U.S. Litigation Funding Investment Market Size, Share, Analysis, Trends, Forecasts, 2032

U.S. Litigation Funding Investment Market By Type (International Litigation, Commercial Litigation, and Bankruptcy Claims), By End-User (BFSI, IT & Telecom, Manufacturing, Healthcare, and Media & Entertainment), and By Region - Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 5 Billion | USD 10 Billion | 9% | 2023 |

U.S. Litigation Funding Investment Industry Prospective:

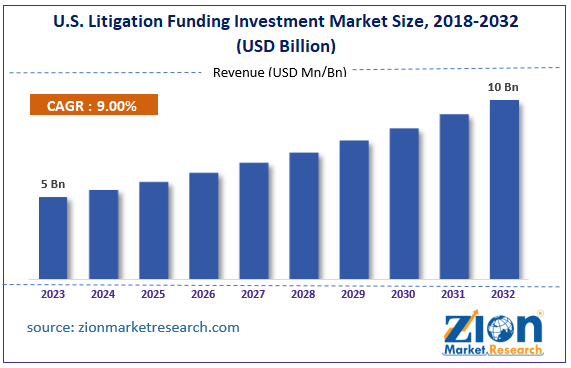

The U.S. litigation funding investment market size was evaluated at $5 billion in 2023 and is slated to hit $10 billion by the end of 2032 with a CAGR of nearly 9% between 2024 and 2032.

U.S. Litigation Funding Investment Market: Overview

Litigation funding is also referred to as third-party funding and has evolved as a notable investment opportunity in the legal space. Furthermore, the fiscal mechanism helps plaintiffs in receiving funds from vendors for covering the costs related to legal claims. Reportedly, vendors will receive the money only if the litigation has a successful outcome.

Key Insights

- As per the analysis shared by our research analyst, the U.S. litigation funding investment market is projected to expand annually at the annual growth rate of around 9% over the forecast timespan (2024-2032)

- In terms of revenue, the U.S. litigation funding investment market size was evaluated at nearly $5 billion in 2023 and is expected to reach $10 billion by 2032.

- The global U.S. litigation funding investment market is anticipated to grow rapidly over the forecast timeline owing to surging demand for litigation investment along with the need for alternative financing.

- In terms of type, the commercial litigation segment is slated to register the highest CAGR over the forecast period.

- Based on end-user, the BFSI segment is predicted to contribute majorly towards the U.S. industry revenue in the upcoming years.

- Region-wise, the Northeastern litigation funding investment industry is projected to register the fastest CAGR during the projected timespan.

Request Free Sample

Request Free Sample

U.S. Litigation Funding Investment Market: Growth Factors

Growing use of litigation funding to boost the market trends in the U.S. by 2032

Surging demand for litigation investment, along with the need for alternative financing, is predicted to boost the growth of the U.S. litigation funding investment market. An escalating need for legal costs in commercial disputes will account majorly towards the market surge in the U.S. An increase in the adoption of litigation funding and a rise in the need for funds for law firms will proliferate the growth of the market in the country. A prominent increment in legal complications and changing economic trends will prompt the growth of the market in the U.S. Technological integration and introduction of new systems such as analytics and AI, along with risk assessment & case evaluation, will prompt the growth of the market in the country.

U.S. Litigation Funding Investment Market: Restraints

A rising operating charges and stringent laws governing litigation investments can restrict the industry surge in the U.S.

A surge in the operational costs and complications witnessed in the legal proceedings can complicate litigation investments, thereby retarding the growth of the U.S. litigation funding investment industry. Reportedly, legal actions in the near future can impose strict laws on litigation funding, thereby further restraining the growth of the industry in the country.

U.S. Litigation Funding Investment Market: Opportunities

Growing ROI in litigation funding can open new growth avenues for the market in the U.S. over 2024-2032

Necessity of diversifying investment portfolios along with high returns on investment with managed risks will prop up the expansion of the U.S. litigation funding investment market. Furthermore, the escalating need for legal finance and demand for regulatory clarity will propel the growth of the market in the country.

U.S. Litigation Funding Investment Market: Challenges

A surge in diligence costs in the upcoming years can challenge the industry's growth in the U.S.

Growing risks of losing litigations can deter third parties from funding the litigation cases in the U.S., thereby hindering the elevation of the U.S. litigation funding investment industry. An increment in the diligence charges and operational challenges can prove to be a huge threat to the industry expansion in the country.

U.S. Litigation Funding Investment Market: Segmentation

The U.S. litigation funding investment market is divided into type, end-user, and region.

In terms of type, the U.S. litigation funding investment market across the globe is bifurcated into international litigation, commercial litigation, and bankruptcy claim segments. Additionally, the commercial litigation segment, which gained approximately 75% of the market earnings in 2023, is expected to register the highest gains during the timeline from 2024 to 2032, owing to a surge in the need for funding commercial litigation. Apart from this, a rise in business disputes has attracted various kinds of investors, thereby contributing notably towards segmental growth.

Based on the end-user, the U.S. litigation funding investment industry is divided into BFSI, IT & telecom, manufacturing, healthcare, and media & entertainment segments. Additionally, the BFSI segment, which accrued about one-third of the industry revenue in 2023, is set to make large-scale contributions toward the industry share in the U.S. during the forecast period owing to a rise in investment in complex financial conflicts, insurance-associated claims, and regulatory challenges.

U.S. Litigation Funding Investment Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | U.S. Litigation Funding Investment Market |

| Market Size in 2023 | USD 5 Billion |

| Market Forecast in 2032 | USD 10 Billion |

| Growth Rate | CAGR of 9% |

| Number of Pages | 227 |

| Key Companies Covered | Lake Whillans Capital Partners, Augusta Ventures Ltd, Burford Capital, Longford Capital Management, Gerchen Keller Capital LLC, Curiam Capital LLC, Calunius Capital LLP, Redress Solutions, Juridica Investments Limited, IM Litigation Funding, Bentham IMF, Parabellum Capital LLC, Omni Bridgeway, Legis Finance, Therium Capital Management., and others. |

| Segments Covered | By Type, By End-User, and By Region |

| Regions Covered in U.S. | Northeast, Midwest, South, and West |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

U.S. Litigation Funding Investment Market: Regional Insights

Western region of the U.S. to establish a leadership position in the market over forecast timeline

Western region, which accounted for three-fourths of the U.S. litigation funding investment market share in 2023, is expected to establish a key position in the U.S. market in the upcoming years. In addition to this, the regional market surge in the forecast time-interval can be credited to high-profile litigations in states such as California in the western region of the U.S. Furthermore, the presence of key corporate firms in the western region of the U.S. will propel the growth of the market in the region. Presence of a strong legal ecosystem in the western states of the U.S. will foster the growth of the regional market.

Northeastern litigation funding investment industry is predicted to register the highest growth rate annually in the next few years. The growth of the industry in the region can be due to Northeastern region being home to financial and legal centers along with complex commercial disputes in the region. High legal costs will further drive the regional industry trends.

Key Developments

- In June 2024, Arcadia Finance, a New York-based new litigation finance company, introduced US$100 million capital funds for litigation. Such moves will boost the growth of the litigation funding investment market in the U.S.

U.S. Litigation Funding Investment Market: Competitive Space

The U.S. litigation funding investment market profiles key players such as:

- Lake Whillans Capital Partners

- Augusta Ventures Ltd

- Burford Capital

- Longford Capital Management

- Gerchen Keller Capital LLC

- Curiam Capital LLC

- Calunius Capital LLP

- Redress Solutions

- Juridica Investments Limited

- IM Litigation Funding

- Bentham IMF

- Parabellum Capital LLC

- Omni Bridgeway

- Legis Finance

- Therium Capital Management.

The U.S. litigation funding investment market is segmented as follows:

By Type

- International Litigation

- Commercial Litigation

- Bankruptcy Claim

By End-User

- BFSI

- IT & Telecom

- Manufacturing

- Healthcare

- Media & Entertainment

By Region

The U.S.

- Northeast

- Midwest

- South

- West

Table Of Content

Methodology

FrequentlyAsked Questions

Litigation funding is also referred to as third-party funding and has evolved as a notable investment opportunity in the legal space.

The global U.S. litigation funding investment market growth over the forecast period can be owing to a prominent increment in legal complications and changing economic trends.

According to a study, the global U.S. litigation funding investment industry size was $5 billion in 2023 and is projected to reach $10 billion by the end of 2032.

The global U.S. litigation funding investment market is anticipated to record a CAGR of nearly 9% from 2024 to 2032.

Northeastern litigation funding investment industry is set to register the fastest CAGR over the forecasting timeline owing to large-scale focus on animal welfare in the region. Apart from this, the region consists of a large proportion of pet owners. For instance, nearly 67% of the U.S. households have pets and a large number among them look for new medical services for their pets.

The U.S. Litigation Funding Investment market is led by players such as Lake Whillans Capital Partners, Augusta Ventures Ltd, Burford Capital, Longford Capital Management, Gerchen Keller Capital LLC, Curiam Capital LLC, Calunius Capital LLP, Redress Solutions, Juridica Investments Limited, IM Litigation Funding, Bentham IMF, Parabellum Capital LLC, Omni Bridgeway, Legis Finance, and Therium Capital Management.

The U.S. litigation funding investment market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTEL analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five force analysis, and value chain analysis.

Choose License Type

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed