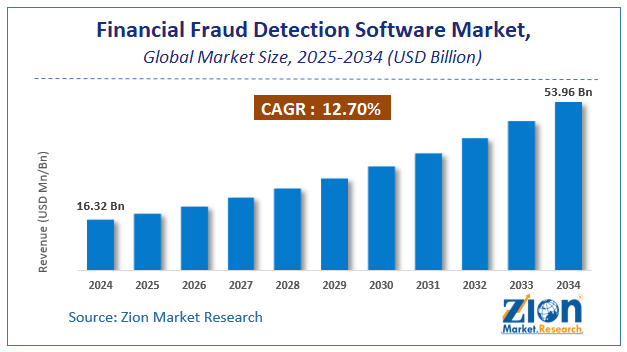

Global Financial Fraud Detection Software Market Revenue Estimated Around USD 53.96 Billion By 2034

20-May-2025 | Zion Market Research

According to the report, the global financial fraud detection software market size was valued at approximately USD 16.32 Billion in 2024 and is predicted to reach around USD 53.96 Billion by the end of 2034, expanding at a CAGR of around 12.7% from 2025 to 2034.

Financial fraud detection software is a type of software that helps financial institutions identify and prevent fraudulent activities. It uses various algorithms and machine learning techniques to analyze large amounts of data and detect patterns that indicate potential fraud. The software can monitor various financial transactions, such as credit card transactions, wire transfers, and account withdrawals, and alert the institution when suspicious activity is detected. By using such software, financial institutions can prevent losses due to fraudulent activities and maintain the trust of their customers. Many financial institutions have implemented fraud detection software as a critical component of their risk management strategy, and the technology is continually evolving to keep up with the changing nature of financial fraud.

The global financial fraud detection software market is driven by the increasing adoption of digital payment systems and the rising frequency of fraudulent activities. The software is expected to provide new growth opportunities as businesses look for ways to enhance their fraud prevention capabilities. Additionally, the increasing awareness of the benefits of fraud detection software, such as reduced losses and improved customer trust, is driving market growth. However, challenges such as the high cost of implementation and the complexity of integrating the software with existing systems are hindering the financial fraud detection software industry growth. Furthermore, the need to comply with regulatory requirements and the ever-evolving nature of fraud are also challenges that must be addressed to fully leverage the potential of this market.

The global financial fraud detection software market is segmented based on deployment, component, end-user, type, and region.

Based on deployment, the financial fraud detection software industry is bifurcated into on-premises and cloud. The cloud-based segment cited the fastest growth rate in 2022 and is further projected to grow rapidly during the forecast period. Cloud-based solutions offer many benefits over on-premises solutions, such as reduced infrastructure costs, scalability, and accessibility from anywhere with an internet connection.

This has led to increased adoption of cloud-based solutions by small and medium-sized businesses, who may not have the resources to implement on-premises solutions. Additionally, the cloud-based approach allows for easier integration with other cloud-based systems and provides real-time monitoring and analytics. As more businesses move their operations to the cloud, the demand for cloud-based financial fraud detection software is expected to continue to grow, providing new growth opportunities for vendors in this segment.

Based on component, the global market is segmented into solution and service.

Based on end-user, the global financial fraud detection software industry is segmented into insurance companies, banks, financial institutions, and others. The bank segment held the largest market share in 2022 and is further predicted to grow exponentially during the forecast period. Banks are increasingly implementing fraud detection solutions to mitigate losses and improve customer trust, as fraud can lead to significant financial and reputational damage. The rise of digital banking has also led to an increase in the number of transactions, making it more difficult to detect fraudulent activities without the use of advanced software.

Additionally, regulatory requirements mandating banks to implement fraud prevention systems have further boosted the demand for financial fraud detection software in the banking segment. As banks continue to prioritize the detection and prevention of fraudulent activities, the demand for financial fraud detection software in this segment is expected to grow.

Based on type, the global financial fraud detection software industry is bifurcated into money laundering, identity theft, debit & credit frauds, claim frauds, and wire transfer frauds.

Based on region, the North American region held the largest financial fraud detection software market share in 2022 and is further anticipated to grow remarkably during the forecast period. This is majorly due to the high adoption of digital payments and the growing number of fraudulent activities in the region. The region has a highly developed financial sector, which has led to increased investment in fraud detection software by financial institutions. The presence of leading vendors in the region has also contributed to the growth of the market.

Furthermore, the North American region is highly regulated, with strict compliance requirements for financial institutions. This has led to increased adoption of fraud detection software to meet regulatory requirements. The increasing awareness of the benefits of fraud detection software and the need to protect assets and reputation have also contributed to market growth. As the trend toward digital payments and banking continues to grow, the demand for financial fraud detection software in North America is expected to remain strong.

Browse the full “Financial Fraud Detection Software Market By Component (Software, Services), By Deployment Mode (On-premise, Cloud), By Application (Payment Fraud, Insurance Fraud, Identity Theft, Money Laundering, Others), By End-user (BFSI, E-commerce, Retail, Healthcare, Government, Others), By Organization Size (Large Enterprises, SMEs), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034” Report at https://www.zionmarketresearch.com/report/financial-fraud-detection-software-market

Recent Developments

- In January 2021, NICE Actimize, a leading provider of financial crime software solutions, launched a new cloud-based fraud detection and prevention solution. The solution, called ActimizeWatch, is designed to help businesses of all sizes prevent fraud in real time by leveraging machine learning and artificial intelligence technologies. ActimizeWatch provides an integrated platform that can be used across multiple channels, including mobile and web, and offers advanced analytics to help detect even the most sophisticated fraud attempts.

- In March 2021, IBM announced that it had launched a new fraud detection and prevention solution for the financial services industry. The solution, called IBM Financial Crimes Insight, is built on IBM Cloud Pak for Data and leverages advanced analytics, artificial intelligence, and machine learning technologies. The solution is designed to help financial institutions detect and prevent fraud across a range of channels, including mobile, web, and call centers. IBM Financial Crimes Insight offers real-time monitoring and analytics, enabling businesses to quickly respond to potential fraud attempts.

Financial Fraud Detection Software Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the financial fraud detection software market on a global and regional basis.

The global financial fraud detection software market is dominated by players like:

- Feedzai

- FICO

- Oracle

- ThreatMetrix

- SAS

- SAP

- Fiserv

- IBM

- Experian

- Bottomline Technologies

- Software AG

- Simility

- NICE Actimize

- Featurespace

- BAE Systems

- Socure

- and Forter

- to name a few.

The global financial fraud detection software market is segmented as follows;

By Component

- Software

- Services

By Deployment Mode

- On-premise

- Cloud

By Application

- Payment Fraud

- Insurance Fraud

- Identity Theft

- Money Laundering

- Others

By End-user

- BFSI

- E-commerce

- Retail

- Healthcare

- Government

- Others

By Organization Size

- Large Enterprises

- SMEs

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

About Us:

Zion Market Research is an obligated company. We create futuristic, cutting-edge, informative reports ranging from industry reports, the company reports to country reports. We provide our clients not only with market statistics unveiled by avowed private publishers and public organizations but also with vogue and newest industry reports along with pre-eminent and niche company profiles. Our database of market research reports comprises a wide variety of reports from cardinal industries. Our database is been updated constantly in order to fulfill our clients with prompt and direct online access to our database. Keeping in mind the client’s needs, we have included expert insights on global industries, products, and market trends in this database. Last but not the least, we make it our duty to ensure the success of clients connected to us—after all—if you do well, a little of the light shines on us.

Contact Us:

Zion Market Research

244 Fifth Avenue, Suite N202

New York, 10001, United States

Tel: +49-322 210 92714

USA/Canada Toll-Free No.1-855-465-4651

Email: sales@zionmarketresearch.com

Website: https://www.zionmarketresearch.com

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed