Air Freight Market Size, Share, Trends, Growth and Forecast 2034

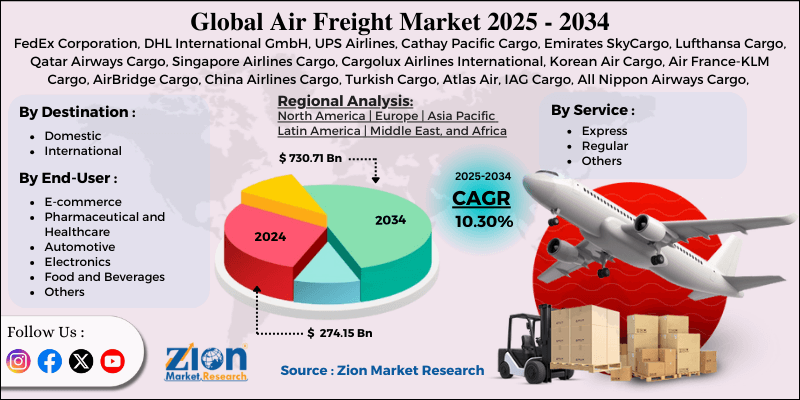

Air Freight Market By Destination (Domestic and International), By Service (Express, Regular, and Others), By End-User (E-commerce, Pharmaceutical and Healthcare, Automotive, Electronics, Food and Beverages, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

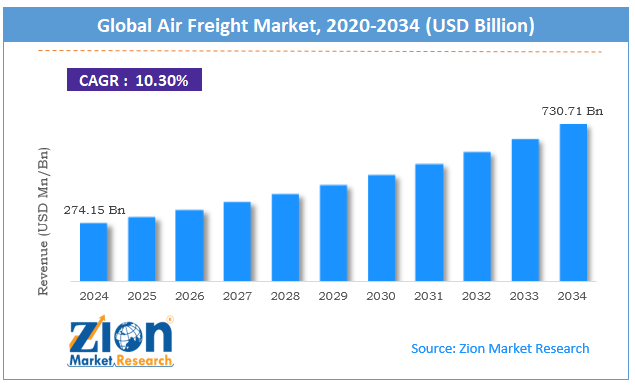

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 274.15 Billion | USD 730.71 Billion | 10.30% | 2024 |

Air Freight Industry Prospective:

The global air freight market was valued at approximately USD 274.15 billion in 2024 and is expected to reach around USD 730.71 billion by 2034, growing at a compound annual growth rate (CAGR) of roughly 10.30% between 2025 and 2034.

Air Freight Market: Overview

Air freight refers to transporting goods via aircraft, providing rapid delivery solutions for time-sensitive, high-value shipments across domestic and international destinations, utilizing dedicated cargo aircraft or the belly capacity of passenger flights. This logistics market specializes in moving high-value, low-volume goods where speed is essential. The air freight industry comprises airlines, freight forwarders, ground handlers, customs brokers, and integrated logistics providers who work together to move cargo.

Modern air freight operations use advanced tracking systems, specialized equipment, and sophisticated software to optimize routing, loading, and delivery. The industry serves e-commerce, pharmaceuticals, electronics, automotive, and perishables, offering various service levels from next-day to more economical standard delivery options.

The growth of cross-border e-commerce, increasing demand for time-critical deliveries, and advancements in cargo handling technology will drive substantial growth in the air freight industry during the forecast period.

Key Insights:

- As per the analysis shared by our research analyst, the global air freight market is estimated to grow annually at a CAGR of around 10.30% over the forecast period (2025-2034)

- In terms of revenue, the global air freight market size was valued at around USD 274.15 billion in 2024 and is projected to reach USD 730.71 billion by 2034.

- The air freight market is projected to grow significantly due to booming e-commerce activity, increasing cross-border trade, technological advancements in cargo operations, and rising demand for expedited deliveries.

- Based on service type, express services lead the market and will continue to lead the global market.

- Based on end-user, e-commerce is anticipated to command the largest market share.

- Based on region, Asia Pacific is projected to dominate the global market during the forecast period.

Air Freight Market: Growth Drivers

Explosive growth in e-commerce and cross-border trade

The global air freight market is experiencing robust growth driven by the unprecedented expansion of e-commerce and increasing cross-border shopping trends.

According to the International Air Transport Association (IATA), e-commerce shipments transported by air increased by 25% annually between 2020 and 2024, outpacing overall air cargo growth. Major online retailers have established air logistics networks to support their delivery promises, with companies reporting that air-eligible products can increase conversion rates.

Consumer expectations for rapid delivery of international purchases have transformed supply chain strategies, with air freight becoming an essential component of e-commerce fulfillment operations. This shift to direct-to-consumer global shopping has changed the traditional distribution model, creating long-term demand for air cargo services that can deliver speed and reliability in today's retail world.

Technological advancements in cargo handling and tracking systems

Innovation in the air freight industry has dramatically improved operational efficiency, cargo security, and shipment transparency. According to logistics technology reports from organizations like the Air Cargo Technology Alliance, implementing advanced cargo management systems has reduced handling times at major cargo hubs.

Modern tracking tech using IoT sensors and blockchain verification allows real-time monitoring of shipment conditions, location, and chain of custody throughout the journey. These systems provide critical data for temperature-controlled pharmaceuticals, electronics, and perishables, so product integrity is maintained during transit.

AI-powered predictive analytics has improved route optimization and capacity utilization, with carriers reporting 15-20% efficiency gains through dynamic scheduling and load planning algorithms. All this continues to make air freight more competitive against other modes and more sustainable and efficient.

Air Freight Market: Restraints

Environmental regulations and sustainability concerns

Despite the growth in demand, the air freight market faces environmental impact and tightening carbon emission regulations. International agreements like the Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA) require carriers to monitor, report, and offset emissions above 2020 levels, creating additional compliance costs.

Industry analysis indicates that environmental compliance measures add approximately 3-8% to operational expenses, which are typically passed to customers. These factors place pressure on air freight economics and other carbon-efficient modes.

The industry must balance demand with sustainability and invest in fleet modernization, alternative fuels, and operational efficiencies to reduce environmental impact while maintaining service levels and cost structures.

Air Freight Market: Opportunities

Integration of unmanned aerial vehicles for last-mile delivery

The air freight market is witnessing expanding opportunities through the development and deployment of drone technology for specialized cargo applications.

According to aviation technology reports and market analyses from organizations like the Unmanned Aerial Logistics Association, commercial drone deliveries are projected to grow annually through 2034. Early implementations have demonstrated significant advantages for urgent medical deliveries, reaching remote locations, and reducing delivery times in congested urban areas.

Transport drones capable of carrying 5kg to 500kg payloads are in development and regulatory approval, with commercial operations already live in limited markets. These solutions complement air freight by extending air logistics networks and providing cost-effective delivery options for time-critical, low-volume shipments.

Autonomous aerial logistics is a significant growth opportunity; early adopters will gain a competitive advantage in specialized delivery segments that require rapid response and flexible routing.

Air Freight Market: Challenges

Capacity constraints and infrastructure limitations

The air freight industry faces persistent challenges related to capacity constraints, particularly during peak shipping periods, and infrastructure limitations at major cargo gateways.

According to airport authority reports and logistics performance indices, major cargo airports are congested during peak periods, which creates bottlenecks in the global supply chain. Limited slots at primary airports, old ground handling facilities, and insufficient warehouse space create operational constraints that impact on-time delivery and increase handling costs.

The specialized nature of air cargo facilities with security screening, temperature control, and special equipment requirements makes it harder to expand capacity. These infrastructure limitations, with high capital requirements for facility development and long approval processes, make it tough for the industry to accommodate growing volumes, especially in fast-growing markets where air freight demand is outpacing infrastructure development.

Air Freight Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Air Freight Market |

| Market Size in 2024 | USD 274.15 Billion |

| Market Forecast in 2034 | USD 730.71 Billion |

| Growth Rate | CAGR of 10.30% |

| Number of Pages | 211 |

| Key Companies Covered | FedEx Corporation, DHL International GmbH, UPS Airlines, Cathay Pacific Cargo, Emirates SkyCargo, Lufthansa Cargo, Qatar Airways Cargo, Singapore Airlines Cargo, Cargolux Airlines International, Korean Air Cargo, Air France-KLM Cargo, AirBridge Cargo, China Airlines Cargo, Turkish Cargo, Atlas Air, IAG Cargo, All Nippon Airways Cargo, Etihad Cargo, American Airlines Cargo, United Cargo, and others. |

| Segments Covered | By Destination, By Service, By End-User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Air Freight Market: Segmentation

The global air freight market is segmented into destination, service, end-user, and region.

Based on type, the market is segregated into domestic and international. International air freight leads the market due to growth in global e-commerce, increased international trade agreements, and rising demand for high-value product shipments across continents.

Based on service, the air freight market is divided into express, regular, and others. Express services are expected to lead the market during the forecast period as businesses and consumers increasingly prioritize speed and time-definite delivery for critical shipments.

Based on end-users, the air freight industry is categorized into e-commerce, pharmaceutical and healthcare, automotive, electronics, food and beverages, and others. E-commerce is expected to lead the market due to the growth in online shopping and consumer expectations for rapid delivery.

Air Freight Market: Regional Analysis

Asia Pacific to lead the market

Asia Pacific leads the air freight market due to its manufacturing strength, rapidly growing middle-class consumer base, and position as the epicenter of global e-commerce growth. It accounts for around 38% of the global market share, driven by China's manufacturing exports and booming domestic e-commerce.

According to air freight industry reports and market analyses from organizations like the Association of Asia Pacific Airlines, the region's air cargo traffic has been growing annually. Investments in airport infrastructure in China, India, Singapore, and Thailand are expanding cargo capacity to support volume growth.

The region's importance in the global supply chain and rapid development of specialized logistics facilities for high-value goods like electronics, pharmaceuticals, and perishable products has further cemented Asia Pacific's position in the global air freight landscape.

Strategic partnerships between regional carriers and international logistics companies have created efficient air freight networks that optimize delivery times and reduce operational costs. Implementing advanced tracking technologies and digital freight platforms has significantly improved shipment visibility and streamlined customs processes across the region's major trade routes.

The Middle East is expected to grow significantly.

The Middle East is one of the fastest-growing air freight market regions, driven by investments in aviation infrastructure, geographical advantage between East and West, and aggressive expansion of cargo operations by regional carriers. Countries like the UAE, Qatar, and Saudi Arabia have developed world-class air cargo hubs that efficiently handle specialized cargo.

According to regional market reports and analyses from organizations like the Middle East Air Transport Association, cargo volumes through Middle Eastern hubs have grown 7-9% annually, much faster than the global average.

Government initiatives to develop the logistics sector and position national carriers as global cargo leaders have created a conducive environment for growth. The region's geographical advantage of single-hop connectivity between major global markets provides natural advantages for air freight, especially for high-value and time-sensitive cargo moving between Asia, Europe, and Africa.

Recent Market Developments:

- In February 2025, CargoAi partnered with CMA CGM AIR CARGO to enhance airfreight services through digital solutions.

- In January 2025, WestJet Cargo joined Freightos' WebCargo and 7LFreight platforms, expanding its digital reach.

Air Freight Market: Competitive Analysis

The global air freight market is led by players like:

- FedEx Corporation

- DHL International GmbH

- UPS Airlines

- Cathay Pacific Cargo

- Emirates SkyCargo

- Lufthansa Cargo

- Qatar Airways Cargo

- Singapore Airlines Cargo

- Cargolux Airlines International

- Korean Air Cargo

- Air France-KLM Cargo

- AirBridge Cargo

- China Airlines Cargo

- Turkish Cargo

- Atlas Air

- IAG Cargo

- All Nippon Airways Cargo

- Etihad Cargo

- American Airlines Cargo

- United Cargo

The global air freight market is segmented as follows:

By Destination

- Domestic

- International

By Service

- Express

- Regular

- Others

By End-User

- E-commerce

- Pharmaceutical and Healthcare

- Automotive

- Electronics

- Food and Beverages

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Air freight refers to transporting goods via aircraft, providing rapid delivery solutions for time-sensitive, high-value shipments across domestic and international destinations, utilizing dedicated cargo aircraft or the belly capacity of passenger flights.

The air freight market is expected to be driven by expanding e-commerce activity, growing cross-border trade, technological advancements in cargo operations, increasing demand for time-sensitive deliveries, and the rising importance of expedited logistics in global supply chains.

According to our study, the global air freight market was worth around USD 274.15 billion in 2024 and is predicted to grow to around USD 730.71 billion by 2034.

The CAGR value of the air freight market is expected to be around 10.30% during 2025-2034.

The global air freight market will register the highest growth in Asia Pacific during the forecast period, with the Middle East showing a particularly strong growth rate.

Key players in the air freight market include FedEx Corporation, DHL International GmbH, UPS Airlines, Cathay Pacific Cargo, Emirates SkyCargo, Lufthansa Cargo, Qatar Airways Cargo, Singapore Airlines Cargo, Cargolux Airlines International, Korean Air Cargo, Air France-KLM Cargo, and AirBridge Cargo.

The report comprehensively analyzes the air freight market, including an in-depth discussion of market drivers, restraints, emerging trends, regional dynamics, and future growth opportunities. It also examines competitive dynamics, technological innovations, and the evolving logistics industry needs shaping the air freight ecosystem.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed