Used Smartphone Market Size, Share, Trends, Growth 2034

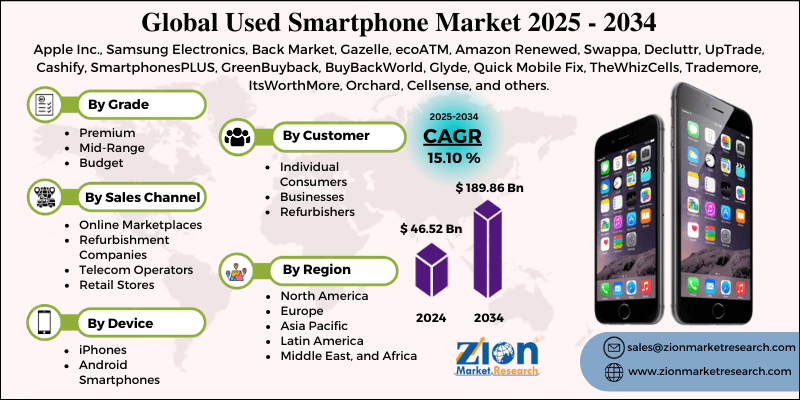

Used Smartphone Market By Grade (Premium, Mid-Range, Budget), By Sales Channel (Online Marketplaces, Refurbishment Companies, Telecom Operators, Retail Stores), By Device Type (iPhones, Android Smartphones), By Customer Type (Individual Consumers, Businesses, Refurbishers), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

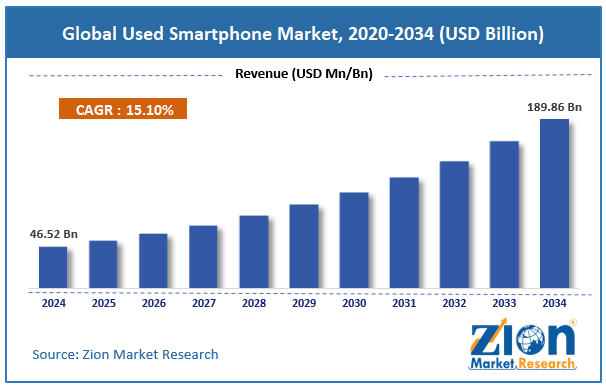

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 46.52 Billion | USD 189.86 Billion | 15.10% | 2024 |

Used Smartphone Industry Prospective:

The global used smartphone market was valued at approximately USD 46.52 billion in 2024 and is expected to reach around USD 189.86 billion by 2034, growing at a compound annual growth rate (CAGR) of roughly 15.10% between 2025 and 2034.

Used Smartphone Market: Overview

The used smartphone market comprises previously owned mobile phones that have been resold, refurbished, or traded in, allowing consumers to access smartphone technology at lower price points while contributing to electronic waste reduction. This fast-growing market segment includes certified pre-owned devices, manufacturer-refurbished, retailer-refurbished, and peer-to-peer resales that extend device lifecycles beyond initial ownership. Rising smartphone costs, environmental consciousness, and improved refurbishment technologies drive the used smartphone industry.

Accelerating the price of new flagships, growing acceptance of refurbished electronics, and expanding refurbishment infrastructure will drive the market over the forecast period.

Key Insights:

- As per the analysis shared by our research analyst, the global used smartphone market is estimated to grow annually at a CAGR of around 15.10% over the forecast period (2025-2034)

- In terms of revenue, the global used smartphone market size was valued at around USD 46.52 billion in 2024 and is projected to reach USD 189.86 billion by 2034.

- The used smartphone market is projected to grow significantly due to increasing new smartphone prices, rising environmental awareness, and expanding certified refurbishment programs across diverse geographic regions.

- Based on grade, premium devices lead the segment and will continue to dominate the global market.

- Based on sales channels, online marketplaces are anticipated to command the largest market share.

- Based on device type, iPhones are expected to lead the market during the forecast period.

- Based on region, North America is projected to dominate the global market during the forecast period.

Used Smartphone Market: Growth Drivers

Rising new smartphone prices and economic considerations

The increase in new smartphone retail prices drives significant growth in the secondary smartphone market. Consumers are looking for value alternatives as flagship devices are now over $1,000.

According to recent research, the average consumer is only willing to pay 12% more for a new smartphone, while flagship prices have increased 58% in the last 5 years. This price-value gap accelerated during economic uncertainties, and consumers prioritized finances without sacrificing technological capabilities.

Budget constraints among younger consumers fuel demand, with a growing preference for premium refurbished devices that offer a flagship experience at mid-range prices. Trade-in incentives and carrier financing options further encourage consumers to explore refurbished smartphones as a cost-effective alternative to buying new flagship models.

Environmental sustainability and circular economy initiatives

Sustainability consciousness is transforming consumer electronics purchasing behavior and creating momentum for device reuse. Certified pre-owned programs, trade-in incentives, and refurbishment certifications are gaining traction with environmentally aware consumers.

Research indicates that used smartphone purchases reduce electronic waste by extending device lifecycles 18-36 months beyond original ownership. Corporate sustainability initiatives, regulatory pressure, and consumer environmental awareness are increasing the adoption of refurbished devices across both individual and business markets, further driving the growth of the used smartphone industry.

Used Smartphone Market: Restraints

Consumer perception concerns and quality variability

Consumer skepticism about refurbished devices lingers and impacts confidence across the used smartphone market. Quality variations between refurbishers and unclear grading standards create purchase uncertainty.

Industry surveys show potential customers worry about battery life and component durability in secondary market devices. The lack of standardized certification frameworks and testing protocols across all segments makes building trust hard.

Leading refurbishment brands and certified pre-owned programs address these concerns by offering extended warranties, transparent grading, and rigorous quality checks. Increasing consumer education and awareness campaigns about refurbishment standards are also helping to build trust in the secondary smartphone market.

Used Smartphone Market: Opportunities

Certified pre-owned program expansion and quality standardization

The formalization of refurbishment standards presents significant opportunities in the global used smartphone market. Developing comprehensive certification frameworks and transparent quality assurance programs creates new segments with tremendous growth potential.

For example, manufacturers with certified pre-owned programs and factory-grade refurbishment are growing faster than general secondary market categories. Extended warranty offerings and after-sales support services resonate with quality-conscious consumers, increasing engagement among previously hesitant customer segments.

Device authentication technologies and component verification systems are also gaining implementation, further expanding the premium refurbished smartphone market. Regulatory bodies and industry alliances are increasingly working toward standardized refurbishment guidelines, which could enhance consumer trust and drive higher adoption rates globally.

Used Smartphone Market: Challenges

Technological obsolescence and software support limitations

Used smartphone market participants say software support discontinuation is their biggest challenge, especially as manufacturers stop updating older device generations. Refurbished device sellers face inventory devaluation when smartphones become incompatible with popular apps.

Industry analysts say that the product's value declines when a smartphone model exceeds official software support. Security update policies vary significantly between manufacturers, creating different value propositions across device brands.

As smartphones get faster, the gap between generations widens; refurbishers report that selling more than three generations-old devices is difficult. Consumer education on software lifecycles compared to hardware durability is challenging, as many consumers are unaware of software support timeframes when buying refurbished devices in the secondary smartphone market.

Used Smartphone Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Used Smartphone Market |

| Market Size in 2024 | USD 46.52 Billion |

| Market Forecast in 2034 | USD 189.86 Billion |

| Growth Rate | CAGR of 15.10% |

| Number of Pages | 211 |

| Key Companies Covered | Apple Inc., Samsung Electronics, Back Market, Gazelle, ecoATM, Amazon Renewed, Swappa, Decluttr, UpTrade, Cashify, SmartphonesPLUS, GreenBuyback, BuyBackWorld, Glyde, Quick Mobile Fix, TheWhizCells, Trademore, ItsWorthMore, Orchard, Cellsense, and others. |

| Segments Covered | By Grade, By Sales Channel, By Device Type, By Customer Type, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Used Smartphone Market: Segmentation

The global used smartphone market is segmented into grade, sales channel, device type, customer type, and region.

Based on grade, the market is segregated into premium, mid-range, and budget categories. Premium devices lead the market by accounting for the largest share of secondary market revenue and representing the most desirable segment for quality-conscious consumers seeking value.

Based on sales channels, the used smartphone industry is divided into online marketplaces, refurbishment companies, telecom operators, and retail stores. Online marketplaces are expected to lead the market during the forecast period as they offer the widest selection, competitive pricing, and convenient comparison shopping for secondary market devices.

Based on device type, the used smartphone industry is categorized into iPhones and Android smartphones. iPhones are expected to lead the market since they maintain higher resale values, have longer software support cycles, and enjoy stronger brand desirability in the secondary market.

Based on customer type, the market is divided into individual consumers, businesses, and refurbishers. Individual consumers are expected to lead the market due to their extensive population base, diverse purchasing power, and direct participation in buying and selling used devices.

Used Smartphone Market: Regional Analysis

North America to lead the market

North America dominates the used smartphone market due to high penetration rates, strong trade-in program infrastructure, and established refurbishment ecosystems. The U.S. accounts for 32% of global used smartphone transactions, as device upgrade cycles create a substantial supply for secondary markets. The region has robust certification standards and quality assurance programs offering various products across different price and quality tiers.

North American consumers are high adopters of certified pre-owned programs from manufacturers and carriers, and premium refurbished devices are becoming mainstream purchase options.

The region has a strong e-commerce infrastructure and established online marketplaces provide trusted transaction platforms. Focus on corporate sustainability initiatives and e-waste reduction programs makes the area more potent in the used smartphone segment.

Rising new device costs, growing environmental awareness, and expanding trade-in programs drive the market. Technological advancements in refurbishment processes and testing protocols are further boosting consumer confidence.

Major retailers and carriers in North America are expanding their buyback and certified pre-owned programs, making refurbished smartphones more accessible and appealing to a broader consumer base.

Asia Pacific is set to grow significantly.

Asia Pacific is experiencing remarkable growth in the used smartphone market, driven by value-conscious consumers, expanding middle-class populations, and improving refurbishment infrastructure. The Asia Pacific used smartphone market has grown, and mid-range refurbished categories are experiencing the most substantial growth.

Countries like India, Indonesia, and Vietnam are leading the adoption of refurbished devices, mainly focusing on the price point and features that work. The economic accessibility of smartphone technology is driving demand for quality devices.

Developing e-commerce platforms specialized in electronics resale are thriving in Asian markets where price is the top purchase consideration. Local refurbishment operations with growing technical capabilities fuel the growth of quality-assured used devices in the Asia Pacific.

Government initiatives promoting e-waste reduction and circular economy practices further boost consumer confidence in the refurbished smartphone market across the Asia Pacific. Increasing partnerships between refurbishers and major smartphone brands further enhance the availability and reliability of certified pre-owned devices in the region.

Recent Market Developments:

- In January 2025, Apple expanded its certified refurbishment program by introducing an advanced device authentication system featuring blockchain verification of component authenticity and comprehensive device history tracking for enhanced consumer confidence.

- In February 2025, Samsung launched an extended circular economy initiative offering premium trade-in values, enhanced refurbishment standards, and a five-year software support commitment for devices entering its certified pre-owned ecosystem.

- In March 2025, Back Market secured significant investment funding to develop its AI-powered testing technology platform designed to standardize quality assessment across thousands of refurbishment partners while providing granular device condition data to consumers.

Used Smartphone Market: Competitive Analysis

The global used smartphone market is led by players like:

- Apple Inc.

- Samsung Electronics

- Back Market

- Gazelle

- ecoATM

- Amazon Renewed

- Swappa

- Decluttr

- UpTrade

- Cashify

- SmartphonesPLUS

- GreenBuyback

- BuyBackWorld

- Glyde

- Quick Mobile Fix

- TheWhizCells

- Trademore

- ItsWorthMore

- Orchard

- Cellsense

The global smartphone market is segmented as follows:

By Grade

- Premium

- Mid-Range

- Budget

By Sales Channel

- Online Marketplaces

- Refurbishment Companies

- Telecom Operators

- Retail Stores

By Device Type

- iPhones

- Android Smartphones

By Customer Type

- Individual Consumers

- Businesses

- Refurbishers

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The used smartphone comprises previously owned mobile phones that have been resold, refurbished, or traded in, allowing consumers to access smartphone technology at lower prices while contributing to electronic waste reduction.

The used smartphone market is expected to be driven by increasing new device prices, growing environmental consciousness, expanding certified refurbishment programs, more extended smartphone hardware durability, and rising consumer acceptance of pre-owned electronics.

According to our study, the global used smartphone market was worth around USD 46.52 billion in 2024 and is predicted to grow to around USD 189.86 billion by 2034.

The CAGR value of the used smartphone market is expected to be around 15.10% during 2025-2034.

The global smartphone market will register the highest growth in North America during the forecast period, with Asia Pacific showing the fastest growth rate.

Key players in the used smartphone market include Apple Inc., Samsung Electronics, Back Market, Gazelle, ecoATM, Amazon Renewed, Swappa, Decluttr, UpTrade, Cashify, SmartphonesPLUS, GreenBuyback, BuyBackWorld, Glyde, Quick Mobile Fix, TheWhizCells, Trademore, ItsWorthMore, Orchard, and Cellsense.

The report comprehensively analyses the used smartphone market, including an in-depth discussion of market drivers, restraints, emerging trends, regional dynamics, and future growth opportunities. It also examines competitive dynamics, refurbishment technologies, and the evolving consumer preferences shaping the secondary smartphone ecosystem.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed