Global Insurance Brokerage Market to Grow USD 278.309 Billion By 2030

31-Jan-2023 | Zion Market Research

Insurance Brokerage Market

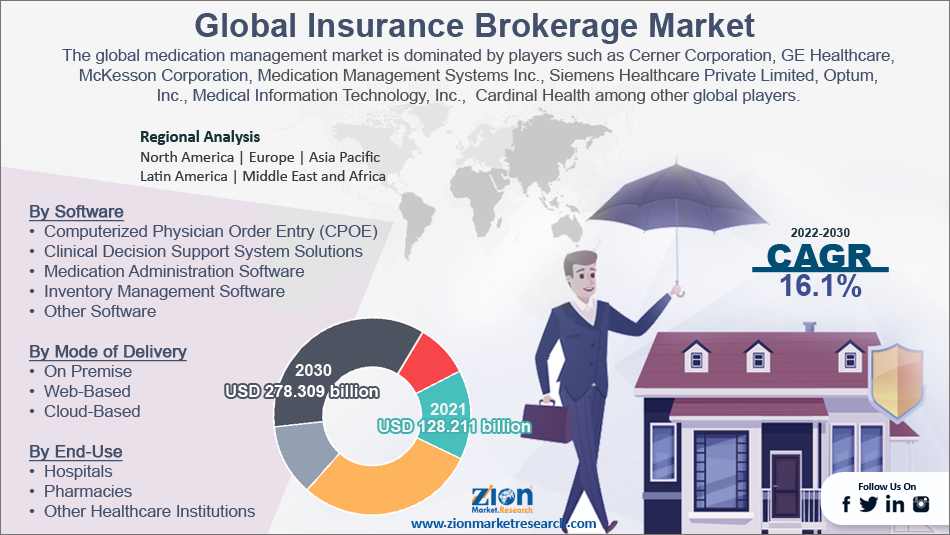

The global insurance brokerage market size was worth around USD 128.21 Billion in 2021 and is predicted to grow to around USD 278.30 Billion by 2030 with a compound annual growth rate (CAGR) of Roughly 16.1% between 2022 and 2030.

Insurance brokerage refers to the profession of financial advisers specially dedicated to the insurance segment. It is run by people called insurance brokers that act as an intermediary between an insurance company and the insurance buyer which can either be an individual or a commercial establishment. To register as an insurance broker or to run an insurance brokerage firm, every country has its sets of rules and regulations that have to be abided by. To cover insurance agents and brokers under one umbrella, the most commonly used term is insurance producers. Insurance brokers talk or negotiate on the behalf of insurance buyers, unlike insurance agents who work for insurance companies.

Companies or people working in this financial segment earn through the means of commission, the percentage of which may vary between nations or sometimes within states in the name country. Although the insurance broker earns commission from the insurance company, their best interest lies in the benefit of the insurance buyer and hence they can be more trusted. Furthermore, insurance brokerage companies earn financial gains by providing consulting or advisory services.

The global insurance brokerage market is expected to benefit from the rising number of insurance companies across the world. Since the market is full of multiple players offering varied types of insurance policies with sometimes confusing clauses, terms, and conditions, it can get intimidating for insurance buyers, especially when they are buying it for the first time. Insurance, in general, is an intimidating aspect for many buyers and they prefer to obtain some advice from a knowledgeable and experienced entity before investing in the same. With the growth in the number of insurance providers, the demand for insurance brokers is at an all-time high since they are expected to conduct research and analysis before submitting recommendations to the clients of finalizing a deal.

Additionally, the generally rising demand for health insurance along with growth in post-purchase services are expected to act as growth contributors in the global market. The growing number of independent players in underdeveloped economies as well as the exhaustive measures undertaken by dominant players to create a larger consumer database could also contribute to the global market growth.

One of the key global market restraints is the general perception of consumers about the profession in general since insurance brokers do not work for particular companies. They act as independent entities and hence many people do not trust them with financial services. On the more technical side, the global market could register certain growth limitations due to the growing research on artificial intelligence which is projected to overtake the insurance broker profession by the end of the decade, as many analysts.

The growing demand for vehicle insurance may provide growth opportunities whereas direct purchasing by consumers could act as a major challenge

Insurance Brokerage Market is segmented based on mode, type, end-user, and region

Based on type, the global market is segmented into general insurance, life insurance, health insurance, and others

- The global market was dominated by the life insurance segment in 2021 due to the simplicity and permanent solution such insurance provides to people with families and loved ones

- Majority of people tend to pay premiums for whole life insurance which covers a larger aspect of life

- The health insurance segment is expected to contribute significantly mostly driven by rising corporate efforts toward human resources

- For instance, Arthrex is known to pay almost 100% of employee insurance coverage and 50% for spouse insurance coverage

Based on end-user, the global market is divided into individuals and corporate

- The segmental growth was driven by the corporate segment in 2021 and it is majorly because corporations and businesses tend to invest in multi-million dollar insurance schemes for various projects. Such transactions are better dealt with the intervention of a third party who has a better hold over the insurance market

- Individual insurance policy takers may find insurance agents as fitting assistance

- In 2019, Marsh & McLennan registered an annual revenue of USD 16.7 billion

North America is projected to lead the global insurance brokerage market as it has in previous years with the United States acting as the main contributor. The growth is driven by the growing government initiatives to encourage insurance schemes in the country for its population along with the already existing and completely functional insurance programs. Furthermore, the US is home to some of the most dominant financial advisory companies running in the segment. Factors like increasing unpredicted incidents causing loss of lives, and assets, growing disposable income allowing people to spend on other non-basic essentials, growing government initiative to promote insurance buying for medical or non-medical purposes, and the rapid adoption of advanced technology to promote insurance brokerage over online channels are projected to help the global market growth further. Given the benefits of using insurance brokerage, the end consumers could prefer opting for them instead of insurance clients.

This review is based on a report by Zion Market Research, titled “Insurance Brokerage Market By Mode (Online and Offline), By Type (General Insurance, Life Insurance, Health Insurance, and Others), By End-User (Individuals and Corporate), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2022 – 2030.”- Report at https://www.zionmarketresearch.com/report/insurance-broking-market

The global insurance brokerage market is led by players like:

- Marsh and McLennan Companies Inc.

- Alliant Insurance Services Inc.

- HUB International Ltd.

- Navnit Insurance Broking Pvt. Ltd.

- Mahindra Insurance Brokers Ltd.

- Truist Financial Corp.

Recent Developments:

- In August 2022, Steadfast Group announced the acquisition of Insurance Brands Australia (IBA), an award-winning insurance advice and distribution business for AUD 301 million. IBA houses more than 400 insurance professionals working across 70 countries

- In November 2022, Marsh and McLennan Agency acquired Focus Insurance, founded in 2001. The latter focuses on customizing personal insurance programs for consumers throughout the USA

The global insurance brokerage market is segmented as follows:

By Mode

- Online

- Offline

By Type

- General Insurance

- Life Insurance

- Health Insurance

- Others

By End-User

- Individuals

- Corporate

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

About Us:

Zion Market Research is an obligated company. We create futuristic, cutting-edge, informative reports ranging from industry reports, the company reports to country reports. We provide our clients not only with market statistics unveiled by avowed private publishers and public organizations but also with vogue and newest industry reports along with pre-eminent and niche company profiles. Our database of market research reports comprises a wide variety of reports from cardinal industries. Our database is been updated constantly in order to fulfill our clients with prompt and direct online access to our database. Keeping in mind the client’s needs, we have included expert insights on global industries, products, and market trends in this database. Last but not the least, we make it our duty to ensure the success of clients connected to us—after all—if you do well, a little of the light shines on us.

Contact Us:

Zion Market Research

244 Fifth Avenue, Suite N202

New York, 10001, United States

Tel: +49-322 210 92714

USA/Canada Toll-Free No.1-855-465-4651

Email: sales@zionmarketresearch.com

Website: https://www.zionmarketresearch.com

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed