U.S. Integrated Delivery Network Market Size Report, Industry Share, Analysis, Growth, 2032

U.S. Integrated Delivery Network Market By Services Type (Long Term Health and Acute Care / Hospital Service), By Integration Model (Vertical and Horizontal), and By Region - Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2023 - 2030

| Market Size in 2022 | Market Forecast in 2030 | CAGR (in %) | Base Year |

|---|---|---|---|

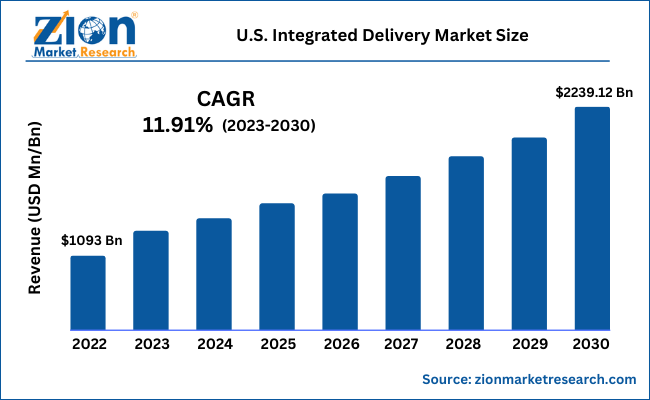

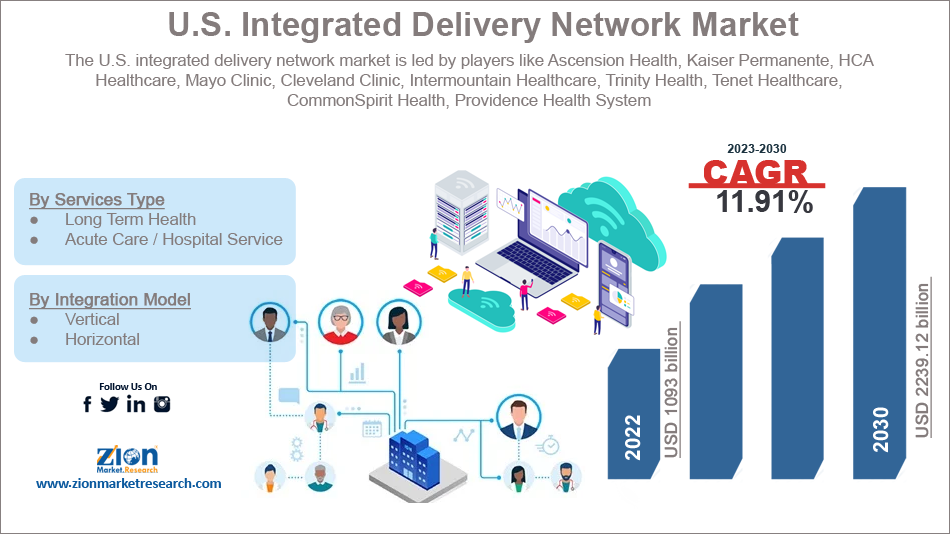

| USD 1093 Billion | USD 2239.12 Billion | 11.91% | 2022 |

Industry Prospective:

The U.S. integrated delivery network market size was worth around USD 1093 Billion in 2022 and is predicted to grow to around USD 2239.12 Billion by 2030 with a compound annual growth rate (CAGR) of roughly 11.91% between 2023 and 2030.

The report analyzes the U.S. integrated delivery network market drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the U.S. integrated delivery network industry.

U.S. Integrated Delivery Market: Overview

In the United States region, an integrated delivery network (IDN) refers to the existence of a collaborative network consisting of healthcare facilities, organizations, and healthcare professionals or providers that work in coherence to deliver effective, coordinated, comprehensive healthcare services to people who require medical care. The system typically includes hospitals, clinics, physician practices, home healthcare agencies, long-term care facilities, and other healthcare entities. The end goal of an IDN system is to ensure that the patients of that region have access to an integrated healthcare system. The stakeholders consistently work toward enhancing the process across providers and settings. It also aims to improve the quality of medical care, patient outcome, and efficiency. The organization and structure of IDN may vary between states and regions but the main goal remains the same throughout.

Key Insights:

- As per the analysis shared by our research analyst, the U.S. integrated delivery network market is estimated to grow annually at a CAGR of around 11.91% over the forecast period (2023-2030)

- In terms of revenue, the U.S. integrated delivery network market size was valued at around USD 1093 billion in 2022 and is projected to reach USD 2239.12 billion, by 2030.

- The U.S. integrated delivery network market is projected to grow at a significant rate due to the rising demand for value-based care

- Based on service type segmentation, acute care / hospital service was predicted to show maximum market share in the year 2022

- Based on model segmentation, vertical was the leading model in 2022

- On the basis of region, Northeastern was the leading revenue generator in 2022

U.S. Integrated Delivery Market: Growth Drivers

Rising demand for value-based care to propel market growth

The U.S. integrated delivery network market is projected to grow owing to the increasing demand for value-based care across the regional states. As patients' awareness rate is rising, there has been a significant shift from the fee-for-service model of the US healthcare infrastructure to value-based care which has assisted in improved investment in IDN architecture of the country.

Such a model focuses on reducing the financial burden of medical care on the patients while also improving patient outcomes. This can be achieved by emphasizing preventive care, care coordination, and population health management.

Over the years, the U.S IDN systems have managed to position themselves allowing them to play a key role in rolling out and implementing such initiatives with providers and payers. The shifting model to ambulatory care also aligns with the industry growth trend.

U.S. Integrated Delivery Market: Restraints

High fragmentation to restrict market expansion

The regional market of IDN is expected to witness restricted growth due to the high fragmentation of the U.S. healthcare system. It involves various stakeholders including hospitals, physicians, payers, and post-acute care providers. All of these responsible parties operate independently and there is a significant lack of effective coordination for the IDN system to reach its true potential. This high fragmentation index can significantly disrupt the seamless integration and coordination of care within IDNs since every unit may have different reimbursement structures, priorities, and information systems.

U.S. Integrated Delivery Market: Opportunities

Growing incidences of chronic diseases to provide several growth opportunities

The U.S. is registering a surge in patients with chronic conditions such as diabetes, cardiovascular conditions, and respiratory disorders. This trend has resulted in the regional healthcare sector facing several challenges.

IDNs are expected to benefit from the range of growth opportunities thus arising by implementing remote monitoring technologies, evidence-based care protocols, and patient education programs. By focusing on preventive strategies and proactive management, IDNs will be in a position to improve outcomes, reduce hospitalizations, and lower healthcare costs.

U.S. Integrated Delivery Market: Challenges

Concerns over cost-efficiency and return on investment to challenge market growth

The U.S. integrated delivery market is projected to come across challenges owing to the growing concerns over cost-efficiency and return on investment (ROI). The establishment of an IDN and operating it effectively required significant investment. Multiple financial resources are required to set up a functional integrated care model which implements advanced technology systems.

Furthermore, the return on investment for the development of care coordination infrastructure should be justified. These factors are likely to impede the regional market growth.

U.S. Integrated Delivery Market: Segmentation

The U.S. integrated delivery network market is segmented based on services type, integration model, and region.

Based on services type, the regional market is segmented as long term health and acute care / hospital service. In 2022, the U.S. integrated delivery network industry was dominated by the acute care / hospital service segment. It led to more than 50.1% of the segmental share. The growth rate was driven by the increasing number of medical services associated with this model.

It includes hospital settings for the diagnosis, treatment, and management of severe or life-threatening illnesses or injuries. They also encompass a range of surgical, medical, and diagnostic interventions that may require specialized care and immediate treatment. By incorporating acute care / hospital services, it becomes possible to reduce fragmentation and promote better care coordination. The segment is expected to grow owing to the rising advancements in medical technologies, diagnostic tools, and treatment modalities.

Based on the integration model, the regional market segments are vertical and horizontal. More than 68.12% of the segmental share was led by the vertical integration model and it involves coordination between organizations that provide different levels of medical care. This model can take up several forms. For instance, integration between hospitals and physicians involves bringing together the involved parties under common ownership or affiliation.

This allows closer collaboration, coordination, and integration of care between hospitals and physicians. Post-acute care integration involves coordination between skilled nursing facilities, rehabilitation centers, and home health agencies. The transition from acute hospital settings to post-acute care becomes easy under this model.

Recent Developments:

- In December 2022, Mckinsey & Company reported that there were several recent trends that pointed toward growing demand for value-based care. The report also claimed that the value-based care market could soon become a USD 1 trillion enterprise. It is emerging as a distinct landscape in the healthcare sector. As per the report, investments toward value-based care quadrupled during the pandemic

- In October 2021, symplr reported that healthcare organizations with different missions and visions are collaborating in the backdrop of surging costs and a rising shift toward value-based care. The entities are joining forces to promote the IDN structure, also known as ‘payviders’. The main goal of the facilities is to improve healthcare safety, quality, and patient outcome

U.S. Integrated Delivery Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | U.S. Integrated Delivery Network Market Research Report |

| Market Size in 2022 | USD 1093 Billion |

| Market Forecast in 2030 | USD 2239.12 Billion |

| Growth Rate | CAGR of 11.91% |

| Number of Pages | 220 |

| Key Companies Covered | Ascension Health, Kaiser Permanente, HCA Healthcare, Mayo Clinic, Cleveland Clinic, Intermountain Healthcare, Trinity Health, Tenet Healthcare, CommonSpirit Health, Providence Health System, University of Pittsburgh Medical Center (UPMC), AdventHealth, Northwell Health, NewYork-Presbyterian Hospital, Advocate Aurora Health, Banner Health, Geisinger Health, Sutter Health, Cedars-Sinai Health System, Baylor Scott & White Health, Bon Secours Mercy Health, Sanford Health, Spectrum Health, Advocate Health Care, and Carolinas HealthCare System (Atrium Health). |

| Segments Covered | By Services Type, By Integration Model, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2022 |

| Historical Year | 2017 to 2021 |

| Forecast Year | 2023 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

U.S. Integrated Delivery Market: Regional Analysis

Northeastern region to provide higher returns

The U.S. integrated delivery market is projected to witness the highest growth in the Northeastern region of the US. It comprises developed states such as New York, Massachusetts, and Pennsylvania. These regions have a presence of robust healthcare systems and academic medical centers. It also boasts of a high concentration of integrated delivery networks which is fueled by early adoption and awareness rate. Furthermore, the existence of densely populated urban regions along with a diverse group of patients with several types of medical conditions contributes to a higher inclination toward IDNs.

In addition to this, the region has been a pioneer in the US area for bringing in revolutionizing health policy initiatives and promoting value-based care and care coordination. Growth in the West region which includes states such as California, Washington, and Oregon may also witness significant growth due to innovative healthcare initiatives and a high degree of market competition.

U.S. Integrated Delivery Market: Competitive Analysis

The U.S. integrated delivery network market is led by players like:

- Ascension Health

- Kaiser Permanente

- HCA Healthcare

- Mayo Clinic

- Cleveland Clinic

- Intermountain Healthcare

- Trinity Health

- Tenet Healthcare

- CommonSpirit Health

- Providence Health System

- University of Pittsburgh Medical Center (UPMC)

- AdventHealth

- Northwell Health

- NewYork-Presbyterian Hospital

- Advocate Aurora Health

- Banner Health

- Geisinger Health

- Sutter Health

- Cedars-Sinai Health System

- Baylor Scott & White Health

- Bon Secours Mercy Health

- Sanford Health

- Spectrum Health

- Advocate Health Care

- Carolinas HealthCare System (Atrium Health).

The U.S. integrated delivery network market is segmented as follows:

By Services Type

- Long Term Health

- Acute Care / Hospital Service

By Integration Model

- Vertical

- Horizontal

By Region

- U.S.

Table Of Content

Methodology

FrequentlyAsked Questions

An integrated delivery network (IDN) refers to the existence of a collaborative network consisting of healthcare facilities, organizations, and healthcare professionals or providers that work in coherence to deliver effective, coordinated, comprehensive healthcare services to people who require medical care.

The U.S. integrated delivery network market is projected to grow owing to the increasing demand for value-based care across the regional states.

According to study, the U.S. integrated delivery network market size was worth around USD 1093 billion in 2022 and is predicted to grow to around USD 2239.12 billion by 2030.

The CAGR value of the U.S. integrated delivery network market is expected to be around 11.91% during 2023-2030.

The U.S. integrated delivery market is projected to witness the highest growth in the Northeastern region of the US.

The U.S. integrated delivery network market is led by players like Ascension Health, Kaiser Permanente, HCA Healthcare, Mayo Clinic, Cleveland Clinic, Intermountain Healthcare, Trinity Health, Tenet Healthcare, CommonSpirit Health, Providence Health System, University of Pittsburgh Medical Center (UPMC), AdventHealth, Northwell Health, NewYork-Presbyterian Hospital, Advocate Aurora Health, Banner Health, Geisinger Health, Sutter Health, Cedars-Sinai Health System, Baylor Scott & White Health, Bon Secours Mercy Health, Sanford Health, Spectrum Health, Advocate Health Care, and Carolinas HealthCare System (Atrium Health).

Choose License Type

List of Contents

Industry Prospective:U.S. Integrated Delivery OverviewKey Insights:U.S. Integrated Delivery Growth DriversU.S. Integrated Delivery RestraintsU.S. Integrated Delivery OpportunitiesU.S. Integrated Delivery ChallengesU.S. Integrated Delivery SegmentationRecent Developments:U.S. Integrated Delivery Report ScopeU.S. Integrated Delivery Regional AnalysisU.S. Integrated Delivery Competitive AnalysisThe U.S. integrated delivery network market is segmented as follows:RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed