Aircraft Turbine Engine Market Size, Share, Trends, Growth 2030

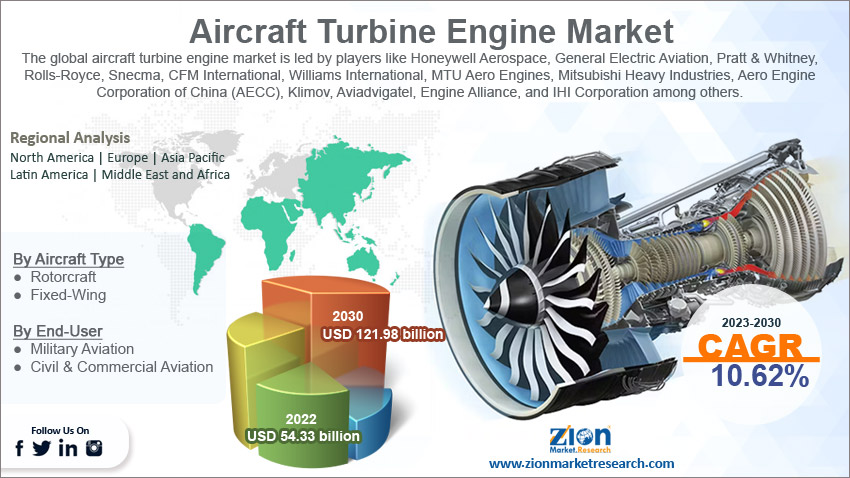

Aircraft Turbine Engine Market By Aircraft Type (Rotorcraft and Fixed-Wing), By End-User (Military Aviation, Civil, & Commercial Aviation), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2023 - 2030

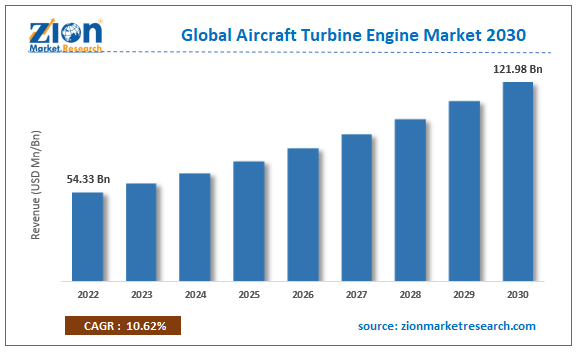

| Market Size in 2022 | Market Forecast in 2030 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 54.33 Billion | USD 121.98 Billion | 10.62% | 2022 |

Aircraft Turbine Engine Industry Prospective:

The global aircraft turbine engine market size was worth around USD 54.33 billion in 2022 and is predicted to grow to around USD 121.98 billion by 2030 with a compound annual growth rate (CAGR) of roughly 10.62% between 2023 and 2030.

Aircraft Turbine Engine Market: Overview

An aircraft turbine engine is also known as a jet engine. In the most generic sense, they are a type of internal combustion engine that discharges an extremely powerful and fast-moving jet of heated gas that in turn generates thrust required for aircraft to take flight. Aircraft turbine engines have managed to change the scope of the modern aerospace and aviation industry. Although the concept of powering these engines is relatively old, practical application was only made possible in the 20th century. Most jet engines currently used in the aviation sector are axial flow, air-breathing, and gas turbine engines in which energy is extracted from a flow of essential combustion gasses. A centrifugal compressor or axial, and in some cases both, are used to increase the temperature and pressure of the ambient air initially drawn into the engine. Once the process is complete, the air is fed into the combustion chamber where fuel is added thus leading to ignition when it comes in contact with compressed and hot air. The efficiency of a turbojet engine is at its optimum level when the speed of the exhaust gas is approximately close to the propulsion speed of the aircraft.

Key Insights:

- As per the analysis shared by our research analyst, the global aircraft turbine engine market is estimated to grow annually at a CAGR of around 10.62% over the forecast period (2023-2030)

- In terms of revenue, the global aircraft turbine engine market size was valued at around USD 54.33 billion in 2022 and is projected to reach USD 121.98 billion, by 2030.

- The global aircraft turbine engine market is projected to grow at a significant rate due to the growing investments in the aviation sector

- Based on aircraft type segmentation, fixed-wing was predicted to show maximum market share in the year 2022

- Based on end-user segmentation, civil & commercial aviation was the leading type in 2022

- On the basis of region, North America was the leading revenue generator in 2022

Request Free Sample

Request Free Sample

Aircraft Turbine Engine Market: Growth Drivers

Growing investments in the aviation sector to drive market growth

The global aircraft turbine engine market is expected to grow owing to the increasing investments from public, private, and government sectors in the aviation industry across countries. The rising dependence and demand for air travel is one of the major driving forces for greater market investments. This mode of transport is beneficial to the movement of people and freight transactions since air travel offers higher convenience in terms of time taken. In November 2023, WestJet, a leading Canadian airline, announced that it would launch new flights by 2024 summer to establish better connectivity with European countries. The company plans to connect three cities in the eastern area of Canada to prime European destinations. In addition to this, October 2023 witnessed the announcement of a brand new airline in Europe that will come into operational existence by 2024. Let’s Fly Away is expected to be based at two most popular airports in Europe and will be offering medium-haul and short-haul trips. Such investments and increases in the number of flights for passengers and freights can be observed worldwide, especially in emerging countries that are striving toward faster growth including India, China, and African nations. In October 2022, the African Development Bank approved a loan of USD 23.6 million that will be used for the construction and development of a new advanced aviation training facility in Kigali. The project is projected to help Rwanda become a prime aviation hub in the coming years.

Turbine engines are much preferred in the aerospace industry due to the multiple advantages associated with these engines. These benefits include higher flight efficiency when higher altitudes are concerned along with smoother operation and better fuel usage rate.

Aircraft Turbine Engine Market: Restraints

High cost of initial investment to restrict market growth

Aircraft turbine engines necessitate a high cost of initial investment. These are heavy machines that involve the use of sophisticated technology. Alongside, the raw materials used in the production of turbine engines are expensive especially when superalloys are used during the production process. These factors greatly restrict the global aircraft turbine engine market growth scope as currently the industry for turbine engines is dominated by selected players. The cost considerations have led to limited entry of new companies resulting in the market trends being led by select businesses.

Aircraft Turbine Engine Market: Opportunities

Surging international partnerships to create new expansion possibilities

The global aircraft turbine engine industry is expected to come across several growth opportunities due to the increasing rate of international partnerships observed concerning the production, designing, material procurement, and final distribution of turbine engines. In June 2023, GE Aerospace, the world’s leading aircraft engine producer, signed a Memorandum of Understanding (MoU) with Hindustan Aeronautics Limited (HAL), India’s public sector aerospace and defense company. The MoU will allow the companies to produce fighter jet engines in India to meet the military needs of the Indian Air Force. In July 2023, the Defense Acquisition Council of India provided preliminary approval for procuring 26 Rafale-M fighters. Simultaneously, announcements related to the joint development of a combat aircraft engine were also recorded.

Growing research on use of biofuel to power aircraft turbine engines may create higher opportunities

The revenue streams in the market are likely to be flooded with more potential due to the ongoing research on the development of efficient biofuel that can be used to power turbine engines in aircraft. The alarming pollution rate caused by the aviation industry has resulted in an urgent need to develop more efficient and environmentally friendly fuel. A recent study by the National Aeronautics and Space Administration confirmed that biofuels can help in reducing jet engine pollution by 50% to 70%.

Aircraft Turbine Engine Market: Challenges

Navigating difficult and volatile international market scenarios to create growth challenges

The global aircraft turbine engine market players are anticipated to face challenges due to the current state of international markets influenced by ongoing wars and dramatically changing trading relationships between countries. These external factors will create obstacles in terms of supply chain disruptions and evolving trading rules thus impeding market growth trends.

Aircraft Turbine Engine Market: Segmentation

The global aircraft turbine engine market is segmented based on aircraft type, end-user, and region.

Based on aircraft type, the global market segments are rotorcraft and fixed-wing. In 2022, the highest demand was observed in the fixed-wing segment. It consists of a large type of aircraft ranging from smaller dimensions to large commercial vehicles. The growing number of airlines along with a surging rate of air-based freight revenue are the most common segmental drivers. As per the International Air Transport Association around USD 6 trillion worth of goods per year are conducted through air cargo.

Based on end-user, the aircraft turbine engine industry is divided into military aviation, civil & commercial aviation. The highest revenue-generating segment in 2022 was the civil & commercial segment owing to the growing investment rates in commercial air travel. Post-COVID-19, international and domestic tourism has increased rapidly and is expected to grow even further during the projection period. Increasing disposable income, rising number of budget aircraft carriers, and other reasons are responsible for the expected growth. In 2022, more than 970 million people traveled internationally.

Aircraft Turbine Engine Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Aircraft Turbine Engine Market |

| Market Size in 2022 | USD 54.33 Billion |

| Market Forecast in 2030 | USD 121.98 Billion |

| Growth Rate | CAGR of 10.62% |

| Number of Pages | 221 |

| Key Companies Covered | Honeywell Aerospace, General Electric Aviation, Pratt & Whitney, Rolls-Royce, Snecma, CFM International, Williams International, MTU Aero Engines, Mitsubishi Heavy Industries, Aero Engine Corporation of China (AECC), Klimov, Aviadvigatel, Engine Alliance, IHI Corporation, and others. |

| Segments Covered | By Aircraft Type, By End-User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2022 |

| Historical Year | 2017 to 2021 |

| Forecast Year | 2023 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Aircraft Turbine Engine Market: Regional Analysis

North America to grow at a steady rate during the forecast period

The global aircraft turbine engine market is expected to be dominated by North America with a steady rate during the forecast period. The region is currently the largest revenue-generator in the global market led by the United States. The country is home to the world's most dominant players that produce excellent-quality and superior functional turbine engines for aircraft. In February 2023, Air India signed a deal with US-based GE Aerospace allowing the latter to provide 20 GE9X and 40 GEnx-1B engines. The deal will also entail a multi-year TrueChoice™ engine services agreement. In addition to this, the North American region operates several commercial aircraft. The rising number of international tourists including students, businesses, and people traveling for leisure has contributed to the regional market. Europe is projected to grow at a steady pace led by Germany and France. These countries are home to dominant suppliers of aircraft turbine engines. In July 2023, Safran, a French aerospace giant, announced that it would set up a new and largest aircraft engine maintenance, repair & overhaul facility in India. The changing shift toward eco-friendly fuel alternatives is likely to promote a higher regional growth rate.

Aircraft Turbine Engine Market: Competitive Analysis

The global aircraft turbine engine market is led by players like:

- Honeywell Aerospace

- General Electric Aviation

- Pratt & Whitney

- Rolls-Royce

- Snecma

- CFM International

- Williams International

- MTU Aero Engines

- Mitsubishi Heavy Industries

- Aero Engine Corporation of China (AECC)

- Klimov

- Aviadvigatel

- Engine Alliance

- IHI Corporation

The global aircraft turbine engine market is segmented as follows:

By Aircraft Type

- Rotorcraft

- Fixed-Wing

By End-User

- Military Aviation

- Civil & Commercial Aviation

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

An aircraft turbine engine is also known as a jet engine.

The global aircraft turbine engine market is expected to grow owing to the increasing investments from public, private, and government sectors in the aviation industry across countries.

According to study, the global aircraft turbine engine market size was worth around USD 54.33 billion in 2022 and is predicted to grow to around USD 121.98 billion by 2030.

The CAGR value of the aircraft turbine engine market is expected to be around 10.62% during 2023-2030.

The global aircraft turbine engine market is expected to be dominated by North America with a steady rate during the forecast period.

The global aircraft turbine engine market is led by players like Honeywell Aerospace, General Electric Aviation, Pratt & Whitney, Rolls-Royce, Snecma, CFM International, Williams International, MTU Aero Engines, Mitsubishi Heavy Industries, Aero Engine Corporation of China (AECC), Klimov, Aviadvigatel, Engine Alliance, and IHI Corporation among others.

The report explores crucial aspects of the aircraft turbine engine market including a detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed