Atomic Layer Deposition Market Size, Share, Trends, Growth 2030

Atomic Layer Deposition Market By Product (Thermal ALD, Metal ALD, and Plasma-Enhanced ALD), By Application (Electronics & Semiconductors, Medical, and Solar Devices), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2023 - 2030

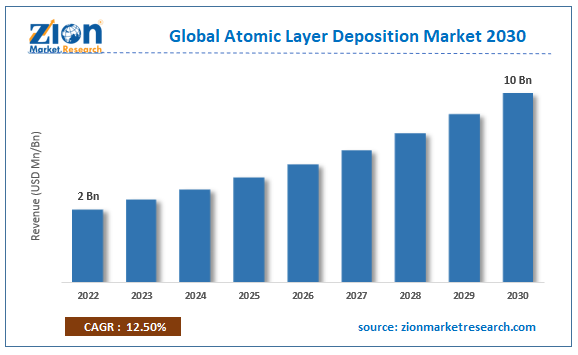

| Market Size in 2022 | Market Forecast in 2030 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 2 Billion | USD 10 Billion | 12.5% | 2022 |

Atomic Layer Deposition Industry Prospective:

The global atomic layer deposition market size was evaluated at $2 billion in 2022 and is slated to hit $10 billion by the end of 2030 with a CAGR of nearly 12.5% between 2023 and 2030.

Atomic Layer Deposition Market: Overview

Atomic layer deposition is a major production procedure used in semiconductor device fabrication and is a component of a tool set that is available for nanomaterial synthesis. It is utilized in data storage equipment, tiny electronic parts, and displays where the film thickness is necessary. Apparently, the advent of Nanotechnology has resulted in the product gaining massive acceptance in various sectors across the globe. It is also used for producing Nano-coatings as well as thin films.

Key Insights

- As per the analysis shared by our research analyst, the global atomic layer deposition market is projected to expand annually at the annual growth rate of around 12.5% over the forecast timespan (2023-2030)

- In terms of revenue, the global atomic layer deposition market size was evaluated at nearly $2 billion in 2022 and is expected to reach $10 billion by 2030.

- The global atomic layer deposition market is anticipated to grow rapidly over the forecast timeline owing to humungous demand for the product in semiconductor & power converting systems.

- In terms of product, the thermal ALD segment is slated to register the highest CAGR over the analysis period.

- Based on application, the electronics & semiconductors segment is slated to register rapid growth in the upcoming years.

- Region-wise, the North American atomic layer deposition industry is projected to register the fastest CAGR during the assessment timeline.

Request Free Sample

Request Free Sample

Atomic Layer Deposition Market: Growth Factors

Escalating product penetration in semiconductor and power transformers will prop up the global market expansion by 2030

The growth of the atomic layer deposition market over the forecast timespan is subject to massive demand for the product in semiconductor & power converting systems. In addition to this, the need for solid-state thin film batteries is surging due to the massive usage of smartwatches, implantable medical equipment, and smartphones will drive the global market surge. Apart from this, the launching of new technologies like plasma-enhanced ALD technology will chart a profitable roadmap for the global market over the forecast timespan. Industrial 4.0 revolution and massive production of solar as well as lithium-ion cells will scale up the global market sphere growth in the forthcoming years. An increase in the use of electric and hybrid vehicles owing to surging environmental concerns will promote global market trends.

Furthermore, atomic layer deposition is used for improving the film characteristics at reduced temperatures. Additionally, escalating demand for miniature & complex parts will drive the market growth over the estimated timespan. Apparently, the product is also used in tin-sensitive solar cells for enhancing its efficacy. New launches and strategic partnerships are projected to leverage the expansion of the market across the globe. For instance, in the last quarter of 2022, Samco, a key producer of deposition, etching, and surface treatment processing devices for semiconductors, introduced a novel PEALD system referred to as AD-800LP. The move is likely to boost the expansion of the market in the near future.

Atomic Layer Deposition Market: Restraints

Need for a huge allocation of funds for installing the technology will thwart the growth of the global industry over 2023-2030

Huge initial investments required for research activities & deployment of atomic layer deposition technology along with a preference for nuclear layer deposition to manufacture tiny & relatively low-cost components will hinder the atomic layer deposition industry growth in the foreseeable future. Rise in product costs can prove to be detrimental to the growth of the industry globally.

Atomic Layer Deposition Market: Opportunities

Supportive government policies prompting setting up of solar power projects will open new growth avenues for the global market in next few years

Government subsidies have provided impetus to the solar power industry and this will not only nullify the negative impact of hindrances on the market growth but will also open new growth avenues for the atomic layer deposition industry over the forecast timespan. Rise in government investments in renewables will further prompt the global market surge.

Atomic Layer Deposition Market: Challenges

Low use of new technologies can create barricades in the expansion of the industry across the globe in the coming eight years

Less use of the novel atomic layer deposition technology in emerging economies along with its restricted use even in some of the developed countries has posed a big challenge to the growth of the atomic layer deposition industry across the globe.

Atomic Layer Deposition Market: Segmentation

The global atomic layer deposition market is sectored into product, application, and region.

In product terms, the global atomic layer deposition market is segregated into thermal ALD, metal ALD, and plasma-enhanced ALD segments. Furthermore, the thermal ALD segment, which acquired nearly three-fourths of the global market proceeds in 2022, is predicted to record the highest rate of growth in the upcoming timespan. The growth of the segment during the projected timeline can be due to the ability of the product in forming uniform atomic layers with conformity as well as surface control. Apart from this, the product is extensively utilized in the deposition of molecules comprising aluminum.

Based on the application, the global atomic layer deposition industry is sectored into electronics & semiconductors, medical, and solar devices segments. Moreover, the electronics & semiconductors segment, which accumulated a major global industry share in 2022, is predicted to lead the global industry over the estimated timeline. The segmental surge over the projected timeframe can be a result of a rise in the demand for electronic parts & semiconductors in the automotive sector.

Atomic Layer Deposition Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Atomic Layer Deposition Market |

| Market Size in 2022 | USD 2 Billion |

| Market Forecast in 2030 | USD 10 Billion |

| Growth Rate | CAGR of 12.5 |

| Number of Pages | 221 |

| Key Companies Covered | Applied Materials Inc., Tosoh Corporation, Ultratech Inc., AIXTRON SE, Air Liquide S.A., Adeka Corporation, NCD Co. Ltd., ALD Nanosolutions Inc., Air Products and Chemicals Inc., Centrotherm Photovoltaics AG, Hitachi Kokusai Electric Inc., Tokyo Electron Ltd., Arradiance Inc., ATMI Inc., Lotus Applied Technology, ASM International N.V., Beneq Oy, Beneq Corporation, Encapsulix SAS, Entegris Inc., CVD Equipment Corporation, Kurt J. Lesker Company, Levitech B.V., SVT Associates Inc., Veeco Instruments Inc., and others. |

| Segments Covered | By Product, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2022 |

| Historical Year | 2017 to 2021 |

| Forecast Year | 2023 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Atomic Layer Deposition Market: Regional Insights

Asia-Pacific is set to retain its domination of the global atomic layer deposition market over the analysis timeframe

Asia-Pacific, which accounted for about 58% of the global atomic layer deposition market revenue in 2022, will be a dominating sub-continent over the prognosis timeline. Moreover, the regional market surge over 2023-2030 can be credited to a huge demand for lightweight and portable equipment in countries such as Taiwan, Japan, and China owing to their energy-efficient features. Moreover, the equipment makes use of atomic layer deposition technology. Apart from this, large-scale use of atomic layer deposition technology in semiconductor chip fabrication in countries such as China, South Korea, and Japan will multiply the size of the regional market. Additionally, the escalating application of electronic devices will further amplify the regional market growth trends in the coming years.

The North American atomic layer deposition industry is set to record the fastest CAGR in the upcoming years due to an increase in urbanization and massive sale of consumer electronic goods in the countries such as Canada and the U.S. Apart from this, a rise in the public-private investments in producing Li-Ion batteries and solar cells due to increase in the setting up of data centers and solar energy ventures in the sub-continent will expand the scope of the regional market demand.

Atomic Layer Deposition Market: Competitive Space

The global atomic layer deposition market profiles key players such as:

- Applied Materials Inc.

- Tosoh Corporation

- Ultratech Inc.

- AIXTRON SE

- Air Liquide S.A.

- Adeka Corporation

- NCD Co. Ltd.

- ALD Nanosolutions Inc.

- Air Products and Chemicals Inc.

- Centrotherm Photovoltaics AG

- Hitachi Kokusai Electric Inc.

- Tokyo Electron Ltd.

- Arradiance Inc.

- ATMI Inc.

- Lotus Applied Technology

- ASM International N.V.

- Beneq Oy

- Beneq Corporation

- Encapsulix SAS

- Entegris Inc.

- CVD Equipment Corporation

- Kurt J. Lesker Company

- Levitech B.V.

- SVT Associates Inc.

- Veeco Instruments Inc.

The global atomic layer deposition market is segmented as follows:

By Product

- Thermal ALD

- Metal ALD

- Plasma-Enhanced ALD

By Application

- Electronics & Semiconductors

- Medical

- Solar Devices

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Atomic layer deposition is a major production procedure used in the semiconductor device fabrication and is a component of a tool set that is available for nanomaterial synthesis.

The global atomic layer deposition market growth can be owing to the need for solid-state thin film batteries is surging due to the massive usage of smart watches, implantable medical equipment, and smartphones.

According to a study, the global atomic layer deposition industry size was $2 billion in 2022 and is projected to reach $10 billion by the end of 2030.

The global atomic layer deposition market is anticipated to record a CAGR of nearly 12.5% from 2023 to 2030.

The North American atomic layer deposition industry is set to register the fastest CAGR over the forecasting timeline owing to an increase in urbanization and massive sale of consumer electronic goods in the countries such as Canada and the U.S. Apart from this, a rise in the public-private investments in producing Li-Ion batteries and solar cells due to increase in the setting up of data centers and solar energy ventures in the sub-continent will expand the scope of the regional market demand.

The global atomic layer deposition market is led by players such as Applied Materials, Inc., Tosoh Corporation, Ultratech, Inc., AIXTRON SE, Air Liquide S.A., Adeka Corporation, NCD Co., Ltd., ALD Nanosolutions, Inc., Air Products and Chemicals, Inc., Centrotherm Photovoltaics AG, Hitachi Kokusai Electric Inc., Tokyo Electron Ltd., Arradiance, Inc., ATMI, Inc., Lotus Applied Technology, ASM International N.V., Beneq Oy, Beneq Corporation, Encapsulix SAS, Entegris, Inc., CVD Equipment Corporation, Kurt J. Lesker Company, Levitech B.V., SVT Associates Inc., and Veeco Instruments Inc.

The atomic layer deposition market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTEL analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five force analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed