Auto Brake Fluid Market Size, Share, Trends, Growth and Forecast 2030

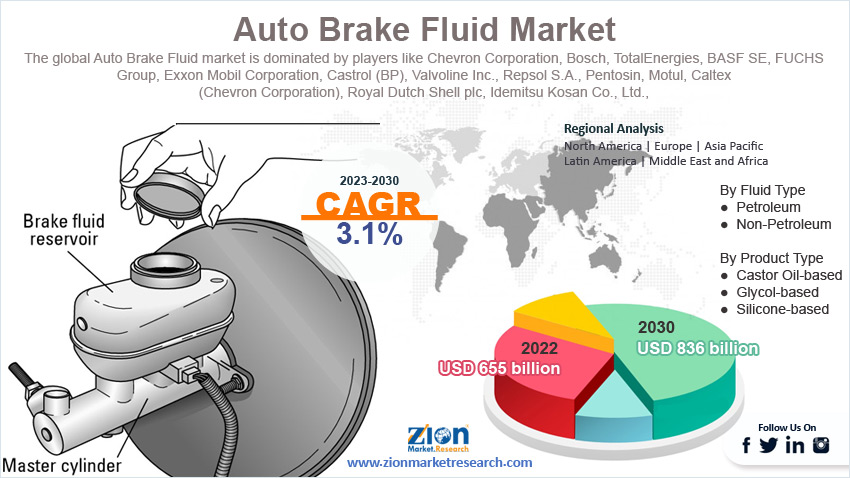

Auto Brake Fluid Market By Fluid Type (Petroleum and Non-Petroleum), By Product Type (Castor Oil-based, Glycol-based, and Silicone-based), By Vehicle Type (Passenger Vehicles, Commercial Vehicles, and Off-road Vehicles), By Market Type (OEM and Aftermarket), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2023 - 2030

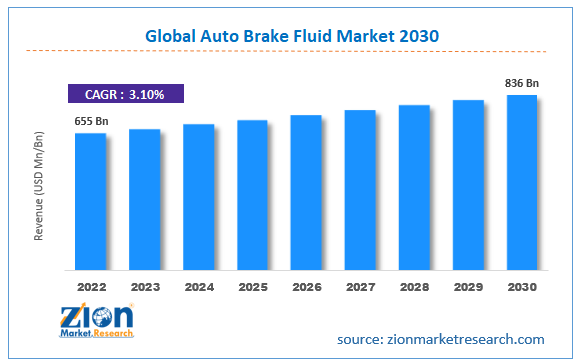

| Market Size in 2022 | Market Forecast in 2030 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 655 Billion | USD 836 Billion | 3.1% | 2022 |

Auto Brake Fluid Industry Prospective:

The global auto brake fluid market size was worth around USD 655 billion in 2022 and is predicted to grow to around USD 836 billion by 2030 with a compound annual growth rate (CAGR) of roughly 3.1% between 2023 and 2030.

Auto Brake Fluid Market: Overview

The term "auto brake fluid" describes a particular type of hydraulic fluid used in the brakes and hydraulic clutches of cars, motorcycles, and some types of bicycles. The hydraulic clutch and brake systems of automobiles both use braking fluid, which belongs to the hydraulic fluid family. The need for brake fluid has increased as a result of modern cars' usage of hydraulic brakes. Hydraulic brakes have gradually replaced mechanical brakes. In cars, brake fluid is used to boost the transfer force, which applies pressure to the brakes. It is impossible to overestimate the importance of brake fluids in this process of keeping the brakes functioning properly. They are designed in a way that prevents harm to the rubber parts that make up the entire braking system. Replacement of these fluids regularly is necessary to keep the braking system operating at its best.

Key Insights

- As per the analysis shared by our research analyst, the global Auto Brake Fluid market is estimated to grow annually at a CAGR of around 3.1% over the forecast period (2023-2030).

- In terms of revenue, the global Auto Brake Fluid market size was valued at around USD 655 billion in 2022 and is projected to reach USD 836 billion, by 2030.

- The growing automotive production especially in developing economies is expected to drive the auto brake fluid market growth during the forecast period.

- Based on the fluid type, the petroleum segment is expected to dominate the market growth during the forecast period.

- Based on the product type, the glycol-based segment is expected to grow at the highest CAGR during the forecast period.

- Based on the market type, the aftermarket segment is expected to grow at a rapid rate over the projected timeframe.

- Based on region, the Asia Pacific is expected to hold a significant market share during the forecast period.

Request Free Sample

Request Free Sample

Auto Brake Fluid Market: Growth Drivers

Increasing demand for light commercial vehicles drives market growth

One form of hydraulic fluid utilized in a variety of vehicles, including passenger automobiles and light commercial vehicles, is brake fluid. Electric cars require brake fluids. Growing consumer awareness is driving up market demand, and government measures toward zero-emission and eco-friendly automobiles are the main drivers of the recent surge in the manufacturing of electric vehicles. A large number of international automakers are making large investments in electric vehicles, including Tesla, General Motors, Toyota, BME, Nissan, Ford, and Volkswagen. Within the following five to ten years, these investments should start to pay off. Approximately 50 million passenger automobiles were produced globally in the first three quarters of 2022, a roughly 9% rise from the same period in 2021. Thus, the aforementioned stats are expected to propel the auto brake fluid market during the forecast period.

Auto Brake Fluid Market: Restraints

Environmental and regulatory challenge hampers market growth

Environmental standards are becoming increasingly stringent for the automotive sector. Environmentally friendly braking fluid formulas may be required as a result, and manufacturers may have difficulties in developing and implementing such formulations. Thus, environmental and regulatory challenge is expected to hamper the auto brake fluid industry over the forecast period.

Auto Brake Fluid Market: Opportunities

Growing consumption in the automobile sector offers an attractive opportunity for market expansion

Due to growing product needs in the automotive sector throughout the forecast period, the worldwide market for auto brake fluid is expected to rise. The growing demand, R&D expenditures, manufacturing, and sales have all contributed to the market's anticipated significant development. Its exceptional qualities, which include quick replacement, smooth and safe operation, resilience to pressure, non-damaging, and others, make it the best option and promote the auto brake fluid market expansion. For instance, in July 2023, under the eLEC brand, Gulf Lubricants introduced a new line of braking fluids and coolants for electric and hybrid powertrains. Even with the addition of regenerative braking for electric cars (EVs), the brake system still needs a fluid with a high boiling point because when the battery is fully charged, the system experiences tremendous demand. The requirement for corrosion resistance increases when regenerative braking is activated since brakes will be utilized less frequently.

Auto Brake Fluid Market: Challenges

Supply chain disruption poses a major challenge to market growth

The COVID-19 epidemic has caused significant obstacles for the automobile braking fluid sector, which has seen a sharp global slowdown in the growth of the auto brake fluid industry. The implementation of lockdowns and other limitations reduced demand, which presented obstacles for the major market participants. The supply chain has been significantly influenced by the market, which is currently experiencing unparalleled volatility. However, in light of the COVID-19 guidelines, big players are regaining their positions when restoration gets underway in 2021 by increasing their output, using their capacity, and engaging in teleshopping.

Auto Brake Fluid Market: Segmentation

The global Auto Brake Fluid industry is segmented based on the fluid type, product type, vehicle type, market type, and region.

Based on the fluid type, the global market is bifurcated into petroleum and non-petroleum. The petroleum segment is expected to dominate the market growth during the forecast period. Glycols, which are generated from petroleum, are frequently used as a foundation in traditional braking fluid formulations. Conventional hydraulic braking systems frequently employ brake fluids with a glycol basis, such as DOT 3 and DOT 4. These brake fluids are renowned for being compatible with a variety of braking system components and having high boiling temperatures. Thereby, driving the auto brake fluid market expansion.

Based on the product type, the global Auto Brake Fluid industry is bifurcated into castor oil-based, glycol-based, and silicone-based. The glycol-based segment is expected to grow at the highest CAGR during the forecast period. Because of their high boiling temperatures, brake fluids based on glycol are well-known for preserving brake system function in hot weather. Furthermore, braking fluids based on glycol have the property of being hygroscopic, which means that over time, they tend to take up moisture from the air around them. Thus, these benefits drive the segment expansion.

Based on the market type, the global auto brake fluid industry is bifurcated into OEM and Aftermarket. The aftermarket segment is expected to grow at a rapid rate over the projected timeframe. The segment expansion is due to its adaptability, satisfying demands for replacement and customization after purchase. Aftermarket services and products, with their emphasis on innovation and cost-effectiveness, draw sectors looking for specialized solutions, rapid developments, and a wide range of product possibilities.

Auto Brake Fluid Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Auto Brake Fluid Market |

| Market Size in 2022 | USD 655 Billion |

| Market Forecast in 2030 | USD 836 Billion |

| Growth Rate | CAGR of 3.1% |

| Number of Pages | 221 |

| Key Companies Covered | Chevron Corporation, Bosch, TotalEnergies, BASF SE, FUCHS Group, Exxon Mobil Corporation, Castrol (BP), Valvoline Inc., Repsol S.A., Pentosin, Motul, Caltex (Chevron Corporation), Royal Dutch Shell plc, Idemitsu Kosan Co. Ltd., Prestone Products Corporation, ATE (Continental AG), TRW Automotive Holdings Corp., ITW Global Brands, Morris Lubricants and Warren Distribution, and others. |

| Segments Covered | By Fluid Type, By Product Type, By Vehicle Type, By Market Type, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2022 |

| Historical Year | 2017 to 2021 |

| Forecast Year | 2023 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Auto Brake Fluid Market: Regional Analysis

Asia Pacific is expected to hold a significant market share during the forecast period

The Asia Pacific is expected to hold a significant auto brake fluid market share during the forecast period because of the existence of major automakers like South Korea, Japan, China, and India. To increase profitability, these nations are putting a lot of effort into building up their automotive manufacturing bases and creating effective supply chains. The governments in the Asia-Pacific area have enacted laws that are conducive to the adoption of electric cars and the expansion of the infrastructure for their manufacture. Thus, throughout the forecast period, it is expected to provide the brake fluids market in the Asia-Pacific region a significant boost. For instance, China is the world's top automobile producer, according to the China Association of Automobile Manufacturers (CAAM), with a total vehicle output of 27 million units in 2022—a 3.4% increase over the 26 million units produced the previous year. Furthermore, the Society of Indian Automobile Manufacturers (SIAM) reports that the Indian automotive sector manufactured 22,933,230 automobiles in 2022 during FY 2021–2022, which ran from April 2021 to March 2022. Furthermore, automobile output rose from 1,69,519 units in June 2022 to 1,93,629 units in July 2022, according to the Centre for Monitoring Indian Economy (CMIE). Brake fluid usage is probably going to rise as a result of these variables.

Auto Brake Fluid Market: Competitive Analysis

The global Auto Brake Fluid market is dominated by players like:

- Chevron Corporation

- Bosch

- TotalEnergies

- BASF SE

- FUCHS Group

- Exxon Mobil Corporation

- Castrol (BP)

- Valvoline Inc.

- Repsol S.A.

- Pentosin

- Motul

- Caltex (Chevron Corporation)

- Royal Dutch Shell plc

- Idemitsu Kosan Co. Ltd.

- Prestone Products Corporation

- ATE (Continental AG)

- TRW Automotive Holdings Corp.

- ITW Global Brands

- Morris Lubricants and Warren Distribution

The global Auto Brake Fluid market is segmented as follows:

By Fluid Type

- Petroleum

- Non-Petroleum

By Product Type

- Castor Oil-based

- Glycol-based

- Silicone-based

By Vehicle Type

- Passenger Vehicles

- Commercial Vehicles

- Off-road Vehicles

By Market Type

- OEM

- Aftermarket

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The term "auto brake fluid" describes a particular type of hydraulic fluid used in the brakes and hydraulic clutches of cars, motorcycles, and some types of bicycles. Automobile The hydraulic clutch and brake systems of automobiles both use braking fluid, which belongs to the hydraulic fluid family. The need for brake fluid has increased as a result of modern cars' usage of hydraulic brakes.

The auto fluid market is expected to be driven by several factors including increasing sales of passenger vehicles, the introduction of EVs, technological advancements, and rising product launches.

According to the report, the global auto brake fluid market size was worth around USD 655 billion in 2022 and is predicted to grow to around USD 836 billion by 2030.

The global Auto Brake Fluid market is expected to grow at a CAGR of 3.1% during the forecast period.

The global Auto Brake Fluid market growth is expected to be driven by the Asia Pacific. It is currently the world’s highest revenue-generating market due to the presence of major automobile manufacturers.

The global Auto Brake Fluid market is dominated by players like Chevron Corporation, Bosch, TotalEnergies, BASF SE, FUCHS Group, Exxon Mobil Corporation, Castrol (BP), Valvoline Inc., Repsol S.A., Pentosin, Motul, Caltex (Chevron Corporation), Royal Dutch Shell plc, Idemitsu Kosan Co., Ltd., Prestone Products Corporation, ATE (Continental AG), TRW Automotive Holdings Corp., ITW Global Brands, Morris Lubricants and Warren Distribution among others.

The Auto Brake Fluid market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed