million in 2023 and is predicted to grow to around USD 1,634.13 million by 2032 with a compound annual growth rate (CAGR) of roughly 4.50% between 2024 and 2032.

US Fire Fighting Foam Market: Overview

Fire fighting foam in the US deals with authorized chemicals and materials used during a fire accident to extinguish or suppress fire flames. The regional industry is growing rapidly driven by several factors. The US heavily regulates the fire fighting foam industry since certain types of chemicals are banned in the nation for fire extinguishing. For multiple years, foam has been used in the country as a fire-extinguishing source for combustible and flammable liquid. As compared to other forms of fire-extinguishing agents, foam performs the role of controlling the fire using multiple mechanisms.

For instance, it suppresses vapors and smothering, separates the product & ignition sources, and delivers a cooling mechanism. The foam is a mass of compact air-filled bubbles. They have lower density as compared to oil, water, and gasoline. It is made of three main components that are air, foam concentrate, and water. The US state governments have specific laws governing the use of fire fighting foam and its components. The regional market is expected to be driven by the rising number of fire-related accidents. Additionally, complex regulatory laws may challenge the market expansion trend over the forecast period

Key Insights:

- As per the analysis shared by our research analyst, the US fire fighting foam market is estimated to grow annually at a CAGR of around 4.50% over the forecast period (2024-2032)

- In terms of revenue, the US fire fighting foam market size was valued at around USD 1,099.61 million in 2023 and is projected to reach USD 1,634.131 million by 2032.

- The US fire fighting foam market is projected to grow at a significant rate due to the increasing number of fire accidents in the country

- Based on the application, the oil & gas segment is growing at a high rate and will continue to dominate the regional market as per industry projection

- Based on the fire type, the type A segment is anticipated to command the largest market share

- Based on region, Coastal areas in the US are projected to dominate the regional market during the forecast period

Request Free Sample

Request Free Sample

US Fire Fighting Foam Market: Growth Drivers

Increasing number of fire accidents in the country to drive market demand rate

The US fire fighting foam market is expected to be driven by the rise in the number of fire-related accidents in the country. According to the National Safety Council, the country reported nearly 1,504,500 fires in 2022. The incidents resulted in the death of 3,790 civilians along with more than 10,000 fire-related injuries. Apart from civilian deaths, the US has also reported a higher number of firefighter deaths while on duty. In 2022, around 100 firefighter fatalities were reported in the country. According to the U.S. Fire Administration, cooking was the leading reason for the maximum number of incidents reported in residential buildings. It accounted for more than 51% of all such accidents. In addition to this, the US is extremely dense in terms of commercial buildings.

Human error, system failure, or other external factors are some of the leading reasons for higher fire accidents in non-residential areas. For instance, in February 2023, a Chicago manufacturing facility was engulfed in intense fire while the cause of the accident remained unknown during the initial investigation. In April 2024, a massive fire broke across the Latrobe shopping plaza in Pennsylvania, USA. The environmental impact of climate change is also a leading cause of natural fires across the country. In August 2023, the Hawaii island of the US reported several wildfires claiming lives and causing severe property damage.

Regional oil & gas sector to promote the use of firefighting foam during the projection period

The US oil & gas industry is one of the largest consumers of firefighting services and foam. The growing investments in the oil & gas sector in the form of the construction of new oil rigs and other associated facilities will promote the adoption of firefighting foam to mitigate any future accidents. In June 2024, reports emerged suggesting Element Fuels Holdings, an oil startup from Dallas, had announced a new proposal for the construction of a state-of-the-art U.S. oil refinery in the last 5 decades. The initial phase of development is expected to cost around USD 1.2 billion. The regional oil & gas industry is heavily regulated in terms of workers and environmental safety, thus ensuring more revenue in the US fire fighting foam market.

US Fire Fighting Foam Market: Restraints

Complex regulations surrounding foam content may limit the industry’s growth trajectory

The US industry for fire fighting foam is expected to be restricted due to the complex and highly dynamic regulatory environment in the country governing foam content. For instance, in December 2020, the House Armed Services Committee directed the regional military to eliminate the use of Per- and Polyfluoroalkyl Substances (PFAS)-containing foam by October 2024. In January 2022, the state of California also banned the use of PFAS-containing fire fighting foam. The lack of nationwide standard regulations regarding foam content can discourage the entry of new players.

US Fire Fighting Foam Market: Opportunities

Ongoing efforts to improve fire fighting services in the country will generate more expansion possibilities

The US fire fighting foam market is projected to generate more growth opportunities in the future due to ongoing efforts by state and national governments to improve fire fighting services. These initiatives are directed toward making fire fighting solutions more effective in managing fire accidents with minimal damage. For instance, in March 2024, the U.S. Fire Administration (USFA) launched a prototype version of the novel, an interpolable digital platform for fire information and analytics. The tool is called the National Emergency Response Information System (NERIS) and is specially designed for American fire and emergency services. The tool aims to provide local fire and emergency services with real-time information and analytical tools to make informed decisions related to fire accidents.

US Fire Fighting Foam Market: Challenges

Supply chain disruption affecting raw material access may challenge the market expansion trend

The US industry for fire fighting foam is expected to be challenged by disruptions in the supply chain of raw materials required for foam preparation. Rising trade disputes with countries leading the production of chemicals and materials required for foam production are a primary factor that could cut off the timely supply of required resources. In addition to this, the cost of transitioning from PFOS-based foams to environmentally friendly solutions can put a financial burden on the market players.

US Fire Fighting Foam Market: Segmentation

The US fire fighting foam market is segmented based on application, fire type, and region.

Based on the application, the regional market segments are aviation, marine, oil & gas, warehousing, mining, and others. In 2023, the highest demand was observed in the oil & gas segment. The industries or companies operating in oil and gas are highly vulnerable to fire incidents due to the inflammable characteristics of the materials the industry is associated with. As the US seeks solutions to reduce oil dependency on other nations during the forecast, more investment can be expected in the regional oil & gas industry. According to the U.S. Energy Information Administration, the country produced 12.9 million barrels per day (b/d) of crude oil in 2023.

Based on the fire type, the US fire fighting foam market is divided into type C, type B, and type A. In 2023, more than 50% of the segmental share was driven by type A fire type. The segmental growth is a result of increased incidents of fire caused by everyday combustible materials such as rubber, cloth, or paper. Foam-based fire extinguishing agents are highly effective in controlling type A fire. Additionally, the demand for fire fighting foam is also driven by type B and type C fires.

US Fire Fighting Foam Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | US Fire Fighting Foam Market |

| Market Size in 2023 | USD 1,099.61 Billion |

| Market Forecast in 2032 | USD 1,634.13 Billion |

| Growth Rate | CAGR of 4.50% |

| Number of Pages | 233 |

| Key Companies Covered | Ansul (Johnson Controls), Solberg (Amerex Corporation), Tyco Fire Products (Johnson Controls), National Foam, Viking Group, Kidde Fire Fighting (Carrier Global), Profoam, Buckeye Fire Equipment, Foamtec International, Angus Fire, Flameguard, Perimeter Solutions, Chemguard, 3M, Williams Fire & Hazard Control., and others. |

| Segments Covered | By Application, By Fire Type, and By Region |

| Regions Covered in U.S. | Northeast, Midwest, South, and West |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

US Fire Fighting Foam Market: Regional Analysis

Coastal areas in the US will register the highest growth rate during the projection period

The US fire fighting foam market will be driven by the coastal regions in the country. The presence of a higher number of oil refineries across the Gulf Coast of the US is an influential factor in the use of fire fighting foam. In June 2024, Element Fuel Holdings LLC announced that it would be spending nearly USD 3 to USD 4 billion on the construction of a new oil refinery in South Texas. In addition, other regions with a higher density of industrial facilities will further promote the use of foam for fighting fires.

For instance, regions such as Ohio, Illinois, and others have a significant presence of large-scale manufacturing and automotive units. These facilities are highly vulnerable to fire-related accidents. The growing investment in upgrading the regional firefighting departments, making them equipped with new systems and tools, will be influential in the industry's future. For instance, in June 2024, the Urbana Fire Department in Illinois announced the development of two new state-of-the-art facilities by 2025.

US Fire Fighting Foam Market: Competitive Analysis

The US fire fighting foam market is led by players like:

- Ansul (Johnson Controls)

- Solberg (Amerex Corporation)

- Tyco Fire Products (Johnson Controls)

- National Foam

- Viking Group

- Kidde Fire Fighting (Carrier Global)

- Profoam

- Buckeye Fire Equipment

- Foamtec International

- Angus Fire

- Flameguard

- Perimeter Solutions

- Chemguard

- 3M

- Williams Fire & Hazard Control.

The US fire fighting foam market is segmented as follows:

By Application

- Aviation

- Marine

- Oil & Gas

- Warehousing

- Mining

- Others

By Fire Type

- Type C

- Type B

- Type A

By Region

- The U.S.

Table Of Content

Methodology

FrequentlyAsked Questions

Fire fighting foam in the US deals with authorized chemicals and materials that can be used during a fire accident to extinguish or suppress fire flames.

The US fire fighting foam market is expected to be driven by the rise in the number of fire-related accidents in the country.

According to study, the US fire fighting foam market size was worth around USD 1,099.61 million in 2023 and is predicted to grow to around USD 1,634.13 million by 2032.

The CAGR value of the US fire fighting foam market is expected to be around 4.50% during 2024-2032.

The US fire fighting foam market will be driven by the coastal regions in the country.

The US fire fighting foam market is led by players like Ansul (Johnson Controls), Solberg (Amerex Corporation), Tyco Fire Products (Johnson Controls), National Foam, Viking Group, Kidde Fire Fighting (Carrier Global), Profoam, Buckeye Fire Equipment, Foamtec International, Angus Fire, Flameguard, Perimeter Solutions, Chemguard, 3M and Williams Fire & Hazard Control.

The report explores crucial aspects of the US fire fighting foam market including a detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed