Actuarial Service Market Size, Share, Analysis, Trends, Growth, Forecasts, 2032

Actuarial Service Market By Product Type (Morbidity, Disability, Mortality, Retirement, Survivorship, and Others), By Application (Insurance and Finance), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

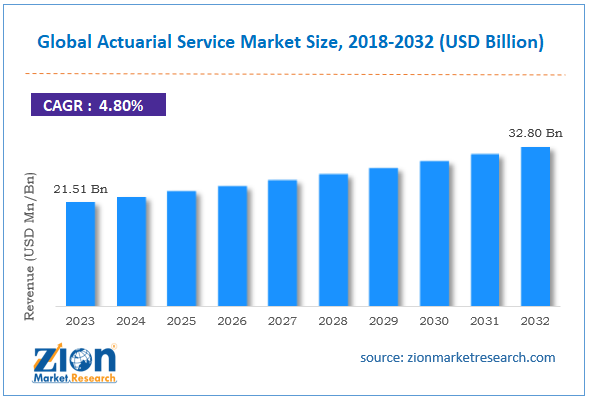

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 21.51 Billion | USD 32.80 Billion | 4.80% | 2023 |

Actuarial Service Industry Prospective:

The global actuarial service market size was worth around USD 21.51 billion in 2023 and is predicted to grow to around USD 32.80 billion by 2032 with a compound annual growth rate (CAGR) of roughly 4.80% between 2024 and 2032.

Actuarial Service Market: Overview

Actuarial services use statistical and mathematical methods to assess risk in many different industries, insurance being one of them. Actuaries help businesses and organizations lower their risk of financial loss by assessing financial risks, analyzing data, and developing plans based on their financial knowledge. They are crucial for determining insurance rates, funding pension plans, and making other financial decisions because they estimate future events using past data and statistical models. Actuarial services are required to ensure that businesses can effectively manage and minimize risk, as well as maintain stable financial conditions. The market growth for actuarial services is driven by several factors including increased risk management needs, insurance industry growth, advancements in data analytics, and others.

Key Insights

- As per the analysis shared by our research analyst, the global actuarial service market is estimated to grow annually at a CAGR of around 4.80% over the forecast period (2024-2032).

- In terms of revenue, the global Actuarial Service market size was valued at around USD 21.51 billion in 2023 and is projected to reach USD 32.80 billion, by 2032.

- The growing insurance industry is expected to drive the global actuarial service market growth over the forecast period.

- Based on the product type, the mortality segment is expected to capture the largest market share over the projected period.

- Based on the application, the finance segment is expected to hold a prominent market share over the projected period.

- Based on region, North America is expected to dominate the market during the forecast period.

Request Free Sample

Request Free Sample

Actuarial Service Market: Growth Drivers

Need for saving time and creating efficiencies drives market growth

Actuaries spend a great deal of time gathering data, but the goal of business intelligence is to minimize this time. Actuaries can gain a considerable advantage by identifying the most important trends and exploring deeper for additional information. Before being fed into the BI platform, the company's data is turned into an accurate and usable format, enabling users to examine and pinpoint important data that bolsters the organization's base estimates. Thus, this is expected to drive the actuarial service market growth during the forecast period.

Actuarial Service Market: Restraints

Lack of skilled workforce hindering market growth

Raising entrance barriers and compliance costs for actuarial service providers can be caused by intricate and dynamic regulatory frameworks. The resources and knowledge needed to adjust to new regulations are substantial. Also, the scalability of actuarial services companies is restricted in certain areas due to a lack of qualified actuaries. It can be difficult to find and keep specialists with the necessary training and expertise. Thus, this is expected to hamper the actuarial service industry growth during the projected period.

Actuarial Service Market: Opportunities

Growing service launch offers a lucrative opportunity for market growth

The growing service launch is expected to offer an attractive opportunity for actuarial service market growth during the projected period. For instance, in August 2023, the multinational management consulting company Oliver Wyman, a division of Marsh McLennan, revealed that it opened an actuarial office in the UK. Colin Forrest has joined the company as a Partner and UK Actuarial Leader to lead the initiative. As a specialized division of the Oliver Wyman Group, Oliver Wyman Actuarial offers actuarial services to corporate clients, investors, insurers, and healthcare providers. Oliver Wyman Actuarial works closely with Oliver Wyman's management consulting group, namely the Insurance & Asset Management Practice, which serves the same clientele with management consulting services. Oliver Wyman's ability to provide management consulting, actuarial experience, and access to insights from throughout Marsh McLennan makes it a unique choice for clients in the insurance market.

Actuarial Service Market: Challenges

Technological advancements and increasing competition pose a major challenge to market expansion

Traditional actuarial approaches are being disrupted by technological advances like artificial intelligence (AI) and machine learning, which also improve data analytics capabilities. To be competitive, businesses need to make expensive technology investments that require constant training. In addition, there is competition in the actuarial services sector, with many companies fighting for clients in different industries. It can be difficult to differentiate services and keep prices competitive while producing excellent work. Therefore, this is expected to pose a major challenge to the actuarial service market growth.

Actuarial Service Market: Segmentation

The global actuarial service industry is segmented based on product type, application, and region.

Based on the product type, the global market is bifurcated into morbidity, disability, mortality, retirement, survivorship, and others. The mortality segment is expected to capture the largest actuarial service market share over the projected period. By examining mortality rates and life expectancy statistics, actuaries are essential in setting life insurance rates. The pricing models of insurers are modified in response to changes in mortality rates or projections of such rates. While lower rates can result in competitive pricing tactics, higher mortality rates might cause premiums to rise to cover larger estimated claims. Additionally, actuaries use mortality data to create new pension plans and insurance products that are customized to meet the demands of customers and changing demographic patterns. Precise mortality estimates have an impact on innovations like hybrid life insurance plans and longevity insurance.

Based on the application, the global actuarial service industry is bifurcated into insurance and finance. The finance segment is expected to hold a prominent market share over the projected period. In the insurance business, actuaries play a crucial role in assessing risks related to policy underwriting, premium setting, and reserve estimation. They make sure insurers are solvent and financially stable by using statistical models and past data to forecast future claims. Furthermore, actuaries are essential for managing financial risk in many different industries as they evaluate and quantify the risks related to liabilities, investments, and operational uncertainty. Actuaries assist companies in navigating the erratic financial markets by offering precise risk assessments and creating mitigation plans. Thus, propel the market growth.

Actuarial Service Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Actuarial Service Market |

| Market Size in 2023 | USD 21.51 Billion |

| Market Forecast in 2032 | USD 32.80 Billion |

| Growth Rate | CAGR of 4.80% |

| Number of Pages | 214 |

| Key Companies Covered | Accenture, Actuarial Resources Corporation, Deloitte, Perr & Knight, Mercer, Huggins Actuarial Services, EY, Griffith, Ballard & Company, Conrad Siegel, Bolton Partners, Milliman, Korn Ferry, Wakely Consulting, Lewis & Ellis, BDO Global, KPMG, American Association of Insurance Services, PricewaterhouseCoopers, Cheiron, and others. |

| Segments Covered | By Product Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Actuarial Service Market: Regional Analysis

North America is expected to dominate the market during the forecast period

North America is expected to dominate the actuarial service market during the forecast period. North America, primarily the US and Canada, accounts for a sizeable portion of the world insurance market. When it comes to evaluating and controlling risks associated with reinsurance, life, health, and property & liability insurance, actuaries are essential. They help insurers with reserve calculations, policy writing, and regulatory compliance. Furthermore, the area is leading worldwide in technical innovation, as developments in machine learning, artificial intelligence, and data analytics are revolutionizing actuarial processes. Actuaries use these technologies to help strategic decision-making, increase predictive accuracy, and improve risk modeling capabilities. Furthermore, the presence of key firms is also a major propelling factor for market revenue growth.

The key players operating in the market adopted several strategies such as collaboration, expansion, and others to remain competitive in the regional market. For instance, in November 2023, in its strategic alliance with one of the top full-service actuarial consulting firms in North America, Novacap, partnered with Foley & Lardner LLP as legal advisors. Lewis & Ellis will be able to grow its current services and create new ones for a changing market with the support of this new relationship. Lewis & Ellis provides specialist actuarial consulting services to a broad range of customers, including mid-sized and regional businesses as well as multinational enterprises. Actuaries at Lewis & Ellis provide advisory services for regulatory compliance, life settlements, risk management, and other areas, in addition to serving clients in the life, health, property, and casualty insurance industries.

Actuarial Service Market: Competitive Analysis

The global actuarial service market is dominated by players like:

- Accenture

- Actuarial Resources Corporation

- Deloitte

- Perr & Knight

- Mercer

- Huggins Actuarial Services

- EY

- Griffith

- Ballard & Company

- Conrad Siegel

- Bolton Partners

- Milliman

- Korn Ferry

- Wakely Consulting

- Lewis & Ellis

- BDO Global

- KPMG

- American Association of Insurance Services

- PricewaterhouseCoopers

- Cheiron

The global actuarial service market is segmented as follows:

By Product Type

- Morbidity

- Disability

- Mortality

- Retirement

- Survivorship

- Others

By Application

- Insurance

- Finance

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Actuarial services use statistical and mathematical methods to assess risk in many different industries, insurance being one of them. Actuaries help businesses and organizations lower their risk of financial loss by assessing financial risks, analyzing data, and developing plans based on their financial knowledge.

The market growth of actuarial services is being driven by several factors including increasing risk management needs, insurance industry growth, advancements in data analytics, and others.

According to the report, the global actuarial service market size was worth around USD 21.51 billion in 2023 and is predicted to grow to around USD 32.80 billion by 2032.

The global actuarial service market is expected to grow at a CAGR of 4.80% during the forecast period.

The global actuarial service market growth is expected to be driven by North America. It is currently the world’s highest revenue-generating market due to the presence of major players.

The global actuarial service market is dominated by players like Accenture, Actuarial Resources Corporation, Deloitte, Perr & Knight, Mercer, Huggins Actuarial Services, EY, Griffith, Ballard & Company, Conrad Siegel, Bolton Partners, Milliman, Korn Ferry, Wakely Consulting, Lewis & Ellis, BDO Global, KPMG, American Association of Insurance Services, PricewaterhouseCoopers and Cheiron among others.

The actuarial service market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed