Insurance Brokerage Market Size, Share, Trends, Growth 2030

Insurance Brokerage Market By Mode (Online and Offline), By Type (General Insurance, Life Insurance, Health Insurance, and Others), By End-User (Individuals and Corporate), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2022 - 2030

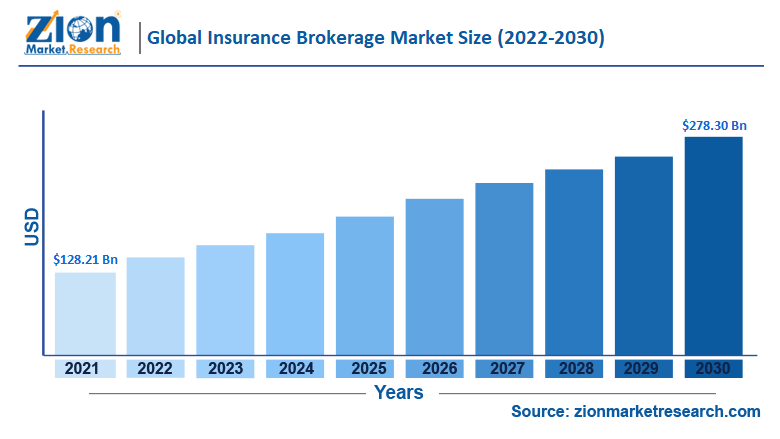

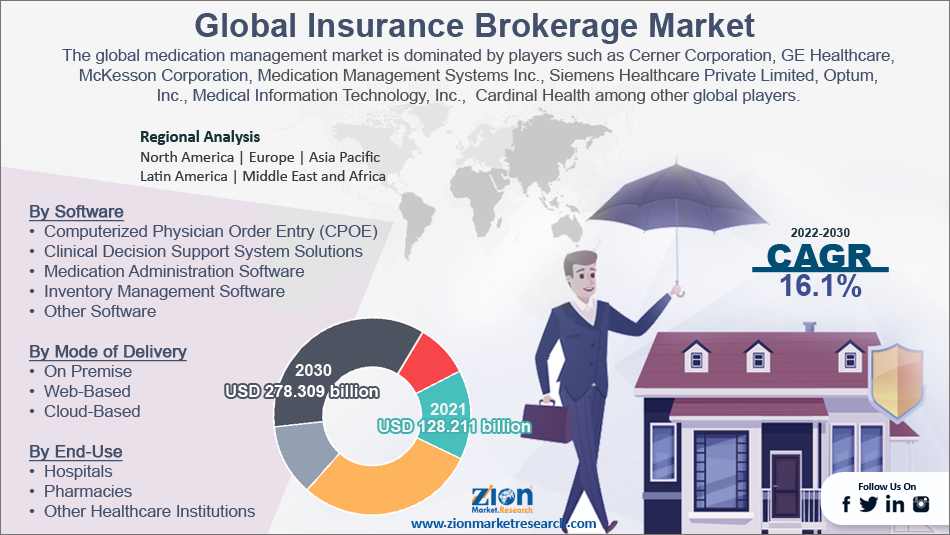

| Market Size in 2021 | Market Forecast in 2030 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 128.21 Billion | USD 278.30 Billion | 16.1% | 2021 |

Insurance Brokerage Industry Prospective:

The global insurance brokerage market size was worth around USD 128.21 Billion in 2021 and is predicted to grow to around USD 278.30 Billion by 2030 with a compound annual growth rate (CAGR) of Roughly 16.1% between 2022 and 2030.

The report analyzes the global insurance brokerage market drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the insurance brokerage market.

Get more information about this report - Request Free Sample PDF

Insurance Brokerage Market: Overview

Insurance brokerage refers to the business of providing independent advice and related services to people in terms of insurance schemes available and their benefits. Insurance is a measure by which people can protect their financial interests, especially losses. Insurance brokerage involves two parties in which one provides the other with a nominal and regular fee in return for an agreement that the other party will compensate monetarily in case of certain events, loss of life, or health conditions. The process is conducted with the aid of an insurance broker who acts as an intermediary between the company and the client. Insurance brokers differ from insurance agents in the sense that the former acts on behalf of the client as they hold negotiations with multiple insurance-based companies whereas the latter acts as a salesperson on behalf of the company.

Key Insights

- As per the analysis shared by our research analyst, the global ISO insurance brokerage market is estimated to grow annually at a CAGR of around 16.1% over the forecast period (2022-2030)

- In terms of revenue, the global ISO insurance brokerage market size was valued at around USD 128.211 billion in 2021 and is projected to reach USD 278.309 billion, by 2030.

- The market is projected to grow at a significant rate due to growing uncertainties in terms of financial loss

- Based on mode segmentation, offline was predicted to show maximum market share in the year 2021

- Based on end-user segmentation, the corporate was the leading user in 2021

- On the basis of region, North America was the leading revenue generator in 2021

To know more about this report, request a sample copy.

Insurance Brokerage Market: Growth Drivers

Growing uncertainties in terms of financial loss to restrict market expansion

The global insurance brokerage market is projected to benefit due to the uncertain situations arising due to multiple factors that can lead to severe financial losses. This includes all types of financial risks including the ones related to business or on the personal front, related to health conditions. Under such situations, more people are looking for ways to ensure that under certain conditions the business or the loved ones can be protected against severe financial strains. Leveraging the benefits offered by insurance brokers, insured entities or persons can benefit higher as opposed to situations where there is no role played by an insurance broker.

One of the key benefits is objective risk assessment since firms working in the global market work toward the benefit of the person who is undertaking the insurance. This means that insurance brokers assess all of the insurance services and provide the clients with a list that best meets their requirements. Such efficiency cannot be achieved by handling insurance that is worth millions of dollars alone or without external help.

Insurance Brokerage Market: Restraints

Partial reliance on insurance agents to restrict market expansion

Insurance brokers work for the insurance buyers and have only professional relationships with the insurance companies, the end-user may think of them as independent entities. However, this very aspect of insurance brokerage means that the people working as brokers have to partially rely on insurance agents, the people who work for the insurance companies. This is because insurance brokers lack the necessary authority to bind the coverage. This right is only present with insurance agents. The dependency of insurance brokers on insurance agents is a disadvantage for the global market players since the completion of the process ultimately lies in the hands of insurance agents, giving them a higher authority.

Insurance Brokerage Market: Opportunities

Growing demand for vehicle insurance to provide growth opportunities

The global insurance brokerage market is expected to benefit from the rising sales in the automotive segment, especially in the high-end, premium, or luxury sub-segment where the buyer prefers to get the vehicle insured for a nominal price. Buyers of luxury cars generally tend to spend on comprehensive insurance and even though the expense can be quite high, it is always recommended to get the vehicles insured. Furthermore, the same trend is currently being witnessed in the other automotive segments where certain countries mandate that every car has to be insured. For instance, in India, the motor vehicles act requires motor vehicles operating in public spaces to be insured.

Insurance Brokerage Market: Challenges

Direct purchasing by consumers to act as a major challenge

One of the key challenges faced by the global market players is when consumers directly opt for insurance purchases without the assistance of a third party. This could be due to various factors like lack of knowledge about the benefits of intermediaries, lack of trust in intermediaries, the result in overall cost when insurance brokers come into the picture, and many other professional or personal reasons. However, the global market players have invested in exhaustive marketing strategies to spread more awareness amongst the population.

Insurance Brokerage Market: Segmentation

The global insurance brokerage market is segmented based on mode, type, end-user, and region

Based on mode, the global market is divided into online and offline

- The global market registered the highest growth in the offline segment since the majority of people prefer to use traditional ways at least during the initial stages of contract signing

- The online mode gains more traction in the urban population or for post-purchase services

- During the projection period, the global market is expected to register the fastest growth in the online segment due to the growing investments in the adoption of advanced technology for enhanced customer experience

- A recent survey concluded that almost 64.9% of the population may prefer online channels for insurance purchases in the coming years

Based on end-user, the global market is divided into individuals and corporate

- The segmental growth was driven by the corporate segment in 2021 and it is majorly because corporations and businesses tend to invest in multi-million dollar insurance schemes for various projects. Such transactions are better dealt with the intervention of a third party who has a better hold over the insurance market

- Individual insurance policy takers may find insurance agents as fitting assistance

- In 2019, Marsh & McLennan registered an annual revenue of USD 16.7 billion

Recent Developments:

- In December 2022, Aditya Birla Capital Limited, a financial solutions provider, announced that it was considering selling its insurance brokerage segment. The move is anticipated to be influenced by the company's plan to restructure its entire financial service business. The company has already started negotiating with potential buyers as the management has failed to reap the expected outcomes from the business

- In November 2022, Marsh McLennan, the world’s most dominating financial service provider announced a partnership with Atlantic Council’s Arsht-Rockefeller Foundation Resilience Center (Arsht-Rock) to encourage the Race to Resilience initiative undertaken by the United Nations (UN). The initiative is aimed at managing climate resilience with a change in approach

Insurance Brokerage Market: Report Scope:

| Report Attributes | Report Details |

|---|---|

| Report Name | Insurance Brokerage Market Research Report |

| Market Size in 2021 | USD 128.21 Billion |

| Market Forecast in 2030 | USD 278.30 Billion |

| Compound Annual Growth Rate | CAGR of 16.1% |

| Number of Pages | 187 |

| Forecast Units | Value (USD Billion), and Volume (Units) |

| Key Companies Covered | Marsh and McLennan Companies Inc., Alliant Insurance Services Inc., HUB International Ltd., Navnit Insurance Broking Pvt. Ltd., Mahindra Insurance Brokers Ltd., and Truist Financial Corp. |

| Segments Covered | By Mode, By Type, By End-User, And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East and Africa (MEA) |

| Countries Covered | North America: U.S and Canada Europe: Germany, Italy, Russia, U.K, Spain, France, Rest of Europe APAC: China, Australia, Japan, India, South Korea, South East Asia, Rest of Asia Pacific Latin America: Brazil, Argentina, Chile The Middle East And Africa: South Africa, GCC, Rest of MEA |

| Base Year | 2021 |

| Historical Year | 2016 to 2020 |

| Forecast Year | 2022 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Insurance Brokerage Market: Regional Analysis

North America to lead with the highest CAGR

The global insurance brokerage market is projected to be dominated by North America during the forecast period with more than 41.2% of the global market share. The US is anticipated to become the leading contributor to the regional market since the country has one of the most advanced and deeply penetrated financial services sectors across the globe. It is also home to some of the leading names in the global market that have constantly re-innovated their programs and services to stay relevant and ahead in the game.

Furthermore, the highly advanced infrastructure and availability of technical services which largely contribute to the growth of any business in the modern digital age act as contributing factors for the high regional revenue. Canada is also registered to grow at a high CAGR. In the country, insurance brokers have self-governing bodies that are responsible for the overall licensing and regulating processes.

Insurance Brokerage Market: Competitive Analysis

The global insurance brokerage market is led by players like:

- Marsh and McLennan Companies Inc.

- Alliant Insurance Services Inc.

- HUB International Ltd.

- Navnit Insurance Broking Pvt. Ltd.

- Mahindra Insurance Brokers Ltd.

- Truist Financial Corp.

The global insurance brokerage market is segmented as follows:

By Mode

- Online

- Offline

By Type

- General Insurance

- Life Insurance

- Health Insurance

- Others

By End-User

- Individuals

- Corporate

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The global insurance brokerage market is projected to benefit due to the uncertain situations arising due to multiple factors that can lead to severe financial losses.

According to study, the Global insurance brokerage market size is anticipated to increase from $ 128.21 billion in 2021 to $ 278.30 billion in 2030, At a CAGR of 16.1%.

The global insurance brokerage market is projected to be dominated by North America during the forecast period with more than 41.2% of the global market share.

The global insurance brokerage market is led by players like Marsh and McLennan Companies Inc., Alliant Insurance Services Inc., HUB International Ltd., Navnit Insurance Broking Pvt. Ltd., Mahindra Insurance Brokers Ltd., and Truist Financial Corp.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed