ATV and SxS Market Size, Share, Trends, Growth 2034

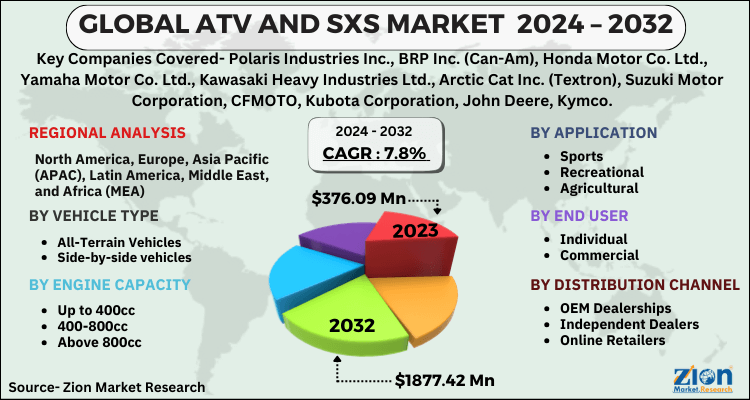

ATV and SxS Market By Vehicle Type (All-Terrain Vehicles, Side-by-side vehicles), By Engine Capacity (Up to 400cc, 400-800cc, and Above 800cc), By Application (Sports, Recreational, Agricultural, Military, and Defense), By End User (Individual, Commercial), By Distribution Channel (OEM Dealerships, Independent Dealers, and Online Retailers), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

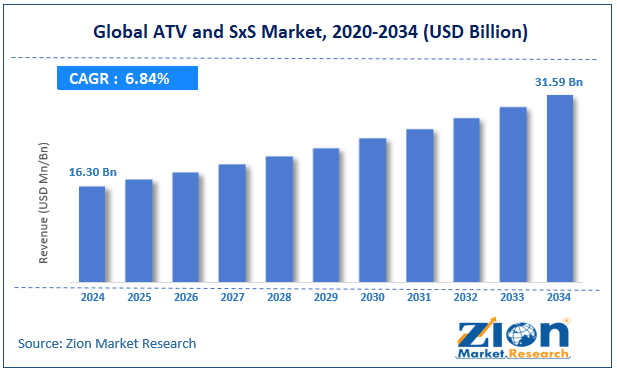

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 16.30 Billion | USD 31.59 Billion | 6.84% | 2024 |

ATV and SxS Industry Prospective:

The global ATV and SxS market size was valued at approximately USD 16.30 billion in 2024 and is expected to reach around USD 31.59 billion by 2034, growing at a compound annual growth rate (CAGR) of roughly 6.84% between 2025 and 2034.

ATV and SxS Market: Overview

All-terrain vehicles (ATVs) are four-wheeled off-road vehicles designed for a single rider. In contrast, side-by-side (SxS) vehicles feature bucket or bench seating for multiple passengers and typically include a cargo bed for utility applications. ATVs and SxS are specialized off-road vehicles designed to handle various terrain conditions that conventional vehicles cannot navigate. This market has changed recreation, agriculture, and utility across many industries.

ATVs and SxS are the foundation of modern off-road mobility, providing powerful engines, suspension, and handling solutions that let you go anywhere, do utility tasks, and play. Outdoor adventure, agricultural efficiency, and demand for versatile utility vehicles drive the ATV and SxS industry.

The expansion of recreation, vehicle performance, safety features technology, and growing adoption of ATVs and SxS for commercial use across many industries will drive the ATV and SxS market substantially over the forecast period.

Key Insights:

- As per the analysis shared by our research analyst, the global ATV and SxS market is estimated to grow annually at a CAGR of around 6.84% over the forecast period (2025-2034)

- In terms of revenue, the global ATV and SxS market size was valued at around USD 16.30 billion in 2024 and is projected to reach USD 31.59 billion by 2034.

- The ATV and SxS market is projected to grow significantly due to the increasing popularity of outdoor recreational activities, rising adoption of ATVs and SxS vehicles in agricultural and industrial applications, and expanding technological innovations enhancing vehicle performance and safety.

- Based on vehicle type, side-by-side vehicles lead the segment and will continue to dominate the global market.

- Based on engine capacity, the 400-800cc segment is anticipated to command the largest market share.

- Based on the application, recreational use is expected to lead the market during the forecast period.

- Based on end-user, individual users will remain the dominant segment during the forecast period.

- Based on region, North America is projected to dominate the global market during the forecast period.

ATV and SxS Market: Growth Drivers

Rising demand for recreational activities and outdoor adventures

In the ATV and SxS industry, with outdoor experiences on the rise, there’s more focus on vehicles that deliver exciting off-road adventures. Consumers are looking for ATV and SxS solutions offering more power, comfort, and safety features to maximize their recreational time. According to recent industry surveys, off-road participation has grown 34% in the last 5 years, and ATV and SxS ownership has grown along with it.

Technological advancements and product innovations

Technology is driving the ATV and SxS market, with manufacturers introducing features like electronic fuel injection, power steering, and improved suspension systems. Modern ATV and SxS vehicles have better fuel efficiency, lower emissions, and better performance.

Research shows that 72% of new ATV and SxS buyers are influenced by technology, and electronic power steering is the number one requested feature. Manufacturers are allocating more of their R&D budget to intelligent vehicle systems, with an 18% growth in new tech investments.

ATV and SxS Market: Restraints

Stringent regulations and safety concerns

Regulatory compliance, safety standards, and environmental restrictions are enormous challenges for the ATV and SxS market. As concerns about vehicle safety and environmental impact grow, manufacturers must adapt to changing regulations.

Industry reports show that 65% of manufacturers say regulatory compliance is the top challenge to market growth, especially for vehicles used for recreation in environmentally sensitive areas.

ATV and SxS Market: Opportunities

Integration of electric powertrains and sustainable technologies

Electric propulsion systems are transforming the ATV and SxS industry by offering improved efficiency, reduced noise levels, and lower operating costs. Electric ATVs and SxS vehicles can now deliver the same performance as traditional engines but with environmental benefits and less maintenance.

For example, companies using electric ATV and SxS solutions report 40% lower running costs and 30% longer service intervals than traditional models.

ATV and SxS Market: Challenges

Price sensitivity and economic fluctuations

The ATV and SxS market is vibrant, but economic uncertainties and price sensitivity present significant barriers to adoption. 58% of potential buyers identify high initial purchase costs as the primary factor delaying their buying decision. 42% of dealers report that economic downturns immediately impact discretionary spending on recreational vehicles.

Supply chain disruptions and raw material price fluctuations make it challenging for manufacturers to maintain competitive pricing. Many regions have seasonal demand patterns that impact inventory management and production planning.

As consumers prioritize value, the demand for cost-effective, multipurpose vehicles that can make recreational and utility applications will continue to grow.

Request Free SampleATV and SxS Market: Report Scope

Request Free SampleATV and SxS Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | ATV and SxS Market |

| Market Size in 2024 | USD 16.30 Billion |

| Market Forecast in 2034 | USD 31.59 Billion |

| Growth Rate | CAGR of 6.84% |

| Number of Pages | 216 |

| Key Companies Covered | Polaris Industries Inc., BRP Inc. (Can-Am), Honda Motor Co. Ltd., Yamaha Motor Co. Ltd., Kawasaki Heavy Industries Ltd., Arctic Cat Inc. (Textron), Suzuki Motor Corporation, CFMOTO, Kubota Corporation, John Deere, Kymco, Hisun Motors, Textron Off Road, Intimidator Group, Bobcat Company, ARGO, SHERP, HISUN Motors, Mahindra & Mahindra Ltd., Tracker Off Road, and others. |

| Segments Covered | By Vehicle Type, By Engine Capacity, By Application, By End User, By Distribution Channel, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

ATV and SxS Market: Segmentation

The global ATV and SxS market is segmented into vehicle type, engine capacity, application, end user, distribution channel, and region.

Based on vehicle type, the ATV and SxS industry is segregated into all-terrain vehicles and side-by-side vehicles. Side-by-side vehicles lead the market by offering enhanced comfort, passenger capacity, and cargo capabilities. SxS vehicles account for approximately 62% of total off-road vehicle sales.

Based on engine capacity, the ATV and SxS market is divided into up to 400cc, 400-800cc, and above 800cc. The 400-800cc segment is expected to lead the market during the forecast period, as these engines provide an optimal balance of power and efficiency, accounting for over 53% of revenue across the recreational and utility segments.

Based on application, the ATV and SxS market is categorized into sports, recreational, agricultural, military, and defense. Recreational applications are expected to lead the market since they represent the most extensive consumer base seeking vehicles for leisure and entertainment activities, accounting for approximately 46% of ATV and SxS vehicle usage.

Based on end users, the industry is segregated into individual and commercial users. Individual users dominate the market due to the widespread adoption of ATVs and SxS vehicles for personal recreation and property maintenance, accounting for approximately 67% of global ATV and SxS vehicle purchases.

ATV and SxS Market: Regional Analysis

North America to lead the market

North America leads the ATV and SxS industry due to its vast trail systems, sizeable rural population, and strong recreational vehicle culture in the US and Canada. The US alone accounts for 52% of global ATV and SxS vehicle sales, as outdoor recreational activities are deeply ingrained in the regional culture.

The region has an extensive dealer network and maintenance infrastructure has built brand loyalty and consumer confidence in ATV and SxS products. Big manufacturers like Polaris, Can-Am, and Honda have set up significant regional production and distribution to ensure product availability and after-sales support.

North American consumers spend 20-25% more on accessorizing and upgrading their off-road vehicles than their global counterparts, thus supporting a thriving aftermarket industry.

North America also benefits from favorable government policies supporting off-road recreation, including designated trail expansions and public land access initiatives, further driving market demand. Strong aftermarket support and financing options also contribute to increasing ATV and SxS adoption across various consumer segments.

Europe to grow significantly

Europe is seeing strong growth in the ATV and SxS market driven by adoption in agricultural applications, expansion of trail networks, and recognition of these vehicles in various sectors. France’s farming industry has seen 22% growth in ATV and SxS adoption over the last 3 years, mainly in livestock management and vineyard operations. Countries like Sweden, Norway, and Finland are building dedicated trail systems for recreational off-road vehicles, expanding the market for tourism-oriented rentals and sales.

The UK has seen significant growth in SxS adoption, especially in rural estates, equestrian centers, and hunting preserves, with 18% annual sales growth. The region’s strict emissions standards drive the transition to cleaner engines and electric powertrains, especially in countries with aggressive climate targets.

Recent Market Developments:

- In January 2025, Polaris introduced new specialty ATVs, including the Sportsman 850 and XP 1000 Mud Edition, Scrambler 850 and XP 1000S, and Sportsman Touring models with enhanced lighting and styling.

- In February 2025, Yamaha launched the all-new RMAX4 1000, a side-by-side (SxS) with advanced technology, setting new benchmarks for off-road performance.

ATV and SxS Market: Competitive Analysis

The global ATV and SxS market is led by players like:

- Polaris Industries Inc.

- BRP Inc. (Can-Am)

- Honda Motor Co. Ltd.

- Yamaha Motor Co. Ltd.

- Kawasaki Heavy Industries Ltd.

- Arctic Cat Inc. (Textron)

- Suzuki Motor Corporation

- CFMOTO

- Kubota Corporation

- John Deere

- Kymco

- Hisun Motors

- Textron Off Road

- Intimidator Group

- Bobcat Company

- ARGO

- SHERP

- HISUN Motors

- Mahindra & Mahindra Ltd.

- Tracker Off Road

The global ATV and SxS market is segmented as follows:

By Vehicle Type

- All-Terrain Vehicles

- Side-by-side vehicles

By Engine Capacity

- Up to 400cc

- 400-800cc

- Above 800cc

By Application

- Sports

- Recreational

- Agricultural

- Military and Defense

By End User

- Individual

- Commercial

By Distribution Channel

- OEM Dealerships

- Independent Dealers

- Online Retailers

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

All-terrain vehicles (ATVs) are four-wheeled off-road vehicles designed for a single rider. In contrast, side-by-side (SxS) vehicles feature bucket or bench seating for multiple passengers and typically include a cargo bed for utility applications.

The ATV and SxS market is expected to be driven by increasing demand for recreational activities, rising adoption in agricultural and utility applications, technological advancements in vehicle performance and safety features, growing interest in electric powertrains, and expansion of trail networks and riding areas.

According to our study, the global ATV and SxS market was worth around USD 16.30 billion in 2024 and is predicted to grow to around USD 31.59 billion by 2034.

The CAGR value of the ATV and SxS market is expected to be around 6.84% during 2025-2034.

The global ATV and SxS market will register the highest growth in North America during the forecast period.

Key players in the ATV and SxS market include Polaris Industries Inc., BRP Inc. (Can-Am), Honda Motor Co., Ltd., Yamaha Motor Co., Ltd., Kawasaki Heavy Industries, Ltd., Arctic Cat Inc. (Textron), Suzuki Motor Corporation, CFMOTO, Kubota Corporation, John Deere, Kymco, Hisun Motors, Textron Off Road, Intimidator Group, Bobcat Company, ARGO, SHERP, HISUN Motors, Mahindra & Mahindra Ltd., and Tracker Off Road.

The report comprehensively analyzes the ATV and SxS market, including an in-depth discussion of market drivers, restraints, emerging trends, regional dynamics, and future growth opportunities. It also examines competitive dynamics, technological innovations, the evolving landscape of vehicle capabilities, consumer preferences, and regulatory requirements shaping the ATV and SxS ecosystem.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed