Wealth Management Market Size, Share, Analysis, Trends, Growth, Segmentation, 2030

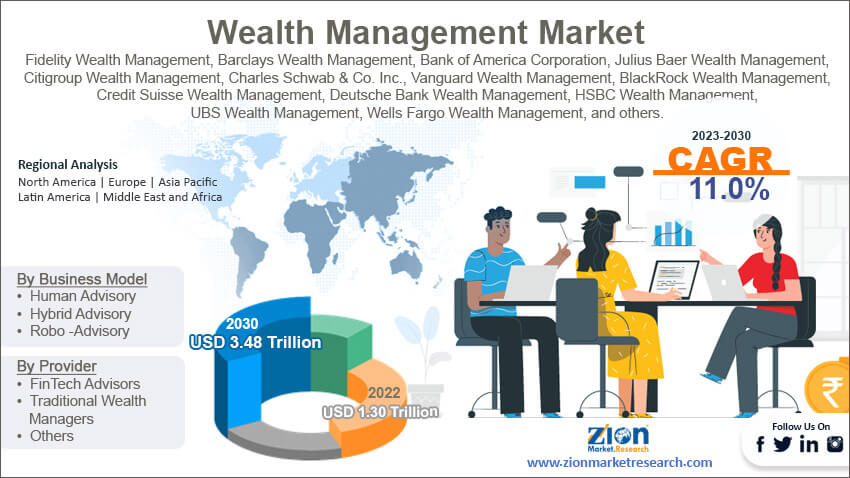

Wealth Management Market - By Business Model (Human Advisory, Hybrid Advisory, and Robo -Advisory), By Provider (FinTech Advisors, Traditional Wealth Managers, and Others), By Services (Portfolio Management and Asset Management), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2023 - 2030

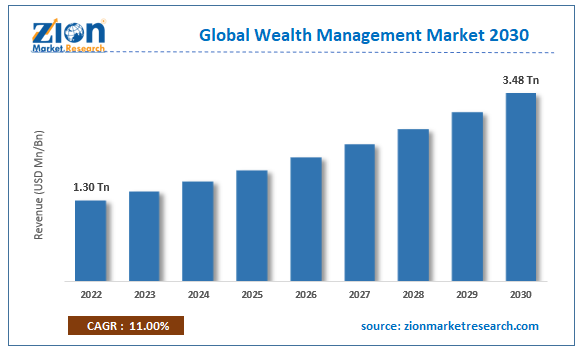

| Market Size in 2022 | Market Forecast in 2030 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1.30 Trillion | USD 3.48 Trillion | 11% | 2022 |

Wealth Management Industry Prospective:

The global wealth management market size was evaluated at $1.30 trillion in 2022 and is slated to hit $3.48 trillion by the end of 2030 with a CAGR of nearly 11% between 2023 and 2030.

Wealth Management Market: Overview

Wealth management is an investment advisory solution integrating financial counseling and investment to address the requirements of wealthy customers. It includes providing strategies for achieving particular financial goals over a specific timeline. Apart from this, managing wealth post-retirement is a part of wealth management activity. In addition to this, real estate planning, accounting & tax services, and legal planning are some of the activities requiring wealth management.

Key Insights

- As per the analysis shared by our research analyst, the global wealth management market is projected to expand annually at the annual growth rate of around 11% over the forecast timespan (2023-2030)

- In terms of revenue, the global wealth management market size was evaluated at nearly $1.30 trillion in 2022 and is expected to reach $3.48 trillion by 2030.

- The global wealth management market is anticipated to grow rapidly over the forecast timeline owing to escalating demand for new kinds of investments including hedge funds, private equity, intellectual property, commodities, and real estate investment trusts.

- In terms of business model, the robo-advisory segment is slated to register the highest CAGR over the forecast period.

- Based on provider, the fintech advisors segment is expected to dominate the segmental growth in the upcoming years.

- Based on services, the asset management segment is predicted to lead the segmental growth in the ensuing years.

- Region-wise, the European wealth management industry is projected to register the fastest CAGR during the assessment timeline.

Request Free Sample

Request Free Sample

Wealth Management Market: Growth Factors

A humongous rise in the fintech companies will prop up the scope of the global market growth by 2030

Escalating demand for new kinds of investments including hedge funds, private equity, intellectual property, commodities, and real estate investment trusts will steer the expansion of the global wealth management market. Apart from this, a prominent increase in the number of Fintech firms has brought a paradigm shift in the global market. Furthermore, wealth management provides a spectrum of benefits such as digitized offerings, reduced financial stress, and the development of financial plans. Massive demand for digitization of business processes is predicted to enlarge the scope of the growth of the global market.

Growing acceptance of big data analytics, AI, chatbots, and IoT will steer the global market trends. Escalating need for tax efficiency, time-savings, risk mitigation, and personalized investment strategies will proliferate the size of the market across the globe. Launching of new wealth management schemes and investments will contribute majorly towards the expansion of the global market. For instance, in November 2023, Shriram Capital, a division of Shriram Group, is likely to make investments of nearly INR 300 crore for commencing a new business for commencing new business through the aggregation of retail bad loans. Such moves will proliferate the size of the global market in the coming years.

Wealth Management Market: Restraints

Oscillation in pricing can decimate the growth of the industry globally in the coming years

Dynamic pricing and higher prices along with strict government laws will prove to be detrimental to the global wealth management industry expansion. Apart from this, low awareness about wealth management activities in emerging economies globally will further impede the growth of the industry across the globe.

Wealth Management Market: Opportunities

Rise in the popularity of wealth management activities globally to scale up the market growth across the globe

An increase in the wealth management activities of the finance firms across the globe along with huge offerings & wealth management schemes offered by companies of emerging economies will generate new growth opportunities for the global wealth management market. Apart from this, a surge in the demand for wealth management products by individuals having high net worth income in countries such as Thailand, China, Philippines, India, Taiwan, Malaysia, and Indonesia will augment the scope of the market growth across the globe.

Wealth Management Market: Challenges

An increase in cyber-terrorism can prove a huge impediment to the growth of the global industry

The rise in the number of cyber-attacks resulting in numerous data loss and leaking of confidential information about the clients as well as data theft is likely to pose a big challenge for the global wealth management industry surge in the upcoming years.

Wealth Management Market: Segmentation

The wealth management market is sectored into the business model, provider, services, and region.

In business model terms, the wealth management market across the globe is segregated into human advisory, hybrid advisory, and robo-advisory segments. Furthermore, the robo-advisory segment, which acquired nearly two-fifths of the global market revenue in 2022, is anticipated to accrue the highest gains over the forecast timespan. The expansion of the segment during 2023-2030 can be due to the sharing of business ideas by robo advisory with the company executives. Furthermore, the latter also discusses wealth management concepts with the board of directors. Apart from this, robo-advisory provides huge benefits to the users as it makes use of algorithm-driven and automated tools. Moreover, it also makes use of personalized portfolio management tools and robo-advisor technology as well as AI for giving proper advice & financial guidance to customers. Robo advisors offer personalized investment recommendations to customers at reduced fees along with leveraging AI tools for automating portfolio management activities.

Based on the provider, the global wealth management industry is sectored into fintech advisors, traditional wealth managers, and others segments. Additionally, the fintech advisors segment, which acquired a key share of the global industry in 2022, is projected to lead the industry growth in the next eight years. The segmental expansion over 2023-2030 can be due to the ability of fintech advisors to provide customized investment plans to consumers. Additionally, they take control of customer finances ranging from taxes and investments in estate planning. They also provide advice to customers on digital stock exchanges, mobile investments, digital banking solutions, and peer-to-peer payments. Apart from this, fintech advisors also tackle complications caused as a result of accounting, government legislation, and tax structure along with various kinds of financial management activities.

Based on the services, the wealth management industry globally is divided into portfolio management and asset management segments. In addition to this, the asset management segment, which dominated the services landscape in 2022, is projected to lead the global market earnings in the next eight years. The segmental expansion over 2023-2030 can be due to the large-scale execution of strategic and operational plans by government firms. Apart from this, the growing popularity of systematic investment plans and educating people about proper investment plans for tax benefits will spearhead the segmental surge.

Wealth Management Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Wealth Management Market |

| Market Size in 2022 | USD 1.3 trillion |

| Market Forecast in 2030 | USD 3.48 trillion |

| Growth Rate | CAGR of 11% |

| Number of Pages | 226 |

| Key Companies Covered | Fidelity Wealth Management, Barclays Wealth Management, Bank of America Corporation, Julius Baer Wealth Management, Citigroup Wealth Management, Charles Schwab & Co. Inc., Vanguard Wealth Management, BlackRock Wealth Management, Credit Suisse Wealth Management, Deutsche Bank Wealth Management, HSBC Wealth Management, Merrill Lynch Wealth Management, Zurich Wealth Management, Northern Trust Wealth Management, JP Morgan Wealth Management, Pictet Wealth Management, Goldman Sachs Wealth Management, Morgan Stanley Wealth Management, UBS Wealth Management, Wells Fargo Wealth Management, and others. |

| Segments Covered | By Business Model, By Provider, By Services, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2022 |

| Historical Year | 2017 to 2021 |

| Forecast Year | 2023 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Wealth Management Market: Regional Insights

North America is predicted to retain its leading position in the global wealth management market over the forecast timeframe

North America, which contributed about two-thirds of the global wealth management market revenue in 2022, will be a leading region over the forecast timeframe. Moreover, the regional market elevation over the coming eight years can be due to technological innovations in wealth management along with notable investments made by government as well as private entities in creating new investment opportunities for the regional population. Supportive government schemes related to wealth management activities in countries such as Canada and the U.S. will drive regional market growth in the coming years.

The European wealth management industry is set to record the fastest CAGR in the next couple of years subject to the presence of key players in countries such as the UK, Finland, Switzerland, Denmark, Sweden, Estonia, Germany, and France. Moreover, a massive rise in big data usage and an increase in AI applications is predicted to boost industry growth in the continent in the upcoming years.

Furthermore, the Asia-Pacific wealth management market is predicted to expand by leaps & bounds in the coming years. The growth of the market in the region can be attributed to swift urbanization and a massive surge in wealth management activities in countries such as China, Indonesia, India, and Malaysia. Rapid urbanization along with a surge in cross-border trade activities is projected to favorably leverage the expansion of the market in the region.

Wealth Management Market: Competitive Space

The global wealth management market profiles key players such as:

- Fidelity Wealth Management

- Barclays Wealth Management

- Bank of America Corporation

- Julius Baer Wealth Management

- Citigroup Wealth Management

- Charles Schwab & Co. Inc.

- Vanguard Wealth Management

- BlackRock Wealth Management

- Credit Suisse Wealth Management

- Deutsche Bank Wealth Management

- HSBC Wealth Management

- Merrill Lynch Wealth Management

- Zurich Wealth Management

- Northern Trust Wealth Management

- JP Morgan Wealth Management

- Pictet Wealth Management

- Goldman Sachs Wealth Management

- Morgan Stanley Wealth Management

- UBS Wealth Management

- Wells Fargo Wealth Management

The global wealth management market is segmented as follows:

By Business Model

- Human Advisory

- Hybrid Advisory

- Robo -Advisory

By Provider

- FinTech Advisors

- Traditional Wealth Managers

- Others

By Services

- Portfolio Management

- Asset Management

By Region

-

North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Wealth management is an investment advisory solution integrating financial counseling and investment to address the requirements of wealthy customers.

The wealth management market growth can be owing to the ability of wealth management activities in providing a spectrum of benefits such as digitized offerings, reduced financial stress, and the development of financial plans.

According to a study, the global wealth management industry size was $1.30 trillion in 2022 and is projected to reach $3.48 trillion by the end of 2030.

The global wealth management market is anticipated to record a CAGR of nearly 11% from 2023 to 2030.

The European wealth management industry is set to register the fastest CAGR over the forecasting timeline owing to the presence of key players in countries such as the UK, Finland, Switzerland, Denmark, Sweden, Estonia, Germany, and France. Moreover, a massive rise in big data usage and an increase in AI applications are predicted to boost industry growth in the continent in the upcoming years.

The global wealth management market is led by players such as Fidelity Wealth Management, Barclays Wealth Management, Bank of America Corporation, Julius Baer Wealth Management, Citigroup Wealth Management, Charles Schwab & Co., Inc., Vanguard Wealth Management, BlackRock Wealth Management, Credit Suisse Wealth Management, Deutsche Bank Wealth Management, HSBC Wealth Management, Merrill Lynch Wealth Management, Zurich Wealth Management, Northern Trust Wealth Management, JP Morgan Wealth Management, Pictet Wealth Management, Goldman Sachs Wealth Management, Morgan Stanley Wealth Management, UBS Wealth Management, and Wells Fargo Wealth Management.

The global wealth management market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTEL analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five force analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed