Zero-Turn Riding Mower Market Size, Share, Trends, Growth 2032

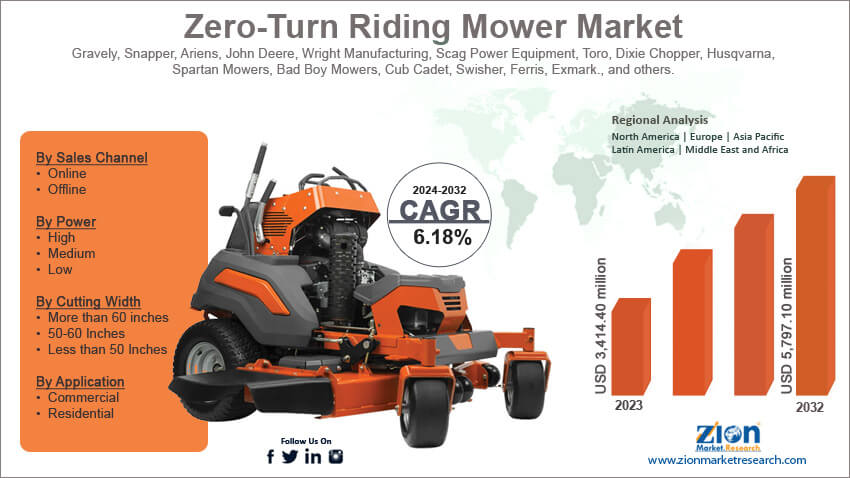

Zero-Turn Riding Mower Market By Sales Channel (Online and Offline), By Power (High, Medium, and Low), By Cutting Width (More than 60 inches, 50-60 Inches, and Less than 50 Inches), By Application (Commercial and Residential), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

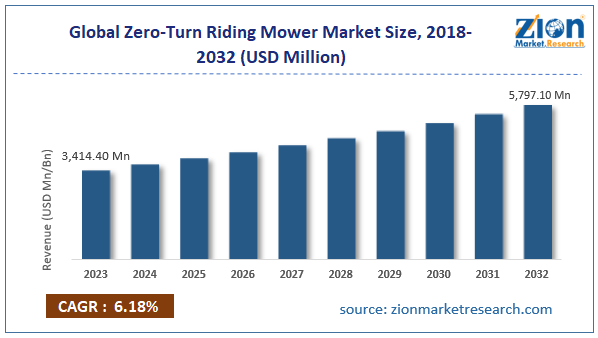

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 3,414.40 million | USD 5,797.10 million | 6.18% | 2023 |

Zero-Turn Riding Mower Industry Prospective:

The global zero-turn riding mower market size was worth around USD 3,414.40 million in 2023 and is predicted to grow to around USD 5,797.10 million by 2032 with a compound annual growth rate (CAGR) of roughly 6.18% between 2024 and 2032.

Zero-Turn Riding Mower Market: Overview

A zero-turn riding mower is a model riding lawn mower. It has a zero turning radius when the two wheels of the mower move in opposite directions. This attribute is the reason for the tool to derive its name. The functioning of a zero-turn riding mower mimics the operation of a tank steering system. The manufacturers of zero-turn riding mowers achieve this attribute in several ways. The most common method is the installation of hydraulic speed control for each wheel drive in the case of a diesel or gasoline-powered engine. The battery-powered versions are installed with two electric motors. Currently, the commercial market is filled with commercial and more professional riding mowers with each variant differing in size of cutting decks, power options, and cost. Contemporary models of zero-turn riding mowers have 4 wheels. Two tires are placed in the front. They are smaller in size. The larger tires are placed at the rear end of the mower. Most zero-turn riding mowers use differential steering which involves changing the speed of the drive tires for steering purposes. The demand for zero-turn riding mowers is growing due to the exceptional results shown by the device in mowing activities. They can move across 180 degrees and do not leave behind any uncut grass. The revenue in the global zero-turn riding mower market is growing rapidly and will deliver exceptional results in the future.

Key Insights:

- As per the analysis shared by our research analyst, the global zero-turn riding mower market is estimated to grow annually at a CAGR of around 6.18% over the forecast period (2024-2032)

- In terms of revenue, the global zero-turn riding mower market size was valued at around USD 3,414.40 million in 2023 and is projected to reach USD 5,797.10 million, by 2032.

- The zero-turn riding mower market is projected to grow at a significant rate due to the surging number of hospitality facilities globally

- Based on the sales channel, the offline segment is growing at a high rate and will continue to dominate the global market as per industry projection

- Based on the cutting width, the 50-60 inches segment is anticipated to command the largest market share

- Based on region, North America is projected to dominate the global market during the forecast period

Request Free Sample

Request Free Sample

Zero-Turn Riding Mower Market: Growth Drivers

Surging number of hospitality facilities globally will drive the market demand rate

The global zero-turn riding mower market is expected to grow due to the increasing number of hospitality establishments across the globe. These facilities include accommodation units such as hotels, luxury resorts, cafes, restaurants, and other places that provide food and lodging-related services to the common people. In recent times, the investment rates in the hospitality industry have surged to new heights driven by several factors. For instance, an increase in the number of tourists including domestic and international has encouraged more players to enter the hospitality business. In addition to this, business travel has augmented in the last decade as globalization continues to impact the world economy. Hospitality facilities especially the ones built on multiple acres of land tend to have extensive lawn areas since it is a pleasing factor for visitors. In 2023, the United Arab Emirates, a major tourist hub, witnessed the launch of the new Atlantis The Royal. It is a luxury beach resort and offers exquisite aesthetics. In February 2023, the Peninsula Istanbul property opened in the centuries-old region of Istanbul. In April 2024, reports suggested that Marriott International is expected to add around 20 properties in Türkiye by the end of 2025. Such investments are likely to drive the demand for efficient zero-turn riding mowers since the equipment is widely useful in maintaining the overall appeal of the property.

Rising construction of standalone housing units with sprawling lawn areas may generate a higher growth rate

In the real-estate sector, there have been significant improvements in the demand for standalone housing units. In 2018, there were more than 82 million detached single-family homes in North America as per official data. Moreover, an increasing number of people are migrating to remote locations away from urban cities for better quality of life. These homes are mostly attacked with sprawling lawn areas that require constant maintenance. In addition to this, most real-estate developers constructing multi-story buildings are focusing on developing residential spaces with expansive lawn areas for the enjoyment of the residents. These factors are expected to trigger the demand in the global zero-turn riding mower market.

Zero-Turn Riding Mower Market: Restraints

High cost of zero-turn variants may limit the market expansion rate

The global zero-turn riding mower industry is expected to be restricted due to the high cost of the zero-turn variants as compared to other counterparts. For instance, the most affordable version of the mower costs around USD 2400 while the most expensive version may range around USD 13000. In addition to this, the other alternatives to zero-turn solutions are less costly and deliver considerably fair results thus causing limited adoption of zero-turn riding mowers.

Zero-Turn Riding Mower Market: Opportunities

Rising innovation in mower technology and efforts toward controlling the growing prices may generate growth opportunities

The global zero-turn riding mower market is expected to witness excellent expansion possibilities during the projection period. The growth during the coming years could be driven by the rise in the number of new product launches with improved features and overall attributes. In May 2024, Konig Industries announced the launch of their new line of zero-turn mowers under the name Mowhawk. The new equipment is highly durable and offers excellent value for money. Mowhawk has a range of 42 to 72 inches and can be used by commercial landscapers as well as by high-end homeowners. The novel line of zero-turn mowers is built using a 7-gauge durable frame and the deck.

Changing consumer preferences toward electric and sustainable mowers may prove beneficial for the industry players

In recent times, there has been a significant growth in the demand for electric vehicles across the board. The rising consumer awareness and changing prices of essential fuels such as diesel and gasoline have resulted in more people opting for electric versions of vehicles including lawnmowers. Manufacturers of lawn mowing equipment must invest in tapping into the growing segment of environmentally-conscious consumers by developing more sustainable solutions that do not rely on non-renewable energy for power. In November 2023, Kubota, an agricultural machinery company, launched a new generation of zero-turn mowers in the form of Ze Electric Zero-Turn range including the Ze-481 and Ze-421. The company aims to achieve its vision of carbon neutrality by 2050 with the announcement of the new launch. The Ze electric series offers operator comfort, performance efficiency, and renewed durability. Ze is powered by three electric drive motors and is extremely environmentally friendly. Such measures are likely to create more demand in the global zero-turn riding mower market.

Zero-Turn Riding Mower Market: Challenges

Lack of service centers and trained professionals for repair work may challenge the market expansion rate

The global industry for zero-turn riding mower is expected to be challenged by the lack of repair service centers for high-end mowers. In addition to this, there is considerable insufficiency in terms of the availability of trained professionals. The repair cost of zero-turn riding mowers can be high causing hesitancy among potential buyers to invest in the tool.

Zero-Turn Riding Mower Market: Segmentation

The global zero-turn riding mower market is segmented based on sales channel, power, cutting width, application, and region.

Based on the sales channel, the global market segments are online and offline. In 2023, the highest growth was witnessed in the offline segment. Zero-turn riding mowers are expensive tools and most buyers prefer to inspect the product before making the purchase. Additionally, offline buying also allows potential customers to test the equipment before deciding if the tool meets their expectations. However, the online segment is an excellent measure through which companies can supply their products on a global scale. Well-maintained zero-turn riding mowers can last more than 2500 hours.

Based on power, the global zero-turn riding mower industry is divided into high, medium, and low.

Based on the cutting width, the global market segments are more than 60 inches, 50-60 inches, and less than 50 inches. In 2023, the highest demand was observed in the 50-60-inch segment since these variants have extended applications across commercial and non-commercial segments. Furthermore, they offer extended coverage making them more cost-efficient than other solutions. Less than 50-inch zero-turn riding mowers are mainly used in smaller lawn areas.

Based on application, the global market is divided into commercial and residential.

Zero-Turn Riding Mower Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Zero-Turn Riding Mower Market |

| Market Size in 2023 | USD 3,414.40 Million |

| Market Forecast in 2032 | USD 5,797.10 Million |

| Growth Rate | CAGR of 6.18% |

| Number of Pages | 216 |

| Key Companies Covered | Gravely, Snapper, Ariens, John Deere, Wright Manufacturing, Scag Power Equipment, Toro, Dixie Chopper, Husqvarna, Spartan Mowers, Bad Boy Mowers, Cub Cadet, Swisher, Ferris, Exmark., and others. |

| Segments Covered | By Sales Channel, By Power, By Cutting Width, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Zero-Turn Riding Mower Market: Regional Analysis

North America will deliver the most revenue during the projection period

The global zero-turn riding mower market is expected to witness the highest growth in North America. In 2023, the region was the leading revenue-generator contributing to more than 37% of the global market share. One of the key regional market growth drivers is the extensive use of lawnmowers in the residential sector. A large part of housing facilities in North America are single-family homes attached with lawn areas that require regular maintenance. In addition to this, the easier access to zero-turn riding mowers through the offline segment further helps the industry with its growth rate. North America, especially the US and Canada regions invest heavily in landscaping activities that include areas such as public parks, golf courses, and other units. In May 2024, Tamarack Resort announced that it would launch its new Osprey Meadows 18-hole championship golf course in July 2024. In March 2024, LaunchPad Golf launched its first-ever site in the US market located in Prior Lake. Additionally, the existence of several key manufacturers of zero-turn riding mowers in the US region helps the regional market flourish.

Zero-Turn Riding Mower Market: Competitive Analysis

The global zero-turn riding mower market is led by players like:

- Gravely

- Snapper

- Ariens

- John Deere

- Wright Manufacturing

- Scag Power Equipment

- Toro

- Dixie Chopper

- Husqvarna

- Spartan Mowers

- Bad Boy Mowers

- Cub Cadet

- Swisher

- Ferris

- Exmark.

The global zero-turn riding mower market is segmented as follows:

By Sales Channel

- Online

- Offline

By Power

- High

- Medium

- Low

By Cutting Width

- More than 60 inches

- 50-60 Inches

- Less than 50 Inches

By Application

- Commercial

- Residential

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

A zero-turn riding mower is a model riding lawn mower. It has a zero turning radius when the two wheels of the mower move in opposite directions.

The global zero-turn riding mower market is expected to grow due to the increasing number of hospitality establishments across the globe.

According to study, the global zero-turn riding mower market size was worth around USD 3,414.40 million in 2023 and is predicted to grow to around USD 5,797.10 million by 2032.

The CAGR value of the zero-turn riding mower market is expected to be around 6.18% during 2024-2032.

The global zero-turn riding mower market is expected to witness the highest growth in North America.

The global zero-turn riding mower market is led by players like Gravely, Snapper, Ariens, John Deere, Wright Manufacturing, Scag Power Equipment, Toro, Dixie Chopper, Husqvarna, Spartan Mowers, Bad Boy Mowers, Cub Cadet, Swisher, Ferris and Exmark.

The report explores crucial aspects of the zero-turn riding mower market including detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed