Agriculture Equipment Market Size, Share, Trends, Growth 2030

Agriculture Equipment Market By Product (Tractors, Harvesters, Planting Equipment, Irrigation & Crop Processing Equipment, Spraying Equipment, Hay & Forage Equipment, and Others), By Application (Land Development & Seed Bed Preparation, Sowing & Planting, Weed Cultivation, Plant Protection, Harvesting & Threshing, and Post-harvest & Agro-processing) and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2022 - 2030

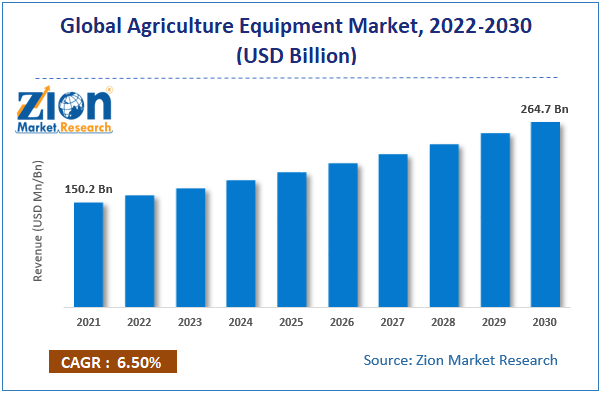

| Market Size in 2021 | Market Forecast in 2030 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 150.2 Billion | USD 264.7 Billion | 6.5% | 2021 |

Agriculture Equipment Industry Prospective:

The global agriculture equipment market size was worth around USD 150.2 billion in 2021 and is predicted to grow to around USD 264.7 billion by 2030 with a compound annual growth rate (CAGR) of roughly 6.5% between 2022 and 2030.

The report analyzes the global agriculture equipment market’s drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the agriculture equipment market.

Agriculture Equipment Market: Overview

Agriculture equipment makes farming more efficient and profitable. It also makes farming easier. It raises crop quality and lowers labor costs. The hand sickle, axe, hoe, shovel and spade, and pickaxe are examples of farming implements. To increase the farming device's efficiency, several producers of agricultural equipment are working on integrating a variety of systems, including GPS, Robotic Systems, and Google Earth. New agricultural techniques are also replacing old farming practices like plowing, tilling, and seeding, which will further increase the lucrative demand for the commodity over the coming years. In addition, modern farming equipment such as harvesters, hay and forage equipment, crop & irrigation processing devices, and sprayers are used in a variety of farming operations to increase the yield of high-quality crops.

Key Insights

- As per the analysis shared by our research analyst, the global agriculture equipment market is estimated to grow annually at a CAGR of around 6.5% over the forecast period (2022-2030).

- In terms of revenue, the global agriculture equipment market size was valued at around USD 150.2 billion in 2021 and is projected to reach USD 264.7 billion, by 2030.

- The growing demand for mechanizing agricultural activities, supportive government programs, and the expanding use of modern agricultural methods are driving the expansion of the agriculture equipment industry.

- Based on the product, the tractor segment held the largest market share in 2021.

- Based on the application, land development & seed bed preparation are expected to dominate the market over the forecast period.

- Based on region, the Asia Pacific region is expected to dominate the market during the forecast period.

To know more about this report, request a sample copy.

Agriculture Equipment Market: Growth Drivers

Government Support with Farm Loan Waivers/ Credit Finance to drive the market growth

Farm loan waiver programs encourage farmers to purchase agricultural equipment. Governments around the world introduced several programs to free farmers from debt and promote farm mechanization. For instance, according to the Organization for Economic Co-operation and Development's (OECD) 2019 Agricultural Policy Monitoring and Evaluation, farm policies in 53 countries—all OECD, EU countries, and 12 significant emerging economies—provided direct support to farmers worth an average of USD 728 billion annually from 2018 to 2020.

Moreover, the Mahatma Phule Farm Loan Waiver Scheme was introduced by the Maharashtra (India) government in December 2019. A program called the Maharashtra Agro Business Network Project (Magnet) for small and marginal fruit and vegetable growers was also announced in March 2021. Thus, the growing government initiative to support farmers is expected to drive the global agricultural equipment market growth over the forecast period.

Agriculture Equipment Market: Restraints

Growth of the rental market to limit the market growth

The largest portion of the global rental industry is accounted for by the purchase of farm equipment like tractors and harvesters, which is a significant investment in agricultural activities. The cost of the equipment made available to farmers reflects the significant investments required throughout the entire design, production, and distribution process.

The poor penetration of farm equipment in developing nations is due to small farmers' inability to invest a large sum. Farmers choose to hire farm equipment to speed up production and turnaround times, which boosts the effectiveness and profitability of the enterprise. Compared to financing the purchase of the equipment through a regular loan from a financial institution, renting farm equipment is more affordable. Farm equipment rental businesses have been pushed by the worldwide shortage of farm manpower and rising labor costs. Therefore, increasing rental market is expected to hamper the market growth over the forecast period.

Agriculture Equipment Market: Opportunities

Increasing technological advancements in agriculture equipment are expected to provide lucrative opportunities for the market expansion

The increasing technological advancements in agriculture equipment is expected to provide lucrative opportunity for market expansion during the forecast period. The market is driven by extensive innovation, capital investments, and the spread of numerous agricultural technologies. The farmer benefits from the innovations in planting and harvesting machinery brought about by big data, AI, and IoT. For instance, in April 2021, the artificial intelligence combine harvester from Zoomlion slowly rolled off the designated manufacturing line in the Kaifeng Industrial Park, signaling the transition of the product from experimental verification to full mass production.

Agriculture Equipment Market: Challenges

Changing emission norms act as a major challenge for the market growth

The changing emission norms act as a major challenge for the global agriculture equipment market growth over the forecast period. Companies like CNH Industrial, John Deere, and AGCO have stated their worries about pollution laws around the world. The adoption of emission standards may restrict the sales of agricultural and construction equipment. Changes to emission rules necessitate considerable R&D expenditures. Each market has its emission standards, which make it more difficult to design components, particularly engines. Thus, act as a major restraint.

Agriculture Equipment Market: Segmentation

The global agriculture equipment market is segmented based on product, application and region

Based on product, the global market is bifurcated into tractors, harvesters, planting equipment, irrigation & crop processing equipment, spraying equipment, hay & forage equipment and others. The tractor segment accounted for the largest market share in 2021 and is expected to continue this pattern over the forecast period. Tractors are necessary for boosting productivity in the agricultural sector due to a lack of workers and a growing population to meet the world's food needs. The rise has also been boosted by the promotion of farm mechanization and the expanding use of precision farming in regions like the Asia Pacific and Latin America. For market players, the advent of electric tractors is expected to represent a considerable growth opportunity. The growth is attributed to the electric tractors' cost-effectiveness as well as their great efficiency and environmental friendliness. Thus, driving the segment growth over the forecast period.

Based on the application, the global agriculture equipment is categorized into land development & seed bed preparation, sowing & planting, weed cultivation, plant protection, harvesting & threshing and post-harvest & agro-processing. The land development & seed bed preparation segment is expected to dominate the market during the forecast period. Tractors, levelers, and agricultural implements are all included in the segment. Due to several factors, including the need for more food increasing the need for mechanized farming, the availability of technologically improved tractors, and increased urbanization leading to a labor crisis compelling farmers to embrace technology, the demand for agricultural tractors is on the rise. It is believed that this will help the market growth.

Recent Developments:

- In July 2022, Heartland Ag Systems, Heartland Solutions, and related affiliates ("Heartland"), the largest Case IH Application Equipment distributorship in North America offering application-focused solutions for commercial applicators, has been acquired by Titan Machinery Inc., a leading network of full-service agricultural and construction equipment stores. Both in terms of scale and strategic fit, this acquisition is significant for Titan Machinery. The ability to access the entire Case IH application equipment product line, including self-propelled sprayers and fertilizer applicators, as well as additional sales opportunities to bundle with tractors, tillage, and construction equipment for the commercial application customer, is of the utmost importance. Titan Machinery, Heartland, Case IH, and the hundreds of commercial application providers in their core markets will all benefit from the increased parts, service, and technical capabilities they bring to the commercial application customers in their highly productive core Agriculture footprint. These capabilities will also be complemented by the long-standing business relationships Heartland has built with commercial application customers.

- In May 2022, JCA Industries, a pioneer in the development of autonomous software for agricultural equipment, implement controls, and electronic system components were acquired by AGCO, a global manufacturer and distributor of agricultural machinery and precision Ag technology. This acquisition will speed AGCO's supply of machine automation and autonomous systems that increase farmer productivity. JCA is one of the most innovative developers of autonomous machine technology for off-road OEMs.

Agriculture Equipment Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Agriculture Equipment Market Research Report |

| Market Size in 2021 | USD 150.2 Billion |

| Market Forecast in 2030 | USD 264.7 Billion |

| Compound Annual Growth Rate | CAGR of 6.5% |

| Number of Pages | 187 |

| Forecast Units | Value (USD Billion), and Volume (Units) |

| Key Companies Covered | Alamo Group Inc., AGCO Corporation, Argo Tractors S.p.A., Bucher, CNH Industrial N.V., Deere & Company, Escorts Limited, KUBOTA Corporation, Mahindra & Mahindra Ltd, YANMAR HOLDINGS Co., Ltd., CLAAS KGaA mbH, ZETOR TRACTORS a.s., Valmont Industries, Inc., JCB, among others. |

| Segments Covered | By Product, By Application, And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East and Africa (MEA) |

| Countries Covered | North America: U.S and Canada Europe: Germany, Italy, Russia, U.K, Spain, France, Rest of Europe APAC: China, Australia, Japan, India, South Korea, South East Asia, Rest of Asia Pacific Latin America: Brazil, Argentina, Chile The Middle East And Africa: South Africa, GCC, Rest of MEA |

| Base Year | 2021 |

| Historical Year | 2016 to 2020 |

| Forecast Year | 2022 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Agriculture Equipment Market: Regional Analysis

The Asia Pacific region is expected to hold a significant market share over the forecast period

The Asia Pacific region is expected to hold a significant global agriculture equipment market share over the forecast period. The growth in the region is attributed to the increased funding by the governments for farm mechanization and the innovative product launch by the key players in the region. For instance, for a variety of crops, including rice, wheat, corn, potatoes, oilseed rapeseed, cotton, and sugarcane, the Chinese government is boosting farm mechanization.

More than USD 2.87 billion as central government subsidies for the purchase of agricultural machinery were provided by the Chinese Ministry of Finance in 2020. By 2025, China wants to have fully mechanized the plowing, planting, and harvesting of its crops. Moreover, in October 2021, the Yuvo Tech+ tractor line was introduced by Mahindra & Mahindra's Farm Equipment Sector, which is a division of the Mahindra Group and the largest volume producer of tractors in the world. Yuvo Tech+ 275 (27.6 kW-37 HP), Yuvo Tech+ 405 (29.1 kW-39 HP), and Yuvo Tech+ 415 are the three kinds of tractors that will be offered (31.33 kW-42 HP).

Additionally, due to the government's expanding subsidies, India is becoming one of the Asia Pacific region's fastest-growing markets. Considering that agriculture accounts for a sizable portion of the nation's GDP, the government is putting a lot of effort towards mechanizing agriculture through a variety of programs. For instance, the Indian government announced a 50% to 80% subsidy on buying agricultural machinery through the PM Kisan Samman Yojana programme. This will support the nation's market expansion.

Besides, the North American region is expected to grow at the fastest CAGR during the forecast period. Large tracts of unexplored farmland are a major factor in the rise, which has increased the need for farm mechanization. Additionally, the usage of intelligent combine harvesters outfitted with monitoring technologies to boost farm production is growing in the region. Growing demand for high-capacity machinery due to large farms, rising labor costs, the integration of robotic systems and Global Positioning Systems (GPS) in tractors and harvesters, and the increasing popularity of self-propelled machines are all predicted to propel regional market growth over the forecast period.

Agriculture Equipment Market: Competitive Analysis

The global agriculture equipment market is dominated by players like

- Alamo Group Inc.

- AGCO Corporation

- Argo Tractors S.p.A.

- Bucher

- CNH Industrial N.V.

- Deere & Company

- Escorts Limited

- KUBOTA Corporation

- Mahindra & Mahindra Ltd

- YANMAR HOLDINGS Co. Ltd.

- CLAAS KGaA mbH

- ZETOR TRACTORS a.s.

- Valmont Industries Inc.

- JCB

The global agriculture equipment market is segmented as follows:

By Product

- Tractors

- Harvesters

- Planting Equipment

- Irrigation & Crop Processing Equipment

- Spraying Equipment

- Hay & Forage Equipment

- Others

By Application

- Land Development & Seed Bed Preparation

- Sowing & Planting

- Weed Cultivation

- Plant Protection

- Harvesting & Threshing

- Post-harvest & Agro-processing

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Global population growth has led to an enormous increase in food demand, which has led to a demand for efficient ways to increase agricultural productivity using new farming equipment. The market patterns are then likely to be influenced by this.

According to the report, the global market size was worth around USD 150.2 billion in 2021 and is predicted to grow to around USD 264.7 billion by 2030 with a compound annual growth rate (CAGR) of roughly 6.5% between 2022 and 2030.

The global agriculture equipment market growth is expected to be driven by the Asia Pacific. It is currently the world’s highest revenue-generating market due to the increasing government initiatives and new product launches in the region.

The global agriculture equipment market is dominated by players like Alamo Group Inc., AGCO Corporation, Argo Tractors S.p.A., Bucher, CNH Industrial N.V., Deere & Company, Escorts Limited, KUBOTA Corporation, Mahindra & Mahindra Ltd, YANMAR HOLDINGS Co., Ltd., CLAAS KGaA mbH, ZETOR TRACTORS a.s., Valmont Industries, Inc., JCB, among others.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed