Global Auto Dealership Market Size, Share, Analysis, Trends, Growth, 2034

Auto Dealership Market By Vehicle Type (New Vehicles, Used Vehicles, and Certified Pre-Owned Vehicles), By Dealership Size (Large Dealerships, Mid-Sized Dealerships, and Small Dealerships), By Ownership Size (Independent Dealerships, Franchised Dealerships, and Factory-Owned Dealerships), By Sales Channel (Physical Dealerships, Online Dealerships, and Hybrid Dealerships), By Vehicle Class (Passenger Cars, Light-Duty Trucks, Medium-Duty Trucks, Heavy-Duty Trucks, Buses, and Motorcycles), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

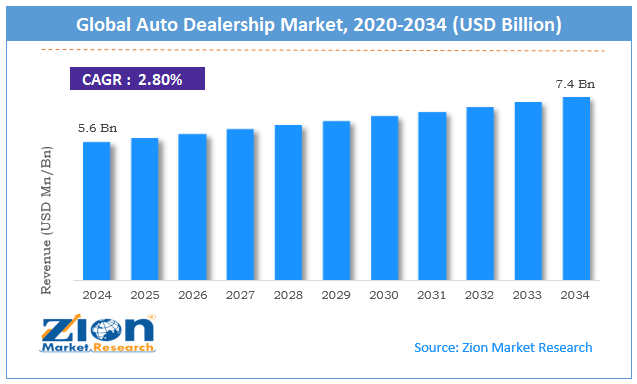

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 5.6 Billion | USD 7.4 Billion | 2.8% | 2024 |

Auto Dealership Industry Prospective:

The global auto dealership market size was worth around USD 5.6 billion in 2024 and is predicted to grow to around USD 7.4 billion by 2034, with a compound annual growth rate (CAGR) of roughly 2.8% between 2025 and 2034.

Auto Dealership Market: Overview

An auto dealership is a company that offers consumers either new or old autos. Usually, it serves as a franchise of a car manufacturer or as an independent merchant. Auto dealerships can also provide related services, including finance, leasing, maintenance, repairs, and trade-ins. They usually have a showroom for car exhibits and a service area for help following purchase.

The auto dealership market is driven by several factors, such as rising vehicle demand, advancement in financing options, shift towards EVs, rising disposable income, and others. However, the high operational cost might hinder the industry's expansion over the projected period.

Key Insights

- As per the analysis shared by our research analyst, the global auto dealership market is estimated to grow annually at a CAGR of around 2.8% over the forecast period (2025-2034).

- In terms of revenue, the global auto dealership market size was valued at around USD 5.6 billion in 2024 and is projected to reach USD 7.4 billion by 2034.

- Increasing demand for passenger cars is expected to drive the auto dealership market over the forecast period.

- Based on the vehicle type, the new vehicles segment is expected to hold the largest market share over the forecast period.

- Based on the dealership size, the large dealership segment is expected to dominate the market expansion over the projected period.

- Based on the ownership structure, the independent dealership segment is expected to hold the largest market share during the forecast period.

- Based on the sales channel, the physical dealership segment is expected to hold the largest market share over the projected period.

- Based on the vehicle class, the passenger cars segment is expected to hold the largest market share over the projected period.

- Based on region, North America is expected to dominate the market during the forecast period.

Auto Dealership Market: Growth Drivers

Increasing demand for personalized customer services drives market growth

The key driver of the expansion of the automotive dealership market is the growing demand for customized vehicle services. Today's Customers are more volatile and need a tailored experience while dealing with a dealership. Dealerships have thus created unique financing options, flexible leasing policies, and tailored auto maintenance schedules.

Moreover, data analytics has become a vital tool in helping dealerships understand customer wants and offer exactly customized solutions. Last but not least, by letting consumers plan the best possible trips, check car details, and get customized recommendations, mobile apps and websites have improved and further tailored the customer experience.

Auto Dealership Market: Restraints

High operational cost hinders market growth

High running expenses for car dealerships create a major challenge that impacts the auto dealership industry's long-term survival as well as profitability. For dealerships, large showrooms, service facilities, and parking lots—often in prime areas—are requirements. Rising commercial property taxes and rents cause overhead expenses to rise in concert.

Moreover, qualified technicians, salespeople, and service advisers also need competitive remuneration. Continuous training helps staff members stay current with new automobile models, technology developments, and customer service standards, therefore raising their expenses.

Furthermore, the need to attract customers—traditional and digital—through TV, internet ads, social media, and promotions which increases running costs—is advertising. Keeping an online presence through digital sales systems and virtual showrooms raises tech-related expenses. Thus, high operational costs hampering the market growth.

Auto Dealership Market: Opportunities

The growing adoption of EVs offers a lucrative opportunity for market growth

Since EV manufacturers have had to make investments in the growth of EV-related infrastructure, which in turn has resulted in an increase in the number of EV technicians hired, this trend has presented opportunities for dealerships.

Manufacturers of electric vehicles have also engaged dealerships in ensuring that EV owners are sufficiently catered to through different sales, service, and support projects as they aim to raise their market share. The growing acceptance of EVs, which has been enabled by governments all across the world to implement rigorous rules to lower carbon emissions, also favors the market for automotive dealerships.

Auto Dealership Market: Challenges

Supply chain disruption poses a major challenge to market expansion

Supply chain disruptions have badly affected the auto dealership industry, leading to lower sales, pricing volatility, and inventory shortages. Among other essential operations, semiconductors are fundamental in the entertainment systems, safety measures, and engine management of modern cars.

Worldwide chip shortages have caused delays in car manufacture, lower inventory in dealerships, and higher car costs. Longer lead times for new automobiles have also come from disruptions in the automotive sector brought on by shortages of raw materials, including steel, aluminum, and rubber, a lack of personnel, and closed factories.

Auto Dealership Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Auto Dealership Market |

| Market Size in 2024 | USD 5.6 Billion |

| Market Forecast in 2034 | USD 7.4 Billion |

| Growth Rate | CAGR of 2.8% |

| Number of Pages | 219 |

| Key Companies Covered | DARCARS, Group 1 Automotive, Sewell Automotive Companies, Berkshire Hathaway Automotive Group, AutoNation, Hendrick Automotive Group, Rusty Wallace Automotive Group, Jim Ellis Automotive Group, Lithia Motor, Fitzgerald Auto Mall, Penske, Sonic Automotive, Germain Motor Company, Asbury, AutoCanada, and others. |

| Segments Covered | By Vehicle Type, By Dealership Size, By Ownership Structure, By Sales Channel, By Vehicle Class, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Auto Dealership Market: Segmentation

The global auto dealership industry is segmented based on vehicle type, dealership size, ownership structure, sales channel, vehicle class, and region.

Based on the vehicle type, the global auto dealership market is bifurcated into new, used, and certified pre-owned vehicles. The new vehicle segment is expected to hold the largest market share over the forecast period. Increasing disposable income and economic recovery have boosted consumer spending on new cars. A shift toward personal vehicle ownership (post-pandemic) has increased demand, especially in urban and suburban areas. Thus driving the segment growth.

Based on the dealership size, the global auto dealership industry is bifurcated into large dealerships, mid-sized dealerships, and small dealerships. The large dealership segment is expected to dominate the market expansion over the projected period. Large dealerships bargain with manufacturers for lower prices, which lowers costs per unit and increases profit margins. Even in the event of supply chain interruptions, bulk buying aids in maintaining a consistent inventory.

Based on the ownership structure, the global auto dealership market is bifurcated into independent dealerships, franchised dealerships, and factory-owned dealerships. The independent dealership segment is expected to hold the largest market share during the forecast period. Sales of independent dealers have increased, particularly in the used car market, due to the growing need for reasonably priced automobiles. Certified pre-owned (CPO) programs are offered by numerous independent dealerships, drawing in customers seeking reliability at reduced costs.

Based on the sales channel, the global auto dealership industry is bifurcated into physical dealerships, online dealerships, and hybrid dealerships. The physical dealership segment is expected to hold the largest market share over the projected period. Unlike online orders, physical dealerships offer instant vehicle availability, minimizing wait periods for clients. Buyers can complete paperwork, receive financing approvals, and drive away with their new automobile on the same day. Thus driving the segment growth.

Based on the vehicle, the global auto dealership market is bifurcated into passenger cars, light-duty trucks, medium-duty trucks, heavy-duty trucks, buses, and motorcycles. The passenger cars segment captures the largest market share over the forecast period. This growth is attributed to the increasing demand for passenger cars across the globe.

Auto Dealership Market: Regional Analysis

Asia Pacific dominates the market over the projected period

The Asia Pacific is expected to dominate the global auto dealership market. The fast economic growth in China, India, Indonesia, and Vietnam is driving the rise of disposable income. First-time buyers of cars are driving increasing demand for both new and secondhand vehicles.

Moreover, the governments of China, Japan, and South Korea are supporting EV acceptance using tax incentives and subsidies. Auto dealerships are charging infrastructure and expanding EV offers to boost income.

Furthermore, the market demand due to the customer desire for competitively priced cars is the market for certified pre-owned (CPO) and used cars. Industry expansion is driven by online markets for used vehicles such as CARS24 and CarDekho.

Auto Dealership Market: Competitive Analysis

The global auto dealership market is dominated by players like:

- DARCARS

- Group 1 Automotive

- Sewell Automotive Companies

- Berkshire Hathaway Automotive Group

- AutoNation

- Hendrick Automotive Group

- Rusty Wallace Automotive Group

- Jim Ellis Automotive Group

- Lithia Motor

- Fitzgerald Auto Mall

- Penske

- Sonic Automotive

- Germain Motor Company

- Asbury

- AutoCanada

The global auto dealership market is segmented as follows:

By Vehicle Type

- New Vehicles

- Used Vehicles

- Certified Pre-Owned Vehicles

By Dealership Size

- Large Dealerships

- Mid-Sized Dealerships

- Small Dealerships

By Ownership Structure

- Independent Dealerships

- Franchised Dealerships

- Factory-Owned Dealerships

By Sales Channel

- Physical Dealerships

- Online Dealerships

- Hybrid Dealerships

By Vehicle Class

- Passenger Cars

- Light-Duty Trucks

- Medium-Duty Trucks

- Heavy-Duty Trucks

- Buses

- Motorcycles

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

An auto dealership is a company that offers consumers either new or old autos. Usually, it serves as a franchise of a car manufacturer or as an independent merchant. Auto dealerships can also provide related services, including finance, leasing, maintenance, repairs, and trade-ins.

The auto dealership market is driven by several factors, such as rising vehicle demand, advancement in financing options, shift towards EVs, rising disposable income, and others.

According to the report, the global auto dealership market size was worth around USD 5.6 billion in 2024 and is predicted to grow to around USD 7.4 billion by 2034.

The global auto dealership market is expected to grow at a CAGR of 2.8% during the forecast period.

The global auto dealership market growth is expected to be driven by the Asia Pacific. It is currently the world’s highest revenue-generating market due to growing vehicle sales and the rising disposable income of the population.

The global auto dealership market is dominated by players like DARCARS, Group 1 Automotive, Sewell Automotive Companies, Berkshire Hathaway Automotive Group, AutoNation, Hendrick Automotive Group, Rusty Wallace Automotive Group, Jim Ellis Automotive Group, Lithia Motor, Fitzgerald Auto Mall, Penske, Sonic Automotive, Germain Motor Company, Asbury and AutoCanada among others.

The auto dealership report covers the geographical market and a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed