Global Automated Optical Inspection Market Size, Share, Growth & Analysis, 2028

Automated Optical Inspection Market By Type (2D and 3D), By Application (Fabrication Phase and Assembly Phase), By Industry Vertical (Consumer Electronics, Telecommunications, Automotive, Medical Devices, Aerospace & Defense, Industrial, and Energy & Power), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data and Forecasts 2022 - 2028

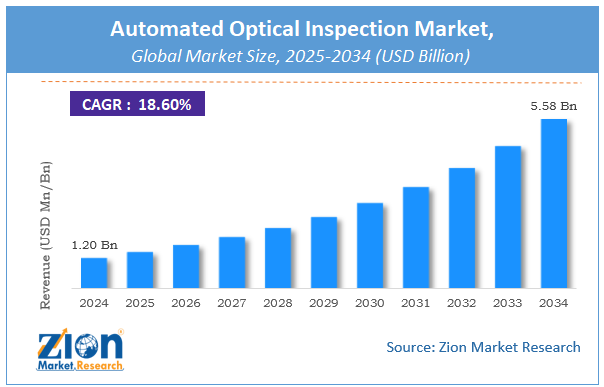

| Market Size in 2021 | Market Forecast in 2028 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 571.6 Million | USD 2,960.4 Million | 19.5% | 2021 |

Automated Optical Inspection Industry Prospective

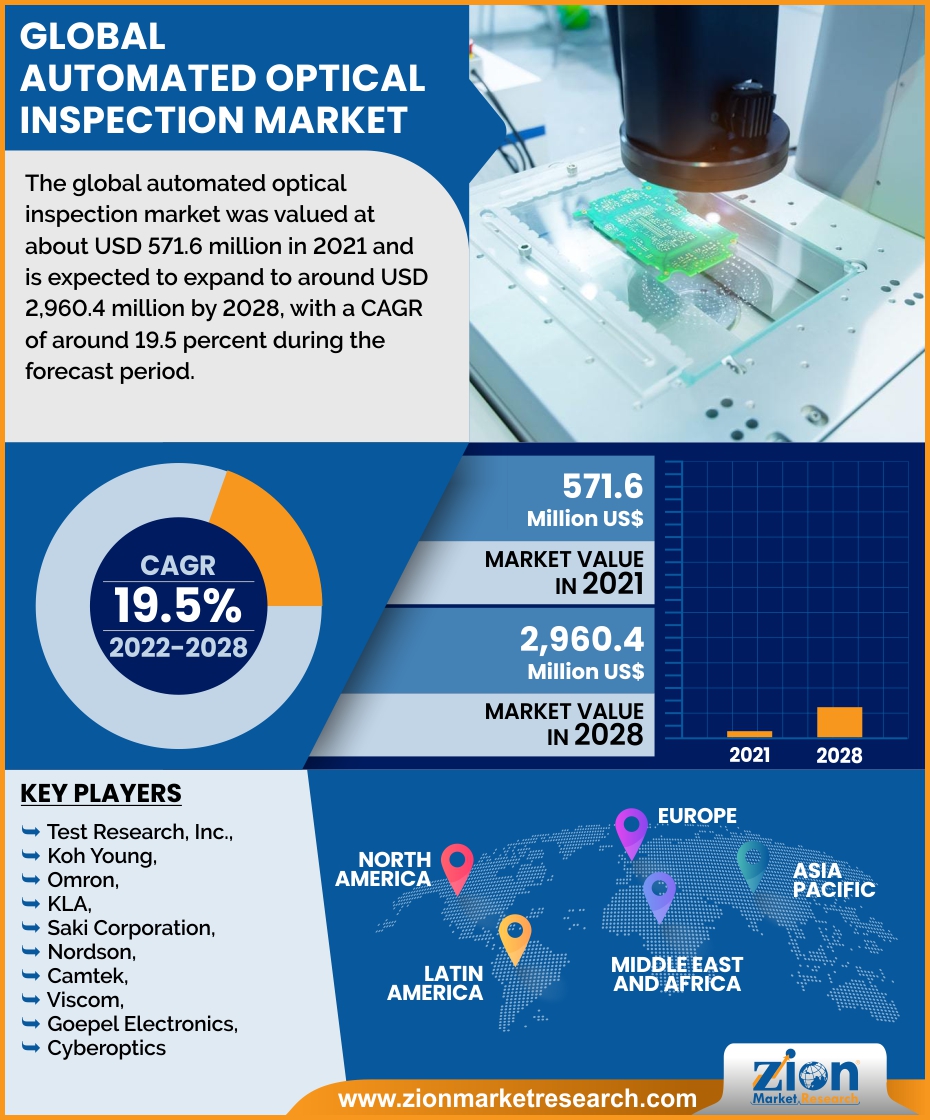

The global automated optical inspection market was valued at about USD 571.6 million in 2021 and is expected to expand to around USD 2,960.4 million by 2028, with a CAGR of around 19.5% during the forecast period. The study examines the market's drivers, constraints, and challenges, as well as the impact they have on the demand throughout the forecast period. In addition, the report looks at new potential in the market for automated optical inspection.

Automated Optical Inspection Market: Overview

Automated optical inspection (AOI) systems are primarily used for thorough observation on a printed circuit board, which verifies a device with the use of an autonomous camera and screen for both major failure and quality abnormalities. These technologies provide even more speed and precision.

Automated optical inspection equipment is quick and provides consistent inspection results. Automated optical inspection systems use a variety of processes to determine if a board is excellent or has any flaws, such as design coordinating, layout coordinating, and statistical pattern matching.

COVID-19 Impact:

The growth of AOI market is significantly declined due to the COVID-19 pandemic as the pandemic limited the availability and usage of hardware parts, such as sensors, across a variety of applications. This is due to the global economy's and enterprises' significant disruptions. However, not all semiconductor firms are experiencing a drop in growth, since remote working and work from home activities have allowed businesses to continue operating during lockdowns.

Some organizations experienced short-term operating challenges as a result of reduced staff availability caused by government social distancing policies during the COVID-19 crisis. Also, COVID-19 has had a negative impact on several enterprises whose fiscal year ends in March 2020.

Automated Optical Inspection Market: Growth Drivers

An increase in demand for consumer electronics is likely to boost the growth of the market

Demand for modern consumer electronic appliances and goods has increased as a result of factors such as urbanization and increased disposable income. Simultaneously, there is an increase in demand for long-lasting, high-quality items at a reasonable price. Electronic manufacturing factories are springing up all over the world as the demand for consumer electronics grows tremendously. The growing demand for improved goods has prompted PCB producers to invest in more cost-effective production procedures.

As a result, PCB manufacturers have implemented AOI systems in their production lines to increase product quality and reduce manufacturing costs. In addition to this, people spending more time indoors has led to increased expenditures on technological advancements, thereby making homes more comfortable and pleasant. This has resulted in a surge in demand for novel consumer electronics. Thus, the growing demand for consumer electronics in developed and emerging countries is likely to boost the growth of the global automated optical inspection market.

Automated Optical Inspection Market: Restraints

Image-based AOI systems' false call rate may impede the growth of the automated optical inspection market

The false call rate (FCR) is described as the number of acceptable components that are mistakenly identified as faulty, and the false call rate is measured in parts-per-million (ppm). When it comes to image-based AOI systems, false calls are the main important consideration. The image-based AOI system employs a series of images to distinguish between faulty and excellent components. At the same time, the operator who collects these photographs and feeds them into the database is the most important part of this system. When images are incorrectly categorized and stored in the image database, parameter optimization becomes difficult.

Furthermore, if a false call occurs, the operator must inspect the problem and restart the operation, resulting in a slower manufacturing process, lower productivity, and higher production costs. All such factors may hinder the growth of the global automated optical inspection market.

Automated Optical Inspection Market: Opportunities

The arrival of the SMART revolution is expected to have ample opportunities for market growth

Smart technology is steadily becoming more widely used, from smartphones, wearables, and laptops to even larger uses in smart homes and smart industries. Smart technology encompasses a wide range of gadgets, including Internet of Things (IoT) devices and smart linked devices. Sensors, processors, software, internet connection, analytics, and apps are used to bring static physical things to life in the Internet of Things (IoT). These gadgets are automated, scalable, and futuristic, and they add significant value. Smart factories, smart homes, and smart cities are just a few examples. Smart-linked gadgets use remote control and are connected to the Bluetooth or internet.

Smart-linked gadgets can provide a personalized experience, but they must be controlled through a remote. Manufacturers have been able to increase the number of components put on a PCB due to the miniaturization trend. The need for AOI systems has been spurred by the necessity to check all components in a timely and reliable manner. Inspecting compact PCBs requires the use of an AOI system.

Automated Optical Inspection Market: Challenges

The need for highly sophisticated software and hardware to deal with vast data poses a major challenge to the market.

As a result of the present demanding scenario in the electronics production environment, modern AOI systems have improved significantly. With the shrinking of electrical components and the increasing complexity of PCB architecture, AOI systems have evolved. Multiple high-definition cameras are being employed in an AOI system to obtain more detailed pictures of complicated PCBs. These newest cameras can shoot at speeds of up to 120 frames per second (fps).

The high-resolution pictures and rapid scanning speeds produce a large amount of data. To store and analyze this huge volume of data, businesses must maintain very complex software and hardware systems solutions. However, not every electronics manufacturer can afford such a pricey support system, which poses a hindrance to the global automated optical inspection market's expansion.

Automated Optical Inspection Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Automated Optical Inspection Market |

| Market Size in 2021 | USD USD 571.6 Million |

| Market Forecast in 2028 | USD USD 2,960.4 Million |

| Growth Rate | CAGR of 19.5% |

| Number of Pages | 168 |

| Key Companies Covered | Test Research, Inc., Koh Young, Omron, KLA, Saki Corporation, Nordson, Camtek, Viscom, Goepel Electronics, Cyberoptics, |

| Segments Covered | By Type, By Application, By Industry Vertical and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2021 |

| Historical Year | 2016 to 2020 |

| Forecast Year | 2022 - 2028 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Automated Optical Inspection Market: Segmentation

The global automated optical inspection market is segregated based on type, application, industry verticals, and region.

Based on the type, the market is split into 2D and 3D.

Based on the application, the market is categorized into the assembly phase and fabrication phase. Among these, the market share for the fabrication phase was highest in 2020, the segment is also projected to register rapid growth over the forecast period.

Based on the industry vertical, segment of the market is categorized into telecommunications, consumer electronics, medical devices, automotive, industrial, aerospace & defense, and energy & power.

Recent Developments

- In March 2021, Viscom introduced a novel Heavy Flex handling solution to address the demand for flexible handling of heavy and large objects. Viscom's S3016 extreme system for optical inline 3D inspection has Heavy Flex handling features.

- In March 2021, Saki Corporation upgraded their 3Di Series AOI system featuring a new Z-axis solution to speed up the evaluation of press-fit components, tall components, and PCBAs in jigs. In 3D mode, the new Z-axis package for the 3Di Series allows for an optimum height measurement range of 40 mm. In 2D, the maximum focus height has been raised to 40 mm.

Automated Optical Inspection Market: Regional Landscape

The Asia Pacific is set to lead the global market during the projected period.

Asia Pacific is the world's biggest producer of printed circuit boards, with the major technologically advanced markets such as Taiwan, China, Japan, and South Korea. As the demand for AOI systems with quicker inspection speeds grows, so does the demand for high-volume PCB fabrication in the region.

Market expansion in this region is also attributed to a combination of low-cost trained labor, a business-friendly climate, cheap manufacturing costs, and expanding demand for electronic equipment. The APAC electronics sector has become a global tech hub for production due to its rapid growth in electronics sectors.

Automated Optical Inspection Market: Competitive Landscape

Some of the major players in the global automated optical inspection market include:

- Test Research, Inc.

- Koh Young

- Omron

- KLA

- Saki Corporation

- Nordson

- Camtek

- Viscom

- Goepel Electronics

- Cyberoptics

The global automated optical inspection market is segmented as follows:

By Type

- 2D

- 3D

By Application

- Fabrication Phase

- Assembly Phase

By Industry Vertical

- Consumer Electronics

- Telecommunications

- Automotive

- Medical Devices

- Aerospace & Defense

- Industrial

- Energy & Power

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Demand for modern consumer electronic appliances and goods has increased as a result of factors such as urbanization and increased disposable income. Simultaneously, there is an increase in demand for long-lasting, high-quality items at a reasonable price. Electronic manufacturing factories are springing up all over the world as the demand for consumer electronics grows tremendously. The growing demand for improved goods has prompted PCB producers to invest in more cost-effective production procedures. As a result, PCB manufacturers have implemented AOI systems in their production lines to increase product quality and reduce manufacturing costs.

According to the Zion Market Research report, the global automated optical inspection market was worth about 571.6 (USD million) in 2021 and is predicted to grow to around 2,960.4 (USD million) by 2028, with a compound annual growth rate (CAGR) of around 19.5 percent.

Asia Pacific is the world's biggest producer of printed circuit boards, with the major technologically advanced market such as Taiwan, China, Japan, and South Korea. As the demand for AOI systems with quicker inspection speeds grows, so does the demand for high-volume PCB fabrication in the region. Market expansion in this region is attributed to a combination of low-cost trained labor, a business-friendly climate, cheap manufacturing costs, and expanding demand for electronic equipment.

Test Research, Inc., Koh Young, Omron, KLA, Saki Corporation, Nordson, Camtek, Viscom, Goepel Electronics, and Cyberoptics are among the key players operating in the global automated optical inspection market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed