Aseptic Connectors Market Trend, Share, Growth, Size, Analysis and Forecast 2032

Aseptic Connectors Market By Product (Gendered and Genderless), By Type (3/4 Inch Connectors, 3/8 Inch Connectors, 1/4 Inch Connectors, 1/2 Inch Connectors, and Others), By End-User (Biopharmaceutical Companies, Pharmaceutical Companies, Food & Beverages, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

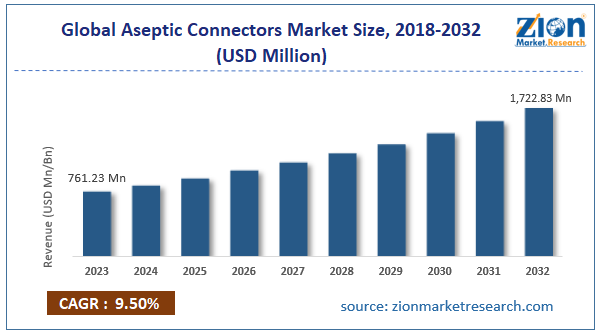

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 761.23 million | USD 1,722.83 million | 9.5% | 2023 |

Aseptic Connectors Industry Prospective:

The global aseptic connectors market size was worth around USD 761.23 million in 2023 and is predicted to grow to around USD 1,722.83 million by 2032 with a compound annual growth rate (CAGR) of roughly 9.50% between 2024 and 2032.

Aseptic Connectors Market: Overview

Aseptic connectors are specially designed sterile connectors used for delivering a sterile fluid pathway. It is used for aseptic processing connecting two tubing lines for transferring fluids in an uncontaminated environment. Each tubing line is connected to a connector at one of the two ends while the other end consists of a removable membrane. This segment facilitates mechanical coupling between the two pieces of tubing. Once the connection between the two tubes is safely established, the membrane can be removed. This method of creating a connection allows for maintaining a process line that remains enclosed and sterile throughout. The industries that have higher demand for aseptic connectors include food & beverages (F&B), biopharmaceutical, and the pharmaceutical industry. Fluids and gasses used in these sectors must remain clean and should not be exposed to contaminants. This is achieved using aseptic connectors. However, in most cases, additional methods of preventing contamination are used along with aseptic connectors. The growing focus on ensuring product integrity and sterility in the pharmaceutical and food & beverages industry is pushing the demand for more efficient aseptic connectors. One of the key challenges faced by aseptic connector users is ensuring that the device is compatible with the existing systems for drug manufacturing or food and beverage production. The forecast period holds high growth opportunities for the aseptic connectors market players.

Key Insights:

- As per the analysis shared by our research analyst, the global aseptic connectors market is estimated to grow annually at a CAGR of around 9.50% over the forecast period (2024-2032)

- In terms of revenue, the global aseptic connectors market size was valued at around USD 761.23 million in 2023 and is projected to reach USD 1,722.83 million, by 2032.

- The market is projected to grow at a significant rate due to the rising interest in gene therapy and other forms of biologics

- Based on the product, the genderless segment is growing at a high rate and will continue to dominate the global market as per industry projection

- Based on the end-user, the pharmaceutical companies segment is anticipated to command the largest market share

- Based on region, North America is projected to dominate the global market during the forecast period

Aseptic Connectors Market: Growth Drivers

Rising interest in gene therapy and other forms of biologics will trigger the market demand rate

The global aseptic connectors market is expected to register a significant growth rate due to the growing investments and interest of the medical community in gene therapy. Furthermore, the industry can benefit from a higher focus on exploring other biologics for enhanced and customized medical care. Gene therapy is one of the more recent approaches undertaken by drug manufacturing companies along with the broader healthcare group for treating patients. It deals with the modification of a patient’s genes for curing or treating diseases. Several mechanisms have been developed over the course of delivering gene therapies. The most prominent methods include inactivating the gene causing the disease, replacing the unwanted gene with a healthy gene copy, or introducing a modified gene to fight the disease. Gene therapy is being widely explored across the globe for treating serious medical conditions such as infectious diseases, cancer, or other forms of genetic conditions. Market reports suggest that investments in gene therapy have soared in the last few years. There is a growing trend of increasing partnerships between businesses to research & develop efficient gene therapy solutions and to expand the treatment application for other diseases that do not have any cure in the current medical industry. In November 2023, reports suggested that the leading activist investors in companies with underperforming results Elliott Investment Management had taken a stake in BioMarin Pharmaceutical. The stake is reported to be worth USD 1 billion.

Rising cases of infectious diseases globally may fuel the market growth rate

The global aseptic connectors market is expected to generate higher growth momentum due to the increasing cases of infectious diseases across the globe. For instance, the common cold is one of the most prevalent and regularly occurring infectious diseases globally. The disease does not have a cure and most medicines are used for managing the associated symptoms. As per reports, an average child suffers 6 to 10 colds every year. The growing population density and exposure to contaminants or infection-carrying objects leads to higher demand for medications for managing the infections thus creating higher use of aseptic connectors.

Aseptic Connectors Market: Restraints

Pollution caused by mishandling of aseptic connectors could limit the product adoption rate

The global industry for aseptic connectors faces several limitations. One of the crucial disadvantages of aseptic connectors is the risk of pollution that may be caused in case the device is mishandled. Additionally, if these products are not safely disposed of following protocols, it can lead to the contaminants spreading in the environment thus putting the living species exposed to harmful chemicals. Furthermore, plastic aseptic connectors also contribute to waste accumulation. Plastic aseptic connectors are mostly single-use entities and contribute to the growing concerns of excessive use of plastic across industries.

Aseptic Connectors Market: Opportunities

Growing launch of new solutions with higher capabilities will generate extensive growth opportunities for the industry players

The global aseptic connectors market is expected to generate growth opportunities due to the increasing offerings by companies manufacturing sterile devices. The constant rate of innovation is a key driver for healthy competition. It also helps in reaching a broader group of audience and can also assist in the global expansion of the products. In April 2023, a part of Dover, Colder Products Company (CPC) announced the launch of the AseptiQuik® W Series. The company is a leading manufacturer of superior-grade connection technologies and its new launch is considered as the largest genderless aseptic connectors currently available in the industry. With the new launch, the CPC has experimented with increasing the transfer rate thus ultimately improving the product’s performance. AseptiQuik® W Series consists of 1 ½ -a inch flow path solution with multiple liters of product transfer occurring per minute. This will help shorten the fluid transfer process.

Surging development of state-of-the-art drug manufacturing facilities will further promote the expansion avenues

Aseptic connectors are widely used across drug manufacturing units and research centers. These devices assist in maintaining drug purity until it reaches the final packaging. The regional governments have become more stringent related to the drug integrity and sterility thus opening higher expansion possibilities for the global aseptic connectors market. The increasing construction rate of drug manufacturing facilities will promote the aseptic connectors adoption rate. In April 2024, Eli Lilly and Company announced the acquisition of a drug manufacturing facility previously owned by Nexus after both companies reached a contract. Similar partnerships can be observed globally at a rapid rate.

Aseptic Connectors Market: Challenges

Surging investments in another form of aseptic manufacturing processes may challenge the market adoption rate

The global industry for aseptic connectors may be challenged due to the growing investments in exploring other forms of aseptic manufacturing. For instance, a leading contender is the growing focus on developing a 100% effective closed-loop system in which the products undergoing the flow are completely isolated from the rest of the surroundings. Apart from other devices, closed-loop systems may use other forms of sterile and ready-to-use equipment such as filters and buffer bags.

Aseptic Connectors Market: Segmentation

The global aseptic connectors market is segmented based on product, end-user, and region.

Based on the product, the global market divisions are gendered and genderless. In 2023, the highest demand was observed in the genderless segment. These connectors do not have any specific gender considerations which means that the connector components are identical. They are widely popular since they eliminate the risk of errors that can be caused due to design and orientation. Furthermore, they also help streamline the entire flow process. As per the World Health Organization (WHO), 1 in every 10 medical products in low or medium-income economies is below the standard level.

Based on type, the global aseptic connectors industry is divided into 3/4 inch connectors, 3/8 inch connectors, 1/4 inch connectors, 1/2 inch connectors, and others.

Based on the end-user, the global market segments are biopharmaceutical companies, pharmaceutical companies, food & beverages, and others. In 2023, the highest demand was observed in the pharmaceutical companies segment. The combined revenue generated from the biopharmaceutical and pharmaceutical sectors was around 80.01% of the total revenue. The growing production of medicinal drugs and the increasing patient groups along with higher access to treatment facilities is driving the market growth rate.

Aseptic Connectors Market Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Aseptic Connectors Market |

| Market Size in 2023 | USD 761.23 Million |

| Market Forecast in 2032 | USD 1,722.83 Million |

| Growth Rate | CAGR of 9.50% |

| Number of Pages | 209 |

| Key Companies Covered | Qosina Corporation, Watson-Marlow Fluid Technology Group, Dover Corporation, Sartorius AG, Saint-Gobain Performance Plastics, AdvantaPure (a division of NewAge Industries), Nordson Medical (a division of Nordson Corporation), Colder Products Company (CPC), Teleflex Incorporated, EMD Millipore Corporation (part of Merck KGaA), Merck KGaA, W. L. Gore & Associates Inc., Pall Corporation (now part of Danaher Corporation), CPC (Colder Products Company), Thermo Fisher Scientific Inc., and others. |

| Segments Covered | By Product, By Type, By End-User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Aseptic Connectors Market: Regional Analysis

North America to dominate the market growth rate during the projection period

The global aseptic connectors market will be dominated by North America during the forecast period. In 2023, it held control over 44% of the total market share. Countries such as the US and Canada aid the region’s dominance over other economies. These are developed nations with higher healthcare expenditures. Moreover, the increasing patient rate in North America facilitates higher demand for drugs thus subsequently leading to greater chances for the use of aseptic connectors. The US is home to some of the leading pharma companies. Moreover, it is also witnessing a surge in investments in the biopharmaceutical sector. In February 2024, reports suggested that the technology giant Samsung Group was planning to foray into the medical industry by investing in US-based biotechnology companies. The company is expected to invest in Latus Bio-based in Cambridge. The latter is a leading developer of treatment for neurological diseases by leveraging adeno-associated viruses (AAVs). Furthermore, the rising number of drug development houses in the US will create more expansion opportunities for the developers of aseptic connectors. As per market projections, Asia-Pacific is expected to grow at a CAGR of over 10% during the projection period. The rising demand for single-use technology and growing production of aseptic connectors will drive the regional growth rate.

Aseptic Connectors Market: Competitive Analysis

The global aseptic connectors market is led by players like:

- Qosina Corporation

- Watson-Marlow Fluid Technology Group

- Dover Corporation

- Sartorius AG

- Saint-Gobain Performance Plastics

- AdvantaPure (a division of NewAge Industries)

- Nordson Medical (a division of Nordson Corporation)

- Colder Products Company (CPC)

- Teleflex Incorporated

- EMD Millipore Corporation (part of Merck KGaA)

- Merck KGaA

- W. L. Gore & Associates Inc.

- Pall Corporation (now part of Danaher Corporation)

- CPC (Colder Products Company)

- Thermo Fisher Scientific Inc.

The global aseptic connectors market is segmented as follows:

By Product

- Gendered

- Genderless

By Type

- 3/4 Inch Connectors

- 3/8 Inch Connectors

- 1/4 Inch Connectors

- 1/2 Inch Connectors

By End-User

- Biopharmaceutical Companies

- Pharmaceutical Companies

- Food & Beverages

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Aseptic connectors are specially designed sterile connectors used for delivering a sterile fluid pathway.

The global aseptic connectors market is expected to register a significant growth rate due to the growing investments and interest of the medical community in gene therapy.

According to study, the global aseptic connectors market size was worth around USD 761.23 million in 2023 and is predicted to grow to around USD 1,722.83 million by 2032.

The CAGR value of aseptic connectors market is expected to be around 9.50% during 2024-2032.

The global aseptic connectors market will be dominated by North America during the forecast period.

The global aseptic connectors market is led by players like Qosina Corporation, Watson-Marlow Fluid Technology Group, Dover Corporation, Sartorius AG, Saint-Gobain Performance Plastics, AdvantaPure (a division of NewAge Industries), Nordson Medical (a division of Nordson Corporation), Colder Products Company (CPC), Teleflex Incorporated, EMD Millipore Corporation (part of Merck KGaA), Merck KGaA, W. L. Gore & Associates, Inc., Pall Corporation (now part of Danaher Corporation), CPC (Colder Products Company) and Thermo Fisher Scientific Inc.

The report explores crucial aspects of the aseptic connectors market including detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed