Advanced Wound Care Market Size, Share, Trends, Growth and Forecast 2034

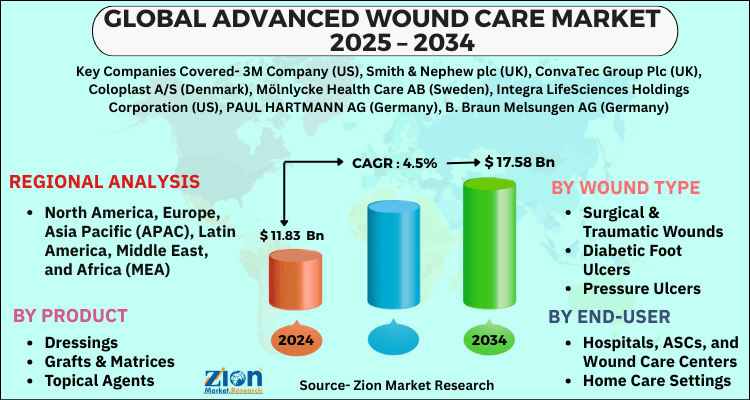

Advanced Wound Care Market By Product (Dressings, Grafts & Matrices, and Topical Agents). By Wound Type (Surgical & Traumatic Wounds, Diabetic Foot Ulcers, Pressure Ulcers, Venous Leg Ulcers, and Burns & Other Wounds). By End Users (Hospitals, ASCs, Wound Care Centers, Home Care Settings, and Other End Users). and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

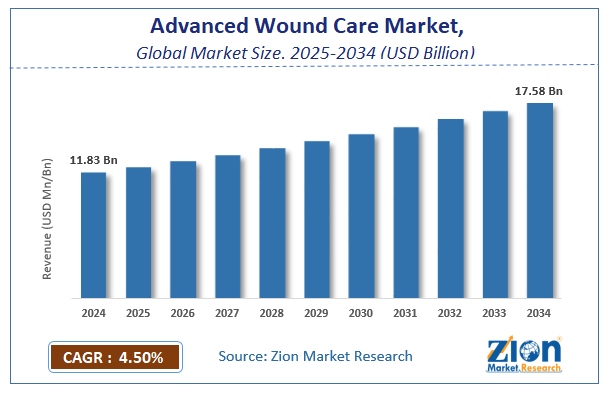

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 11.83 Billion | USD 17.58 Billion | 4.5% | 2024 |

Advanced Wound Care Market: Industry Perspective

The Advanced Wound Care Market was worth around USD 11.83 Billion in 2024 and is estimated to grow to about USD 17.58 Billion by 2034, with a compound annual growth rate (CAGR) of roughly 4.5% between 2025 and 2034. The report analyzes the Advanced Wound Care Market drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the Advanced Wound Care Market.

Advanced Wound Care Market: Overview

Advanced wound care solutions aid in the treatment of diabetic foot ulcers, which are common in diabetic patients. These products aid in the retention of moisture and the quick healing of wounds both inside and topically. The use of advanced wound care products is predicted to expand as the number of diabetic patients increases. Additionally, these medications aid in the absorption of necrotic tissues, which is useful in the treatment of surgical site infections. As a result, healthcare professionals prefer improved wound care products, which is expected to drive market expansion throughout the forecast period.

The constantly increasing frequency of hospital visits for wound treatment will drive up the demand for advanced wound care. The growing frequency of chronic diseases around the world is driving the demand for sophisticated wound care solutions. Moreover, the growing senior population is likely to drive market expansion, as the older population heals slowly. The technical advances in advanced wound care products are expected to have a substantial impact on the advanced wound care market.

Key Insights

- As per the analysis shared by our research analyst, the global advanced wound care market is estimated to grow annually at a CAGR of around 4.5% over the forecast period (2025-2034).

- Regarding revenue, the global advanced wound care market size was valued at around USD 11.83 Billion in 2024 and is projected to reach USD 17.58 Billion by 2034.

- The advanced wound care market is projected to grow at a significant rate due to increasing prevalence of chronic wounds, a growing geriatric population, and technological advancements in wound care products.

- Based on Products, the Dressings segment is expected to lead the global market.

- On the basis of Wound Type, the Surgical & Traumatic Wounds segment is growing at a high rate and will continue to dominate the global market.

- Based on the End Users, the Hospitals segment is projected to swipe the largest market share.

- Based on region, North America is predicted to dominate the global market during the forecast period.

Advanced Wound Care Market: Driver

The increasing prevalence of diseases and disorders that impair wound healing abilities

Wound healing is hampered by physical health issues such as acute wounds, chronic wounds, and surgical wounds. The presence of acute, chronic, and surgical wounds has increased significantly over the last decade, owing primarily to an increase in the global aging population, increasing traumatic wounds, an increase in the number of surgeries, and an increase in the prevalence of conditions such as obesity and diabetes. Diabetes and obesity can increase the overall frequency and complexity of wounds such as infections, ulcerations (leg or foot ulcers), and chronic wounds, all of which require treatment (advanced wound management) and result in high medical expenses.

Advanced wound care treatments such as hydrophilic foam dressings, hydrogels, hydrofibers, and alginates, which can absorb up to 20 times their weight, allow for a faster and more successful recovery from these disorders. Incisions can be used to drain abscesses in most cases. Since incisions on the plantar area heal slowly, patients are immobilized for a longer period of time. This will increase the need for advanced wound management for wound drainage and faster healing, which will increase the demand for advanced wound care products.

Advanced Wound Care Market: Restraint

Advanced wound care products are expensive.

The high cost of chronic wound therapies and advanced wound care products may limit their uptake, particularly in cost-sensitive areas such as Asia and the Rest of the World. In these areas, patients and physicians prefer less expensive advanced wound care products.

However, with increased awareness of the efficacy of these treatments and rising disposable incomes in many of these nations, the use of advanced wound care products is projected to rise in the future years. Although these goods are more expensive than standard gauzes, current studies show that they save money in the long run due to lower labor costs.

Advanced Wound Care Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Advanced Wound Care Market |

| Market Size in 2024 | USD 11.83 Billion |

| Market Forecast in 2034 | USD 17.58 Billion |

| Growth Rate | CAGR of 4.5% |

| Number of Pages | 199 |

| Key Companies Covered | 3M Company (US), Smith & Nephew plc (UK), ConvaTec Group Plc (UK), Coloplast A/S (Denmark), Mölnlycke Health Care AB (Sweden), Integra LifeSciences Holdings Corporation (US), PAUL HARTMANN AG (Germany), B. Braun Melsungen AG (Germany), Cardinal Health Inc, and others. |

| Segments Covered | By Products, By Wound Type, By End Users, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Advanced Wound Care Market: Opportunity

Emerging economies' growth potential

In comparison to Europe and North America, the Asia Pacific and Latin American markets for advanced wound treatment are relatively underdeveloped and offer enormous growth potential. As a result, various players are working on expanding their presence in these locations. Emerging economies such as India, South Korea, Malaysia, and Vietnam, as well as Africa and Middle Eastern countries such as Israel, Saudi Arabia, and the United Arab Emirates, provide considerable growth prospects for major market players.

This is due to reduced regulatory hurdles, advancements in healthcare infrastructure, an increasing patient population, and increased healthcare expenditure. Furthermore, regulatory rules in the Asia Pacific region are more adaptable and business-friendly than in industrialized countries.

Advanced Wound Care Market: Segmentation

The Advanced Wound Care Market is segregated based on Product, Wound Type, and End User.

By Product, the market is classified into Dressings, Grafts & Matrices, and Topical Agents. The dressings sector held the greatest share of the advanced wound care market in the forecast period, owing to rising spending on chronic and surgical wounds, a rise in burn injuries, and technical developments in dressings. The cheaper cost of wound dressings and their great efficiency in wound exudate management is likely to increase their usage.

By Wound Type, the market is classified into Surgical & Traumatic Wounds, Diabetic Foot Ulcers, Pressure Ulcers, Venous Leg Ulcers, and Burns & Other Wounds. In the forecast period, the surgical & traumatic wounds segment held the greatest proportion of the advanced wound care market. This segment's growth is being driven by factors such as an increase in the number of surgical procedures performed and an increase in the prevalence of chronic illnesses. The chronic wounds segment, on the other hand, is predicted to grow at the fastest rate throughout the projection period. The segment's growth is likely to be driven by an increase in the frequency of diabetic foot ulcers, venous pressure ulcers, and other chronic wounds.

By End User, the market is classified into Hospitals, ASCs, Wound Care Centers, Home Care Settings, and Other End Users. The hospitals, ASCs, and wound care centers category held the greatest proportion of the advanced wound care market in the forecast period. The high volume of treatment operations performed in hospitals, as well as the availability of reimbursements, are driving the expansion of this market. Similarly, an increase in the number of procedures performed around the world is aiding the market's momentum. During the projected period, the home healthcare category is expected to grow at the quickest rate. During the COVID-19 pandemic, there was an increase in demand for improved wound care items in-home healthcare. Furthermore, an increase in the senior population is expected to drive improved wound care products even further.

Recent Developments

- In 2020, ConvaMax, a novel superabsorbent wound dressing solution from ConvaTec Group PLC, was introduced. This medication was created to treat wounds that exude a lot of fluid, such as diabetic foot ulcers, pressure ulcers, leg ulcers, and others.

Advanced Wound Care Market: Regional Landscape

In terms of revenue, North America dominated the advanced wound care market throughout the forecast period. Adoption is predicted to increase because of the rising prevalence of acute and chronic wounds, as well as the greater treatment expenses associated with pressure ulcers, diabetic foot ulcers, and surgical wounds. Furthermore, North America's dominance in this industry is due to the presence of acceptable reimbursement rules in the United States and Canada. Furthermore, the expanding geriatric population and the increasing number of chronic wound patients would boost the market's growth rate in this region.

The Asia Pacific market is likely to rise rapidly because of rising per capita healthcare spending. Furthermore, market participants in this region are making significant expenditures, which will boost demand for sophisticated wound treatment products. Furthermore, there is a growing awareness of the availability of chronic wound care, as well as a surge in demand for these goods. Furthermore, increased healthcare expenditure will drive the market's growth rate in this area.

Advanced Wound Care Market: Competitive Landscape

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the advanced wound care market on a global and regional basis.

Some of the main competitors dominating the Advanced Wound Care Market include -

- 3M Company (US)

- Smith & Nephew plc (UK)

- ConvaTec Group Plc (UK)

- Coloplast A/S (Denmark)

- Mölnlycke Health Care AB (Sweden)

- Integra LifeSciences Holdings Corporation (US)

- PAUL HARTMANN AG (Germany)

- B. Braun Melsungen AG (Germany)

- Cardinal Health

- Organogenesis Holdings Inc. (US)

- Misonix

- MiMedx Group

- Zimmer Biomet Holdings

- Lohmann & Rauscher GmbH & Co. KG (Germany)

- DeRoyal Industries

- Medline Industries

- DermaRite Industries

- Kerecis (Iceland)

- Advancis Medical (UK)

- Winner Medical Co.

- Hollister Incorporated (US)

- Mil Laboratories Pvt. Ltd. (India)

- Shield Line (US)

- ZENI MEDICAL (US)

- Carilex Medical (Germany)

- Pensar Medical

- LLC (US)

- Wuhan VSD Medical Science & Technology Co.

- HAROMED B.V. (Belgium).

Advanced Wound Care Market is segmented as follows:

By Product

- Dressings

- Grafts & Matrices

- Topical Agents

By Wound Type

- Surgical & Traumatic Wounds

- Diabetic Foot Ulcers

- Pressure Ulcers

- Venous Leg Ulcers

- Burns & Other Wounds

By End-User

- Hospitals, ASCs, and Wound Care Centers

- Home Care Settings

- Other End Users

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

The global advanced wound care market is expected to grow due to rising prevalence of chronic wounds and diabetes, increasing adoption of innovative wound healing technologies, growing demand for minimally invasive treatments, and advancements in biomaterials and regenerative medicine.

According to a study, the global advanced wound care market size was worth around USD 11.83 Billion in 2024 and is expected to reach USD 17.58 Billion by 2034.

The global advanced wound care market is expected to grow at a CAGR of 4.5% during the forecast period.

North America is expected to dominate the advanced wound care market over the forecast period.

Leading players in the global advanced wound care market include 3M Company (US), Smith & Nephew plc (UK), ConvaTec Group Plc (UK), Coloplast A/S (Denmark), Mölnlycke Health Care AB (Sweden), Integra LifeSciences Holdings Corporation (US), PAUL HARTMANN AG (Germany), B. Braun Melsungen AG (Germany), Cardinal Health Inc, among others.

The report explores crucial aspects of the advanced wound care market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed