AIS Transponder Market Size, Share, Trends, Growth 2030

AIS Transponder Market By Type (Class A and Class B), By Application (Fleet Management, Vessel Tracking, Maritime Security, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2023 - 2030

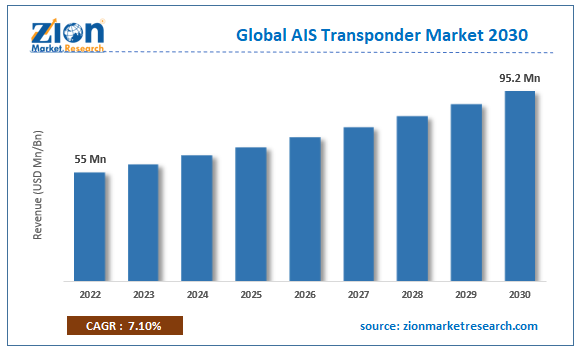

| Market Size in 2022 | Market Forecast in 2030 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 55 Million | USD 95.2 Million | 7.1% | 2022 |

AIS Transponder Industry Prospective:

The global AIS Transponder market size was worth around USD 55 million in 2022 and is predicted to grow to around USD 95.2 million by 2030 with a compound annual growth rate (CAGR) of roughly 7.1% between 2023 and 2030.

AIS Transponder Market: Overview

AIS transponders use an integrated VHF radio to automatically broadcast the ship's position and velocity at predetermined intervals. The ship's GPS or, if it malfunctions, an integrated GPS receiver provides the location and velocity information. At the same time, the ship's compass provides heading information, which the AIS simultaneously communicates. Less commonly communicated other data, such as the name of the vessel and VHF call sign, are input during equipment installation. AIS transponders installed on other ships or land-based systems, such as VTS systems, receive the signals.

Key Insights

- As per the analysis shared by our research analyst, the global AIS transponder market is estimated to grow annually at a CAGR of around 7.1% over the forecast period (2023-2030).

- In terms of revenue, the global AIS Transponder market size was valued at around USD 55 million in 2022 and is projected to reach USD 95.2 million, by 2030.

- The growing maritime trade is expected to propel the AIS transponder market growth during the forecast period.

- Based on the type, class A is expected to capture a significant market share during the forecast period.

- Based on application, the fleet management segment is expected to hold a significant market share over the forecast period.

- Based on region, North America is expected to dominate the market during the forecast period.

Request Free Sample

Request Free Sample

AIS Transponder Market: Growth Drivers

Increasing maritime trade drives market growth

The market for AIS transponders has been significantly fueled by the expansion of international marine trade. The rising use of AIS technology is a result of the requirement for effective vessel tracking and management to ensure the seamless movement of products across seas. For instance, according to the UNCTAD, following an almost four percent contraction in 2020 due to the COVID-19 epidemic, worldwide marine trade saw a 3.2% anticipated volume recovery in 2021. 11.0 billion tons have been transported, which is a little less than what was shipped before the pandemic hit. Asia continues to be the world's most important maritime freight region in 2021, with Asian ports—both in developed and developing nations—loading over 4.6 billion tons of cargo, or roughly 42% of all cargo loaded in ports globally. Asian ports received over 7.1 billion tons in 2021, or 64% of the total cargo discharged worldwide.

AIS Transponder Market: Restraints

Cybersecurity threats hamper the market growth

The increasing automation and digitalization of the marine industry have resulted in a perpetual need to change vessels. The infrastructure of autonomous vessels is made up of electromechanical systems, highly integrated software & hardware, and computer networks. According to national regulations, one of the main cyber threats on the internet is AIS data, which might make ships more susceptible to cyberattacks and piracy, which could result in terror activities. These AIS data leaks may have a negative impact on port infrastructure and ship safety and security, which would impede AIS transponder industry growth.

AIS Transponder Market: Opportunities

The growing product launches offer a lucrative opportunity for market growth

The growing product launches are expected to offer a lucrative opportunity for AIS transponder market growth during the projected period. In November 2023, Onboard SpaceX Falcon 9, Ymir-1, a satellite featuring Saab technology, was launched into orbit. This signals the start of a new age in marine communication. The next generation of the Automatic Identification System (AIS), which ships use to transmit position, speed, course, and other data, is being developed, and Ymir-1 is a test satellite. All bigger ships and boats operating in civilian traffic must have AIS. The cutting-edge transponder on the satellite was constructed by Saab TransponderTech, a well-known producer of AIS transponders.

AIS Transponder Market: Challenges

High cost and lack of universal standards pose a major challenge to market growth

Installing AIS transponders may be expensive initially, particularly for smaller vessels. The cost of AIS technology may be too much for certain ship owners and operators, which would slow down the rate of adoption, thereby challenging the AIS transponder industry expansion. Furthermore, there may be differences in how these standards are applied and enforced globally, even despite international legislation about the use of AIS. Uneven compliance with AIS standards between nations or regions might provide challenges for smooth international interoperability.

AIS Transponder Market: Segmentation

The global AIS Transponder industry is segmented based on the type, application, and region.

Based on the type, the global market is bifurcated into class A and class B. Class A is expected to capture a significant market share during the forecast period. Class A AIS transponders are often mandatory for larger vessels, as per regulations set by the International Maritime Organization (IMO). These regulations are in place to enhance maritime safety and prevent collisions. Transmitting at a power level of 12.5 watts, Class A AIS transponders (SOLAS Compliant) use the Self-Organizing TDMA (SOTDMA) broadcast mode. While moving forward, dynamic data is sent every 2 to 10 seconds, and while stationary, it is sent every 3 minutes. Every six minutes, static and voyage-related data, including the name of the ship and its contents, are communicated. A DSC (156.525 MHz) receiver, an external GPS, a heading and rate of turn indicator, as well as the ability to send and receive safety-related text messages, are all necessary for Class A AIS transponders. Thereby, driving the market growth.

Based on the application, the global AIS transponder industry is bifurcated into fleet management, vessel tracking, maritime security, and others. The fleet management segment is expected to hold a significant market share over the forecast period. The growth in the segment is attributed to the growing number of ships on the ocean. For instance, the Review of Maritime Transport 2021 International by the United Nations Conference on Trade and Development (UNCTAD) states that maritime shipments decreased by 3.8% to 10.65 billion metric tons. Early in 2021, there were 99,800 ships in the globe with a gross metric tonnage of 100 or more, or 2,134,639,907 DWT (deadweight tonnage) capacity. The year before January 1, 2021, saw a 3% increase in the size of the global shipping fleet. The increasing quantity of ships has made it more challenging for shipping corporations to oversee and evaluate these sizable fleets, especially as emission regulations and reporting requirements are often changing. Shipping businesses can operate their fleet in real-time with the use of fleet management tools, allowing ships to sail around any unanticipated weather conditions. Fleet managers may now set alarms with no advance time, allowing the personnel on the ships to make fast decisions. Thereby, driving the market growth.

AIS Transponder Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | AIS Transponder Market |

| Market Size in 2022 | USD 55 Million |

| Market Forecast in 2030 | USD 95.2 Million |

| Growth Rate | CAGR of 7.1% |

| Number of Pages | 231 |

| Key Companies Covered | Comar Systems, Digital Yacht, Samyung ENC, Nauticast, SRT Marine Systems, SIMRAD, Vesper Marine, Weatherdock AG, ACR Artex, ComNav, Kongsberg Group, Saab, Xinuo Information Technology, ExNC Entwicklungs-and Vertriebsges.mbH, SRT, CML Microsystems Plc, MSM, and others. |

| Segments Covered | By Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2022 |

| Historical Year | 2017 to 2021 |

| Forecast Year | 2023 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

AIS Transponder Market: Regional Analysis

North America is expected to dominate the market during the forecast period

North America is expected to dominate the global AIS transponder market during the forecast period owing to the presence of major players. For instance, one of the leading providers of satellite-based AIS solutions is exactEarth, a Canadian company. They run a network of satellites to deliver real-time vessel tracking information all around the world. Similar to this, US-based businesses like ORBCOMM and Kongsberg Maritime provide AIS services and solutions, including hardware, software, and analytics, to the North American market as well as other markets. In North America, the United States Coast Guard (USCG) has played a significant role in fostering AIS acceptance and deployment. The Nationwide Automatic Identification System (NAIS), a network of AIS transmitters and receivers around the US coastline and interior waterways, was put into place by the USCG. The objectives of this program are to promote maritime security initiatives, increase navigation safety, and improve marine situational awareness. North America's leadership in the market is demonstrated by the USCG's dedication to AIS installation. Thus, this is expected to propel the market expansion in the region.

AIS Transponder Market: Competitive Analysis

The global AIS Transponder market is dominated by players like:

- Comar Systems

- Digital Yacht

- Samyung ENC

- Nauticast

- SRT Marine Systems

- SIMRAD

- Vesper Marine

- Weatherdock AG

- ACR Artex

- ComNav

- Kongsberg Group

- Saab

- Xinuo Information Technology

- ExNC Entwicklungs-and Vertriebsges.mbH

- SRT

- CML Microsystems Plc

- MSM

The global AIS Transponder market is segmented as follows:

By Type

- Class A

- Class B

By Application

- Fleet Management

- Vessel Tracking

- Maritime Security

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

AIS transponders use an integrated VHF radio to automatically broadcast the ship's position and velocity at predetermined intervals. The ship's GPS or, if it malfunctions, an integrated GPS receiver provides the location and velocity information. At the same time, the ship's compass provides heading information, which the AIS simultaneously communicates. Less commonly communicated other data, such as the name of the vessel and VHF call sign, are input during equipment installation. AIS transponders installed on other ships or land-based systems, such as VTS systems, receive the signals.

The AIS transponder market is expanding due to rising government laws and regulations for the installation of Automatic Identification Systems (AIS), increased technical improvements in navigation & marine traffic management systems, and an increase in the need for safe transit across waterways.

According to the report, the global AIS transponder market size was worth around USD 55 million in 2022 and is predicted to grow to around USD 95.2 million by 2030.

The global AIS Transponder market is expected to grow at a CAGR of 7.1% during the forecast period.

The global AIS Transponder market growth is expected to be driven by North America. It is currently the world’s highest revenue-generating market due to the presence of major players.

The global AIS Transponder market is dominated by players like Comar Systems, Digital Yacht, Samyung ENC, Nauticast, SRT Marine Systems, SIMRAD, Vesper Marine, Weatherdock AG, ACR Artex, ComNav, Kongsberg Group, Saab, Xinuo Information Technology, ExNC Entwicklungs-and Vertriebsges.mbH, SRT, CML Microsystems Plc, and MSM among others.

The AIS Transponder market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed