Aerostructure Composites Market Size, Share, Trends, Growth and Forecast 2028

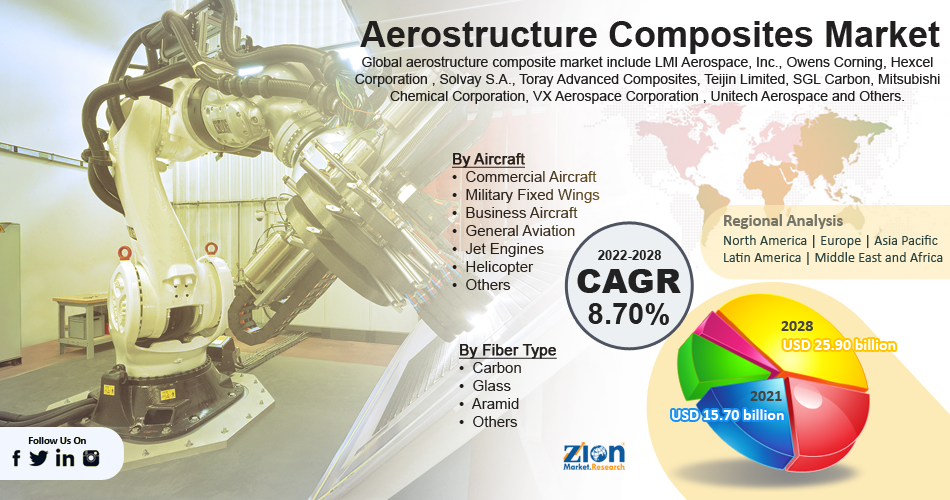

Aerostructure Composites Market By Fiber Type (Carbon Fiber Composites, Aramid Fiber Composites, Glass Fiber Composites, Others), By Aircraft Type (Commercial Aircraft, Business & General Aviation, Helicopter, Military Fixed Wings, Jet Engines and Others), And By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data and Forecasts 2022 - 2028

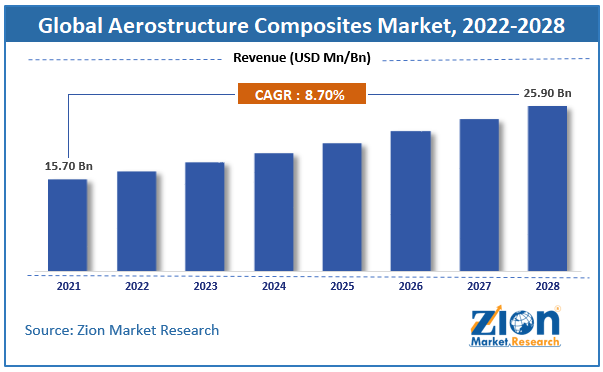

| Market Size in 2021 | Market Forecast in 2028 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 15.70 Billion | USD 25.90 Billion | 8.70% | 2021 |

Aerostructure Composites Industry Prospective:

The global aerostructure composite market size was worth around USD 15.70 billion in 2021 and is estimated to grow to about USD 25.90 billion by 2028, with a compound annual growth rate (CAGR) of approximately 8.70% over the forecast period. The report analyzes the aerostructure composite market drivers, restraints/challenges, and their effect on the demands during the projection period. In addition, the report explores emerging opportunities in the aerostructure composite market.

Aerostructure Composite Market: Overview

The fuselage, the wings, and the flight control surfaces are all examples of aerostructures, which are part of an aircraft's airframe. Recent developments in composite and additive manufacturing methods have changed the dynamics of international aftermarket and airframe requirements. Manufacturing of more lightweight, fewer-component aircraft is now possible because of the development of innovative composite solutions. Technology advancements have also allowed manufacturers to analyze an aircraft's construction using infrared light and computer modeling to determine its performance and longevity. These tests can be used to assess the aerostructures' integrity because they are crucial in guaranteeing that an aircraft can sustain aerodynamic forces. From helicopters and sophisticated combat aircraft to corporate jets and passenger flights, aerostructures are essential to various aircraft. Demand for military aircraft has been rising due to increased spending in the military and defense sector to improve the size of military aircraft fleets and their combat effectiveness in nations around the world. This is another important factor that is anticipated to fuel global aerostructure composite market revenue growth in the future.

Key Insights

- As per the analysis shared by our research analyst, the aerostructure composite market value to grow at a CAGR of 8.70% over the forecast period.

- In terms of revenue, the global aerostructure composite market size was valued at around USD 15.70 billion in 2021 and is projected to reach USD 25.90 billion by 2028.

- The demand for fuel-efficient aeroplanes, as well as the booming space and defense industries, are the major factors driving the growth of the market.

- By aircraft, the military fixed wings category dominated the market in 2021.

- North America dominated the global aerostructure composite market in 2021.

Aerostructure Composite Market: Growth Drivers

Growing demand for air travel around the world to boost the market expansion

In its most recent Global Market Forecast, Airbus predicts that when air traffic starts to reach pre-crisis levels, demand for it will grow. The industry's growth had slowed during the COVID era, but now that passenger traffic has proven its resiliency, it is expected to resume growing at a rate of 3.9% annually. The business predicts that over the next 20 years, the fleet expansion will gradually give way to an accelerated replacement of older, less fuel-efficient aircraft. As a result, nearly 39,000 new passengers and freighter aircraft must be delivered over the next 20 years, 15,250 of which must be replacements for older, less fuel-efficient versions. The market for aerostructure is anticipated to boom as the rise of air travel also does. New materials are invented and developed in aerostructures to significantly reduce the airplane's weight. This lowers fuel consumption and lowers carbon emissions.

Aerostructure Composite Market: Restraints

The high cost of composites, along with other factors such as safety constraints, is restraining the market growth.

The initial cost of the aircraft is further increased by the fact that aerostructure composites are substantially more expensive than metal. Composites are also expensive and challenging to repair, which might hurt the business.

Equipment that is specialized and expensive must be used to find the flaws in the composite structure. Additionally, inspectors must receive specialized training to identify any flaw in the aircraft's composite components, which raises the maintenance expense in addition to expenses for additional tools like rivet guns, bucking bars, and epoxy glue. The aerostructure sector places the highest premium on fire and safety issues. The epoxy resin used in the composites must be carefully chosen and made to prevent the spread of fire in the event of a fire outbreak. Additionally, due to concerns about safety and durability, aerospace composites are less frequently used in long-haul flights, which limits the global aerostructure composite market's expansion.

Aerostructure Composite Market: Opportunities

Adoption of morphing technologies for wings to create lucrative growth avenues for market

The capacity to change shape is called morphing. In engineering, it is useful for various reasons, including adapting to changing external conditions, enhancing interaction with other bodies, and maneuvering in different media like water or air. At various stages of flight, an aircraft's conventional rigid wings cannot function at their maximum efficiency. Engineers may now produce new morphing aircraft wing designs that can change shape while flying, thanks to advances in morphing technology. The primary goal of aircraft designers is to produce a most rigid structure capable of safely withstanding flight circumstances, including elements like high speed, bad weather, and extremes of both hot and low temperatures. To maximize speed, range, and fuel efficiency, aircraft designers strive to make their designs as light as feasible.

Aerostructure Composite Market: Challenges

Uncertainties in failure prediction of composites to pose challenge for market expansion

Due to their high specific strength, stiffness, and material anisotropy, which may be employed to tune structural properties, advanced composite materials are widely used in major aircraft constructions. These composite materials' characteristics are not uniform and can change randomly inside big structures like wings and fuselage. The composite rotor and airframe structures' remaining useful lives are unpredictable due to the intricacy of failure processes and susceptibility to manufacturing flaws that could result in structural damage.

Aerostructure Composite Market: Segmentation

The global aerostructure composite market is segregated based on fiber type, aircraft, and region.

Based on the fiber type, The market is segmented into carbon, glass, aramid, and other fiber types. Carbon fiber is reinforced in a suitable resin system to create a successful composite system. Low thermal expansion, good chemical resistance, high stiffness, low weight, high tensile strength, and high-temperature tolerance are just a few of the excellent qualities of carbon fiber that contribute to its growing popularity in the aerostructure composites business.

Based on the aircraft type, the global aerostructure composite market is segmented into business, general, military fixed-wing, commercial, jet engines, helicopters, and other products. Among these, fixed-wing aircraft led the market in 2021 and is expected to maintain its dominance throughout the forecast period. Less than two-thirds of the aerostructure composites market is dominated by the commercial aerostructure segment. Due to major advancements in the civilian aerospace sector and the replacement of the fleet that is about to retire, the commercial aerospace segment is anticipated to maintain its position. As of January 2020, Boeing had already produced 945 Dreamliner, and over 900 more are still to be delivered to customers. Additionally, manufacturers are anticipated to come up with alternative designs, propelling the aerostructure composites business, given the surge in demand for mid-size commercial aircraft and the success of using composite in their construction. Furthermore, the market is anticipated to grow considerably during the forecast period due to the growing use of composite materials in military aircraft.

Recent Developments

- A joint development agreement (JDA) between Solvay and SGL Carbon was signed in December 2019 to create the first composite materials based on large-tow intermediate modulus (IM) carbon fiber. These resources address the need to lower prices and CO2 emissions and enhance the manufacturing process and commercial aircraft's fuel efficiency.

- Teijin Limited and Boeing reached an agreement in January 2019 to deliver unidirectional pre-impregnated tape (TENAX TPUD). The company's success in the aircraft industry over the long period was aided by this.

- Teijin Limited purchased Renegade Materials Corporation in February 2019, which provided extremely heat-resistant thermoset prepreg to the North American aerospace industry. As a result, the business was better able to maintain its position as a top supplier of solutions for aerospace applications.

Aerostructure Composites Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Aerostructure Composites Market Size Report |

| Market Size in 2021 | USD 15.70 Billion |

| Market Forecast in 2028 | USD 25.90 Billion |

| Growth Rate | CAGR of 8.70% |

| Number of Pages | 230 |

| Forecast Units | Value (USD Billion), and Volume (Units) |

| Key Companies Covered | LMI Aerospace, Inc., Owens Corning, Hexcel Corporation , Solvay S.A., Toray Advanced Composites, Teijin Limited, SGL Carbon, Mitsubishi Chemical Corporation, VX Aerospace Corporation , Unitech Aerospace and Others. |

| Segments Covered | By Fiber Type, By Aircraft, and By Region |

| Base Year | 2021 |

| Historical Year | 2012 to 2017 |

| Forecast Year | 2021 - 2028 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Aerostructure Composite Market: Regional Landscape

North America dominated the aerostructure composite market in 2021

North America dominates the global aerostructure composite market due to the presence of significant aircraft producers and the availability of cutting-edge technology needed to produce aerostructure components in the region. For instance, of the four fuselage portions of the Boeing 787, two are produced in the United States (the nose section in Kansa and the rear section in Charleston). In contrast, two mid-sections are produced in Italy, and one is produced by Kawasaki Heavy Industries in Japan. The United States city of Everett, Washington, is where all these pieces are brought together and connected.

The Asia Pacific is expected to have considerable growth in the future years due to the high growth of the aerostructure industry in the region. To support the expansion of the aerostructure industry in developing nations like China and India, the demand for mid-sized commercial aircraft has greatly expanded. In addition, the increasing spending on fighter jets and the military in nations like India is anticipated to open up attractive potential opportunities for market participants.

Aerostructure Composite Market: Competitive Landscape

The global aerostructure composite market is led by players like:

- LMI Aerospace

- Owens Corning

- Hexcel Corporation

- Solvay S.A.

- Toray Advanced Composites

- Teijin Limited

- SGL Carbon

- Mitsubishi Chemical Corporation

- VX Aerospace Corporation

- Unitech Aerospace and Others.

The global Aerostructure Composite Market is segmented as follows:

By Fiber Type

- Carbon

- Glass

- Aramid

- Others

By Aircraft

- Commercial Aircraft

- Military Fixed Wings

- Business Aircraft

- General Aviation

- Jet Engines

- Helicopter

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The demand for fuel-efficient aeroplanes, as well as the booming space and defense industries, are major factors boosting the market for aerostructure composites.

The aerostructure composite market was worth around USD 15.70 billion in 2021 and is estimated to grow to about USD 25.90 billion by 2028, with a compound annual growth rate (CAGR) of approximately 8.70% over the forecast period.

North America leads the global market of aerostructure composites strongly backed by the presence of major aircraft manufacturers and the availability of technological advancement required for manufacturing aerostructure component in the region.

Key players functioning in the aerostructure composite market include LMI Aerospace, Inc., Owens Corning, Hexcel Corporation , Solvay S.A., Toray Advanced Composites, Teijin Limited, SGL Carbon, Mitsubishi Chemical Corporation, VX Aerospace Corporation , Unitech Aerospace and Others

Choose License Type

List of Contents

Aerostructure CompositesIndustry Prospective:Aerostructure Composite OverviewKey InsightsAerostructure Composite Growth DriversAerostructure Composite RestraintsAerostructure Composite OpportunitiesAerostructure Composite ChallengesAerostructure Composite SegmentationRecent DevelopmentsMarket:Report ScopeAerostructure Composite Regional LandscapeAerostructure Composite Competitive LandscapeRelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed