US Home Textile Market Size, Share, Trends, Growth 2032

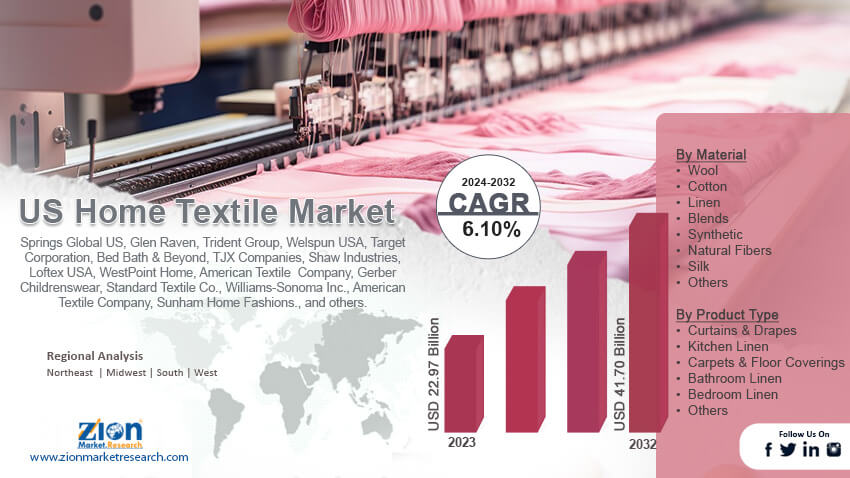

US Home Textile Market By Material (Wool, Cotton, Linen, Blends, Synthetic, Natural Fibers, Silk, and Others), By Product Type (Curtains & Drapes, Kitchen Linen, Carpets & Floor Coverings, Bathroom Linen, Bedroom Linen, and Others), By Price Range (Economy, Mid-Range, and Luxury), and By Region - and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032-

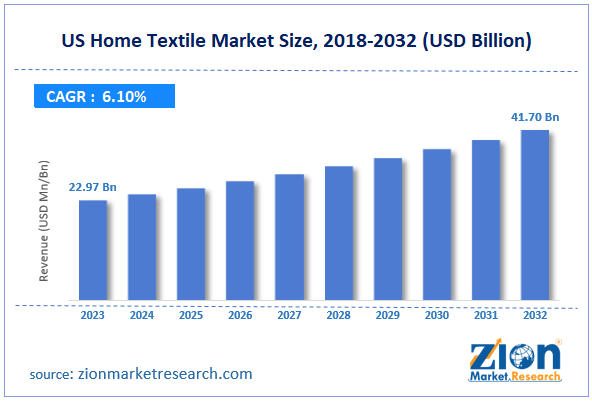

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 22.97 Billion | USD 41.70 Billion | 6.10% | 2023 |

US Home Textile Industry Prospective:

The US home textile market size was worth around USD 22.97 billion in 2023 and is predicted to grow to around USD 41.70 billion by 2032 with a compound annual growth rate (CAGR) of roughly 6.10% between 2024 and 2032.

US Home Textile Market: Overview

The US home textile industry is a special brand of the regional textile industry dealing with home furnishing. It consists of specially designed clothes and fabrics that are made specially for an internally enclosed environment. In some cases, home textiles may not offer functional purposes as they are used purely as decorative items. Home textile products are either made of synthetic products or natural items. The latter is generally priced at a higher value depending on the raw material and its source. The US industry for home textiles comprises several types of materials such as cotton, silk, and natural or synthetic fibers. Products must fulfill certain requirements to be classified as home textile fabric. For instance, they must be visually appealing.

Additionally, they should also offer moisture absorption, abrasion resistance, color fastness, shrinkage, and softness. The United States has specific rules and laws that ascertain the quality of products being sold in the commercial market. These regulations are comprehensive and cover aspects such as labeling, lab testing, chemical restrictions, and specific certifications. During the forecast period, the industry for home textiles in the US is expected to generate impressive revenue. However, growing pollution caused by textile waste may impact the regional market growth trends.

Key Insights:

- As per the analysis shared by our research analyst, the US home textile market is estimated to grow annually at a CAGR of around 6.10% over the forecast period (2024-2032)

- In terms of revenue, the US home textile market size was valued at around USD 22.97 billion in 2023 and is projected to reach USD 41.70 billion, by 2032.

- The US home textile market is projected to grow at a significant rate due to the growing number of homeowners in the country

- Based on the material, the cotton segment is growing at a high rate and will continue to dominate the regional market as per industry projection

- Based on the price range, the mid-range segment is anticipated to command the largest market share

- Based on region, the East Coast is projected to dominate the regional market during the forecast period

Request Free Sample

Request Free Sample

US Home Textile Market: Growth Drivers

Growing number of homeowners in the country to promote a higher market demand rate

The US home textile market is expected to grow due to the rising number of homeowners in the country. The current US population stands at 332.18 million. Following statistics published by the Federal Reserve, over 66.1% of the regional population owns a house. Home renting is also widely popular in the country. As of 2023, around 110 million people in the US were renting homes. The increasing regional population along with the growing number of immigrants and expatriates in the country are driving housing demand.

Additionally, the US is widely popular among students for higher education. The country attracts millions of students from across the globe every year since it houses several reputational colleges and universities. The US offers several 100% scholarships for master's and Doctor of Philosophy (PhD) programs. People living in the US can easily access home loans with a credit score of 580. The growing construction of new homes across price ranges is attracting more buyers in the regional real estate business. This includes affordable housing as well as luxury homes for the ultra-rich section of society. In May 2024, reports emerged suggesting that the region of Portland in the USA was witnessing the construction of a novel housing solution. It focuses on two essential parameters for owning a house in the US. These parameters are affordability and climate change. The new complex, upon completion, will offer around 105 units. It is expected to become Oregon’s first tallest affordable housing building made with mass timber.

Surging demand for home textiles in the regional hospitality sector will prove beneficial for the industry players

The hospitality sector in the US is a thriving market. Home textile products such as curtains, bed linen, towels, and pillows are essential across all lodging facilities. The growing domestic and international tourism in the US is fueling more investments in the hospitality sector. The rise in the number of affordable accommodation centers as well as luxury hotels is projected to help the US home textile market grow. In 2023, the country’s hospitality industry was valued at over USD 200 billion.

US Home Textile Market: Restraints

Concerns over pollution caused by home textile waste may limit the industry’s growth rate

The US industry for home textiles is projected to face growth restrictions since the industry is a leading contributor to the growing pollution in the country. As per the U.S. Environmental Protection Agency (EPA), more than 17 million tons of waste was generated by the regional textile sector in 2018. The number has been increasing with every passing year. The existence of non-biodegradable waste in the environment can cause soil, water, land, and air pollution. EPA estimated that over 66 million tons of pollution was emitted in the US in 2022.

US Home Textile Market: Opportunities

Rising demand for organic product-based home textiles will register significant revenue

The US home textile market will generate more growth in the coming years. In recent times, the demand for organic or chemical-free home textile items has grown in the country. Companies producing home textiles in the US must focus on using environmentally friendly raw materials for making home textiles. These products are beneficial for the environment as well as home residents since they are free of harmful chemicals. In November 2022, a leading direct-to-customer (DTC) brand based in US Coyuchi, launched its immersive ‘at home’ retail shop. The company is a valuable producer of organic luxury linens and the new store is located in Palo Alto, Calif. The facility spans 1,300 square feet and allows customers a highly engaging experience in buying home textile products. In December 2022, Milliken & Co., a Spartanburg, South Carolina-based textile manufacturer, announced an investment of USD 27.4 million. The company used the fund to expand its business operations in Blacksburg. The growing entry of international brands including Asian and European companies in the US will promote higher innovation and development further helping the industry grow.

US Home Textile Market: Challenges

Rising number of counterfeit product sellers impacting brand value will challenge the market expansion rate

The regional industry for home textiles in the US is expected to be challenged by the rising number of counterfeit product sellers. Low-grade home textile items are prone to damage in a few washes. Additionally, they tend to lose texture and color with every wash. The sale of counterfeit products impacts brand value and revenue. In addition to this, the risk of economic slowdown in the US may restrict consumption patterns reducing the demand for home textiles.

US Home Textile Market: Segmentation

The US home textile market is segmented based on material, product type, price range, and region.

Based on the material, the regional market segments are wool, cotton, linen, blends, synthetic, natural fibers, silk, and others. In 2023, the highest growth was observed in the cotton segment. The material is extremely versatile and allows home furnishing makers to experiment with cotton for producing a wide range of products. The most common application of cotton in home textiles includes curtains, towels, bed linens, and others. The United States Department of Agriculture estimates that the US will produce around 16 million bales of cotton in 2024/2025.

Based on product type, the US home textile industry is divided into curtains & drapes, kitchen lines, carpets & floor coverings, bathroom linen, bedroom linen, and others.

Based on the price range, the regional market is divided into economy, mid-range, and luxury. In 2023, the highest growth rate was registered in the mid-range segment. These products offer high-grade products at reasonable prices. Moreover, they have higher durability compared to economy products. A mid-range queen-size bed sheet may cost between USD 50 and USD 200 in the US.

US Home Textile Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | US Home Textile Market |

| Market Size in 2023 | USD 22.97 Billion |

| Market Forecast in 2032 | USD 41.70 Billion |

| Growth Rate | CAGR of 6.10% |

| Number of Pages | 214 |

| Key Companies Covered | Springs Global US, Glen Raven, Trident Group, Welspun USA, Target Corporation, Bed Bath & Beyond, TJX Companies, Shaw Industries, Loftex USA, WestPoint Home, American Textile Company, Gerber Childrenswear, Standard Textile Co., Williams-Sonoma Inc., American Textile Company, Sunham Home Fashions., and others. |

| Segments Covered | By Material, By Product Type, By Price Range, and By Region |

| Regions Covered in U.S. | Northeast, Midwest, South, and West |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

US Home Textile Market: Regional Analysis

East Coast is expected to deliver the highest growth in the US during the projection period

The US home textile market is projected to generate extensive growth in the eastern states. North Carolina will deliver exceptional growth since the region has a rich and thriving textile industry. It is one of the most influential states in the US in terms of textile production. In March 2023, Tex-Tech Industries, a leading North Carolina-based textile manufacturer, announced an investment of USD 24 million for the construction of a new production facility in the Winston-Salem area. In April 2023, Conover-based Manufacturing Solutions Center, a member of the North Carolina Manufacturing Extension Partnership, launched a new facility called Manufacturing Solutions Center II. The company can now expand its production capacity with the technologically advanced facility. Additionally, the US is registering higher investments in the development of new textile manufacturing technology. In October 2023, Gaston College Fiber Innovation Center in North Carolina received a donation worth USD 1.2 million of equipment from Truetzschler. The technology focuses on reducing the carbon footprint of textile and fiber production. Moreover, the regional market is expected to receive higher demand for organic home textile products across residential and commercial settings.

US Home Textile Market: Competitive Analysis

The US home textile market is led by players like:

- Springs Global US

- Glen Raven

- Trident Group

- Welspun USA

- Target Corporation

- Bed Bath & Beyond

- TJX Companies

- Shaw Industries

- Loftex USA

- WestPoint Home

- American Textile Company

- Gerber Childrenswear

- Standard Textile Co.

- Williams-Sonoma Inc.

- American Textile Company

- Sunham Home Fashions.

The US home textile market is segmented as follows:

By Material

- Wool

- Cotton

- Linen

- Blends

- Synthetic

- Natural Fibers

- Silk

- Others

By Product Type

- Curtains & Drapes

- Kitchen Linen

- Carpets & Floor Coverings

- Bathroom Linen

- Bedroom Linen

- Others

By Price Range

- Economy

- Mid-Range

- Luxury

By Region

- The U.S.

Table Of Content

Methodology

FrequentlyAsked Questions

The US home textile industry is a special brand of the regional textile industry dealing with home furnishing.

The US home textile market is expected to grow due to the rising number of homeowners in the country.

According to study, the US home textile market size was worth around USD 22.97 billion in 2023 and is predicted to grow to around USD 41.70 billion by 2032.

The CAGR value of the US home textile market is expected to be around 6.10% during 2024-2032.

The US home textile market is projected to generate extensive growth in the eastern states.

The US home textile market is led by players like Springs Global US, Glen Raven, Trident Group, Welspun USA, Target Corporation, Bed Bath & Beyond, TJX Companies, Shaw Industries, Loftex USA, WestPoint Home, American Textile Company, Gerber Childrenswear, Standard Textile Co., Williams-Sonoma Inc., American Textile Company, and Sunham Home Fashions.

The report explores crucial aspects of the US home textile market including a detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed