Auto Parts and Accessories Market Size, Share, Trends, Growth 2034

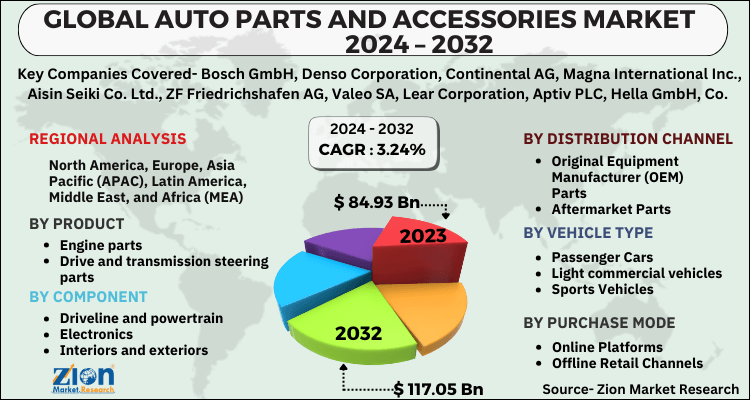

Auto Parts and Accessories Market By Product (Engine Parts, Drive and Transmission Steering Parts, Braking Parts, Electrical Parts, Suspension, And Others), By Component (Driveline and Powertrain, Electronics, Interiors and Exteriors, Lighting, Seating, And Others), By Distribution Channel (Original Equipment Manufacturer (OEM) Parts, And Aftermarket Parts), By Vehicle Type (Passenger Cars, Commercial Vehicles, And Two-Wheelers Passenger Cars, Light Commercial Vehicle, Sports Vehicles, Commercial Vehicles, Two-Wheelers, And Others), By Purchase Mode (Online Platforms, Offline Retail Channels, And Specialized Automotive Stores), And By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, And Forecasts 2025 - 2034

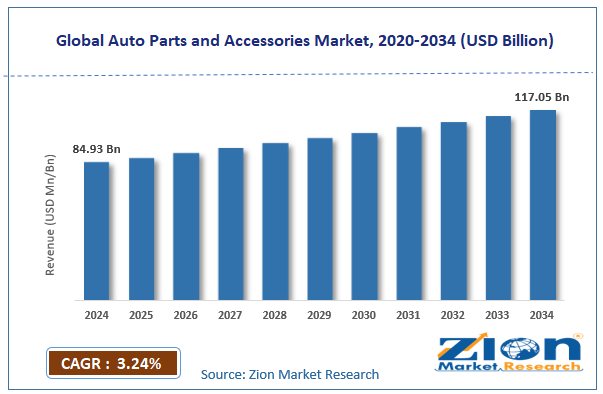

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 84.93 Billion | USD 117.05 Billion | 3.24% | 2024 |

Auto Parts and Accessories Industry Prospective:

The global auto parts and accessories market size was valued at approximately USD 84.93 billion in 2024 and is expected to reach around USD 117.05 billion by 2034, growing at a compound annual growth rate (CAGR) of roughly 3.24% between 2025 and 2034.

Auto Parts and Accessories Market: Overview

Auto parts and accessories refer to the various components and supplementary items used in an automobile's manufacture, maintenance, repair, or enhancement. The auto parts and accessories market is continuously experiencing technological innovation, shifting consumer preferences, and a regulatory environment affecting manufacturing, distribution, and consumption trends.

Some technologies driving change in the auto parts and accessories industry include electric vehicle parts, advanced driver assistance systems (ADAS), and sustainable production technologies.

As technology evolves, vehicle complexity increases, and customization becomes a trend, this leads to reshaping the auto parts and accessories industry at its core. The transition toward electric and hybrid vehicles, coupled with sophisticated electronic systems, has expanded the market's scope beyond traditional mechanical components.

Key Insights:

- As per the analysis shared by our research analyst, the global auto parts and accessories market is estimated to grow annually at a CAGR of around 3.24% over the forecast period (2025-2034)

- In terms of revenue, the global auto parts and accessories market was valued at around USD 84.93 billion in 2024 and is projected to reach USD 117.05 billion by 2034.

- The auto parts and accessories market is projected to grow significantly due to rising vehicle production, increasing average vehicle age, and technological innovations.

- Based on the product, engine parts are anticipated to command the largest market share.

- Based on the components, the driveline and powertrain will continue dominating the global market, as per industry projections.

- Based on the distribution channel, the aftermarket parts are expected to lead the market during the forecast period.

- Based on the vehicle type, passenger cars represent the largest segment.

- Based on the purchase mode, online distribution channels are experiencing exponential growth.

- Based on region, North America is projected to dominate the global market during the forecast period.

Auto Parts and Accessories Market: Growth Drivers

Technological Advancement and Electric Vehicle Ecosystem

The auto parts and accessories market is constantly transforming due to the implementation of electric technology in automobiles. The EV market requires newer components such as battery systems, power electronics, electric drivetrains, and charging infrastructure. The global push toward sustainable transportation drives investments in advanced materials, lightweight components, and high-efficiency systems. Manufacturers thus focus on developing specialized parts to achieve higher EV performance, energy efficiency enhancements, and extended range abilities.

Increasing Vehicle Complexity and Technological Integration

Modern vehicles are becoming increasingly sophisticated, incorporating advanced electronic systems, connectivity features, and complex mechanical components. The technological complexity of vehicles requires unique auto components and accessories; hence, manufacturers are accelerating market growth for these items. Advanced driver-assistance systems (ADAS), integrated infotainment systems, and sensor-based technologies create new opportunities for precision-engineered automotive components. Technological advancements lead to more frequent changes in automotive components while boosting the overall need for auto parts and accessories.

Auto Parts and Accessories Market: Restraints

Global Supply Chain Disruptions

In the auto parts and accessories industry, supply chain problems, which extend because of geopolitical tensions and economic insecurities, create substantial market obstacles. The components' availability and prices are often affected by semiconductor shortages, raw material price volatility, and complex logistics networks. Both production costs and market stability remain negatively influenced when disruptions occur in the supply chain network, which targets OEM and the aftermarket sectors.

Stringent Regulatory Compliance

In the auto parts and accessories market, safety and emissions regulations have become more vigorous, making manufacturers constantly need technology updates. Manufacturers need to dedicate significant funding to research and development activities for updated regulatory compliance purposes. Implementing compliance requirements introduces significant complexities that affect multiple stages in part creation and production alongside certification procedures.

Auto Parts and Accessories Market: Opportunities

Emerging Markets and Infrastructure Development

The auto parts and accessories industry offers significant growth prospects throughout developing nations within Asia-Pacific, Latin America, and Africa. Higher vehicle sales, expanded infrastructure investments, and rising disposable incomes drive the market. These regions offer significant potential for market penetration, particularly in the aftermarket and replacement component segments.

Digital Transformation and E-Commerce Integration

The digital revolution has dramatically changed how auto parts distributors operate their distribution networks in the industry. Users now benefit from remarkable access coupled with transparent cost details and simple buying processes possible through online platforms. Advanced digital technologies like augmented reality (AR) for part selection, AI-driven recommendation systems, and blockchain-enabled supply chain tracking create innovative market solutions.

Auto Parts and Accessories Market: Challenges

Rapid Technological Obsolescence

The accelerating pace of automotive technology creates challenges of rapid component obsolescence. Manufacturers must dedicate constant investments to research and development activities, which demand sizeable financial backing and specialized technological knowledge. The transition towards electric and autonomous vehicles further amplifies this challenge, necessitating continuous innovation.

Request Free Sample

Request Free Sample

Auto Parts and Accessories Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Auto Parts and Accessories Market |

| Market Size in 2024 | USD 84.93 Billion |

| Market Forecast in 2034 | USD 117.05 Billion |

| Growth Rate | CAGR of 3.24% |

| Number of Pages | 224 |

| Key Companies Covered | Bosch GmbH, Denso Corporation, Continental AG, Magna International Inc., Aisin Seiki Co. Ltd., ZF Friedrichshafen AG, Valeo SA, Lear Corporation, Aptiv PLC, Hella GmbH, Co. KGaA., and others. |

| Segments Covered | By Product, By Component, By Component, By Vehicle Type, By Purchase Mode, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Auto Parts and Accessories Market: Segmentation

The global auto parts and accessories market is segmented based on product, component, distribution channel, vehicle type, purchase mode, and region.

Based on the product, the market is segregated into engine parts, drive and transmission steering, braking, electrical, and suspension parts. Engine parts lead the auto parts and accessories market due to their critical role in vehicle performance, efficiency, and regulatory compliance. As engine technology advances with a focus on fuel efficiency, emissions control, and electrification, the demand for high-quality engine components continues to grow.

Based on the components, the auto parts and accessories industry is segmented into driveline and powertrain, electronics, interiors and exteriors, lighting, seating, and others. Driveline and powertrain lead the market as they are critical components that directly impact vehicle performance, fuel efficiency, and overall functionality. The increasing demand for advanced powertrain technologies, including hybrid and electric drivetrains, further strengthens this segment.

Based on the distribution channel, the market is divided into original equipment manufacturer (OEM) parts and aftermarket parts. Aftermarket parts lead the market due to their widespread availability, cost-effectiveness, and growing consumer preference for customization and replacement solutions. Unlike OEM parts, which are limited to specific vehicle manufacturers, aftermarket components offer a broader range of options, catering to various vehicle models and budgets.

Based on vehicle type, the market is segmented into passenger cars, light commercial vehicles, sports vehicles, commercial vehicles, and two-wheelers. Passenger cars lead the market due to their high production volume, increasing consumer demand, and frequent replacement needs for parts and accessories. The increasing average vehicle age and growing demand for replacement parts further strengthen this segment's market position.

Based on purchase mode, the auto parts and accessories industry is categorized into online platforms, offline retail channels, and specialized automotive stores. Online distribution channels are experiencing exponential growth, driven by digital transformation, convenience, and transparent pricing models.

Auto Parts and Accessories Market: Regional Analysis

North America to lead the market growth rate during the forecast period

North America leads the global auto parts and accessories market, driven by a complex ecosystem of advanced automotive manufacturing, technological innovation, and robust aftermarket investments. The United States is the focal point for market expansion because it possesses a mature automotive industry of sophisticated businesses that constantly develop advanced technologies.

High vehicle ownership rates and a consumer base demonstrating significant spending on vehicle maintenance, customization, and performance enhancement further solidify the region's market leadership. The market environment in this region benefits from multiple top-notch research and development centres, together with the strategic alliances between automotive manufacturing companies and aftermarket component suppliers.

Additionally, stringent automotive safety and emissions regulations drive continuous technological advancements, compelling manufacturers to invest heavily in research, development, and next-generation automotive component technologies.

Asia-Pacific has an emerging market potential.

The Asia-Pacific region is the fastest-growing sector within the worldwide auto parts and accessories market due to synchronized advancements in economics and technology and rising automotive production capabilities. Asia-Pacific nations, including China, India, Japan, and South Korea, have transformed into prominent forces in automotive parts production while dedicating substantial funds to industrial base advancement and technological advancements.

The growth of the middle class in this region leads to both rising disposable income levels and increasing demand for cars, thereby creating an unprecedented surge in automotive part requirements and accessories purchases.

The market flourishes because of rapid urbanization, government support for automotive manufacturing and electric vehicles, and infrastructure development. The shift toward electric and hybrid cars in countries like China and India, backed by substantial government incentives and environmental policies, creates new opportunities for specialized automotive components and technologies.

Recent Market Developments:

- In February 2024, Tesla introduced a comprehensive aftermarket parts program for its electric vehicle lineup.

- In May 2024, Bosch launched an advanced AI-driven predictive maintenance platform for automotive components.

- In July 2024, Continental AG unveiled a revolutionary modular EV powertrain component system.

- In September 2024, Amazon Automotive expanded its parts marketplace with enhanced AR-based selection tools.

- In November 2024, Magna International introduced a breakthrough lightweight composite materials technology for automotive parts.

Auto Parts and Accessories Market: Competitive Analysis

Key market players include:

- Bosch GmbH

- Denso Corporation

- Continental AG

- Magna International Inc.

- Aisin Seiki Co. Ltd.

- ZF Friedrichshafen AG

- Valeo SA

- Lear Corporation

- Aptiv PLC

- Hella GmbH

- Co. KGaA.

The global auto parts and accessories market is segmented as follows:

By Product

- Engine parts

- Drive and transmission steering parts

- Braking parts

- Electrical parts

- Suspension

- Others

By Component

- Driveline and powertrain

- Electronics

- Interiors and exteriors

- Lighting

- Seating

- Others

By Distribution Channel

- Original Equipment Manufacturer (OEM) Parts

- Aftermarket Parts

By Vehicle Type

- Passenger Cars

- Light commercial vehicles

- Sports Vehicles

- Commercial Vehicles

- Two-Wheelers

- Others

By Purchase Mode

- Online Platforms

- Offline Retail Channels

- Specialized Automotive Stores

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Auto parts and accessories refer to the various components and supplementary items used in an automobile's manufacture, maintenance, repair, or enhancement.

Technological advancements, electric vehicle ecosystem development, digital transformation, and emerging market expansion will drive auto parts and accessories market growth.

The global auto parts and accessories market is projected to grow from USD 84.93 billion in 2024 to approximately USD 117.05 billion by 2034.

The auto parts and accessories market is anticipated to grow at a compound annual growth rate (CAGR) of approximately 3.24% between 2025 and 2034.

North America and Asia-Pacific are expected to lead the auto parts and accessories market growth, driven by technological innovation and automotive manufacturing capabilities.

Key participants in the auto parts and accessories market include Bosch GmbH, Denso Corporation, Continental AG, Magna International Inc., Aisin Seiki Co., Ltd., ZF Friedrichshafen AG, Valeo SA, Lear Corporation, Aptiv PLC, Hella GmbH and Co. KGaA.

The report explores crucial aspects of the auto parts and accessories market, including a detailed discussion of existing growth factors and restraints while browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed