Automotive Lead-Acid Battery Market Size, Share, Growth, Forecast 2030

Automotive Lead-Acid Battery Market By Product (SLI Batteries and Micro Hybrid Batteries), By Type (Flooded Batteries and VRLA Batteries), By End-Use (Passenger Cars and Light & Heavy Commercial Vehicles), and By Region - Global And Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, And Forecasts 2023 - 2030

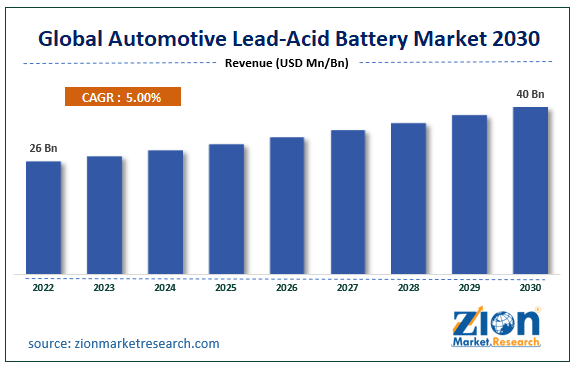

| Market Size in 2022 | Market Forecast in 2030 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 26 Billion | USD 40 Billion | 5.0% | 2022 |

Automotive Lead-Acid Battery Industry Perspective:

The global automotive lead-acid battery market size was evaluated at $26 billion in 2022 and is slated to hit $40 billion by the end of 2030 with a CAGR of nearly 5% between 2023 and 2030.

The market report is an indispensable guide on growth factors, challenges, restraints, and opportunities in the global market space. The automotive lead-acid battery industry report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, PESTEL analysis, SWOT analysis, Porter’s five force analysis, and value chain analysis. Additionally, the automotive lead-acid battery market report explores the investor and stakeholder space to help companies make data-driven decisions.

Automotive Lead-Acid Battery Market: Overview

An automotive lead-acid battery is a rechargeable battery that is utilized for starting a motor vehicle. The key aim of the product is to provide an electric current to an electric-powered motor that starts the chemically-driven internal combustion engine that propels the engine. Reportedly, the lead-acid battery comprises two kinds of lead in a mixture of acids and can perform an electrochemical reaction. After that, it transforms chemical energy into electric current and this can lead to voltage production in automotive. Additionally, lead acid batteries provide voltage to accessories of the vehicle including air conditioner charging plugs, wipers, and music players.

Key Insights

- As per the analysis shared by our research analyst, the global automotive lead-acid battery market is projected to expand annually at the annual growth rate of around 5% over the forecast timespan (2023-2030)

- In terms of revenue, the global automotive lead-acid battery market size was evaluated at nearly $26 billion in 2022 and is expected to reach $40 billion by 2030.

- The global automotive lead-acid battery market is anticipated to record massive growth over the forecast period owing to a growing demand for electric & hybrid vehicles across the globe.

- In terms of product, the SLI batteries segment is slated to register the fastest CAGR over the analysis period.

- On the basis of type, the VRLA batteries segment is predicted to dominate the segmental surge over the forecast period.

- Based on end-use, the passenger cars segment is expected to lead the segment over the forecast timespan.

- Region-wise, the North American automotive lead-acid battery market is projected to register the highest CAGR during the assessment timeline.

Request Free Sample

Request Free Sample

Automotive Lead-Acid Battery Market: Growth Factors

Humungous sales of electric & hybrid automotive to boost the global market trends

Growing demand for electric & hybrid vehicles is predicted to carve a profitable roadmap for the global automotive lead-acid battery market. Additionally, strict emission laws implemented by various governments for protecting the environment along with the need for enhancing fuel efficiency in vehicles have led to demand for lead-acid batteries in vehicles. Apart from this, operational benefits provided by the product will drive global market trends.

Furthermore, the demand for cost-efficient energy solutions will spearhead the scope of growth of the global market. Moreover, low product costs and the ability to be easily charged and maintained can benefit the expansion of the market across the globe.

New product launches will contribute majorly to the size of the global market. In May 2023, Solis, a China-based solar & energy storage solutions provider, introduced an advanced power hybrid inverter referred to as S6. Reportedly, the firm declared that these inverters can work well with both lithium-ion batteries as well as lead-acid batteries. Such moves will expand the scope of demand for lead–acid batteries in automotive.

Automotive Lead-Acid Battery Market: Restraints

Changing prices of lead-acid batteries can impede the global industry expansion

Oscillating costs of lead-acid batteries will put brakes on the global automotive lead-acid battery industry expansion. Apart from this, strict regulations related to lead emissions can further depreciate the sales of the product across the globe.

Automotive Lead-Acid Battery Market: Opportunities

Rise in the vehicle production is set to open new opportunities for growth for the global market

A surge in the manufacture and demand for vehicles across the globe will open new growth avenues for the global automotive lead-acid battery market. In addition to this, technological breakthroughs in upgrading batteries will create new vistas of growth for the global market.

Automotive Lead-Acid Battery Market: Challenges

Limited capacity use of the product can prove to be a big challenge for the global industry expansion

Restricted use of the capacity of lead-acid batteries can pose a challenge to the expansion of the global automotive lead-acid battery industry. Apart from this, lead-acid batteries have a lesser number of charging-discharging cycles before they experience a decline in performance and this has manifested into a huge challenge for their demand and sales across the globe.

Automotive Lead-Acid Battery Market: Segmentation

The global automotive lead-acid battery market is sectored into product, type, end-user, and region.

In product terms, the global automotive lead-acid battery market is segregated into SLI batteries and micro-hybrid batteries segments. In addition to this, the SLI batteries segment, which gathered nearly 55% of the global market share in 2022, is slated to record the highest CAGR in the forecast timeline.

The growth of the segment in the ensuing years can be attributed to the extensive use of the product in commercial vehicles, motorcycles, and passenger vehicles. Additionally, a rise in the demand for the product can be due to an increase in vehicle production, strict emission laws, and demand for new automotive systems.

On the basis of the type, the automotive lead-acid battery industry across the globe is sectored into flooded batteries and VRLA batteries segments. Furthermore, the VRLA batteries segment, which gained a sizable industry share of the global industry in 2022, is expected to lead the type segment in the forecasting years.

The segmental surge in the forecast timeline can be subject to the large-scale application of VRLA batteries in micro-hybrid vehicles. Moreover, they aid the energy storage needs of micro-hybrid automotive systems, thereby boosting global industry trends.

Based on the end-use, the global automotive lead-acid battery market is bifurcated into passenger cars and light & heavy commercial vehicles segments. In addition to this, the passenger cars segment, which contributed majorly towards the global market share in 2022, is projected to establish global market domination in the coming years. The segmental surge over the predicted timeframe can be due to the prominent demand for lead-acid batteries in passenger cars.

Automotive Lead-Acid Battery Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Automotive Lead-Acid Battery Market Report |

| Market Size in 2022 | USD 26 Billion |

| Market Forecast in 2030 | USD 40 Billion |

| Growth Rate | CAGR of 5% |

| Number of Pages | 215 |

| Key Companies Covered | Exide Industries Ltd., Clarios, Exide Technologies Inc., GS Yuasa Corporation, EnerSys Inc., Panasonic Corporation, East Penn Manufacturing Company, Leoch International Technology Limited, and CSB Battery Company Limited. |

| Segments Covered | By Product, By Type, By End-Use, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2022 |

| Historical Year | 2017 to 2021 |

| Forecast Year | 2023 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Automotive Lead-Acid Battery Market: Regional Insights

Asia-Pacific to account for a major share of the global market over the analysis timeline

Asia-Pacific, which accounted for more than 50% of the global automotive lead-acid battery market share in 2022, is predicted to dominate the global market over the expected timeframe. The market surge in the region over the assessment timeline can be due to a rise in rapid industrialization, urbanization, and escalating demand for premium cars in countries such as India, China, Malaysia, South Korea, Japan, and Singapore.

In addition to this, the presence of key automotive manufacturers in the region will contribute significantly to the market revenue in the Asia-Pacific. Furthermore, a surge in demand for electric and hybrid vehicles in the sub-continent at subsidized costs will embellish the regional market trends.

Furthermore, the automotive lead-acid battery industry in North America is set to register the fastest CAGR in the assessment timeline. The key growth driving factors of the industry in the region include growing renewable energy trends translating into massive demand for electric vehicles in countries such as Canada and the U.S. Moreover, a rise in the disposable income of the customers will promulgate the scope of the growth of the industry in the region.

Automotive Lead-Acid Battery Market: Competitive Space

The global automotive lead-acid battery market profiles key players such as:

- Exide Industries Ltd.

- Clarios

- Exide Technologies Inc.

- GS Yuasa Corporation

- EnerSys Inc.

- Panasonic Corporation

- East Penn Manufacturing Company

- Leoch International Technology Limited

- CSB Battery Company Limited.

The global automotive lead-acid battery market is segmented as follows:

By Product

- SLI Batteries

- Micro Hybrid Batteries

By Type

- Flooded Batteries

- VRLA Batteries

By End-Use

- Passenger Cars

- Light & Heavy Commercial Vehicles

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

An automotive lead-acid battery is a rechargeable battery that is utilized for starting a motor vehicle. The key aim of the product is to provide an electric current to an electric-powered motor that starts the chemically-driven internal combustion engine that propels the engine. Reportedly, the lead-acid battery comprises two kinds of lead in a mixture of acid and can perform an electrochemical reaction. After that, it transforms chemical energy into electric current and this can lead to voltage production in automotive.

The global automotive lead-acid battery market growth is owing to strict emission laws implemented by various governments for protecting the environment along with the need for enhancing fuel efficiency in vehicles leading to demand for lead-acid batteries in vehicles.

According to a study, the global automotive lead-acid battery industry size was $26 billion in 2022 and is projected to reach $40 billion by the end of 2030.

The global automotive lead-acid battery market is anticipated to record a CAGR of nearly 5% from 2023 to 2030.

The North American automotive lead-acid battery industry is set to register the highest CAGR over the forecasting timeline owing to growing renewable energy trends translating into massive demand for electric vehicles in countries such as Canada and the U.S. Moreover, a rise in the disposable income of the customers will promulgate the scope of the growth of the industry in the region.

The global automotive lead-acid battery market is led by players such as Exide Industries Ltd., Clarios, Exide Technologies Inc., GS Yuasa Corporation, EnerSys Inc., Panasonic Corporation, East Penn Manufacturing Company, Leoch International Technology Limited, and CSB Battery Company Limited.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed