US Online Gambling & Betting Market Size, Share, Analysis, Trends, Growth, Forecasts, 2032

US Online Gambling & Betting Market By Device (Mobile, Desktop, and Others), By Type (Online Poker & Casinos, Sports Betting, Online Lottery, Daily Fantasy Sports (DFS), and Horse Racing Betting), and By Region - Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032-

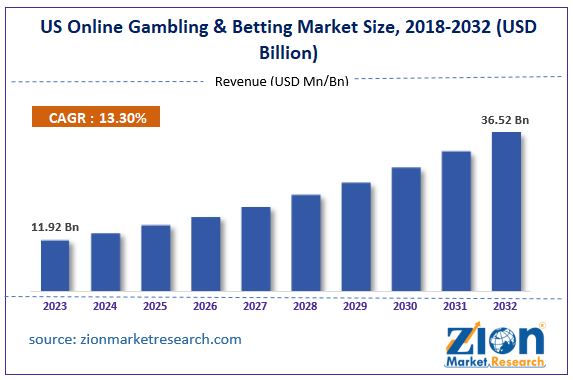

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 11.92 Billion | USD 36.52 Billion | 13.30% | 2023 |

US Online Gambling & Betting Industry Prospective:

The US online gambling & betting market size was worth around USD 11.92 billion in 2023 and is predicted to grow to around USD 36.52 billion by 2032 with a compound annual growth rate (CAGR) of roughly 13.30% between 2024 and 2032.

US Online Gambling & Betting Market: Overview

The US gambling & betting industry is a growing sector focused on user engagement and entertainment. It refers to any form of gambling or betting that is carried out through digital mediums such as smartphones, tablets, and laptops. According to market research, one of the most popular forms of online gambling is games related to digital casinos. In the majority of cases, participants involved in online gambling or betting in the US operate with real money. However, the number of applications offering gambling or betting using other modes of currency is rising steadily. For instance, certain online gambling or betting platforms in the US allow exchange in the form of cryptocurrencies. The US online gambling & betting industry is mostly regulated by state laws. However, specific types of digital gambling or betting are regulated by federal agencies. The regional industry is governed by strict but evolving policies. The growing launch of advanced online gambling and betting applications is expected to create more growth opportunities. However, the existence of policies that complicate the process of payment collection may limit the market’s expansion rate.

Key Insights:

- As per the analysis shared by our research analyst, the US online gambling & betting market is estimated to grow annually at a CAGR of around 13.30% over the forecast period (2024-2032)

- In terms of revenue, the US online gambling & betting market size was valued at around USD 11.92 billion in 2023 and is projected to reach USD 36.52 billion by 2032.

- The US online gambling & betting market is projected to grow at a significant rate due to the increased access to consumer electronics and the Internet

- Based on the device, the mobile segment is growing at a high rate and will continue to dominate the regional market as per industry projection

- Based on the type, the sports betting segment is anticipated to command the largest market share

- Based on region, the Northeastern states of the US are projected to dominate the regional market during the forecast period

Request Free Sample

Request Free Sample

US Online Gambling & Betting Market: Growth Drivers

Increased access to consumer electronics and the Internet will drive the market demand rate

The US online gambling & betting market is expected to be driven by higher access to consumer electronics within the region. The US is one of the highly developed nations in the current world order. The spending capacity of an average US citizen is several times higher than that of people from emerging nations. In addition to this, access to basic consumer electronics such as smartphones is extremely simple. Most network providers in the company provide financial assistance for the purchase of smartphones at a minimal down payment and equated monthly installment (EMI). In addition, the growing investment in upgrading network infrastructure in the country will play a crucial role in generating revenue in the online gambling or betting sectors. According to the Cellular Telecommunications and Internet Association, the regional wireless providers invested nearly USD 39 billion in 2022 for building a 5G ecosystem in the country. According to Ericsson, the country is expected to have more than 195 million 5 subscribers by the end of 2026.

Growing legalization and clearer framework regarding online gambling & betting will promote an expansion rate

The US state and federal government is taking several steps to draft clearer frameworks surrounding digital betting and gambling. Once the industry regulations become transparent, more people will be encouraged to participate in digital betting or gambling. For instance, in 2024, North Carolina became the latest state to legalize online sports betting. The Unlawful Internet Gambling Enforcement Act (UIGEA) has allowed the regional players to collect only lawfully allowed payments. Thus creating a more safe space for participants in online betting and gambling. The surge in awareness programs run by government and regional welfare agencies to protect players’ welfare has also been crucial to the regional industry. In March 2024, Washington announced a new federal regulation with the guidance of three Northeastern University advisers. The new law is called the SAFE Bet Act and aims to prevent players in the US online gambling and betting from harm caused by any form of gambling.

US Online Gambling & Betting Market: Restraints

Severe repercussions of online betting or gambling limit the industry’s growth rate

The US industry for online gambling & betting is expected to be restricted due to severe repercussions of participating in such events. In a recent research conducted at California University, researchers concluded that the risk of filing bankruptcy increased by 30% in the case of online gambling. A report published by Harvard Health in 2023 concluded that at least 1% of adults in the US have severe gambling addictions and problems. Irresponsible online gambling or betting can lead to severe monetary losses and impact the social lives of the people involved.

US Online Gambling & Betting Market: Opportunities

Increasing launch of new online portals for betting and gambling will generate more growth opportunities

The US online gambling & betting market is expected to generate more growth opportunities in the coming years due to the rising number of portals facilitating the events. In August 2023, ESPN announced that it would soon launch a new digital gambling portal called ESPN BET. The fans of the website could use the portal to engage in sports betting digitally. The launch worth USD 2 billion was a result of a partnership between Penn Entertainment, a sports betting giant, and the news broadcaster. In January 2024, Miami-based Betr Holdings, Inc. announced its plan for future expansion. The company launched new market access deals for online casinos and sportsbooks in Pennsylvania. It also launched deals for online sportsbooks in Kentucky and Colorado. The company has made several other moves to achieve higher revenue. Market players are actively investing in leveraging the offerings of Artificial Intelligence (AI) to deliver a more engaging user experience. AI can assist in delivering more customized and secure platforms for online gamblers and betting participants. It can also help companies detect fraud or any illegal activity through the portal.

US Online Gambling & Betting Market: Challenges

Evolving market regulations is a major challenge for the industry players

The US online gambling & betting industry is challenged by the evolving characteristics of the regional market. The US laws and regulations governing digital gambling or betting change from one state to another. While the region has specific Federal laws regulating the industry, the final authorization on legalization and laws related to digital gambling or betting lies with the state officials. Complying with changing rules is difficult for companies, and non-compliance can lead to serious penalties.

US Online Gambling & Betting Market: Segmentation

The US online gambling & betting market is segmented based on device, type, and region.

Based on the device, the regional market segments are mobile, desktop, and others. In 2023, the highest growth was observed in the mobile segment. Smartphones allow participants to indulge in online gambling or betting activities from any location. Additionally, the market players have launched several mobile-based applications to tap into a broader consumer group. Higher access to technologically advanced smartphones and faster internet is driving the segmental demand. Market study suggests that more than 150 million people in the US use iPhones, whereas more than 90.01% of US citizens own a smartphone.

Based on the type, the regional market is divided into online poker & casinos, sports betting, online lottery, daily fantasy sports (DFS), and horse racing betting. In 2023, the highest demand was observed in the sports betting segment. The segmental revenue is a result of sector-friendly state and federal regulations. Additionally, access to online sportsbooks is easier as compared to other forms of online gambling. According to market research, over 20.01% of online gamblers in the country are over the age of 18 years.

US Online Gambling & Betting Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | US Online Gambling & Betting Market |

| Market Size in 2023 | USD 11.92 Billion |

| Market Forecast in 2032 | USD 36.52 Billion |

| Growth Rate | CAGR of 13.30% |

| Number of Pages | 231 |

| Key Companies Covered | BetRivers (Rush Street Interactive), DraftKings, Golden Nugget Online Gaming, Betway, Bally Bet, Caesars Entertainment, Hard Rock Digital, BetMGM, Unibet (Kindred Group), Penn Entertainment (Barstool Sportsbook), 888 Holdings, FanDuel, Fox Bet, PointsBet, WynnBET., and others. |

| Segments Covered | By Device, By Type, and By Region |

| Regions Covered in U.S. | Northeast, Midwest, South, and West |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

US Online Gambling & Betting Market: Regional Analysis

Northeastern states will deliver the highest results during the projection period

The US online gambling & betting market will be led by prominent Northeastern states. The regions include New York, Pennsylvania, and New Jersey. Over the years, one of the leading states in terms of dominance over online betting or gambling has been New Jersey. The state law for online betting or gambling in New Jersey is comprehensive. It is regulated under the New Jersey Casino Control Act. Pennsylvania, on the other hand, offers several online sportsbooks for participants. It is also dominated by strong regulatory guidelines.

New York is one of the states that have recently legalized online sports betting. In July 2024, official reports suggested that the region of Georgia was actively working on leveraging the potential of online sports wagering in the region. The increasing investments by gambling and betting companies to launch user-friendly applications will fuel regional market demand in the coming years. For instance, Arizona witnessed the launch of online sports betting in 2021 and since then has registered steady growth over the years. In 2024, Fanatics Sportsbook and bet365 expanded in the region.

US Online Gambling & Betting Market: Competitive Analysis

The US online gambling & betting market is led by players like:

- BetRivers (Rush Street Interactive)

- DraftKings

- Golden Nugget Online Gaming

- Betway

- Bally Bet

- Caesars Entertainment

- Hard Rock Digital

- BetMGM

- Unibet (Kindred Group)

- Penn Entertainment (Barstool Sportsbook)

- 888 Holdings

- FanDuel

- Fox Bet

- PointsBet

- WynnBET.

The US online gambling & betting market is segmented as follows:

By Device

- Mobile

- Desktop

- Others

By Type

- Online Poker & Casinos

- Sports Betting

- Online Lottery

- Daily Fantasy Sports (DFS)

- Horse Racing Betting

By Region

- The U.S.

Table Of Content

Methodology

FrequentlyAsked Questions

The US gambling & betting industry is a growing sector focused on user engagement and entertainment.

The US online gambling & betting market is expected to be driven by higher access to consumer electronics within the region.

According to study, the US online gambling & betting market size was worth around USD 11.92 billion in 2023 and is predicted to grow to around USD 36.52 billion by 2032.

The CAGR value of the US online gambling & betting market is expected to be around 13.30% during 2024-2032.

The US online gambling & betting market will be led by prominent Northeastern states.

The US online gambling & betting market is led by players like BetRivers (Rush Street Interactive), DraftKings, Golden Nugget Online Gaming, Betway, Bally Bet, Caesars Entertainment, Hard Rock Digital, BetMGM, Unibet (Kindred Group), Penn Entertainment (Barstool Sportsbook), 888 Holdings, FanDuel, Fox Bet, PointsBet and WynnBET.

The report explores crucial aspects of the US online gambling & betting market including a detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

Choose License Type

List of Contents

US Online Gambling BettingIndustry Prospective:US Online Gambling Betting OverviewKey Insights:US Online Gambling Betting Growth DriversUS Online Gambling Betting RestraintsUS Online Gambling Betting OpportunitiesUS Online Gambling Betting ChallengesUS Online Gambling Betting SegmentationUS Online Gambling Betting Report ScopeUS Online Gambling Betting Regional AnalysisUS Online Gambling Betting Competitive AnalysisThe US online gambling betting market is segmented as follows:HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed