Agricultural Robots Market Size, Share, Trends, Growth 2030

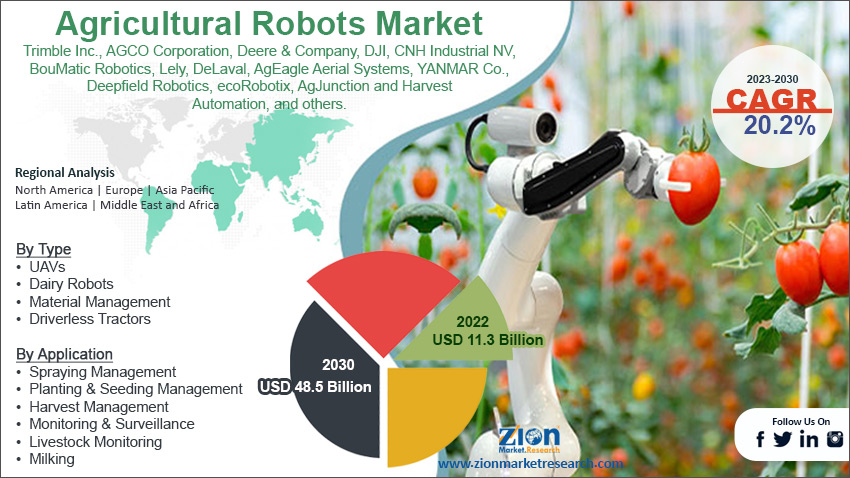

Agricultural Robots Market By Offering (Software, Hardware and Service), By Type (UAVs, Dairy Robots, Material Management and Driverless Tractors), By Application (Spraying Management, Planting & Seeding Management, Harvest Management, Monitoring & Surveillance, Livestock Monitoring, Milking and Others) and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2023 - 2030

| Market Size in 2022 | Market Forecast in 2030 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 11.3 Billion | USD 48.5 Billion | 20.2% | 2022 |

Agricultural Robots Industry Prospective:

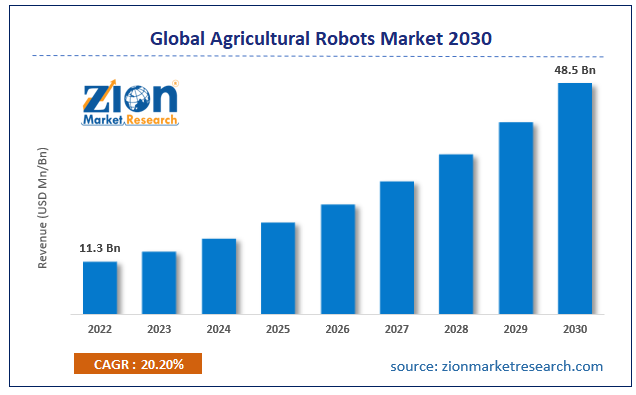

The global Agricultural Robots market size was worth around USD 11.3 billion in 2022 and is predicted to grow to around USD 48.5 billion by 2030 with a compound annual growth rate (CAGR) of roughly 20.2% between 2023 and 2030.

Agricultural Robots Market: Overview

Agricultural robots, often known as agribots, are specialized devices used in the agricultural business to execute a variety of activities. These robots are outfitted with cutting-edge technology and capabilities that allow them to perform specialized agricultural tasks autonomously or with minimum human assistance. They are used for a variety of tasks like planting, seeding, weeding, harvesting, and crop monitoring. They are built to travel fields, function in a variety of weather situations, and interact with plants and soil. These robots may be taught to do jobs effectively and correctly, contributing to higher agricultural output and lower labor costs. The functioning of these robots varies according to their intended use.

Planting robots, for example, employ precise procedures to spread seeds at ideal depths and spacing, assuring uniform growth. Weeding robots use computer vision and machine learning algorithms to locate and eliminate weeds while minimizing crop damage. Harvesting robots include sensors and robotic arms that allow them to select and collect ripe fruits and vegetables.

Key Insights

- As per the analysis shared by our research analyst, the global Agricultural Robots market is estimated to grow annually at a CAGR of around 20.2% over the forecast period (2023-2030).

- In terms of revenue, the global Agricultural Robots market size was valued at around USD 11.3 billion in 2022 and is projected to reach USD 48.5 billion, by 2030.

- The growing labor cost is expected to propel the market growth during the forecast period.

- Based on the offering, the hardware segment is expected to dominate the agriculture robot industry over the projected period.

- Based on the type, the Dairy Robots segment is expected to hold a significant market share during the forecast period.

- Based on the application, the Planting & Seeding Management segment is expected to capture a significant market share during the forecast period.

- Based on region, North America is expected to dominate the market during the forecast period.

Request Free Sample

Request Free Sample

Agricultural Robots Market: Growth Drivers

Technological advancement drives market growth

Automation, artificial intelligence, and robotics are developing at a rapid pace, which is propelling the use of agribots. These technologies have greatly enhanced the capabilities of agricultural robots, making them more adaptable, efficient, and economical. For instance, the combination of computer vision and machine learning algorithms enables robots to distinguish between crops and weeds, allowing for targeted and precise weed control.

Robots can navigate fields and avoid obstacles with the help of navigation systems and sensors. The availability of sophisticated sensors, like cameras and multispectral imaging, provides real-time data for crop monitoring and optimization. These technological advancements make agricultural robots more capable of carrying out complex tasks and making decisions, which is propelling the adoption of agribots.

Agricultural Robots Market: Restraints

High initial investment hampers market growth

A major obstacle for many farmers may be the initial expenses associated with the procurement and application of agricultural robot technology. Particularly for small and resource-constrained agricultural businesses, adoption may be hampered by high initial investment costs.

For instance, the majority of farmers cannot afford the average fruit-picking harvesting robot, which typically costs between USD 250,000 and USD 750,000. Due to the exorbitant costs, several businesses are thinking about leasing their robots to clients rather than expecting full payment.

Agricultural Robots Market: Opportunities

Growing funding provides a lucrative opportunity for market growth

The growing funding is expected to offer a lucrative opportunity for market growth during the forecast period. For instance, in October 2023, Mark Spencer declared that £12.5 million in government financing would be distributed among 19 creative initiatives using automation and robotic technology to increase productivity, food security, and sustainable agricultural methods. With this announcement, the government has committed £120 million in total since 2021 to support industry-led research and development in horticulture and agriculture.

A new system to digitally map and monitor vineyards using drones, robots, and sensors is being developed as part of the Farming Futures Automation and Robotics competition. Other projects include the development of a navigation system for field-based robotic vehicles to improve accuracy and reliability and enable safe navigation in farmyard and field operations. All of these projects are funded by the competition.

Agricultural Robots Market: Challenges

The complexity of integration poses a major challenge to market growth

Integrating robotics into traditional farming processes may necessitate infrastructural and workflow improvements. The complexity of combining modern technology with existing farming processes might present difficulties and hinder acceptance. Thus, the complexity of integration might pose a major challenge to the agriculture robots industry expansion.

Agricultural Robots Market: Segmentation

The Global Agricultural Robots industry is segmented based on the offering, type, application and region.

Based on the offering, the global agricultural robots market is bifurcated into Software, Hardware and Service. The hardware segment is expected to dominate the agriculture robot industry over the projected period. The hardware sector is essential to the agricultural robotics industry since it provides the foundation for these cutting-edge farming solutions. It includes the hardware—motors, batteries, and other mechanical parts—that allows robots to carry out a variety of activities in agricultural environments. The fact that farm robot components are capital-intensive is another element in the hardware segment's dominance. Research, development, and manufacturing costs associated with producing high-quality hardware are costly. Due to their complexity, hardware components frequently require sophisticated technical knowledge, exacting production procedures, and stringent quality control procedures. Because they have the financial and technological means to invest in hardware development, well-established firms like GEA Group and CLAAS KGaA mbH have a competitive advantage that contributes to their dominance in the market.

Based on the type, the global agricultural robots industry is categorized into UAVs, Dairy Robots, Material Management and Driverless Tractors. The Dairy Robots segment is expected to hold a significant market share during the forecast period. The growing number of dairy producers around the world is a major element fueling this development. More farmers are entering the dairy sector to fulfil the increasing demand from consumers as the need for dairy products continues to expand on a worldwide scale. However, there are drawbacks to this boom in dairy farming as well, such as the requirement for labor-saving and effective solutions. For instance, according to figures released by the International Dairy Federation (IDF), there will be almost 133 million dairy farms in the world in 2021. In addition, the dairy business on a worldwide scale trades around 9% of the world's milk produced annually.

Based on the application, the global agricultural robots industry is segmented into Spraying Management, Planting & Seeding Management, Harvest Management, Monitoring & Surveillance, Livestock Monitoring, Milking and Others. The Planting & Seeding Management segment is expected to capture a significant market share during the forecast period. Technological developments are one of the main causes that have contributed to this rise, among other important considerations. As automation, robotics, and artificial intelligence technologies continue to advance, agricultural robots have grown in capability and effectiveness.

Agricultural Robots Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Agricultural Robots Market |

| Market Size in 2022 | USD 11.3 Billion |

| Market Forecast in 2030 | USD 48.5 Billion |

| Growth Rate | CAGR of 20.2% |

| Number of Pages | 208 |

| Key Companies Covered | Trimble Inc., AGCO Corporation, Deere & Company, DJI, CNH Industrial NV, BouMatic Robotics, Lely, DeLaval, AgEagle Aerial Systems, YANMAR Co., Deepfield Robotics, ecoRobotix, AgJunction and Harvest Automation, and others. |

| Segments Covered | By Offering, By Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2022 |

| Historical Year | 2017 to 2021 |

| Forecast Year | 2023 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Regional Analysis

North America is expected to dominate the Agricultural Robots market during the forecast period

North America is expected to dominate the Agricultural Robots industry during the forecast period. The substantial quantity of agriculture in the area is one important element. For instance, according to statistics released by the US Department of Agriculture in February 2022, the average farm size in 2021 was 445 acres, which was somewhat larger than the 444 acres recorded in the year prior. Because North America has among of the biggest average agricultural sizes worldwide, manual maintenance and monitoring may be extremely difficult and resource-intensive. North American farmers have embraced agricultural robots and automation technology rapidly to overcome this obstacle, hoping to increase crop yields and efficiency.

Furthermore, the area gains from having easy access to cutting-edge agricultural technologies. A thriving network of digital firms, academic institutions, and agriculturally-focused innovation hubs exists in North America. Innovative agricultural robotics solutions are developed and used more easily in this conducive setting. Furthermore, North America's strong dedication to precision and sustainable agricultural techniques has increased demand for precision agriculture instruments such as robotic harvesters, drones, and autonomous tractors. Because of its large acreage and easy availability of cutting-edge technologies, North America is the global leader in terms of revenue. The region has seen significant expansion in this industry.

Agricultural Robots Market: Competitive Analysis

The global agricultural robots market is dominated by players like:

- Trimble Inc.

- AGCO Corporation

- Deere & Company

- DJI

- CNH Industrial NV

- BouMatic Robotics

- Lely

- DeLaval

- AgEagle Aerial Systems

- YANMAR Co.

- Deepfield Robotics

- ecoRobotix

- AgJunction and Harvest Automation

The global Agricultural Robots market is segmented as follows:

By Offering

- Software

- Hardware

- Service

By Type

- UAVs

- Dairy Robots

- Material Management

- Driverless Tractors

By Application

- Spraying Management

- Planting & Seeding Management

- Harvest Management

- Monitoring & Surveillance

- Livestock Monitoring

- Milking

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Agricultural robots, often known as agribots, are specialized devices used in the agricultural business to execute a variety of activities. These robots are outfitted with cutting-edge technology and capabilities that allow them to perform specialized agricultural tasks autonomously or with minimum human assistance.

The Agricultural Robots market is driven by several factors including growing labor costs, rising technological advancements, rising funding, growing product launch, increasing demand for food and many others.

According to the report, the global market size was worth around USD 11.3 billion in 2022 and is predicted to grow to around USD 48.5 billion by 2030.

The global Agricultural Robots market is expected to grow at a CAGR of 20.2% during the forecast period.

The global Agricultural Robots market growth is expected to be driven by North America. It is currently the world’s highest revenue-generating market due to the growing investment.

The global Agricultural Robots market is dominated by players like Trimble Inc., AGCO Corporation, Deere & Company, DJI, CNH Industrial NV, BouMatic Robotics, Lely, DeLaval, AgEagle Aerial Systems, YANMAR Co., Deepfield Robotics, ecoRobotix, AgJunction and Harvest Automation among others.

The Agricultural Robots market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed