Accounts Receivable Automation Market Size, Share, Trends, Growth and Forecast 2032

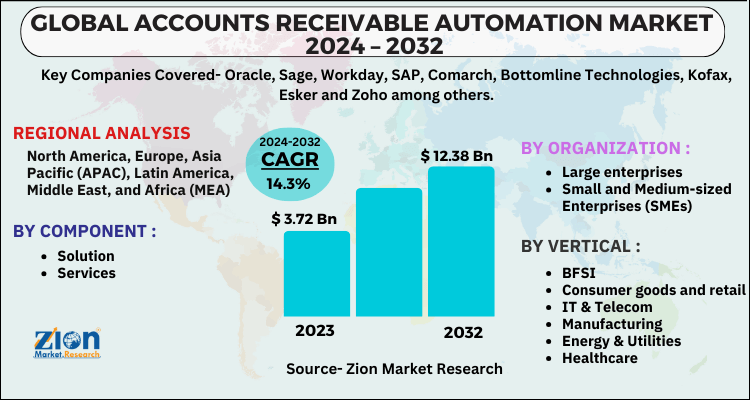

Accounts Receivable Automation Market By Component (Solution And Services), By Organization Size (Large Enterprises and Small and Medium-sized Enterprises (SMEs)) By Vertical (Consumer Goods and Retail, BFSI, Manufacturing, IT and Telecom, Healthcare, Energy & Utilities and Others) By Region - Global Industry Perspective, Comprehensive Analysis and Forecast, 2024 - 2032

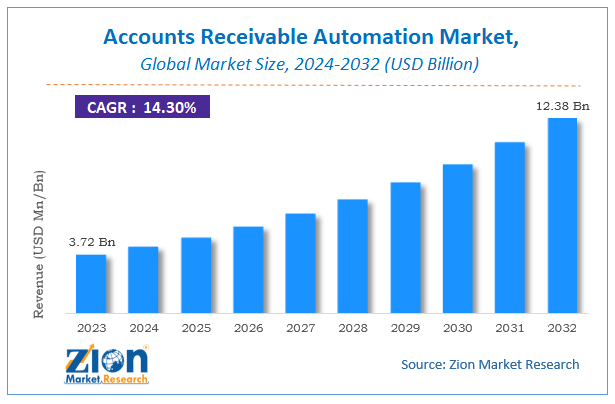

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 3.72 Billion | USD 12.38 Billion | 14.3% | 2023 |

Accounts Receivable Automation Market Insights

According to Zion Market Research, the global Accounts Receivable Automation Market was worth USD 3.72 Billion in 2023. The market is forecast to reach USD 12.38 Billion by 2032, growing at a compound annual growth rate (CAGR) of 14.3% during the forecast period 2024-2032. The report offers a comprehensive analysis of the market, highlighting the factors that will determine growth, potential challenges, and opportunities that could emerge in the Accounts Receivable Automation Market industry over the next decade.

The report gives a transparent view on the Accounts receivable automation market. We have included a detailed competitive scenario and portfolio of leading vendors operative in accounts receivable automation market. To understand the competitive landscape in the accounts receivable automation market, an analysis of Porter’s Five Forces model for the accounts receivable automation market has also been included. The study encompasses a market attractiveness analysis, wherein component, organization size, vertical and regional segments are benchmarked based on their market size, growth rate and general attractiveness.

Accounts receivable automation enables organizations across numerous industries to automate their cash receivable procedures. The software helps clients in speeding up workflows, enhancing control over processes, saving time and effortlessly sharing data through the cloud.

The demand for the market is expected to flourish owing to rising focus on improvement of cash flow, drop in outstanding sales days and improvement in accounting cycle are some of the major factors driving market growth in the forecast period. Many vendors are providing accounts receivable automation solutions via private or public cloud. These cloud based solutions are available on subscription basis and pay- per- use business model. Many companies and organizations are expecting to have these solutions deployed on cloud, as it provides numerous advantages, such as flexibility, scalability, cost-efficiency and enhanced collaboration.

This implementation of AR automation solution on cloud will ease businesses and enterprises to focus on their core competencies, instead of focusing on It infrastructure. These AR automation solutions are gaining popularity due to their extraordinary deployment feasibility and flexibility benefits and availability. Moreover, healthcare industry under vertical segment is adopting and implementing new technologies in order to provide enhanced services to patients. The requirement for efficient payment acceptance technologies to streamline operations to enhance customer experience the organizations are implementing AR automation solutions. However, reluctance of enterprises toward automating their accounts receivable processes is anticipated to hinder market growth.

Global Accounts Receivable Automation Market Segmentation

The accounts receivable automation market is segmented into component, which is further bifurcated into solution and services. Services are anticipated to witness growth in the estimated period. It plays a vital role in efficiently carrying out numerous tasks performed in the receivable process by the organization. The services segment is further bifurcated into support & maintenance services and consulting & implementation. This is expected to increase digital transactions in the developing economies which will further fuel demand for accounts receivable automation services. Furthermore, the demand for consulting & implementation services is anticipated to bolster the AR automation market with a surge in the adoption of payment acceptance technology.

Global Accounts Receivable Automation Market: Regional Analysis

The accounts receivable automation market on the basis of region is divided into North America, Europe, Asia- Pacific, Latin America, and Middle East and Africa. Asia pacific is anticipated to witness growth in the forecast period, owing to the rising need to automate day-to-day operational processes. Numerous organizations in the Asia pacific region are trying to automate the accounting processes to reduce the number of errors due to manual work. This is anticipated to propel market growth for Asia Pacific region.

Accounts Receivable Automation Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Accounts Receivable Automation Market |

| Market Size in 2023 | USD 3.72 Billion |

| Market Forecast in 2032 | USD 12.38 Billion |

| Growth Rate | CAGR of 14.3% |

| Number of Pages | 168 |

| Key Companies Covered | Oracle, Sage, Workday, SAP, Comarch, Bottomline Technologies, Kofax, Esker and Zoho among others |

| Segments Covered | By Product, By Procedures, By Application and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Global Accounts Receivable Automation Market: Competitive Players

The competitive profiling of noticeable players of accounts receivable automation market includes company and financial overview, business strategies adopted by them, their recent developments and product offered by them which can help in assessing competition in the market. Noticeable players included in the report are:

- Oracle

- Sage

- Workday

- SAP

- Comarch

- Bottomline Technologies

- Kofax

- Esker and Zoho among others.

The report segment of global accounts receivable automation market as follows:

Global Accounts Receivable Automation Market: By Component Segment Analysis

- Solution

- Services

Global Accounts Receivable Automation Market: By Organization Size Segment Analysis

- Large enterprises

- Small and Medium-sized Enterprises (SMEs)

Global Accounts Receivable Automation Market: By Vertical Segment Analysis

- BFSI

- Consumer goods and retail

- IT & Telecom

- Manufacturing

- Energy & Utilities

- Healthcare

- Others

Global Accounts Receivable Automation Market: By Region Segment Analysis

- North America

- U.S.

- Europe

- UK

- France

- Germany

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- Middle East and Africa

Table Of Content

Methodology

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed