Agricultural Tractors Market Size, Share, Growth Report 2032

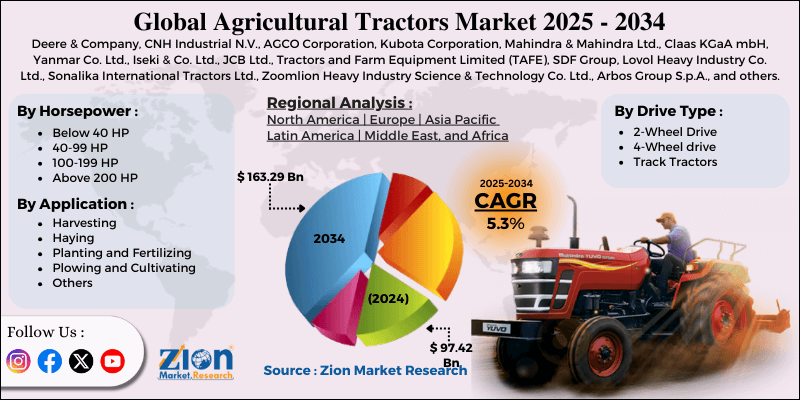

Agricultural Tractors Market By Horsepower (Below 40 HP, 40-99 HP, 100-199 HP, and Above 200 HP), By Drive Type (2-Wheel Drive, 4-Wheel Drive, and Track Tractors), By Application (Harvesting, Haying, Planting and Fertilizing, Plowing and Cultivating, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

Agricultural Tractors Industry Prospective:

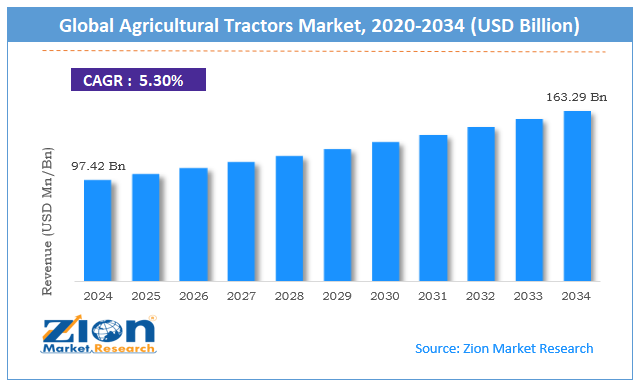

The global agricultural tractors market was valued at approximately USD 97.42 billion in 2024 and is expected to reach around USD 163.29 billion by 2034, growing at a compound annual growth rate (CAGR) of roughly 5.30% between 2025 and 2034.

Agricultural Tractors Market: Overview

Agricultural tractors are powerful, versatile farm vehicles designed to pull implements and power farming equipment and perform various field operations ranging from soil cultivation to harvesting, serving as the primary mechanical workhorses of modern agriculture. The market consists of diverse products, from small utility tractors used in specialty farming to large articulated tractors employed in extensive commercial operations.

Modern agricultural tractors have come a long way from their mechanical predecessors. They now have features like GPS guidance systems, precision farming, auto steering, and integrated data management platforms to increase productivity, efficiency, and sustainability.

The growing demand for food production to support an expanding global population, increasing adoption of mechanized farming practices, and technological advancements in tractor design and functionality drive substantial growth in the agricultural tractors market.

Key Insights:

- As per the analysis shared by our research analyst, the global agricultural tractors market is estimated to grow annually at a CAGR of around 5.30% over the forecast period (2025-2034)

- In terms of revenue, the global agricultural tractors market size was valued at around USD 97.42 billion in 2024 and is projected to reach USD 163.29 billion by 2034.

- The agricultural tractors market is projected to grow significantly due to government subsidies for farm mechanization, rising labor shortages in agriculture, increasing awareness of precision farming benefits, and expanding rural infrastructure that supports equipment accessibility.

- Based on horsepower, the 40-99 HP segment leads and will continue to dominate the global market.

- Based on drive type, 2-wheel drive tractors represent the largest segment by volume.

- Based on the application, plowing and cultivating continue to lead in market share.

- Based on region, Asia Pacific dominates the global market during the forecast period.

Agricultural Tractors Market: Growth Drivers

Increasing global food demand and farm mechanization

The global population continues to grow steadily, creating a heightened demand for agricultural output and efficiency. Farmers are turning to mechanization to increase productivity and address labor shortages in rural areas. Government subsidies and favorable financing options have accelerated tractor adoption, especially in developing agricultural economies. Larger farms in some regions require more powerful and efficient machines to maintain productivity.

Research in the agricultural tractors market shows that mechanization can increase farm productivity and reduce input costs, creating a compelling economic case for adoption. Climate variability and unpredictable weather patterns also prompt farmers to invest in reliable, high-performance tractors to ensure timely planting and harvesting.

Technological advancements and the integration of smart farming

The global agricultural tractor industry is being transformed by technology, with manufacturers incorporating digital systems and automation to improve performance, efficiency, and operator experience.

Precision agriculture features like GPS-guided auto-steering systems are becoming standard in medium to high-range tractors, improving accuracy and reducing operator fatigue. Telematics and IoT integration allow real-time monitoring of tractor performance, maintenance needs, and operational analytics to optimize farm operations.

Advanced transmission systems and power management technologies have improved fuel efficiency and reduced emissions while maintaining or improving performance. Hybrid and electric power systems are emerging in smaller tractors to address sustainability concerns and potential cost savings.

Agricultural Tractors Market: Restraints

High initial investment and maintenance costs

The global agricultural tractors market faces significant challenges related to affordability, particularly for small and medium-sized farmers who constitute a large portion of the global agricultural community. The initial purchase price of modern tractors with advanced technologies represents a substantial investment that many farmers find difficult to justify, especially in regions with volatile agricultural commodity prices.

Maintenance and repair costs keep rising as tractors become more complex and have specialized parts requiring technical know-how and genuine parts. Financing is limited in developing agricultural economies despite the productivity benefits tractors offer.

Economic uncertainty in many agricultural areas due to climate variability, trade issues, and market fluctuations can delay investment in farm equipment.

Agricultural Tractors Market: Opportunities

Precision agriculture and autonomous farming solutions

The growing emphasis on precision in agricultural operations presents opportunities in the agricultural tractors market, with farmers increasingly seeking equipment that enables data-driven, optimized farming practices.

Autonomous tractor technologies are advancing rapidly, with semi-autonomous features already available. Integration with farm management software and IoT platforms creates a solution beyond the tractor to optimize the entire farming operation.

Retrofit kits for automation and precision agriculture capabilities can upgrade older equipment, expanding the market to the existing tractor fleet. Subscription models for advanced features are emerging, so farmers can access advanced features without buying premium equipment upfront.

Agricultural Tractors Market: Challenges

Regulatory compliance and environmental concerns

Global agricultural tractor manufacturers face challenges from emissions regulations and sustainability requirements that necessitate research and development investment and manufacturing adaptations. Complex emission standards across different markets create compliance challenges for global manufacturers seeking economies of scale in production.

The transition toward lower-emission engines has increased production costs, which manufacturers must either absorb or pass on to consumers who may resist price increases. Technical challenges in maintaining performance while meeting emissions requirements have led to more complex engine designs and after-treatment systems that can impact reliability and user experience.

Evolving regulations around autonomous operations and safety features create additional compliance requirements in the advanced agricultural tractors market.

Agricultural Tractors Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Agricultural Tractors Market |

| Market Size in 2024 | USD 97.42 Billion |

| Market Forecast in 2034 | USD 163.29 Billion |

| Growth Rate | CAGR of 5.30% |

| Number of Pages | 212 |

| Key Companies Covered | Deere & Company, CNH Industrial N.V., AGCO Corporation, Kubota Corporation, Mahindra & Mahindra Ltd., Claas KGaA mbH, Yanmar Co. Ltd., Iseki & Co. Ltd., JCB Ltd., Tractors and Farm Equipment Limited (TAFE), SDF Group, Lovol Heavy Industry Co. Ltd., Sonalika International Tractors Ltd., Zoomlion Heavy Industry Science & Technology Co. Ltd., Arbos Group S.p.A., and others. |

| Segments Covered | By Horsepower, By Drive Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Agricultural Tractors Market: Segmentation

The global agricultural tractors market is segmented into horsepower, drive type, application, and region.

Based on horsepower, the market is segregated into below 40 HP, 40-99 HP, 100-199 HP, and above 200 HP. The 40-99 HP segment leads the market because it offers an ideal balance between power and affordability, making it suitable for both small and medium-sized farms engaged in a variety of cropping and field preparation activities.

Based on drive type, the agricultural tractors industry is divided into 2-wheel drive, 4-wheel drive, and track tractors. 2-wheel drive tractors have the largest market share due to their lower cost and suitability for many standard farming operations in favorable terrain conditions.

Based on application, the market is categorized into harvesting, haying, planting and fertilizing, plowing and cultivating, and others. Plowing and cultivating applications are expected to lead the market during the forecast period due to their fundamental role in crop production and soil preparation.

Agricultural Tractors Market: Regional Analysis

Asia Pacific to lead the market

The Asia Pacific leads the global agricultural tractors market, driven by the region's vast agricultural lands, governmental support for farm mechanization, and the presence of major manufacturing hubs. Countries like India and China have small to medium-sized farming operations transitioning to mechanization; hence, there is a huge demand for small and medium-sized tractors.

The region has local manufacturing by both domestic and international brands; therefore, competitive pricing and models tailored to regional farming practices are in demand. Government subsidies and agricultural development programs promote tractor adoption to improve productivity and address rural labor shortages.

Rising farm incomes in certain areas have enabled farmers to invest in higher-specification machines with advanced features. Local innovation has resulted in tractors specifically designed for regional crops, field conditions, and farming practices that meet the unique requirements of Asia Pacific agriculture.

The rapid digitalization of farming practices across the region has also spurred demand for tractors with integrated smart technology features, allowing even smaller operations to benefit from precision agriculture capabilities previously available only to large commercial farms.

North America is expected to show steady growth

North America is a growing agricultural tractors market with a strong demand for high-horsepower, technologically advanced models driven by the region's large-scale commercial farming operations. The United States and Canada have some of the world's largest average farm sizes, driving demand for powerful machinery capable of covering large acres.

Farmers in the region show high adoption rates for precision agriculture technologies, creating premium market segments for advanced, feature-rich tractors. The well-established dealer network provides comprehensive sales and aftermarket support, reinforcing brand loyalty and enabling effective distribution.

Replacement cycles are relatively stable, creating predictable demand patterns despite market maturity. During periods of strong agricultural commodity prices, farmers typically accelerate replacement cycles and upgrade to more advanced models.

Recent Market Developments:

- In January 2025, John Deere introduced an autonomous electric tractor model designed for specialty crop operations, featuring advanced obstacle detection and zero emissions operation.

- In March 2025, AGCO Corporation launched a comprehensive precision agriculture suite integrating tractor operations with farm management software through enhanced connectivity and data integration capabilities.

Agricultural Tractors Market: Competitive Analysis

Players lead the global agricultural tractors market like:

- Deere & Company

- CNH Industrial N.V.

- AGCO Corporation

- Kubota Corporation

- Mahindra & Mahindra Ltd.

- Claas KGaA mbH

- Yanmar Co. Ltd.

- Iseki & Co. Ltd.

- JCB Ltd.

- Tractors and Farm Equipment Limited (TAFE)

- SDF Group

- Lovol Heavy Industry Co. Ltd.

- Sonalika International Tractors Ltd.

- Zoomlion Heavy Industry Science & Technology Co. Ltd.

- Arbos Group S.p.A.

The global agricultural tractors market is segmented as follows:

By Horsepower

- Below 40 HP

- 40-99 HP

- 100-199 HP

- Above 200 HP

By Drive Type

- 2-Wheel Drive

- 4-Wheel drive

- Track Tractors

By Application

- Harvesting

- Haying

- Planting and Fertilizing

- Plowing and Cultivating

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Agricultural tractors are powerful, versatile farm vehicles designed to pull implements and power farming equipment and perform various field operations ranging from soil cultivation to harvesting, serving as the primary mechanical workhorses of modern agriculture.

The agricultural tractors market is expected to be driven by increasing food demand from a growing global population, technological advancements in precision farming, government subsidies for farm mechanization, labor shortages in agricultural regions, and the development of electric and autonomous tractor models.

According to our study, the global agricultural tractors market was worth around USD 97.42 billion in 2024 and is predicted to grow to around USD 163.29 billion by 2034.

The CAGR value of the agricultural tractors market is expected to be around 5.30% during 2025-2034.

The global agricultural tractors market will register the highest value in Asia Pacific during the forecast period, with North America showing stable growth in the high-horsepower segments.

Key players in the agricultural tractors market include Deere & Company, CNH Industrial N.V., AGCO Corporation, Kubota Corporation, Mahindra & Mahindra Ltd., Claas KGaA mbH, Yanmar Co., Ltd., Iseki & Co., Ltd., JCB Ltd., Tractors and Farm Equipment Limited (TAFE), SDF Group, Lovol Heavy Industry Co., Ltd., Sonalika International Tractors Ltd., Zoomlion Heavy Industry Science & Technology Co., Ltd., and Arbos Group S.p.A.

The report comprehensively analyzes the agricultural tractors market, including a detailed examination of market drivers, restraints, emerging trends, regional dynamics, and future growth opportunities. It also examines competitive dynamics, technological innovations, and the evolving farming practices shaping the agricultural tractors industry worldwide.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed