Usage-Based Insurance Market Size, Share, Trends, Growth 2032

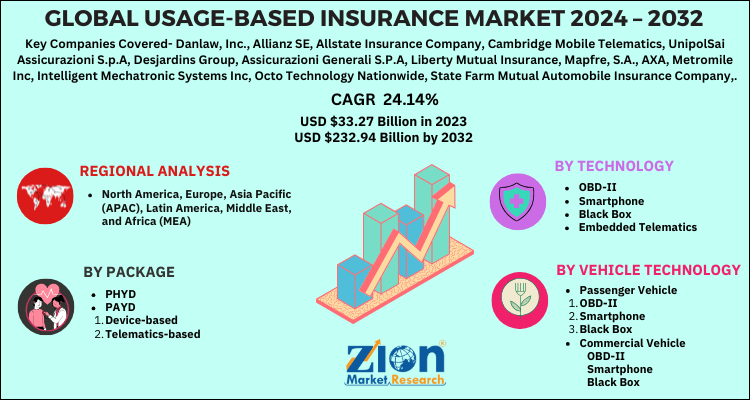

Usage-Based Insurance Market By Technology (Blackbox, Smartphone, Embedded Telematics, and OBD-II), By Package (Pay-How-You-Drive (PHYD) and Pay-As-You-Drive (PAYD) [Telematics-Based and Device-Based]), By Vehicle Technology (Commercial Vehicle and Passenger Vehicle), and By Region - Global Industry Perspective, Comprehensive Analysis, and Forecast, 2024 - 2032

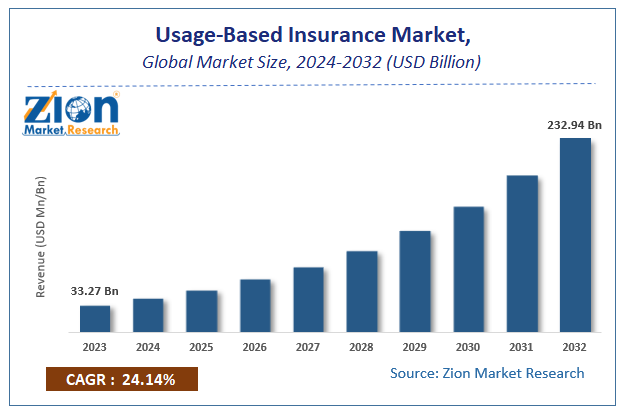

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 33.27 Billion | USD 232.94 Billion | 24.14% | 2023 |

Usage-Based Insurance Market Insights

According to a report from Zion Market Research, the global Usage-Based Insurance Market was valued at USD 33.27 Billion in 2023 and is projected to hit USD 232.94 Billion by 2032, with a compound annual growth rate (CAGR) of 24.14% during the forecast period 2024-2032.

This report explores market strengths, weakness, opportunities, and threats. It also provides valuable insights into the market's growth drivers, challenges, and the future prospects that may emerge in the Usage-Based Insurance industry over the next decade.

The report offers valuation and analysis of the usage-based insurance market on a global as well as regional level. The study offers a comprehensive assessment of the industry competition, limitations, sales estimates, avenues, current & emerging trends, and industry-validated market data. The report offers historical data from 2016 to 2018 along with a forecast from 2019 to 2025 based on value (USD Billion).

Usage-Based Insurance Market: Overview

Usage-based insurance offers insurance coverage depending on the total miles a customer covers in a drive along with other driving variables including site, speed, and behavior of the driver. Moreover, UBI depends on telematics instruments for collating automotive-operating information which the insurers or insurance firms can evaluate for determining the charges of insurance policies accurately, examining claims, and restructure collisions for analyzing.

Usage-Based Insurance Market: Growth Drivers

The usage-based insurance industry is impacted due to an array of factors. Let us discuss a few of them. Connected vehicles such as connected cars have the ability to connect to usage-based insurance systems as well as drivers via smartphones, music players, and other wireless systems in possession of drivers. This will add substantially towards the growth of the usage-based insurance market in the near future.

Smartphone Packages have played a crucial role in the usage-based insurance (UBI) business landscape with drivers eager to access reports pertaining to their driving behaviour & consoles through real-time feedback. Apart from this, a transformation from UBI 1.0 to UBI 3.0 has also witnessed a paradigm shift through mobile data integration with OBDII technology. This is likely to enhance the experience of the drivers along with promoting safe driving, thereby enhancing the market progression over the coming years.

Usage-based insurance has surpassed the boundaries of the conventional insurance model along with the facilitation of driver interaction with the insurer. Through enabling of automotive insurers offering personalized touch points with policy owners, strong customer relationship between vehicle insurers & policy owners is developed. This factor has made notably influenced the growth of the usage-based insurance industry. It has become a need of an hour to set up uniform interoperability standards across various platforms offering telematics access. Moreover, owners such as insurers as well as technology & service providers are required to set up & adhere to these standards. This will not only encompass data standards but also standards for embedded electronic & mechanical features. This will further drive the expansion of the usage-based insurance market over the forecast period.

Insurers are unfurling new opportunities for accruing profits from connected-car ecosystems. A strong connected car ecosystem involved an array of participants like vehicle manufacturers, telecom firms, insurance firms, digital platform behemoths like Amazon & Uber, and sensor & chip manufacturers. Moreover, the emergence of the ecosystem is transforming the competitive scenario for the players across the usage-based insurance sector. Furthermore, the advent of predictive modeling or AI technology has facilitated the real-time data streaming from the connected vehicles and this will alter the structure of the usage-based insurance industry along with facilitating its ascension to new growth horizons.

Some of the major industry players were early accepters of the connectivity tools and derived the benefits of being the first movers in the usage-based insurance industry. For instance, in 2008, Progressive Casualty Insurance Company, a key industry participant, had launched Snapshot – a usage-based insurance program – that offered nearly 30% discount to the drivers based on when & how well they drive their cars. Reportedly, over 3 million persons had signed for the service. Furthermore, car telematics can enhance road safety, play a key role in enhancing driving behavior, and assign insurance premiums through usage-based insurance, thereby enlarging the scope of the car insurance industry. Car telematics also helps in gathering data from automobiles & drivers and transfer them across WANs (wide area networks). This data will help in improving the claim-processing efficiency, influencing the driving behaviour, and reduce the insurer losses. This will prompt the growth of the usage-based insurance market over the forecast period.

Usage-Based Insurance Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Usage-Based Insurance Market |

| Market Size in 2023 | USD 33.27 Billion |

| Market Forecast in 2032 | USD 232.94 Billion |

| Growth Rate | CAGR of 24.14% |

| Number of Pages | 110 |

| Key Companies Covered | Danlaw, Inc., Allianz SE, Allstate Insurance Company, Cambridge Mobile Telematics, UnipolSai Assicurazioni S.p.A, Desjardins Group, Assicurazioni Generali S.P.A, Liberty Mutual Insurance, Mapfre, S.A., AXA, Metromile Inc, Intelligent Mechatronic Systems Inc, Octo Technology Nationwide, State Farm Mutual Automobile Insurance Company, Insure The Box Limited, Progressive Casualty Insurance Company, TomTom International BV, Sierra Wireless, Zubie, Inc., and Vodafone Automotive S.p.A |

| Segments Covered | By Technology, By Package, By Vehicle Technology And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Usage-Based Insurance Market: Regional Analysis

In the rapidly changing landscape & scenario of the usage-based insurance industry, the passenger vehicle segment is predicted to witness huge growth along with majorly influencing the business growth over 2019-2025. The growth is attributed to a rise in the acceptance of OBD equipment and Blackbox in the passenger cars for checking the vehicle health, distance covered, and driving traits of drivers. Latin America And The Middle East & Africa Combined To Soar Overall Market Growth By 2025. The growth of the markets in these regions over the forecast timeline is attributed to large-scale introduction of insurance telematics schemes in countries like Brazil, South Africa, and Argentina.

Usage-Based Insurance Market: Competitive Analysis

The usage-based insurance market is led by players like:

- Danlaw, Inc

- Allianz SE

- Allstate Insurance Company

- Cambridge Mobile Telematics

- UnipolSai Assicurazioni S.p.A

- Desjardins Group

- Assicurazioni Generali S.P.A

- Liberty Mutual Insurance

- Mapfre

- S.A.

- AXA

- Metromile Inc

- Intelligent Mechatronic Systems Inc

- Octo Technology Nationwide

- State Farm Mutual Automobile Insurance Company

- Insure The Box Limited

- Progressive Casualty Insurance Company

- TomTom International BV

- Sierra Wireless

- Zubie, Inc

- Vodafone Automotive S.p.A.

The global usage-based insurance market is segmented as follows:

By Package

- PHYD

- PAYD

- Device-based

- Telematics-based

By Technology

- OBD-II

- Smartphone

- Black Box

- Embedded Telematics

By Vehicle Technology

- Passenger Vehicle

- OBD-II

- Smartphone

- Black Box

- Embedded Telematics

- Commercial Vehicle

- OBD-II

- Smartphone

- Black Box

- Embedded Telematics

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Our Market Research Study Answers Questions Such As:

- What is the market size of usage-based insurance market?

- What are the major aspects that are likely to create huge impact on the market growth over the forecast timeframe?

- What is the market position of the firm in the global usage-based insurance market and ways as to how the firm can improve it?

- What type of opportunities or challenges will business rivals face?

- What are the modes of entry for the players in global usage-based insurance business?

Table Of Content

Methodology

FrequentlyAsked Questions

Usage-based insurance (UBI) is a form of auto insurance that determines premiums by analyzing an individual's driving habits, rather than conventional factors such as credit scores or demographics. Telematics technology is utilized by UBI to monitor vehicle behaviors, including distance traveled, speed, braking patterns, and time of day.

A significant factor contributing to the expansion of the UBI market is the growing prevalence of telematics devices and Internet of Things (IoT) technologies in vehicles, which collect real-time data on driving behavior.

According to a report from Zion Market Research, the global Usage-Based Insurance Market was valued at USD 33.27 Billion in 2023 and is projected to hit USD 232.94 Billion by 2032.

According to a report from Zion Market Research, the global Usage-Based Insurance Market a compound annual growth rate (CAGR) of 24.14% during the forecast period 2024-2032.

The growth of the markets in these regions over the forecast timeline is attributed to large-scale introduction of insurance telematics schemes in countries like Brazil, South Africa, and Argentina.

Key players involved in the usage-based insurance business and profiled in the usage-based insurance market report include Danlaw, Inc., Allianz SE, Allstate Insurance Company, Cambridge Mobile Telematics, UnipolSai Assicurazioni S.p.A, Desjardins Group, Assicurazioni Generali S.P.A, Liberty Mutual Insurance, Mapfre, S.A., AXA, Metromile Inc, Intelligent Mechatronic Systems Inc, Octo Technology Nationwide, State Farm Mutual Automobile Insurance Company, Insure The Box Limited, Progressive Casualty Insurance Company, TomTom International BV, Sierra Wireless, Zubie, Inc., and Vodafone Automotive S.p.A.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed