US Pet Market Size, Share, Trends, Growth 2032

US Pet Market By Pet Type (Dog, Cat, Bird, and Others), By Product Type (Food, Medicine, and Others), By Sales Channel (Supermarket, Hypermarket, Specialty Store, and Online Retail Stores), and By Country-State Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

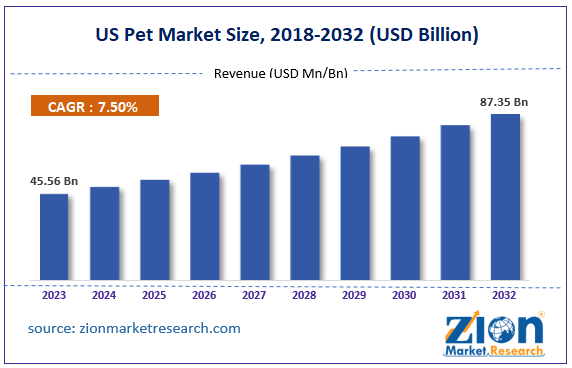

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 45.56 Billion | USD 87.35 Billion | 7.5% | 2023 |

US Pet Industry Prospective:

The US pet market size was worth around USD 45.56 billion in 2023 and is predicted to grow to around USD 87.35 million by 2032 with a compound annual growth rate (CAGR) of roughly 7.5% between 2024 and 2032.

US Pet Market: Overview

A domesticated animal is kept for companionship or enjoyment, such as a dog, cat, bird, or fish. Pet owners provide their animals love, food, and shelter; many times, these animals are considered family members. Any business or activity that deals with the care, comfort, and company of animals is referred to as the "pet industry". This covers the manufacturing and distribution of pet medical supplies, toys, snacks, food, accessories, and grooming products. The US pet market is undergoing a revolution because of several innovations that reflect shifting customer tastes and cultural shifts.

Key Insights

- As per the analysis shared by our research analyst, the US Pet market is estimated to grow annually at a CAGR of around 7.5% over the forecast period (2024-2032).

- In terms of revenue, the US Pet market size was valued at around USD 45.56 billion in 2023 and is projected to reach USD 87.35 million, by 2032.

- The increasing pet ownership is expected to propel the US pet market growth over the projected period.

- Based on the pet type, the dog segment is expected to dominate the market over the forecast period.

- Based on the product type, the food segment is expected to hold a prominent market share over the forecast period.

- Based on the sales channel, the online retail stores segment is expected to grow at a rapid rate during the forecast period.

- Based on the state, California is expected to dominate the market over the projected period.

Request Free Sample

Request Free Sample

US Pet Market: Growth Drivers

Pet humanization and the trend toward premiumization drive market growth

The growing humanization of pets—the practice of pet owners treating their animals like family members—is the primary driver of the pet industry in the United States. Demand for high-end, premium pet foods is rising as pet owners understand how crucial it is to provide their animals with nutritious meals that closely resemble their eating habits. Diets that prioritize natural, organic, and non-GMO products, for instance, increase sales of these goods. Pet foods made to satisfy specific dietary requirements, like diets high in protein, free of grains, or free of gluten, are increasingly gaining popularity. The premiumization trend is having an impact on packaging, which includes favoring eco-friendly goods or creating unique packaging that enhances the whole pet care experience.

US Pet Market: Restraints

The high cost of pet foods impedes market growth

The US pet industry may suffer from the high cost of food in several ways. Growing food prices have a direct impact on consumers' discretionary spending, which includes pet budgets. Pet owners who are having financial difficulties due to the high cost of human food may put essential supplies ahead of upscale pet food or other expenses associated with caring for their pets. As a result, they might decide to buy less expensive pet food or spend less overall on pet care, which would reduce the demand for pet-related goods and services. Additionally, as rising food costs influence pet ownership inclinations, they indirectly damage the pet sector.

US Pet Market: Opportunities

The growing e-commerce industry offers a lucrative opportunity for market growth

The COVID-19 epidemic has sped up the growth of internet buying, which has become a major factor in the US pet industry. The increasing ease and convenience of online shopping by consumers has increased the potential for pet food sales via digital channels. It makes it simple for pet owners to investigate product ingredients, compare costs, read reviews, and have their favorite pet food delivered straight to their homes. Auto-renewal options are frequently available to guarantee a steady supply of food. The proliferation of direct-to-consumer pet food firms has been made possible by the digital revolution, offering customers an increased selection of products. The US pet industry is expanding as a result of the combination of these factors, which has increased online sales of pet products.

US Pet Market: Challenges

Concerns related to the environment and health pose a major challenge to market expansion

The environmental impact of the pet industry, especially the production of pet food, is under investigation. Sustainability and carbon footprint worries could result in greater regulations or pressure on businesses to use greener practices. Furthermore, a constraining element may be the development of human allergies and health issues connected to pets. Allergies may prevent some people from owning pets, which would lower the pool of potential customers. Thus, the concern related to the environment and health is expected to pose a major challenge for the US pet market expansion.

US Pet Market: Segmentation

The US Pet industry is segmented based on pet type, product type, sales channel, and state.

Based on the pet type, the US Pet market is bifurcated into dog, cat, bird, and others. The dog segment is expected to dominate the market over the forecast period. Dogs are an important driver behind the US pet market because of their popularity and status as cherished companions. As the most popular pet choice in the country, dogs have a range of implications on consumer spending. Because dog owners prioritize their pets' health, there is a need for premium food, medical supplies, grooming services, and accessories. The different needs of different dog breeds, which vary from specific diets and healthcare to bespoke accessories and training equipment, also help the pet industry. The pet sector is also growing as a result of rising awareness of canine health and nutrition, which increases demand for high-end and organic dog products. Consequently, the enduring bond between humans and dogs keeps spurring innovation and industry growth.

Based on the product type, the US Pet industry is segmented into food, medicine, and others. The food segment is expected to hold a prominent market share over the forecast period. Pet food products that are high-end and specialized are in high demand. This includes grain-free, organic, natural, and human-grade options. When it comes to premium food that they believe is safer and healthier for their pets, pet owners are willing to pay a premium for it. Additionally, as pet owners become more concerned about their pets' health, there is a growing need for functional pet diets that provide health advantages including joint support, weight management, or skin and coat care. Supplement and specialist diet sales have surged as a result of this health-conscious culture. Moreover, the ease of shopping via the Internet has greatly aided in the expansion of the pet food industry. Pet food subscription services are among the many products available on e-commerce platforms, and their availability has increased sales.

Based on the sales channel, the US Pet market is segmented into supermarket, hypermarket, specialty stores, and online retail stores. The online retail stores segment is expected to grow at a rapid rate during the forecast period. Compared to physical locations, online retailers frequently provide a broader selection of goods, including specialty and niche items like organic, natural, and prescription pet meals. This range accommodates a wide range of customer requirements and tastes. Additionally, pet owners may purchase from the comfort of their homes with a wide range of products available from online retailers that might not be found in physical stores. Those in rural locations and busy consumers find this accessibility especially enticing.

US Pet Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | US Pet Market |

| Market Size in 2023 | USD 45.56 Billion |

| Market Forecast in 2032 | USD 87.35 Billion |

| Growth Rate | CAGR of 7.5% |

| Number of Pages | 221 |

| Key Companies Covered | Blue Buffalo, Mars Petcare Inc., Nestlé Purina PetCare, Petco Health and Wellness Company Inc., M. Smucker Company, Hill’s Pet Nutrition, Champion Petfoods, Central Garden & Pet Company, PetSmart Inc., Spectrum Brands Holdings Inc., Chewy Inc., Colgate Palmolive, Zoetis Inc., Pet Valu Inc., Freshpet Inc., Pet Supplies Plus, Nutro Company, Boehringer Ingelheim Animal Health USA Inc., Petland Inc., WellPet LLC, and others. |

| Segments Covered | By Pet Type, By Product Type, By Sales Channel, and By Region |

| States Covered in US | California, Florida, New York, Washington, Texas, New Jersey, Georgia, Oregon, Arizona, and Colorado |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

US Pet Market: State Analysis

California is expected to dominate the market over the forecast period

California is expected to dominate the US pet market over the forecast period. The revenue growth of the market in the state is attributed to the rising pet ownership. This adds to the high demand for food, grooming, veterinary care, and accessories for pets, among other goods and services. Furthermore, there is a great demand for natural and organic pet foods as well as wellness items like vitamins and specialty diets because the state places a significant emphasis on health and wellness. California's health-conscious customers are eager to spend money on premium pet supplies, which is fueling the state's expansion in the US pet market.

US Pet Market: Competitive Analysis

The US Pet market is dominated by players like:

- Blue Buffalo

- Mars Petcare Inc.

- Nestlé Purina PetCare

- Petco Health and Wellness Company Inc.

- M. Smucker Company

- Hill’s Pet Nutrition

- Champion Petfoods

- Central Garden & Pet Company

- PetSmart Inc.

- Spectrum Brands Holdings Inc.

- Chewy Inc.

- Colgate Palmolive

- Zoetis Inc.

- Pet Valu Inc.

- Freshpet Inc.

- Pet Supplies Plus

- Nutro Company

- Boehringer Ingelheim Animal Health USA Inc.

- Petland Inc.

- WellPet LLC

The US Pet market is segmented as follows:

By Pet Type

- Dog

- Cat

- Bird

- Others

By Product Type

- Food

- Medicine

- Others

By Sales Channel

- Supermarket

- Hypermarket

- Specialty Store

- Online Retail Stores

By State

- California

- Florida

- New York

- Washington

- Texas

- New Jersey

- Georgia

- Oregon

- Arizona

- Colorado

- Others

Table Of Content

Methodology

FrequentlyAsked Questions

A domesticated animal is kept for companionship or enjoyment, such as a dog, cat, bird, or fish. Pet owners provide their animals love, food, and shelter; many times, these animals are considered members of the family. Any business or activity that deals with the care, comfort, and company of animals is referred to as the "pet industry". This covers the manufacturing and distribution of pet medical supplies, toys, snacks, food, accessories, and grooming products. The US pet market is undergoing a revolution because of several innovations that reflect shifting customer tastes and cultural shifts.

The US pet sector is expanding due to several causes, such as rising disposable incomes, the humanization of pets, an increase in pet ownership, and more knowledge of pet nutrition and health. The move toward high-end and organic pet food items also helps to expand the industry.

According to the report, the US Pet market size was worth around USD 45.56 billion in 2023 and is predicted to grow to around USD 87.35 million by 2032.

The US Pet market is expected to grow at a CAGR of 7.5% during the forecast period.

US Pet market growth is driven by California. It is currently the nation's highest revenue-generating market due to the increasing pet ownership.

The US Pet market is dominated by players like Blue Buffalo, Mars Petcare Inc., Nestlé Purina PetCare, Petco Health and Wellness Company Inc., M. Smucker Company, Hill’s Pet Nutrition, Champion Petfoods, Central Garden & Pet Company, PetSmart Inc., Spectrum Brands Holdings Inc., Chewy Inc., Colgate Palmolive, Zoetis Inc., Pet Valu Inc., Freshpet Inc., Pet Supplies Plus, Nutro Company, Boehringer Ingelheim Animal Health USA Inc., Petland Inc., and WellPet LLC among others.

The US Pet market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed