Adsorbent Market Size, Share, Growth & Trends 2028

Adsorbent Market By Type (Molecular Sieves, Activated Carbon, Silica Gel, Activated Alumina, Others), By Application (Petroleum Refining, Chemicals/Petrochemicals, Gas Refining, Water Treatment, Air Separation & Drying, Packaging, Others), and By Region - Global and Regional Industry Overview, Comprehensive Analysis, Market Intelligence, Historical Data, and Forecasts 2022 - 2028

| Market Size in 2021 | Market Forecast in 2028 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 3,829.50 Million | USD 5340.62 Million | 18.5% | 2021 |

Adsorbent Market Size And Industry Analysis

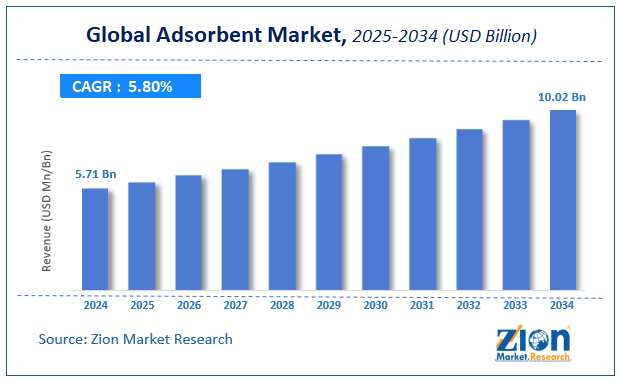

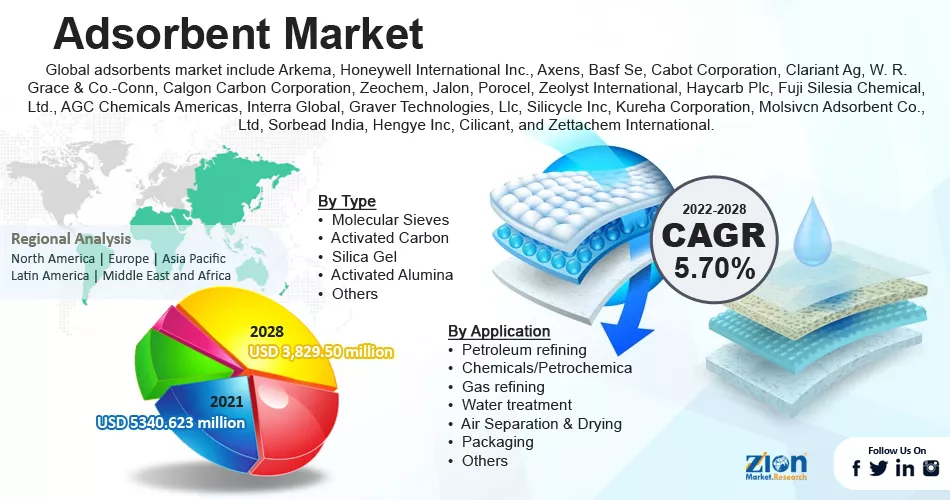

The global adsorbent market size was worth USD 3,829.50 million in 2021 and is estimated to grow to USD 5340.623 million by 2028, with a compound annual growth rate (CAGR) of approximately 5.70 percent over the forecast period. The report analyzes the adsorbent market's drivers, restraints/challenges, and their effect on the demands during the projection period. In addition, the report explores emerging opportunities in the adsorbent market.

Absorbent Market: Overview

Adsorbents are substances that absorb another substance. Adsorbents form layers on the surface through the adhesion process. They remove certain qualities from solids, liquids, and gases and cause them to adhere to their surfaces while retaining their chemical and physical properties. Moldings, rods, and spherical pallets are the most common forms of adsorbents. Abrasion resistance and high thermal stability are among the features that have found their way into various end-user sectors, including air separation, petrochemicals & drying, and water treatment.

Adsorbents are used in the gas sector to dry gases such as steam crack gas, methyl chloride, LNG, and others. It is used in water plants to remove fluoride and arsenic through a process known as DE fluoridation. Because of the expansion of main end-use sectors such as water and air treatment, chemicals, and petrochemicals, the adsorbent industry has grown significantly. Furthermore, stringent regulatory regulations create massive market potential for the leading competitors in the adsorbent industry.

However, the availability and high cost of raw materials for some specific adsorbents are expected to impede the overall growth of the adsorbent market over the forecast period. The biggest limitation in the global adsorbent market is the variation in oil prices, which has a negative impact on petroleum demand, decreasing the adsorbent market value. Oil prices have fallen over the years, which has impacted company profitability. Furthermore, the demand for adsorbents has been hampered by uncertainties in oil-producing nations.

Covid-19 Impact:

The new coronavirus or Covid 19 pandemic has negatively influenced the worldwide adsorbent market, causing the market size to shrink steadily. Because adsorbents are not consumer items in and of themselves, the growth of the adsorbents market depends on the end-use industries. However, the industries were compelled to stop operations because of the pandemic, affecting the adsorbents industry. Due to various country lockdowns and restrictions, demand for various consumer products such as automobiles, electronic goods, and so on had subsided, which was not predicted by the adsorbent market leaders. Thus, the market experienced a demand for adsorbents, which continued until 2021.

Key Insights

- As per the analysis shared by our research analyst, the global adsorbents market value is expected to grow at a CAGR of 5.70% over the forecast period.

- In terms of revenue, the global adsorbents market size was valued at around USD 3,829.50 million in 2021 and is projected to reach USD 5340.62 million by 2028.

- Because of the widespread use of adsorption materials in various sectors, firms involved in their development seek to increase production capacity to satisfy rising product demand. These additional expenditures are projected to be focused mostly on expanding current capacity and establishing new facilities.

- By type, the molecular sieves category dominated the market in 2021.

- By application, the petroleum refining category dominated the market in 2021.

- North America dominated the global adsorbents market in 2021.

Absorbent Market: Growth Drivers

Demand for oxygen concentrators is increasing fueling the market expansion.

With the rise of COVID-19 cases and a scarcity of oxygen cylinders in numerous Indian states, oxygen concentrators are among the most sought-after equipment for oxygen therapy, particularly among patients in home isolation and hospitals running low on oxygen. Medical equipment that concentrates oxygen from the surrounding environment is known as an oxygen concentrator. Atmospheric air contains around 78% nitrogen and 21% oxygen, with the remaining 1% comprised of various gases.

The oxygen concentrator draws in this air, filters it via a sieve, reintroduces the nitrogen, and operates on the residual oxygen. Concentrators are portable and do not require a particular temperature, unlike LMO, which must be kept and carried in cryogenic tankers. Concentrators, unlike cylinders, require a power source to draw ambient air. PSA is a method to isolate some gas species from a mixture of gases under pressure based on the species' molecular properties and affinity for an adsorbent material. This has increased the demand for the global adsorbents market.

Absorbent Market: Restraints

Reduced service life owing to high impurity levels to hamper market growth.

The capacity of adsorbent materials to attract molecules on their surfaces is restricted. Once the capacity is depleted, additional refining and purification will generate an equilibrium, resulting in desorption. Adsorbents are employed in refining and purifying processes to adsorb different pollutants and impurities such as (CO2 or H2S), mercaptans, manufacturing chemicals, and hydrate inhibitors. At this point, the contaminants present react with the adsorbents, resulting in adsorbent renewal. These contaminants either regenerate or degrade the adsorbent. The service life of adsorbents is determined by the material's regeneration capability, which might be a constraint for the global adsorbents market.

Absorbent Market: Opportunity

Technology for denitrogenating/desulfurization to drive market growth prospects

Because of rising demand for distillate fuels and dwindling supplies of lighter, easier-to-process crude, refineries are being forced to handle heavier stocks. The main issues faced while processing these sorts of stocks are the increased nitrogen and sulphur levels, which, when burned, generate nitrogen and sulphur oxides that are harmful to the environment. The usual procedures used in refineries throughout the world to remove organic nitrogen/sulfur compounds from liquid fuels include hydrogenation and hydro-sulfurization with hydro-treating catalysts. These processes often demand high pressure, high temperatures, and hydrogen consumption. The current hydro-desulfurization procedure removes only simple sulphur compounds and not refractory sulphur compounds found in liquid fuels.

Absorbent Market: Challenges

Raw material depletion to create challenges for market growth

Coal, bauxite, silicate, zeolite, and clay are the primary raw materials used to produce adsorbents. Because all these natural resources are naturally available, excessive exploitation and mining of these raw materials are not appropriate for preserving them. Because mineral resources are limited, exponential expansion and rising demand are unsustainable. These diminishing mineral resources may significantly threaten the adsorbent's business.

Adsorbent Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Adsorbent Market |

| Market Size in 2021 | USD 3,829.50 Million |

| Market Forecast in 2028 | USD 5340.62 Million |

| Growth Rate | CAGR of 18.5% |

| Number of Pages | 288 |

| Key Companies Covered | Arkema, Honeywell International Inc., Axens, Basf Se, Cabot Corporation, Clariant Ag, W. R. Grace & Co.-Conn, Calgon Carbon Corporation, Zeochem, Jalon, Porocel, Zeolyst International, Haycarb Plc, Fuji Silesia Chemical, Ltd., AGC Chemicals Americas, Interra Global, Graver Technologies, Llc, Silicycle Inc, Kureha Corporation, Molsivcn Adsorbent Co., Ltd, Sorbead India, Hengye Inc, Cilicant, Zettachem International., |

| Segments Covered | By Type, By Application and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2021 |

| Historical Year | 2016 - 2020 |

| Forecast Year | 2022 - 2028 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Absorbent Market: Segmentation

The global adsorbent market is segregated based on type, application, and region.

Based on type, the market is segmented into molecular sieves, activated carbon, silica gel, activated alumina, and others. Molecular sieves are expected to be the most rapidly developing category over the projection period. The rising usage of adsorbents in petroleum refining is to blame for the growth of this industry. Molecular sieves are commonly employed in the petroleum industry, notably for filtering gas streams and in the science lab for separating chemicals and drying materials. The four primary types of molecular sieves are 3A, 4A, 5A, and 13X. The molecule's chemical formula determines the pore size of molecular sieves.

Based on application, the market is segmented into petroleum refining, chemicals/petrochemicals, gas refining, water treatment, air separation & drying, packaging, and others. In the historical past, petroleum refining accounted for a substantial portion of the global adsorbents market. Adsorption materials are employed in the petroleum refining alkylation feed dehydration process to cleanse the feedstock. Because of the widespread use of adsorption materials in petroleum refining, the market is likely to expand significantly.

Recent Development:

- January 2020: According to Honeywell, Altus Midstream implemented Honeywell UOP's Ortloff SRX technology at its Diamond Central cryogenic gas processing facility, making it the first global usage of the breakthrough technology to extract valuable natural gas liquids (NGLs) from input gas. The Reeves County, Texas, plant launched in May 2019 and can now handle up to 600 million standard cubic feet of natural gas daily.

- June 2021: W. R. Grace & Co. has completed its acquisition of Albemarle Corporation's Fine Chemistry Services business for approximately USD 570 million, including USD 300 million in cash and USD 270 million funded by the issuance to Albemarle of non-participating preferred equity of a newly formed Grace subsidiary.

Report Scope:

Absorbent Market: Regional Landscape

North America dominated the global absorbent market in 2021

Over the projected period, the North America adsorbents market is expected to grow considerably. This is mostly due to commercial shale gas production in North America and the resulting need for adsorption materials for petroleum gas processing. The oil and petrochemical sectors, particularly in the United States and Canada, are important drivers of growth in the North American area. Furthermore, this region has recently witnessed a shale gas boom, which has expanded the demand for adsorbents in the petrochemical sectors. Furthermore, the pharmaceutical, food, and beverage sectors have seen significant growth, increasing the demand for adsorbents for drying solvents and synthesis products.

One of the most important adsorbent market regions in the Asia Pacific. One of the important reasons driving the growth of the Asia Pacific adsorbents market is the increased demand for adsorbents in various industries. The market will likely gain from rising demand for environmentally friendly and cost-effective adsorbent solutions in the coming years. The expansion of the population in this region has given rise to pharmaceuticals, food & beverage, petrochemicals, and a variety of other businesses, which has expanded the size of the adsorbents market. Furthermore, developing countries such as India and China have been steadily expanding their need for crude oil, which has increased the demand for adsorbent materials and stimulated growth.

Absorbent Market: Competitive Landscape

Some of the main competitors dominating the global adsorbents market include

- Arkema

- Honeywell International Inc.

- Axens

- Basf Se

- Cabot Corporation

- Clariant Ag

- W. R. Grace & Co.-Conn

- Calgon Carbon Corporation

- Zeochem

- Jalon

- Porocel

- Zeolyst International

- Haycarb Plc

- Fuji Silesia Chemical, Ltd.

- AGC Chemicals Americas

- Interra Global

- Graver Technologies, Llc

- Silicycle Inc

- Kureha Corporation

- Molsivcn Adsorbent Co., Ltd

- Sorbead India

- Hengye Inc

- Cilicant

- Zettachem International.

Global Adsorbents Market is segmented as follows:

By Type

- Molecular Sieves

- Activated Carbon

- Silica Gel

- Activated Alumina

- Others

By Application

- Petroleum refining

- Chemicals/Petrochemicals

- Gas refining

- Water treatment

- Air Separation & Drying

- Packaging

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The main reasons anticipated to propel the adsorbents market during the forecast period is large-scale innovations in oil and gas processing, as well as socioeconomic changes such as the greater usage of adsorbents in maintaining purity requirements in numerous applications and due to environmental concerns, are driving market expansion.

According to the report, the global adsorbents market size was worth USD 3,829.50 million in 2021 and is estimated to grow to USD 5340.62 million by 2028, with a compound annual growth rate (CAGR) of approximately 5.70 percent over the forecast period.

The North American adsorbents market is predicted to increase significantly over the forecast period. This is mostly due to the commercial extraction of shale gas in North America, as well as the consequent need for adsorption materials for petroleum gas processing.

Some of the main competitors dominating the global adsorbents market include - include Arkema, Honeywell International Inc., Axens, Basf Se, Cabot Corporation, Clariant Ag, W. R. Grace & Co.-Conn, Calgon Carbon Corporation, Zeochem, Jalon, Porocel, Zeolyst International, Haycarb Plc, Fuji Silesia Chemical, Ltd., AGC Chemicals Americas, Interra Global, Graver Technologies, Llc, Silicycle Inc, Kureha Corporation, Molsivcn Adsorbent Co., Ltd, Sorbead India, Hengye Inc, Cilicant, and Zettachem International.

Choose License Type

List of Contents

Market Size And Industry AnalysisAbsorbent OverviewCovid-19 Impact:Key InsightsAbsorbent Growth DriversAbsorbent RestraintsAbsorbent OpportunityAbsorbent ChallengesReport ScopeAbsorbent SegmentationRecent Development:Report Scope:Absorbent Regional LandscapeAbsorbent Competitive LandscapeGlobal Adsorbents Market is segmented as follows:RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed