Automotive Aluminum Extrusion Market Size, Share, Trends, Growth and Forecast 2034

Automotive Aluminum Extrusion Market By Type (Sub Frames, Door Beams, Pillars, Special Frames, Body Panels, Bumpers, and Others), By Vehicle (Mid-Size, Mini-Compact, Luxury, Executive, Utility Vehicles, Heavy Commercial Vehicles, Light Commercial Vehicles, and Others), By Aluminum Grade (7000 Series, 6000 Series, 5000 Series, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

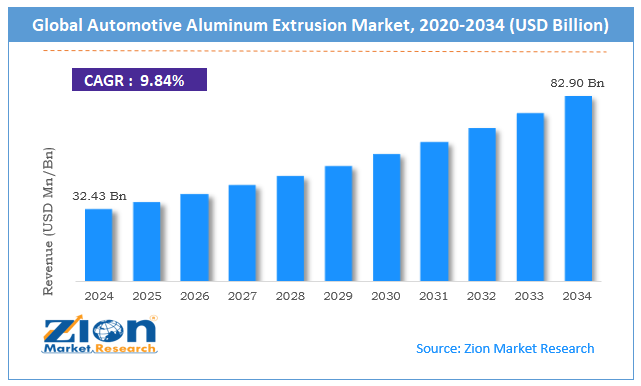

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 32.43 Billion | USD 82.90 Billion | 9.84% | 2024 |

Automotive Aluminum Extrusion Industry Prospective:

The global automotive aluminum extrusion market size was worth around USD 32.43 billion in 2024 and is predicted to grow to around USD 82.90 billion by 2034, with a compound annual growth rate (CAGR) of roughly 9.84% between 2025 and 2034.

Automotive Aluminum Extrusion Market: Overview

Automotive aluminum extrusion is a highly popular manufacturing process in the automotive industry that uses aluminum alloy billets to create different parts of a vehicle. The method includes enforcing aluminum alloy billets through pre-shaped die to make specific and complex profiles for automotive components such as frames, door beams, bumpers, etc.

According to market research, automotive aluminum extrusion is generally preferred for producing energy absorption boxes, bumper anti-collision beams, front girdles, door anti-collision beams, radiators, brackets, and instrument panel brackets. The growing demand for lightweight vehicles for commercial and personal applications is fueling the demand for aluminum extrusion since steel can drastically increase a vehicle’s weight.

During the forecast period, the growing investments in the electric vehicle (EV) sector are expected to create more expansion opportunities for automotive aluminum extrusion service providers.

On the other hand, one of the major drawbacks for the market is the frequent disruption in the supply chain of aluminum which is drastically impacted by changes in several external factors.

Key Insights:

- As per the analysis shared by our research analyst, the global automotive aluminum extrusion market is estimated to grow annually at a CAGR of around 9.84% over the forecast period (2025-2034)

- In terms of revenue, the global automotive aluminum extrusion market size was valued at around USD 32.43 billion in 2024 and is projected to reach USD 82.90 billion by 2034.

- The automotive aluminum extrusion market is projected to grow at a significant rate due to the increasing demand for lightweight vehicles.

- Based on the type, the sub-frames segment is growing at a high rate and will continue to dominate the global market as per industry projections.

- Based on the aluminum grade, the 6000 series segment is anticipated to command the largest market share.

- Based on region, Asia-Pacific is projected to dominate the global market during the forecast period.

Automotive Aluminum Extrusion Market: Growth Drivers

Increasing demand for light-weight vehicles to drive market revenue during the forecast period

The global automotive aluminum extrusion market is expected to be driven by the rising demand for lightweight vehicles across the globe. According to automobile science, a vehicle's fuel efficiency can be drastically improved by reducing the overall weight of the automotive.

In addition, other advantages of vehicles with lighter weights include reduced carbon emissions and improvements in overall performance. The fuel industry globally has been severely affected by the ongoing war between Russia and Ukraine and other geopolitical incidents occurring worldwide.

Fuel price volatility has reached unprecedented levels, encouraging automobile users to seek vehicles with optimal fuel consumption. Market research indicates that vehicles with aluminum parts tend to consume 18% less fuel than other heavier materials, such as steel.

Safety features offered by automotive parts made of aluminum to fuel market expansion rate

One of the primary reasons for the increased adoption of the automotive aluminum extrusion process worldwide is the safety feature of aluminum alloys. Market analysis indicates that automotive bodies such as bumper anti-collision beams and door anti-collision beams produced using aluminum extruders significantly improve the overall safety of the vehicle and its passengers.

The growing rate of road accidents leading to fatalities has promoted increased demand for stronger vehicles that can prevent any significant damage to the passengers in case of an accident, thus prompting higher investments in the global automotive aluminum extrusion market.

Automotive Aluminum Extrusion Market: Restraints

Frequent disruptions in the aluminum supply chain act as the most significant growth barrier

The global industry for automotive aluminum extrusion is expected to be restricted by the frequent disruptions observed in the supply chain of raw materials. Extensive market studies prove that 2024 was plagued with a severe shortage of alumina, further affected by rising geopolitical tension and changing trade relationships between partnering countries.

Since aluminum is produced from natural resources, over-extraction of the core material Bauxite can lead to severe environmental damage, further impacting the industry’s final revenue.

Automotive Aluminum Extrusion Market: Opportunities

Increasing investments toward EVs globally to create growth opportunities for industry players

The global automotive aluminum extrusion market is projected to generate growth opportunities due to the rising investments in electric vehicles. The automotive industry is currently witnessing a revolutionary change as internal combustion engine-powered vehicles are being increasingly replaced by electric variants. EVs are more environmentally friendly since they operate on stored energy.

Electric vehicle makers generally opt for automotive aluminum extrusion since EVs are considered lighter vehicles, as increased weight can disrupt battery performance. The surging support from the regional government to promote EV manufacturing across major economies will create demand for automotive aluminum extrusion in the coming years.

As per official statistics, more than 11 million plug-in passenger cars were sold in 2024 across Europe. Other countries such as China, the US, and India are also witnessing a sharp rise in EV-based investments, especially in funds directed toward improving battery lifetime and overall performance.

Automotive Aluminum Extrusion Market: Challenges

Limited access to superior-grade aluminum and high costs to challenge market size in the future

The global automotive aluminum extrusion industry is expected to be challenged by the limited access to high-quality aluminum. Generally, the 6000 and 7000 series of aluminum are considered more reliable and high-performance.

However, consistent access to these materials can be difficult. In addition to this, the aluminum extrusion process is more expensive since the raw material is highly priced. The process requires skilled expertise and employs complex manufacturing processes, further inhibiting the market’s growth rate.

Automotive Aluminum Extrusion Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Automotive Aluminum Extrusion Market |

| Market Size in 2024 | USD 32.43 Billion |

| Market Forecast in 2034 | USD 82.90 Billion |

| Growth Rate | CAGR of 9.84% |

| Number of Pages | 215 |

| Key Companies Covered | Bonnell Aluminum, Constellium, ALCOA Corporation, Press Metal Aluminium Holdings, Hydro Extrusions, Hindalco Industries, Novelis, China Zhongwang Holdings, Sapa Group, Kaiser Aluminum, Gulf Extrusions, Arconic, Norsk Hydro, ETEM Group, UACJ Corporation, and others. |

| Segments Covered | By Type, By Vehicle, By Aluminum Grade, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Automotive Aluminum Extrusion Market: Segmentation

The global automotive aluminum extrusion market is segmented based on type, vehicle, aluminum grade, and region.

Based on the type, the global market segments are sub-frames, door beams, pillars, special frames, body panels, bumpers, and others. In 2024, the highest growth was listed in the sub-frames segment due to greater applications of the extrusions in manufacturing of crucial vehicle components such as drivetrain and suspension.

Furthermore, aluminum-based sub-frames can considerably reduce a vehicle's overall weight and further help it achieve fuel or battery efficiency. Aluminum extrusions are around 40% to 50% lighter than steel counterparts.

Based on vehicles, the global automotive aluminum extrusion industry is divided into mid-size, mini-compact, luxury, executive, utility vehicles, heavy commercial vehicles, light commercial vehicles, and others.

Based on the aluminum grade, the global market segments are 7000 series, 6000 series, 500 series, and others. In 2024, the highest growth was listed in the 6000 series, which contains silicon and magnesium. The aluminum 6000 series has higher corrosion resistance and superior strength, making the material highly qualified due to being used as automotive parts. According to market research, the 6000 series have tensile strength in the range of 150 to 350 MPa.

Automotive Aluminum Extrusion Market: Regional Analysis

Asia-Pacific to deliver the highest return on investment (ROI) during the forecast period

The global automotive aluminum extrusion market is projected to be led by Asia-Pacific during the forecast period. Countries such as China, India, Japan, and South Korea will lead the regional market, with China emerging as the highest revenue generator.

In 2024, China was one of the leading producers and exporters of electric vehicles. The region is home to some of the most advanced and highly automated vehicle assembly factories, rolling out automotives rapidly to keep up with the growing demand from the commercial market. In addition, China is also the leading exporter of aluminum, and in 2024, it exported over USD 33 billion worth of the material.

In November 2024, Shandong Weiqiao Entrepreneurship Group, a leading Chinese conglomerate, launched 6 new aluminum alloy materials with autonomous intellectual property rights. The novel product WQAL ® WHS 340, 370, 400 alloy has applications in the automotive industry along with other sectors.

On the other hand, extensive regional government support to encourage higher growth in the Asian automotive industry will further help the region thrive. An influential factor for automotive aluminum extrusion through Asia-Pacific is the increased need for fuel-efficient vehicles as sales of automotive vehicles are on a consistent rise.

Automotive Aluminum Extrusion Market: Competitive Analysis

The global automotive aluminum extrusion market is led by players like:

- Bonnell Aluminum

- Constellium

- ALCOA Corporation

- Press Metal Aluminium Holdings

- Hydro Extrusions

- Hindalco Industries

- Novelis

- China Zhongwang Holdings

- Sapa Group

- Kaiser Aluminum

- Gulf Extrusions

- Arconic

- Norsk Hydro

- ETEM Group

- UACJ Corporation

The global automotive aluminum extrusion market is segmented as follows:

By Type

- Sub Frames

- Door Beams

- Pillars

- Special Frames

- Body Panels

- Bumpers

- Others

By Vehicle

- Mid-Size

- Mini-Compact

- Luxury

- Executive

- Utility Vehicles

- Heavy Commercial Vehicles

- Light Commercial Vehicles

- Others

By Aluminum Grade

- 7000 Series

- 6000 Series

- 5000 Series

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Automotive aluminum extrusion is a highly popular manufacturing process in the automotive industry that uses aluminum alloy billets to create different parts of a vehicle.

The global automotive aluminum extrusion market is expected to be driven by the rising demand for lightweight vehicles across the globe.

According to study, the global automotive aluminum extrusion market size was worth around USD 32.43 billion in 2024 and is predicted to grow to around USD 82.90 billion by 2034.

The CAGR value of automotive aluminum extrusion market is expected to be around 9.84% during 2025-2034.

The global automotive aluminum extrusion market is projected to be led by Asia-Pacific during the forecast period.

The global automotive aluminum extrusion market is led by players like Bonnell Aluminum, Constellium, ALCOA Corporation, Press Metal Aluminium Holdings, Hydro Extrusions, Hindalco Industries, Novelis, China Zhongwang Holdings, Sapa Group, Kaiser Aluminum, Gulf Extrusions, Arconic, Norsk Hydro, ETEM Group and UACJ Corporation.

The report explores crucial aspects of the automotive aluminum extrusion market, including a detailed discussion of existing growth factors and restraints while browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed