Financial Fraud Detection Software Market Size, Share, Trends, Growth 2030

Financial Fraud Detection Software Market By Deployment (On-Premises and Cloud), By Component (Solution and Service), By End-User (Insurance Companies, Banks, Financial Institutions, and Others), By Type (Money Laundering, Identity Theft, Debit & Credit Card Frauds, Claim Frauds, and Wire Transfer Frauds), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2023 - 2030

| Market Size in 2022 | Market Forecast in 2030 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 12.87 Billion | USD 33.17 Billion | 12.56% | 2022 |

Financial Fraud Detection Software Industry Prospective:

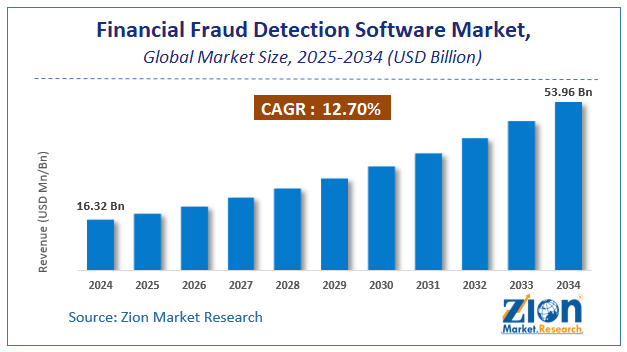

The global financial fraud detection software market size was worth around USD 12.87 Billion in 2022 and is predicted to grow to around USD 33.17 Billion by 2030 with a compound annual growth rate (CAGR) of roughly 12.56% between 2023 and 2030.

The report analyzes the global financial fraud detection software market drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the financial fraud detection software industry.

Financial Fraud Detection Software Market: Overview

Financial fraud detection software and programs that assist in identifying, detecting, and preventing any finance-related malpractices or fraudulent activities that may be occurring in various types of financial institutions. The tools leverage the benefits of advanced technologies and analytical algorithms to scan through large volumes of data in real-time and quickly to detect any transaction that deviates from normal patterns and could be an indicator of fraud. The industry is growing at an exceptional rate as the world moves toward digitizing every aspect of financial transactions that occur at the business or personal level. The software programs make use of different types of solutions like authentication solutions, fraud analytics, risk and compliance solutions governance, and solutions that monitor transactions across the consumer group of the financial unit using the software. These programs are essential in detecting any abnormal payment patterns and transactions and are useful in avoiding irreparable damage to the entity using the software.

Key Insights:

- As per the analysis shared by our research analyst, the global financial fraud detection software market is estimated to grow annually at a CAGR of around 12.56% over the forecast period (2023-2030)

- In terms of revenue, the global financial fraud detection software market size was valued at around USD 12.87 Billion in 2022 and is projected to reach USD 33.17 Billion, by 2030.

- The financial fraud detection software market is projected to grow at a significant rate due to the growing incidences of financial fraud

- Based on end-user segmentation, banks was predicted to show maximum market share in the year 2022

- Based on deployment segmentation, the cloud was the leading vertical in 2022

- On the basis of region, North America was the leading revenue generator in 2022

Financial Fraud Detection Software Market: Growth Drivers

Growing incidences of financial fraud to propel market growth

The global financial fraud detection software market is projected to grow owing to the growing associated incidences across the globe. Such incidents are occurring more frequently in recent times as compared to the last decade and they can be observed across transaction groups including personal transactions, business-related, and government unit-related. The banking sector along with other units that deal in different types of monetary transactions has become highly prone to cyber-attacks and financial fraud. Factors like rapid digitization, lack of security awareness amongst consumers, insider threats, rising complexity, and economic instability are the leading causes of the increase in digital cyber-crimes including financial fraud. In addition to this, the rising rate of digital payment systems makes consumers more vulnerable to becoming victims to financial fraudsters causing a greater need to have fraud-detecting software programs in place.

Financial Fraud Detection Software Market: Restraints

Integration challenges to restrict the market growth

One of the key growth restrictions that exist in the global financial fraud detection software industry is the complex integration challenges faced by market players in terms of aligning new systems along with already existing technologies in place. Integrating fraud detection software programs can be challenging and time-consuming. Furthermore, it required high initial investment along with expenses associated with the employment of skilled professionals that can optimize the use of advanced technology. Additionally, companies are required to spend on training existing employees for them to become comfortable with using new and complex systems for maximum optimization.

Financial Fraud Detection Software Market: Opportunities

Higher demand for end-user verticals to provide growth opportunities

Given the benefits of using financial fraud detection software programs, the demand for such systems has increased multifold in the last couple of years. Earlier, the main target consumer group for product providers were banking and financial institutes. However, in recent times, corporates and smaller businesses have incorporated such tools to detect any fraudulent activities in everyday business transactions. Moreover, the growing e-commerce sector is expected to open more doors for growth as it is one of the hotspots in terms of financial fraud.

Financial Fraud Detection Software Market: Challenges

Growing incidents of false positive rates to act as a challenge

False positive rates are incidents in which the program concludes legitimate transactions as fraudulent activities. The growing rate of such incidents is a major challenge for global industry players to tackle. False positive rates can occur due to multiple human or mechanical errors like the input of wrong data, along with lack of context and integration, and several other times of human error in understanding. Software programs are also highly prone to collapse under certain situations.

Financial Fraud Detection Software Market: Segmentation

The global financial fraud detection software market is segmented based on deployment, component, end-user, type, and region.

Based on deployment, the global market segments are on-premises and cloud. The year 2022 witnessed the highest growth in the cloud-based segment due to several advantages of using the systems along with the availability of a number of product and service providers. Some of the advantages of using cloud systems include higher cost-saving and scalability. The former eliminates the requirement of the business to invest in setting up information technology (IT) infrastructure to support the deployment of such advanced programs. The latter allows companies to scale up or scale down the use of the software depending on the company’s actual requirement. Other factors like better security, accessibility, and automatic updates act as a bonus for using cloud systems. As per Gartner, banks typically spend about 7.2% of their revenue on IT systems.

Based on component, the global market divisions are solution and service.

Based on end-user, the global market segments are insurance companies, banks, financial institutions, and others. Currently, banks lead the segmental growth since they are the most vulnerable and targeting segment in terms of financial fraud. This includes credit and debit card fraud, money laundering, and identity theft. The growing number of financial frauds in banks is a leading cause of high CAGR in this segment. As per a recent study by Javelin Strategy & Research, the US witnesses more than 14.4 million cases of identity theft in 2018.

Based on type, the global market divisions are money laundering, identity theft, debit & credit frauds, claim frauds, and wire transfer frauds.

Recent Developments:

- In January 2023, the Reserve Bank of India (RBI), the country's national bank, issued a green signal to 6 entities for testing fintech products that can effectively manage financial fraud. The move came under India’s sandbox scheme, which deals with the live testing of products and services. The 6 entities include Creditwatch and HSBC bank

- In March 2022, ACI Worldwide, a leading provider of real-time payment software programs and services, launched Fraud Scoring Services. It is the first-of-its-kind fraud scoring platform that uses advanced machine learning abilities and can be used by financial units of all sizes

- In June 2022, eFraud Services announced the launch of a new financial fraud detection software called eFraud Converter which is Ai-driven and a software-as-a-service (SaaS) solution

Financial Fraud Detection Software Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Financial Fraud Detection Software Market Research Report |

| Market Size in 2022 | USD 12.87 Billion |

| Market Forecast in 2030 | USD 33.17 Billion |

| Growth Rate | CAGR of 12.56% |

| Number of Pages | 210 |

| Key Companies Covered | Feedzai, FICO, Oracle, ThreatMetrix, SAS, SAP, Fiserv, IBM, Experian, Bottomline Technologies, Software AG, Simility, NICE Actimize, Featurespace, BAE Systems, Socure, and Forter, to name a few. |

| Segments Covered | By Deployment, By Component, By End-User, By Type, And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2022 |

| Historical Year | 2017 to 2021 |

| Forecast Year | 2023 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Financial Fraud Detection Software Market: Regional Analysis

North America to emerge as the largest market

The global financial fraud detection software market is expected to register the highest growth in North America since it currently holds the most significant segment of the global market share. Factors like the presence of key industry players along with a high product awareness rate and growing adoption of advanced systems to improve digital safety aspects are leading reasons for high regional CAGR. The US is home to one of the most advanced banking systems that work with updated IT infrastructure and banking technologies.

The growing number of fraudulent transactions including identity theft and credit or debit card fraud has led to the government deploying various stringent regulatory measures to ensure consumer safety. Growth in Asia-Pacific is expected to be driven by the rising number of players along with the growing use of digital payment methods necessitating better safety processes in place.

Financial Fraud Detection Software Market: Competitive Analysis

The global financial fraud detection software market is led by players like:

- Feedzai

- FICO

- Oracle

- ThreatMetrix

- SAS

- SAP

- Fiserv

- IBM

- Experian

- Bottomline Technologies

- Software AG

- Simility

- NICE Actimize

- Featurespace

- BAE Systems

- Socure

- Forter

The global financial fraud detection software market is segmented as follows:

By Deployment

- On-Premises

- Cloud

By Component

- Solution

- Service

By End-User

- Insurance Companies

- Banks

- Financial Institutions

- Others

By Type

- Money Laundering

- Identity Theft

- Debit & Credit Card Frauds

- Claim Frauds

- Transfer Frauds

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Financial fraud detection software and programs that assist in identifying, detecting, and preventing any finance-related malpractices or fraudulent activities that may be occurring in various types of financial institutions.

The global financial fraud detection software market is projected to grow owing to the growing associated incidences across the globe.

According to study, the global financial fraud detection software market size was worth around USD 12.87 Billion in 2022 and is predicted to grow to around USD 33.17 Billion by 2030.

The CAGR value of the financial fraud detection software market is expected to be around 12.56% during 2023-2030.

The global financial fraud detection software market is expected to register the highest growth in North America since it currently holds the most significant segment of the global market share.

The global financial fraud detection software market is led by players like Feedzai, FICO, Oracle, ThreatMetrix, SAS, SAP, Fiserv, IBM, Experian, Bottomline Technologies, Software AG, Simility, NICE Actimize, Featurespace, BAE Systems, Socure, and Forter to name a few.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed